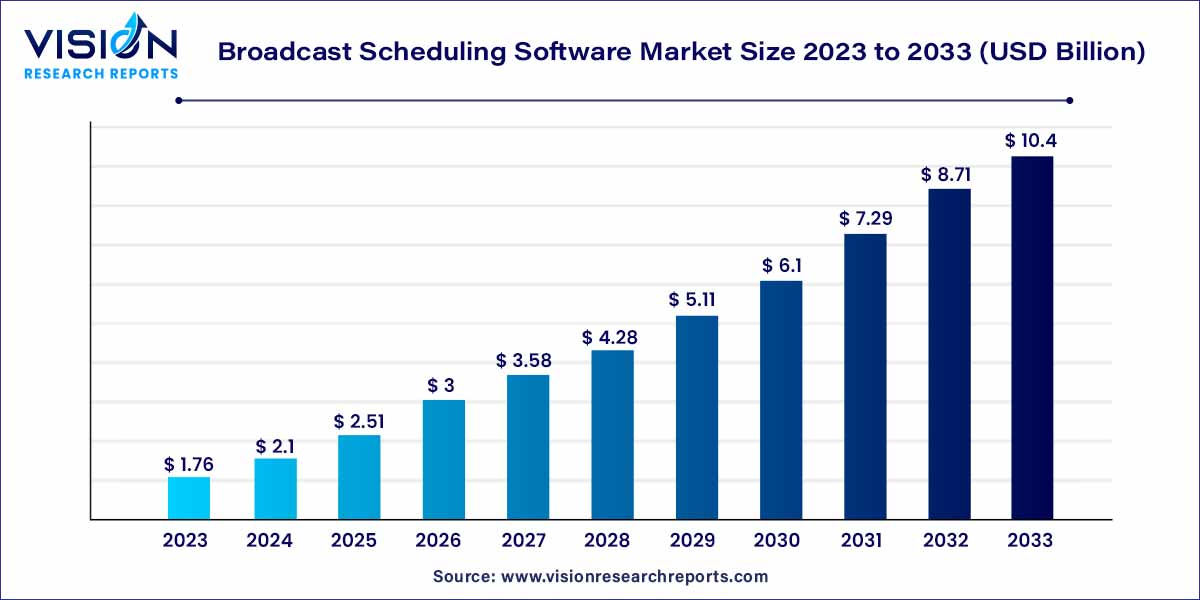

The global broadcast scheduling software market size was estimated at USD 1.76 billion in 2023 and it is expected to surpass around USD 10.4 billion by 2033, poised to grow at a CAGR of 19.44% from 2024 to 2033. The broadcast scheduling software market is witnessing a transformative phase, propelled by the rapid evolution of media consumption patterns and technological advancements in the broadcasting industry. Broadcast scheduling software plays a pivotal role in the seamless delivery of content across various platforms, ensuring optimal utilization of airtime, efficient management of programming, and enhanced viewer engagement. This overview delves into the key aspects shaping the broadcast scheduling software market, including market dynamics, growth drivers, challenges, and emerging trends.

The growth of the broadcast scheduling software market is driven by several key factors. One of the primary growth drivers is the increasing demand for personalized and engaging content. With viewers and listeners expecting tailored experiences, broadcasters are turning to advanced scheduling solutions to curate content based on audience preferences, thereby enhancing viewer engagement and loyalty. Additionally, the rise of digital transformation in the broadcasting industry is fueling the adoption of scheduling software, enabling seamless integration with digital platforms and optimizing content delivery processes. Another significant factor contributing to market growth is the emphasis on targeted advertising. Broadcast scheduling software allows for precise ad placements, maximizing the impact of advertising campaigns and boosting revenue for broadcasters.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 19.44% |

| Market Revenue by 2033 | USD 10.4 billion |

| Revenue Share of North America in 2022 | 41% |

| CAGR of Asia Pacific from 2024 to 2033 | 22.37% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units)Companies Covered |

The software segment accounted for the largest revenue share of 64% in 2023. These software solutions are designed with advanced algorithms that enable automatic scheduling of programs, commercials, and promotions. They optimize the utilization of available airtime, ensuring a balanced and appealing content mix. Moreover, these software solutions often come equipped with features for content management, allowing broadcasters to efficiently organize and categorize their media assets. This centralized approach simplifies the retrieval and scheduling of content, streamlining the entire workflow for media professionals.

The service segment is anticipated to grow at the noteworthy CAGR of 21.75% over the forecast period. These services range from consultation and implementation to training and technical support. Media organizations often seek expert consultation to choose the most suitable scheduling software tailored to their specific requirements. Implementation services play a crucial role in integrating the software seamlessly into existing infrastructures, ensuring a smooth transition and minimizing disruptions.

The on-premise segment generated the maximum market share of 53% in 2023. On-premises deployment involves the installation and operation of scheduling software within the premises of the broadcasting organization. This traditional approach provides a high level of control and customization, allowing broadcasters to fine-tune the software to align precisely with their workflow and security requirements. With on-premises solutions, media organizations have complete ownership and management of their scheduling infrastructure, ensuring data privacy and compliance with industry regulations.

The cloud segment is expected to grow at the notable CAGR of 21.83% over the forecast period. The cloud-based deployment has emerged as a transformative force, offering scalability, flexibility, and accessibility to broadcasters. Cloud-based scheduling software operates on remote servers, accessible through the internet, eliminating the need for on-site hardware and maintenance. This model allows media organizations to scale their scheduling resources based on demand, accommodating fluctuations in viewership and content requirements. Cloud solutions offer seamless collaboration among geographically dispersed teams, enabling real-time updates, remote access, and streamlined communication.

TV segment accounted for the highest revenue share of 47% in 2023. Television networks, both traditional and cable, rely heavily on advanced scheduling software to orchestrate their programming seamlessly. These solutions facilitate automated scheduling of TV shows, commercials, and promotional content, optimizing the allocation of airtime and ensuring a balanced and engaging viewer experience. TV networks utilize scheduling software to manage diverse content formats, including news programs, dramas, reality shows, and live events.

The digital platforms segment is estimated to register the fastest CAGR of 22.27% over the forecast period. The digital landscape has witnessed a significant shift towards online streaming services, on-demand content, and live streaming platforms. Digital platforms, ranging from streaming apps to social media channels, leverage broadcast scheduling software to curate and deliver content to audiences across the globe. These platforms require sophisticated solutions that can adapt to the dynamic nature of digital media consumption. Scheduling software tailored for digital platforms enables personalized content recommendations, interactive features, and real-time updates, enhancing user engagement and satisfaction.

North America dominated the market with largest revenue share of 41% in 2023. In North America, a robust media and entertainment sector, coupled with the early adoption of advanced technologies, drives the demand for cutting-edge scheduling solutions. The region's emphasis on digital transformation and data-driven decision-making fosters innovation in broadcast scheduling software. Similarly, in Europe, a diverse landscape of languages and cultures necessitates adaptable scheduling software capable of catering to varied audience preferences. European broadcasters leverage scheduling solutions to enhance localization efforts, ensuring that content resonates effectively with specific demographic groups in different countries.

Asia Pacific is expected to grow at the fastest CAGR of 22.37% over the forecast period. The Asia-Pacific region is experiencing rapid growth in the broadcast scheduling software market, driven by the expansion of digital platforms and streaming services. With a vast and diverse audience, broadcasters are increasingly focusing on content localization and adaptation. Mobile applications for scheduling management are particularly popular in this region, catering to the widespread use of smartphones. The demand for cost-effective scheduling solutions is creating opportunities for cloud-based deployments.

In April 2023, Brightcove Inc. announced a partnership with Frequency Networks. Frequency, a prominent player in free ad-supported streaming TV (FAST) channel solutions, has successfully integrated with Brightcove's acclaimed video platform. This integration empowers customers to develop, launch, and oversee FAST channels effortlessly, enabling them to extend their audience and boost their earnings easily.

In January 2022, Banneker Partners announced the acquisition of Xytech Systems LLC. This acquisition represents a strategic investment by Banneker Partners to expedite Xytech's capacity to improve its range of solutions and operational delivery capabilities within this critical market segment.

By Solution

By Deployment

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Solution Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Broadcast Scheduling Software Market

5.1. COVID-19 Landscape: Broadcast Scheduling Software Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Broadcast Scheduling Software Market, By Solution

8.1. Broadcast Scheduling Software Market, by Solution, 2024-2033

8.1.1 Software

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Services

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Professional Services

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Managed Services

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Broadcast Scheduling Software Market, By Deployment

9.1. Broadcast Scheduling Software Market, by Deployment, 2024-2033

9.1.1. On-Premises

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Cloud

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Hybrid

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Broadcast Scheduling Software Market, By Application

10.1. Broadcast Scheduling Software Market, by Application, 2024-2033

10.1.1. TV

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Radio

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Digital Platforms

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Broadcast Scheduling Software Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Solution (2021-2033)

11.1.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.1.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Solution (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Solution (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Solution (2021-2033)

11.2.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.2.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Solution (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Solution (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Solution (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Solution (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Solution (2021-2033)

11.3.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.3.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Solution (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Solution (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Solution (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Solution (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Solution (2021-2033)

11.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Solution (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Solution (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Solution (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Solution (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Solution (2021-2033)

11.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Solution (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Solution (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

Chapter 12. Company Profiles

12.1. Advanced Broadcast Servicess Limited.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Schedule it Ltd.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. WideOrbit.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Marketron Broadcast Solutions.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Imagine Communications.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Chetu Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. AMC Networks Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. AxelTech

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others