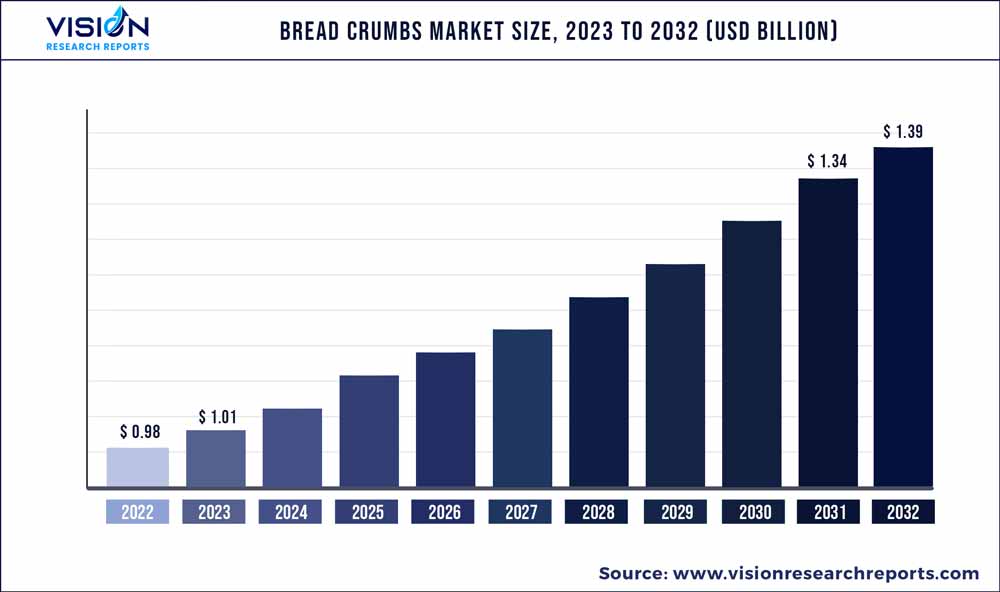

The global bread crumbs market size was estimated at around USD 0.98 billion in 2022 and it is projected to hit around USD 1.39 billion by 2032, growing at a CAGR of 3.54% from 2023 to 2032. The bread crumbs market in the United States was accounted for USD 158.4 million in 2022.

Key Pointers

Report Scope of the Bread Crumbs Market

| Report Coverage | Details |

| Revenue Share of Asia Pacific in 2022 | 54% |

| CAGR of North America from 2023 to 2032 | 3.47% |

| Revenue Forecast by 2032 | USD 1.39 billion |

| Growth Rate from 2023 to 2032 | CAGR of 3.54% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Kikkoman Corporation; Gonnella Baking Company; DeLallo; 4C Foods; Vigo Importing Co; General Mills; Edward & Sons Trading Co.; Aleia’s Gluten Free Foods Inc |

The growth is driven by a rise in the number of households and restaurants utilizing bread crumbs as a coating agent coupled with the steady consumption of fried foods. Seafood, fried foods, and processed meat consumed at food service outlets and households require high amounts of bread crumbs to enhance their visual appeal, texture, and taste. The use of bread crumbs serves as a convenient option for food retailers to provide a standardized blend of ingredients utilizing bread crumbs in food applications.

In addition, the rising consumption of fast food among the younger populace has also fueled the demand for bread crumbs. Quick service and fast-food chains strongly rely on breadcrumbs for several items on their menus. Fried food companies operating in the market are also actively innovating and producing customized foods to cater to diverse ethnic groups by utilizing different kinds of spices and blends into bread crumbs. Several fast-food companies are incorporating influences from Mediterranean, Asian, and Mexican cuisines to widen their reach among consumers.

The usage of bread waste generated in baking and other food applications can be effectively utilized in the manufacturing of breadcrumbs. The waste derived from the baking process can be dried, ground, and sifted to create breadcrumbs that can be extensively used for several baked goods and dessert applications. In addition, staling of bread is the main cause of the short shelf life of products in several supermarkets and hypermarkets. For instance, according to Tesco, in 2021-2022, close to 10% of baked goods were wasted.

Product Insights

In terms of product, the market is segmented into dry, fresh, panko, and others. The dry segment held the largest share of 56% in terms of revenue. Factors such as high absorption and longer shelf life are major factors driving the demand for dry bread crumbs. Dried bread crumbs can be stored in containers for longer periods and pose as a feasible option than fresh breadcrumbs. In addition, the wide availability of dried bread crumbs in flavored and plain options is an opportunity for several manufacturers to offer diverse flavors and types to consumers.

The panko segment is expected to showcase the fastest CAGR of 3.88% during the forecast period. Factors such as rising consumer awareness toward new cuisines coupled with the unique texture offered by panko bread crumbs are the primary factors driving the product demand. Panko bread crumbs are crispier, coarser and offer a desirable crunch in processed meat and processed foods.

Growing consumer awareness towards gourmet and exotic cuisines among the urban populace globally is driving the demand for panko breadcrumbs in several flavors such as honey, soy, and ginger. In addition, the rise of plant-based diets is also supporting the growth of the segment. For example, in October 2022, U.S.-based Noodles & Company announced the launch of plant-based panko chicken protein.

Seasoning Insights

The unflavored breadcrumbs segment held the largest share of 69% in 2022. Unflavored bread crumbs are a convenient option for both household and food service usage owing to the potential for customization and versatility offered by natural breadcrumbs. Unflavored breadcrumbs allow food service manufacturers to customize and add different types of herbs and seasonings catering to specific recipes or tastes. In addition, unflavored breadcrumbs are extensively used in the bakery industry owing to their neutral taste and flavor.

The paprika segment is expected to showcase the fastest CAGR of 4.59% during the forecast period. Growing consumer demand for unique and diverse flavors in the food processing industry is driving the demand for paprika seasoning in the market. Paprika-flavored breadcrumbs offer spicy, smoky, and sweet notes, thereby generating interest from several consumers. Additionally, the prevalent usage of paprika in a variety of cuisines such as Spanish, Hungarian, American, and Mediterranean has boosted the demand for paprika-flavored bread crumbs.

End-use Insights

The fresh food item segment held the largest share of 31% in 2022. The wide usage of bread crumbs as a breading ingredient, coating, and binding agent in several food applications is fueling the demand for the fresh food item segment. Breadcrumbs are often used as coating and binding agents in meats and food products to provide structure. U.S.-based Newly Weds Foods offers a variety of bread crumbs such as sheeted, homestyle, Japanese-style, and American-style breaders as binders, thickeners, and coatings.

The frozen food item segment is expected to showcase the fastest CAGR of 3.77% during the forecast period. Rising demand for frozen food due to hectic lifestyles is boosting the demand for breadcrumbs in frozen food items. Breadcrumbs are increasingly used as fillers and texture enhancers in frozen products such as meatballs, and frozen doughs to bulk the mixture and retain the moisture in frozen products.

Distribution Channel Insights

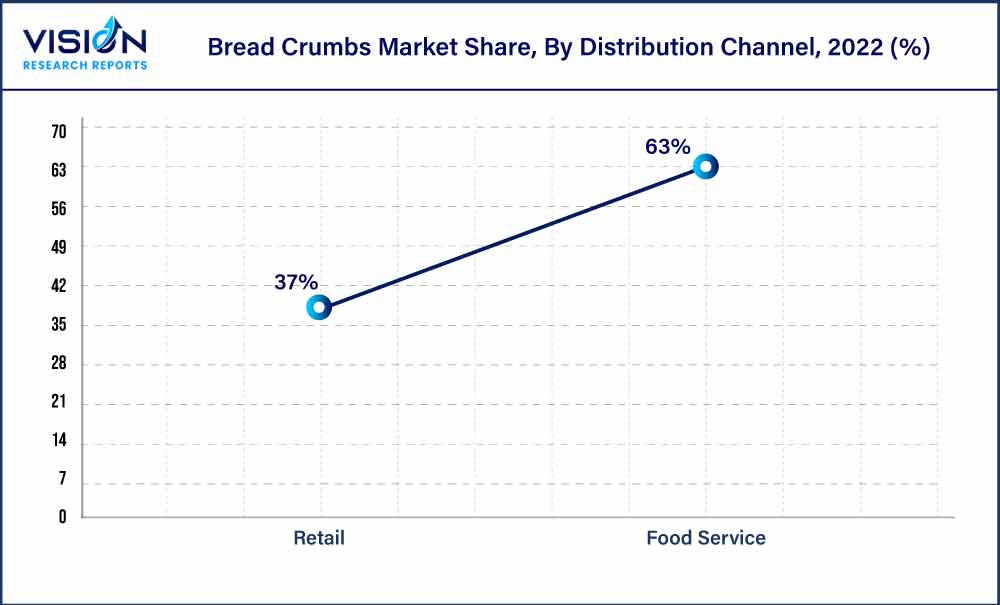

The distribution channel segment is bifurcated into food service and retail. The food service segment held the largest share of 63% in 2022. The growing demand for processed foods such as breaded fish fillets, fritters, chicken tenders, and other snacks is driving the usage of breadcrumbs in the food service industry. Several food manufacturers increasingly use bread crumbs as thickening, breading, and breading agents in a variety of processed foods.

The retail segment is anticipated to grow at a CAGR of 3.74% during the forecast period. The retail segment comprises supermarkets/hypermarkets, online channels, wholesale stores, and other convenience stores. The high demand for ready-to-eat foods has encouraged several supermarkets across the globe such as Walmart, Tesco, and others to stock up on flavored and unflavored bread crumbs.

Regional Insights

The Asia Pacific market held a dominant revenue share of 54% in 2022 owing to the presence of a large food service industry coupled with rising consumer demand for global cuisine are the primary factors driving the demand for breadcrumbs in the region. Additionally, the high consumption of processed meat and fish also favors the demand for breaded fish and meat in the region.

Moreover, India’s breadcrumbs market showcased a significant growth rate of 4.08% over the forecast period. The shift in dietary patterns coupled with a rise in the number of consumers in the country utilizing convenience foods in their meals is favoring the demand for breadcrumbs in the country.

The North America breadcrumbs market is expected to grow at a CAGR of 3.47% from 2023 to 2032. Advances in food technology and the high consumption of fast food in the region are the major factors driving the demand for the overall market. In March 2022, Kerry invested USD 136 million towards the breadcrumbs and coating facility in Georgia. The facility provides breader blends, panko breadcrumbs, and cracker meals.

The Europe region is expected to witness a steady growth rate of 3.35% during the forecast period, owing to the increasing demand for fish and chips in the region. In addition, the growing demand for frozen and processed foods is anticipated to drive market growth.

Bread Crumbs Market Segmentations:

By Product

By Seasoning

By End-use

By Distribution Channel

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Bread Crumbs Market

5.1. COVID-19 Landscape: Bread Crumbs Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Bread Crumbs Market, By Product

8.1. Bread Crumbs Market, by Product, 2023-2032

8.1.1. Dry

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Fresh

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Panko

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Bread Crumbs Market, By Seasoning

9.1. Bread Crumbs Market, by Seasoning, 2023-2032

9.1.1. Unflavored

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Italian

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. French

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Cheese

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Paprika

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Garlic

9.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Bread Crumbs Market, By End-use

10.1. Bread Crumbs Market, by End-use, 2023-2032

10.1.1. Dessert

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Fresh Food Items

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Frozen Food Items

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Pet Treats

10.1.4.1. Market Revenue and Forecast (2020-2032)

10.1.5. Others

10.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Bread Crumbs Market, By Distribution Channel

11.1. Bread Crumbs Market, by Distribution Channel, 2023-2032

11.1.1. Food Service

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Retail

11.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Bread Crumbs Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product (2020-2032)

12.1.2. Market Revenue and Forecast, by Seasoning (2020-2032)

12.1.3. Market Revenue and Forecast, by End-use (2020-2032)

12.1.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Product (2020-2032)

12.1.5.2. Market Revenue and Forecast, by Seasoning (2020-2032)

12.1.5.3. Market Revenue and Forecast, by End-use (2020-2032)

12.1.5.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Product (2020-2032)

12.1.6.2. Market Revenue and Forecast, by Seasoning (2020-2032)

12.1.6.3. Market Revenue and Forecast, by End-use (2020-2032)

12.1.6.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Product (2020-2032)

12.2.2. Market Revenue and Forecast, by Seasoning (2020-2032)

12.2.3. Market Revenue and Forecast, by End-use (2020-2032)

12.2.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Product (2020-2032)

12.2.5.2. Market Revenue and Forecast, by Seasoning (2020-2032)

12.2.5.3. Market Revenue and Forecast, by End-use (2020-2032)

12.2.5.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Product (2020-2032)

12.2.6.2. Market Revenue and Forecast, by Seasoning (2020-2032)

12.2.6.3. Market Revenue and Forecast, by End-use (2020-2032)

12.2.6.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Product (2020-2032)

12.2.7.2. Market Revenue and Forecast, by Seasoning (2020-2032)

12.2.7.3. Market Revenue and Forecast, by End-use (2020-2032)

12.2.7.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Product (2020-2032)

12.2.8.2. Market Revenue and Forecast, by Seasoning (2020-2032)

12.2.8.3. Market Revenue and Forecast, by End-use (2020-2032)

12.2.8.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Product (2020-2032)

12.3.2. Market Revenue and Forecast, by Seasoning (2020-2032)

12.3.3. Market Revenue and Forecast, by End-use (2020-2032)

12.3.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Product (2020-2032)

12.3.5.2. Market Revenue and Forecast, by Seasoning (2020-2032)

12.3.5.3. Market Revenue and Forecast, by End-use (2020-2032)

12.3.5.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Product (2020-2032)

12.3.6.2. Market Revenue and Forecast, by Seasoning (2020-2032)

12.3.6.3. Market Revenue and Forecast, by End-use (2020-2032)

12.3.6.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Product (2020-2032)

12.3.7.2. Market Revenue and Forecast, by Seasoning (2020-2032)

12.3.7.3. Market Revenue and Forecast, by End-use (2020-2032)

12.3.7.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Product (2020-2032)

12.3.8.2. Market Revenue and Forecast, by Seasoning (2020-2032)

12.3.8.3. Market Revenue and Forecast, by End-use (2020-2032)

12.3.8.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Product (2020-2032)

12.4.2. Market Revenue and Forecast, by Seasoning (2020-2032)

12.4.3. Market Revenue and Forecast, by End-use (2020-2032)

12.4.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Product (2020-2032)

12.4.5.2. Market Revenue and Forecast, by Seasoning (2020-2032)

12.4.5.3. Market Revenue and Forecast, by End-use (2020-2032)

12.4.5.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Product (2020-2032)

12.4.6.2. Market Revenue and Forecast, by Seasoning (2020-2032)

12.4.6.3. Market Revenue and Forecast, by End-use (2020-2032)

12.4.6.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Product (2020-2032)

12.4.7.2. Market Revenue and Forecast, by Seasoning (2020-2032)

12.4.7.3. Market Revenue and Forecast, by End-use (2020-2032)

12.4.7.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Product (2020-2032)

12.4.8.2. Market Revenue and Forecast, by Seasoning (2020-2032)

12.4.8.3. Market Revenue and Forecast, by End-use (2020-2032)

12.4.8.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Product (2020-2032)

12.5.2. Market Revenue and Forecast, by Seasoning (2020-2032)

12.5.3. Market Revenue and Forecast, by End-use (2020-2032)

12.5.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Product (2020-2032)

12.5.5.2. Market Revenue and Forecast, by Seasoning (2020-2032)

12.5.5.3. Market Revenue and Forecast, by End-use (2020-2032)

12.5.5.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Product (2020-2032)

12.5.6.2. Market Revenue and Forecast, by Seasoning (2020-2032)

12.5.6.3. Market Revenue and Forecast, by End-use (2020-2032)

12.5.6.4. Market Revenue and Forecast, by Distribution Channel (2020-2032)

Chapter 13. Company Profiles

13.1. Kikkoman Corporation

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Gonnella Baking Company

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. DeLallo

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. 4C Foods

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Vigo Importing Co

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. General Mills

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Edward & Sons Trading Co.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Aleia’s Gluten Free Foods Inc

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others