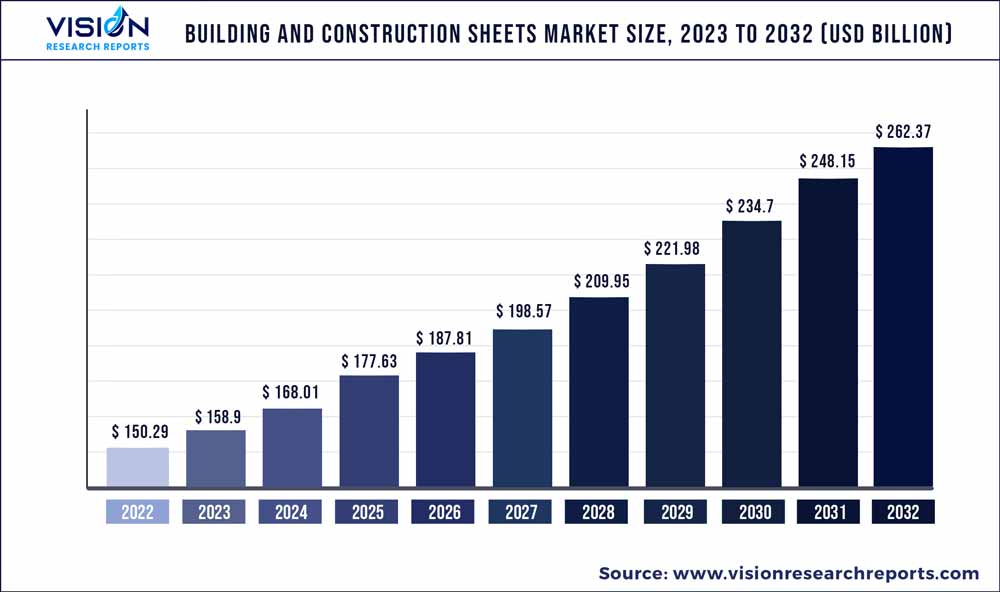

The global building and construction sheets market size was estimated at around USD 150.29 billion in 2022 and it is projected to hit around USD 262.37 billion by 2032, growing at a CAGR of 5.73% from 2023 to 2032.

Key Pointers

Report Scope of the Building And Construction Sheets Market

| Report Coverage | Details |

| Market Size in 2022 | USD 150.29 billion |

| Revenue Forecast by 2032 | USD 262.37 billion |

| Growth rate from 2023 to 2032 | CAGR of 5.73% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Paul Bauder GmbH & Co. KG; GAF Materials Corporation; Atlas Roofing Corporation; CertainTeed Corporation; Owens Corning Corp.; Etex; Fletcher Building Limited; North American Roofing Services; Inc.; Icopal ApS; EURAMAX |

The increasing spending in the construction and building industry by governments in major countries such as U.S., Canada, and China is expected to boost product demand.

The rapidly expanding urbanization and industrialization are also driving the building & construction sheets market growth. Furthermore, the increasing focus on industrial and public infrastructure requirements across the globe is projected to create potential demand over the forecast period. The economic development across rapidly developing countries including India, Mexico, and Nigeria is further projected to propel the building & construction sheets market growth.

There is continuous involvement of government and international non-profit organizations in the development of their respective areas and countries in terms of infrastructural development projects that can meet the demand of the growing population. Additionally, the rising focus to limit the emission of greenhouse gases (GHG) across the buildings and construction industry is another factor anticipated to create demand in the near future.

Polymer sheets are used in a variety of applications in the building and construction industry, including sound barriers, greenhouses, window glazing, and furniture. Furthermore, the growing trend of interior decoration and architecture is expected to boost the demand for polymer sheets and their raw materials such as polyester, PVC, polyamides, and polyurethanes.

The building & construction sheets market is segmented into residential, commercial, and industrial based on end-use. The market for metal sheets in residential air handling and ventilation systems is expected to grow in response to rising demand for modern heating, cooling, and ventilation systems in modern buildings. Furthermore, rising green building practices are increasing the demand for bio-based polymer sheets in the residential sector.

North America is expected to be driven by the growing residential and commercial real estate industries in the United States, owing to rising consumer confidence and low-interest rates. Additionally, the construction industry is one of the primary contributors to Canada and Mexico's annual GDP, which is expected to drive the market over the forecast period.

Stringent regulations governing the depletion and recycling of conventional materials such as metal and wood are expected to drive demand for bio-based polymers in building and construction applications. Building & construction sheets market growth is being driven by the use of polymers in form sheets in FRP bridge sections, bridge bearings, flooring, and cladding panels’ applications.

Product Insights

Polymer sheets are used in a wide range of applications including greenhouses, sound barriers, furniture, and window glazing in the building & construction sector. Also, the rising trend of interior decoration and architecture is predicted to fuel the demand for polymer sheets and their raw materials including polyester, PVC, polyamides, and polyurethanes.

Metal sheets accounted for 35.71% of the revenue share in 2022 on account of the availability of a wide range of metal deposits and the high durability of metal components. Metals used in building & construction products include lead, aluminum tin, zinc, copper & its alloys, iron & its alloys; however, aluminum is the widely used metal due to its lightweight and anti-corrosion properties.

A wide range of rubber sheets including natural, neoprene, EPDM, and nitrile rubber sheets are available commercially. Rubber sheets are popularly used in flooring applications; however, the product is expected to account for the smallest share over the forecast period owing to low penetration and the availability of substitutes such as bitumen sheets.

Bitumen sheets are expected to grow at a CAGR of 5.22%. The sheets protect the infrastructure and prevent water leakage. Therefore, the product is majorly used in waterproofing activities in the building & construction industry. Highly sticky and viscous bitumen sheets are used in the form of roofing felt for roof construction.

Application Insights

Factors, such as the growing building & construction industry, rising global construction spending, increasing disposable income, and changing lifestyles, are likely to boost the demand for the product in key application industries. Roofing accounted for 22.73% of the revenue share in 2022, and the demand is projected to be fueled by the surge in residential construction activities in developed nations coupled with increasing penetration of the product in the application.

Heating, Ventilation and Air Conditioning (HVAC) applications provide proper ventilation and a comfortable and climate-controlled environment. The changing environmental conditions across the globe has created the need for efficient HVAC systems in buildings. As a result, the demand for aluminum sheets is registering growth in the industry as they are lightweight and easy to install.

Doors and windows segments accounted for a revenue share of over 26.94% in 2022. Metals such as aluminum and steel are widely used in the manufacturing of windows and doors in buildings owing to the lightweight and highly durable properties exhibited by the metals. Besides, the rising use of vinyl, cellular PVC, and thermoplastic alloys sheets is also expected to drive growth.

Function Insights

Building & construction sheets offer various functions such as protection, insulation, water & soundproofing, glazing, and bonding. However, protection accounted for the largest revenue share in 2022 owing to the rising demand for the product in different applications including roofing and windows & doors.

Insulation is another crucial function of the product, and the segment is projected to demonstrate a CAGR of 6.37% over the forecast period on account of the rising regulatory standards and safety concerns associated with the electrical application in buildings. Also, thermal insulation in the roofing application offered by the product is expected to drive the segment growth.

Polycarbonate sheets are used in the building & construction sector for application in skylight lenses and safety & security glazing. Architectural glazing offers enhanced light diffusion to reduce the glare and aid in improving light distribution through the glazed surface. The growing penetration of polymer products in architectural glazing is expected to drive growth.

Sound & waterproofing is another major function of the product, which majorly employs a variety of bituminous and rubber sheets in basements, walls, balconies, decks, and roofs in the building & construction industry. Benefits offered by the product including flexibility, tear-resistant, and elasticity to protect the structure from leakage is expected to drive market growth over the forecast period.

End-use Insights

The global spending on residential buildings construction is higher in comparison to industrial and commercial spending with the growing demand for residential real estate in developing as well as developed economies. As a result, the residential construction accounted for the largest market share in 2022 and is likely to register a CAGR of 6.22% in the forecast period.

Rising demand for up-to-date heating, cooling, and ventilation systems in modern buildings is expected to fuel the market for metal sheets in residential air handling & ventilation systems. Besides, growing green building practices are fueling the demand for bio-based polymer sheets in the residential sector.

The growth of non-residential buildings sector is strongest in Asia Pacific, led by China and India. The market for the product is expected to register growth on account of rising expenditure on the building offices and commercial, industrial, and institutional structures. Also, the rise in investments in office & hotel construction are expected to trigger growth in the forecast period.

Metal and polymer sheets are majorly used for roofing, electrical, and HVAC applications in industrial buildings to provide protection and insulation to the workforce and machinery. Growing industrialization in developing economies is expected to drive the demand for the product in industrial buildings in the forecast period.

Distribution Channel Insights

Distribution via direct supply accounted for a major market share of over 77.46% for building & construction sheets on account of the presence of well-established distribution channels and logistical systems. Direct distribution channels offer cost-effective products in bulk quantities to a wide range of application industries.

The third-party distribution channel is predicted to register a CAGR of 6.36% on account of rising demand from the residential segment. Growing demand for the product in interior decoration, wall & ceiling protection, attractive roofing, and decorative flooring in small quantities is estimated to drive third-party distribution channel segment over the forecast period.

Regional Insights

North America is projected to be driven by the growing residential & commercial real estate in the U.S. owing to rising consumer confidence and low-interest rates in the industry. Besides, the construction industry is one of the primary contributors to the annual GDP of Canada and Mexico and estimated to drive the market over the forecast period.

The construction industry in Europe is expected to recover and exhibit a positive growth on account of the positive trends witnessed in Germany and the U.K. Also, the budget deficit in several western European economies is anticipated to reduce, which, in turn, is likely to positively impact the building & construction sheets market.

Asia Pacific is likely to be the fastest-growing market on the account of increase in spending on residential real estate construction in the forecast period. A rapidly growing industry in Asia is characterized by a rising population, rapid urbanization, and strong economic growth, which, in turn, is expected to trigger the market for the product at an estimated CAGR of 6.64% over the forecast period.

The development of luxury apartment buildings and hotels in Central & South America is predicted to fuel construction spending and support the product market in Brazil, Chile, Argentina, Peru, and Uruguay. Continued spending on commercial and industrial sectors and a surge in investor acquisitions in the real estate are likely to aid the demand for sheets over the forecast period.

Building And Construction Sheets Market Segmentations:

By Product

By Application

By Function

By End-use

By Distribution Channel

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Building And Construction Sheets Market

5.1. COVID-19 Landscape: Building And Construction Sheets Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Building And Construction Sheets Market, By Product

8.1. Building And Construction Sheets Market, by Product, 2023-2032

8.1.1. Bitumen

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Rubber

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Metal

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Polymer

8.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Building And Construction Sheets Market, By Application

9.1. Building And Construction Sheets Market, by Application, 2023-2032

9.1.1. Flooring

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Walls & Ceiling

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Windows

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Doors

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Roofing

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Building Envelop

9.1.6.1. Market Revenue and Forecast (2020-2032)

9.1.7. Electrical

9.1.7.1. Market Revenue and Forecast (2020-2032)

9.1.8. HVAC

9.1.8.1. Market Revenue and Forecast (2020-2032)

9.1.9. Plumbing

9.1.9.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Building And Construction Sheets Market, By Function

10.1. Building And Construction Sheets Market, by Function, 2023-2032

10.1.1. Bonding

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Protection

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Insulation

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Glazing

10.1.4.1. Market Revenue and Forecast (2020-2032)

10.1.5. Water Proofing

10.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Building And Construction Sheets Market, By End-use

11.1. Building And Construction Sheets Market, by End-use, 2023-2032

11.1.1. Residential

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Commercial

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Industrial

11.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Building And Construction Sheets Market, By Distribution Channel

12.1. Building And Construction Sheets Market, by Distribution Channel, 2023-2032

12.1.1. Direct

12.1.1.1. Market Revenue and Forecast (2020-2032)

12.1.2. Third-party

12.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 13. Global Building And Construction Sheets Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Product (2020-2032)

13.1.2. Market Revenue and Forecast, by Application (2020-2032)

13.1.3. Market Revenue and Forecast, by Function (2020-2032)

13.1.4. Market Revenue and Forecast, by End-use (2020-2032)

13.1.5. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Product (2020-2032)

13.1.6.2. Market Revenue and Forecast, by Application (2020-2032)

13.1.6.3. Market Revenue and Forecast, by Function (2020-2032)

13.1.6.4. Market Revenue and Forecast, by End-use (2020-2032)

13.1.7. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Product (2020-2032)

13.1.8.2. Market Revenue and Forecast, by Application (2020-2032)

13.1.8.3. Market Revenue and Forecast, by Function (2020-2032)

13.1.8.4. Market Revenue and Forecast, by End-use (2020-2032)

13.1.8.5. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Product (2020-2032)

13.2.2. Market Revenue and Forecast, by Application (2020-2032)

13.2.3. Market Revenue and Forecast, by Function (2020-2032)

13.2.4. Market Revenue and Forecast, by End-use (2020-2032)

13.2.5. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Product (2020-2032)

13.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

13.2.6.3. Market Revenue and Forecast, by Function (2020-2032)

13.2.7. Market Revenue and Forecast, by End-use (2020-2032)

13.2.8. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Product (2020-2032)

13.2.9.2. Market Revenue and Forecast, by Application (2020-2032)

13.2.9.3. Market Revenue and Forecast, by Function (2020-2032)

13.2.10. Market Revenue and Forecast, by End-use (2020-2032)

13.2.11. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Product (2020-2032)

13.2.12.2. Market Revenue and Forecast, by Application (2020-2032)

13.2.12.3. Market Revenue and Forecast, by Function (2020-2032)

13.2.12.4. Market Revenue and Forecast, by End-use (2020-2032)

13.2.13. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Product (2020-2032)

13.2.14.2. Market Revenue and Forecast, by Application (2020-2032)

13.2.14.3. Market Revenue and Forecast, by Function (2020-2032)

13.2.14.4. Market Revenue and Forecast, by End-use (2020-2032)

13.2.15. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Product (2020-2032)

13.3.2. Market Revenue and Forecast, by Application (2020-2032)

13.3.3. Market Revenue and Forecast, by Function (2020-2032)

13.3.4. Market Revenue and Forecast, by End-use (2020-2032)

13.3.5. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Product (2020-2032)

13.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

13.3.6.3. Market Revenue and Forecast, by Function (2020-2032)

13.3.6.4. Market Revenue and Forecast, by End-use (2020-2032)

13.3.7. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Product (2020-2032)

13.3.8.2. Market Revenue and Forecast, by Application (2020-2032)

13.3.8.3. Market Revenue and Forecast, by Function (2020-2032)

13.3.8.4. Market Revenue and Forecast, by End-use (2020-2032)

13.3.9. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Product (2020-2032)

13.3.10.2. Market Revenue and Forecast, by Application (2020-2032)

13.3.10.3. Market Revenue and Forecast, by Function (2020-2032)

13.3.10.4. Market Revenue and Forecast, by End-use (2020-2032)

13.3.10.5. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Product (2020-2032)

13.3.11.2. Market Revenue and Forecast, by Application (2020-2032)

13.3.11.3. Market Revenue and Forecast, by Function (2020-2032)

13.3.11.4. Market Revenue and Forecast, by End-use (2020-2032)

13.3.11.5. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Product (2020-2032)

13.4.2. Market Revenue and Forecast, by Application (2020-2032)

13.4.3. Market Revenue and Forecast, by Function (2020-2032)

13.4.4. Market Revenue and Forecast, by End-use (2020-2032)

13.4.5. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Product (2020-2032)

13.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

13.4.6.3. Market Revenue and Forecast, by Function (2020-2032)

13.4.6.4. Market Revenue and Forecast, by End-use (2020-2032)

13.4.7. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Product (2020-2032)

13.4.8.2. Market Revenue and Forecast, by Application (2020-2032)

13.4.8.3. Market Revenue and Forecast, by Function (2020-2032)

13.4.8.4. Market Revenue and Forecast, by End-use (2020-2032)

13.4.9. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Product (2020-2032)

13.4.10.2. Market Revenue and Forecast, by Application (2020-2032)

13.4.10.3. Market Revenue and Forecast, by Function (2020-2032)

13.4.10.4. Market Revenue and Forecast, by End-use (2020-2032)

13.4.10.5. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Product (2020-2032)

13.4.11.2. Market Revenue and Forecast, by Application (2020-2032)

13.4.11.3. Market Revenue and Forecast, by Function (2020-2032)

13.4.11.4. Market Revenue and Forecast, by End-use (2020-2032)

13.4.11.5. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Product (2020-2032)

13.5.2. Market Revenue and Forecast, by Application (2020-2032)

13.5.3. Market Revenue and Forecast, by Function (2020-2032)

13.5.4. Market Revenue and Forecast, by End-use (2020-2032)

13.5.5. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Product (2020-2032)

13.5.6.2. Market Revenue and Forecast, by Application (2020-2032)

13.5.6.3. Market Revenue and Forecast, by Function (2020-2032)

13.5.6.4. Market Revenue and Forecast, by End-use (2020-2032)

13.5.7. Market Revenue and Forecast, by Distribution Channel (2020-2032)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Product (2020-2032)

13.5.8.2. Market Revenue and Forecast, by Application (2020-2032)

13.5.8.3. Market Revenue and Forecast, by Function (2020-2032)

13.5.8.4. Market Revenue and Forecast, by End-use (2020-2032)

13.5.8.5. Market Revenue and Forecast, by Distribution Channel (2020-2032)

Chapter 14. Company Profiles

14.1. Paul Bauder GmbH & Co. KG

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. GAF Materials Corporation

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Atlas Roofing Corporation

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. CertainTeed Corporation

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Owens Corning Corp.

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Etex

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Fletcher Building Limited

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. North American Roofing Services; Inc.

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Icopal ApS

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. EURAMAX

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others