The global bunker fuel market size was valued at around USD 125.08 billion in 2024 and it is projected to hit around USD 192.39 billion by 2034, growing at a CAGR of 4.40% from 2025 to 2034.

The bunker fuel market plays a pivotal role in the global maritime industry, serving as the primary fuel source for ships engaged in international and domestic trade. This market is influenced by global shipping activities, environmental regulations, and the evolving landscape of marine fuel standards. Traditionally dominated by heavy fuel oil (HFO), the industry is undergoing a transformation driven by stringent emission norms from the International Maritime Organization (IMO), pushing demand toward cleaner alternatives like very low sulfur fuel oil (VLSFO), marine gas oil (MGO), and liquefied natural gas (LNG).

One of the primary drivers of growth in the bunker fuel market is the expansion of global maritime trade. As international commerce increases, driven by the demand for raw materials, consumer goods, and energy supplies, shipping remains the most cost-effective mode of bulk transport. This directly correlates with a rising need for bunker fuel to power the global merchant fleet. Furthermore, economic recovery in emerging markets and infrastructural development in port cities are boosting marine transportation activities, contributing to steady fuel demand in the sector.

Another significant growth factor is the shift toward cleaner and compliant fuel alternatives in response to stringent environmental regulations. The IMO 2020 regulation, which mandates the reduction of sulfur content in marine fuels, has accelerated the adoption of low-sulfur fuels like VLSFO and MGO. Additionally, rising investments in LNG bunkering infrastructure and research into biofuels and ammonia as marine fuel alternatives are opening new revenue streams for fuel suppliers. The push for decarbonization is not only driving innovation but also expanding the scope of the market beyond traditional fuel types.

One of the most prominent trends shaping the bunker fuel market is the industry's transition toward low-sulfur and environmentally friendly fuel alternatives. Following the enforcement of IMO 2020, there has been a notable shift from traditional heavy fuel oil (HFO) to very low sulfur fuel oil (VLSFO), marine gas oil (MGO), and liquefied natural gas (LNG). This regulatory-driven transformation has led refiners to invest heavily in desulfurization processes and shipping companies to upgrade their vessels for fuel compatibility, signaling a long-term movement toward sustainability.

Another emerging trend is the growing interest in alternative marine fuels such as biofuels, ammonia, methanol, and hydrogen. These options are being explored as part of the maritime sector’s commitment to achieving net-zero carbon emissions by 2050. While still in the early stages of adoption, pilot projects and collaborative initiatives among energy providers, shipbuilders, and regulatory bodies are laying the groundwork for broader commercial use. Technological advancements in fuel conversion systems and dual-fuel engines are further supporting this evolution.

Digitalization and data-driven optimization in fuel procurement and consumption are also transforming the bunker fuel market. Digital platforms and AI-enabled tools are helping shipping companies improve fuel efficiency, manage compliance, and reduce operational costs. Additionally, blockchain-based systems are gaining traction to enhance transparency and trust in bunker transactions, reducing fraud and improving traceability throughout the fuel supply chain.

A major challenge in the bunker fuel market is the high cost and limited availability of compliant and alternative fuels. With the implementation of IMO 2020 and the push for carbon-neutral shipping, many ship operators have been compelled to shift to VLSFO, MGO, or LNG. However, these fuels are often more expensive than traditional HFO and may not be readily available in all ports, especially in developing regions. This disparity creates logistical and financial strain for shipowners, particularly smaller operators who may lack the infrastructure or capital to adapt quickly.

Another critical issue is the uncertainty and complexity of environmental regulations. The maritime sector must comply with a constantly evolving set of global, regional, and local emission standards, which vary widely in scope and enforcement. This regulatory fragmentation makes long-term planning and investment decisions difficult for fuel suppliers and shipping companies. Additionally, retrofitting ships with new engine technologies or scrubber systems to meet these regulations requires significant upfront capital and technical expertise.

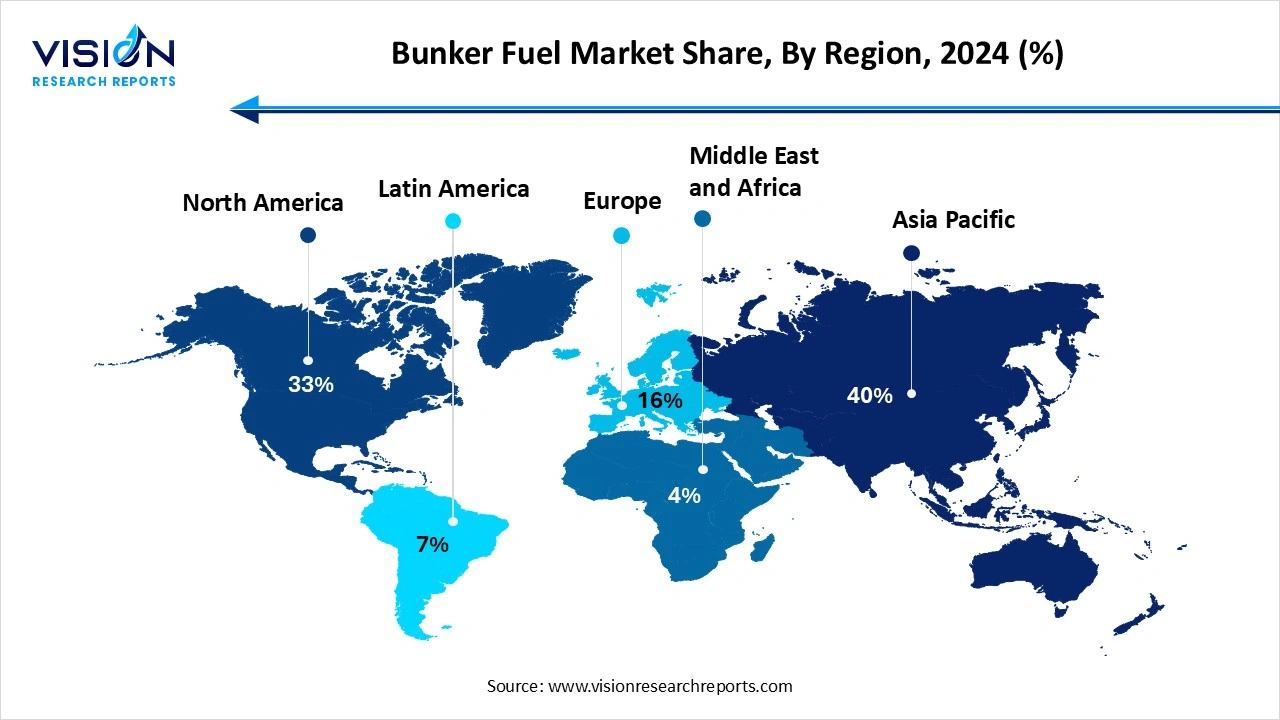

The Asia Pacific region dominates the global market with highest share of 40% in 2024. driven by its expansive maritime trade networks and the presence of some of the world’s busiest ports such as Singapore, Shanghai, and Hong Kong. These ports serve as key refueling hubs for vessels traveling along critical international trade routes. Rapid industrialization, increasing energy consumption, and strong economic growth in countries like China, India, South Korea, and Japan further bolster regional demand for marine fuels. Governments in the region are also actively supporting cleaner marine fuel initiatives and infrastructure development, including LNG.

The North America also holds a prominent position in the global bunker fuel market due to its robust shipping activity along both the Atlantic and Pacific coasts, as well as in the Gulf of Mexico. The region's stringent environmental regulations, particularly from the U.S. Environmental Protection Agency (EPA), have accelerated the transition toward low-sulfur fuels and greener alternatives. Major ports such as Los Angeles, Houston, and New York act as significant bunkering stations, with infrastructure upgrades supporting both conventional and alternative fuels. Technological advancements and regulatory incentives are prompting vessel operators in this region to adopt more efficient and sustainable fuel solutions.

The North America also holds a prominent position in the global bunker fuel market due to its robust shipping activity along both the Atlantic and Pacific coasts, as well as in the Gulf of Mexico. The region's stringent environmental regulations, particularly from the U.S. Environmental Protection Agency (EPA), have accelerated the transition toward low-sulfur fuels and greener alternatives. Major ports such as Los Angeles, Houston, and New York act as significant bunkering stations, with infrastructure upgrades supporting both conventional and alternative fuels. Technological advancements and regulatory incentives are prompting vessel operators in this region to adopt more efficient and sustainable fuel solutions.

The very low sulfur fuel oil (VLSFO) holds a vital position in the bunker fuel market, offering a practical solution to meet the International Maritime Organization’s (IMO) strict sulfur emission standards without compromising cost efficiency for shipping operators. By striking a balance between regulatory compliance and dependable operational performance, VLSFO has become the fuel of choice for commercial shipping fleets globally. With ongoing investments in port infrastructure and fuel supply chains to enhance VLSFO accessibility, its dominance in the marine fuel landscape is steadily strengthening.

The (VLSFO) is meticulously blended and subjected to rigorous quality control to ensure efficient engine performance and reduced emissions. Its growing adoption is largely attributed to its seamless compatibility with current marine engines and the reduced capital investment it requires when compared to alternative fuels. Furthermore, long-term supply agreements and adaptable bunker delivery systems offer marine operators both reliability and operational ease.

The bulk carriers represent a significant segment within the global bunker fuel market due to their extensive use in transporting commodities such as coal, iron ore, grain, and other raw materials across international waters. These vessels operate on long-haul routes that require consistent and efficient fuel supply, making fuel cost and performance key considerations. With the global demand for raw materials remaining strong, especially from emerging economies, the need for reliable bunker fuel options continues to grow. Ship operators in this segment are increasingly opting for compliant fuels such as Very Low Sulfur Fuel Oil (VLSFO) or installing scrubber.

The oil tankers also play a vital role in the bunker fuel market, given their essential function in transporting crude oil and refined petroleum products. These vessels typically travel on fixed trade routes and have high fuel consumption rates due to their massive size and weight-carrying capacity. The efficiency and availability of bunker fuel are crucial in ensuring uninterrupted operations, particularly in geopolitically sensitive regions that influence oil supply chains. Environmental compliance is a growing priority for this segment as well, with many operators transitioning to low-sulfur fuels or investing in retrofitting solutions. Moreover, fluctuating oil prices directly affect both the operational costs and profit margins of tanker operators, making bunker fuel procurement strategies a critical aspect of their logistics planning.

By Type

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Bunker Fuel Market

5.1. COVID-19 Landscape: Bunker Fuel Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Bunker Fuel Market, By Type

8.1. Bunker Fuel Market, by Type

8.1.1. High Sulfur Fuel Oil (HSFO)

8.1.1.1. Market Revenue and Forecast

8.1.2. Marine Gas Oil (MGO)

8.1.2.1. Market Revenue and Forecast

8.1.3. Others

8.1.3.1. Market Revenue and Forecast

Chapter 9. Bunker Fuel Market, By Application

9.1. Bunker Fuel Market, by Application

9.1.1. Bulk Carrier

9.1.1.1. Market Revenue and Forecast

9.1.2. Oil Tanker

9.1.2.1. Market Revenue and Forecast

9.1.3. Container

9.1.3.1. Market Revenue and Forecast

9.1.4. General Cargo

9.1.4.1. Market Revenue and Forecast

9.1.5. Chemical Tanker

9.1.5.1. Market Revenue and Forecast

9.1.6. Fishing Vessels

9.1.6.1. Market Revenue and Forecast

9.1.7. Gas Tanker

9.1.7.1. Market Revenue and Forecast

9.1.8. Others

9.1.8.1. Market Revenue and Forecast

Chapter 10. Bunker Fuel Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Type

10.1.2. Market Revenue and Forecast, by Application

Chapter 11. Company Profiles

11.1. BP Marine

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Chevron Corporation

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Royal Dutch Shell Plc

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. ExxonMobil Corporation

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. TotalEnergies SE

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Gazprom Neft PJSC

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. China Marine Bunker (CHIMBUSCO)

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. World Fuel Services Corporation

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Bunker Holding A/S

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Neste Corporation

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others