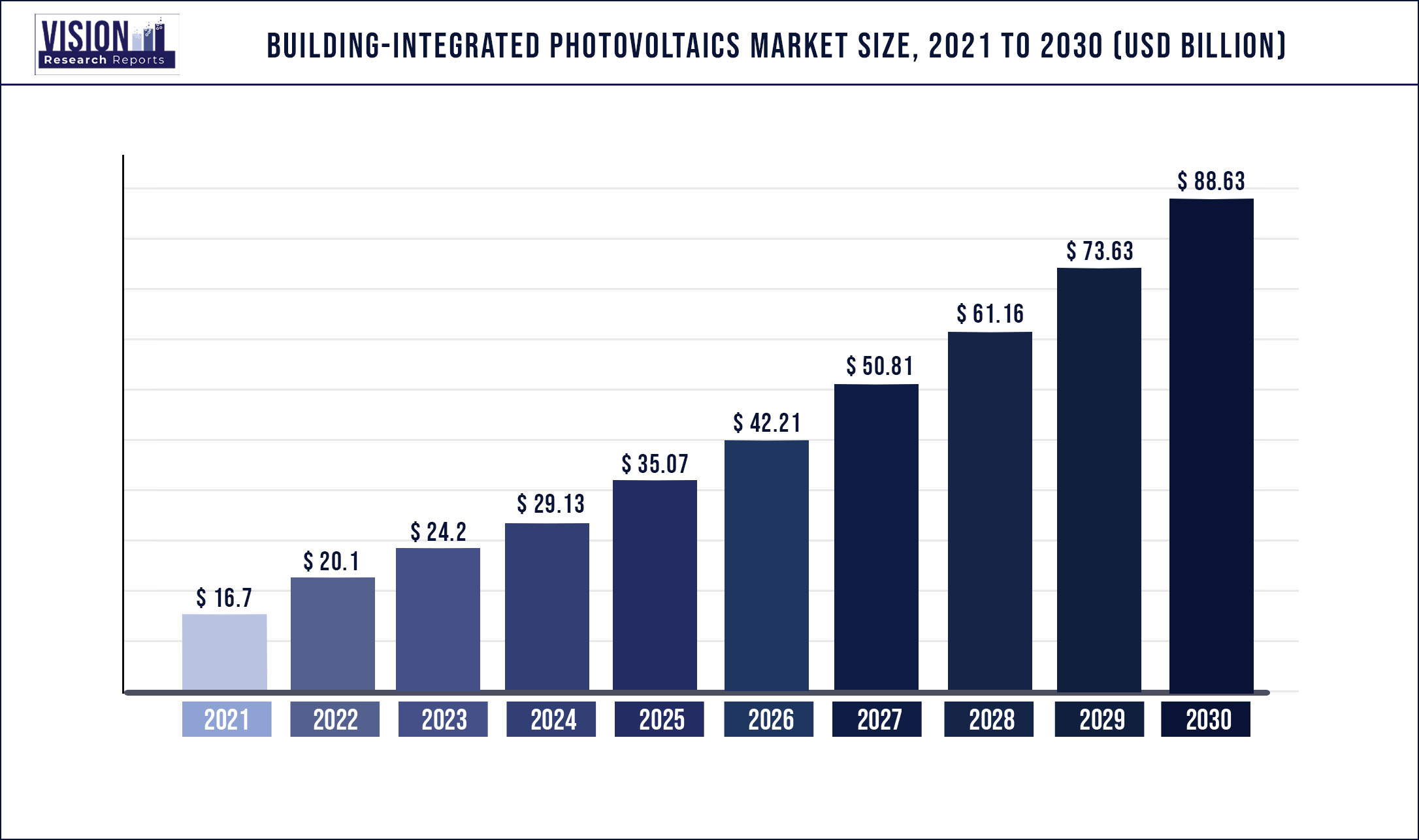

The global building-integrated photovoltaics market was surpassed at USD 16.7 billion in 2021 and is expected to hit around USD 88.63 billion by 2030, growing at a CAGR of 20.38% from 2022 to 2030

Report Highlights

The rapid expansion of the solar photovoltaic (PV) installation capacities of different countries, coupled with increasing demand for renewable energy sources, is expected to drive the growth of the market across the world. The rising consumer awareness coupled with the product’s superior performance over the last decade has primarily driven the market for building-integrated photovoltaics (BIPV).

The crystalline silicon segment led the market in 2021 and had a market share of 71.02%. The crystalline silicon segment was the dominant segment in 2021 which is attributed to the high strength of crystalline silicon BIPV coupled with superior resistance to adverse weather conditions. This segment is driven by declining prices of crystalline silicon cells, which is expected to lower the installation cost in the coming years.

Favorable government legislations, coupled with the unilateral obligation of countries such as Germany, Italy, France, the UK, the U.S., China, Japan, and India to the Kyoto Protocol, designated to reduce greenhouse gas (GHG) emissions, are also expected to promote the growth of the market in the coming years.

In application, roof installations led the market with a market share of 61.46% in 2021. Photovoltaics integrated with building roofs are known to exhibit efficiency due to improved incidence of light on the roof surface. The development of interlocking roof systems that use interlocked tiles, which provide a high conversion efficiency and a significant reduction in the weight of building integrated roofs, is likely to drive the market over the forecast period.

Based on the end-user, the industrial segment led the BIPV market in 2021 and had a market share of 40.13%. The demand for BIPV in industrial establishments is likely to grow as the consumers in this segment are not price-sensitive and emphasize on reducing the overall cost for companies. In addition, several industries, in a bid to project an environment-friendly image to their consumers, adopt these solutions.

The demand for BIPV installations is anticipated to be fueled by the improvements observed in their operational efficiency. In addition, the growing affinity of multinationals toward the adoption of environment-friendly energy sources is likely to have a positive impact on the BIPV market.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 16.7 billion |

| Revenue Forecast by 2030 | USD 88.63 billion |

| Growth rate from 2022 to 2030 | CAGR of 20.38% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Technology, application, end-use, region |

| Companies Covered | SolarWindow Technologies, Inc.; AGC Inc.; Hanergy Mobile Energy Holding Group Limited; The Solaria Corporation; Heliatek GmbH; Carmanah Technologies Corp.; Greatcell; Tesla; BELECTRIC; ertex solartechnik GmbH; Canadian Solar; Onyx Solar Group LLC; NanoPV Solar Inc.; SOLAXESS |

Technology Type Insights

Based on technology type, the global market has been further divided into Crystalline Silicon, Thin film, and others. The crystalline silicon segment led the market and accounted for 71.23% of the global revenue share in 2021. Crystalline silicon cells can be integrated into building roofs by using smart mounting systems, which replace the sections of the roof while keeping its integrity intact. This type of integration does not account for large investments and provides high efficiency. Another option for integration is the replacement of roof tiles with crystalline silicon cells. In addition, the market witnesses the use of anti-reflective coatings, which aid the capture of solar energy and provide superior efficiency. Crystalline silicon has the highest energy conversion efficiency at present; commercial modules typically convert 13%-21% of the incident sunlight into electricity.

The thin film held a share of 22.3% in the global BIPV market in 2021. The thin-film BIPV market is expected to witness sustained growth over the forecast period due to rapid technological advancements leading to the introduction of advanced products. Thin-film BIPVs are readily used in case of considerable weight constraints for the building. In such cases, the building envelope is unable to support the weight of crystalline silicon integration, leading to high demand for thin-film integrated installation. Thin film is advantageous as it can be used for curved surfaces owing to its superior flexibility

Other technology segment includes advanced integrated photovoltaic manufacturing technologies such as dye-sensitized cells (DSC) and organic photovoltaics (BIOPV). The demand is expected to be driven by the superior energy bandgap of organic photovoltaics. Rapid technological advancements have led to a significant increase in the efficiency of organic PVs, which is anticipated to boost their demand over the forecast period.

Application Insights

The roof installation segment led the market and accounted for the largest revenue share of more than 61.54% in 2021. The roof segment will maintain its lead throughout the forecast period. Photovoltaics integrated with building roofs are known to exhibit efficiency due to improved incidence of light on the roof surface. The segment accounted for the highest market share in 2021 owing to the higher strength and improved aesthetic appeal of integrated roofs and skylights. The demand for building integrated roofs is expected to increase over the forecast period due to the development of superior products.

The market is anticipated to have a steady growth in all segments as the demand for BIPV increases. The superior efficiency of solar walls due to strong incident sunlight is expected to drive the demand for BIPV in walls over the forecast period. The introduction of advanced low-weight solar panels is expected to facilitate the demand for building integrated walls. The development of advanced solutions such as the combination of amorphous silicon transparent glass solar panels with an opaque glazing unit is likely to drive the demand for BIPV in these applications. The use of double- and triple-glazed insulating glass in BIPV walls is also expected to boost the product demand over the forecast period.

BIPV facades experience high demand, primarily in the developed economies that have a well-established electricity distribution system. The demand for the integration of photovoltaics with facades is driven by their increasing installation in the commercial sector. Glass integrations are expected to grow on account of the high transparency of integrated systems coupled with superior integration of glass and BIPV cells. The development of photovoltaic materials with high absorption is expected to propel the product demand over the forecast period.

The others application segment includes shading and membranes. The demand for such products is high in residential installations due to the development of lightweight materials for use on uneven surfaces. The installations do not generally use crystalline silicon photovoltaic modules, as the structure is incapable of supporting heavyweight.

End-use Insights

The industrial segment led the market in 2021 and accounted for 40.2% market share. The demand for building-integrated photovoltaics in industrial applications is expected to be fueled by their growing usage to reduce reliance on non-renewable energy sources. The segment is anticipated to expand in the wake of increasing adoption in the European region. In addition, companies in developed economies in Europe exhibit an increased tendency toward the use of integrated photovoltaics in a bid to improve the aesthetic appeal of buildings.

The demand for building-integrated photovoltaics in commercial establishments is likely to be fueled by the growing number of retrofit projects using these installations. The high emphasis on the aesthetic appeal of solar energy-harnessing systems, primarily in commercial establishments, is likely to fuel the product demand in this sector.

The demand for building-integrated photovoltaics in the residential sector is expected to be driven over the forecast period owing to increasing awareness regarding the use of renewable sources of energy for electricity generation among consumers. However, the high cost of integration of photovoltaics into the building envelope is expected to act as a restraint for the market growth over the forecast period.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Building-integrated Photovoltaics Market

5.1. COVID-19 Landscape: Building-integrated Photovoltaics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Building-integrated Photovoltaics Market, By Technology

8.1. Building-integrated Photovoltaics Market, by Technology, 2022-2030

8.1.1 Crystalline Silicon

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Thin Film

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Others

8.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Building-integrated Photovoltaics Market, By Application

9.1. Building-integrated Photovoltaics Market, by Application, 2022-2030

9.1.1. Roof

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Glass

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Wall

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Facade

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Building-integrated Photovoltaics Market, By End-use

10.1. Building-integrated Photovoltaics Market, by End-use, 2022-2030

10.1.1. Industrial

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Commercial

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Residential

10.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Building-integrated Photovoltaics Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Technology (2017-2030)

11.1.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.3. Market Revenue and Forecast, by End-use (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Technology (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Technology (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Technology (2017-2030)

11.2.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Technology (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Technology (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Technology (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Technology (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Technology (2017-2030)

11.3.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Technology (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Technology (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Technology (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Technology (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Technology (2017-2030)

11.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Technology (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Technology (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Technology (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Technology (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Technology (2017-2030)

11.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Technology (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Technology (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.5.3. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 12. Company Profiles

12.1. SolarWindow Technologies, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. AGC Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Hanergy Mobile Energy Holding Group Limited

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. The Solaria Corporation

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Heliatek GmbH,

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Carmanah Technologies Corp.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Greatcell

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Tesla

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. BELECTRIC

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. ertex solartechnik GmbH

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others