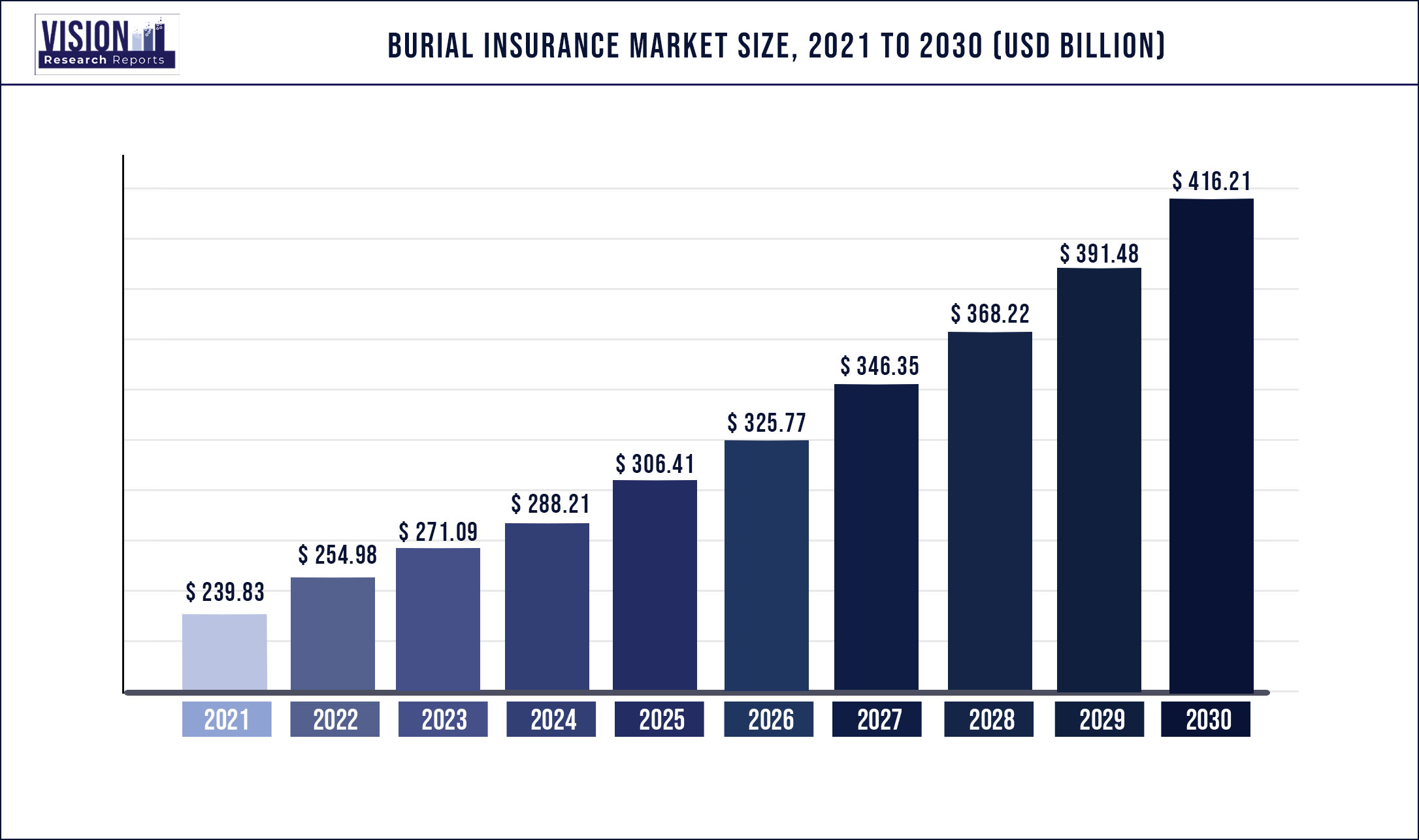

The global burial insurance market was valued at USD 239.83 billion in 2021 and it is predicted to surpass around USD 416.21 billion by 2030 with a CAGR of 6.32% from 2022 to 2030

Report Highlights

The industry is expected to grow over the forecast period owing to the rising awareness among the people. Furthermore, due to the rising awareness, companies are trying to enter the market through marketing strategies including providing various funeral insurance plans, which could attract a wide range of people. For instance, in Brazil, currently, there are different types of funeral insurance policies including preneed funeral insurance, final expense insurance, and burial insurance.

Furthermore, according to the FSCA's 2022 Financial Sector Outlook Study, in countries such as South Africa, around 60% of people reported the use of insurance products. Additionally, according to the report, insurance penetration, which is calculated by utilizing premiums as a percentage of GDP, which was 13.7% in 2020, placing it among the highest in the world and surpassing the U.K. and the U.S. This shows how well acceptable general insurance is among South Africans, which would help the industry expansion for burial insurance in various ways.

The population is aging in many wealthy nations and serving this expanding group requires insurers to concentrate on the best possible opportunities. They must, at least, adapt their services to better meet the needs of elderly persons, such as providing more complex and diverse payment choices for health insurance and making burial insurance a critical component of their plans. Being one of such companies to create a range of goods and services that customers can easily access in a seamless and integrated manner, whereby not only technological advancement is made for better accessibility, but also funeral costs are taken into account and may then be integrated into clients' current plans, will eventually result in the company gaining attention from end consumers, resulting in company revenue share growth.

For instance, Munich Re acquired tech company Relayr in 2018. Through this acquisition, the company hopes to achieve its goal of digitizing its existing business to provide a more comprehensive range of services. This could also help the company's other subsidiary, ERGO Group AG, which provides all types of insurance policies, including those that cover funeral expenses, ultimately indicating the insurer's way to bring in an upgrade in their current policy whereby digitization would help with the faster process to reach and process.

In order to take advantage of diverse sorts of services and technological capabilities needed for future success, forward-thinking insurers are widening their options and going beyond conventional vendors. To improve company position in the global market, these companies have used a variety of strategies, including partnerships, collaborations, product launches, joint ventures, and mergers & acquisitions. For instance, in December 2020, Chubb and Nubank through their strategic partnership intend to launch a digital life insurance product in Brazil. This service also covers funeral expenses. In addition, this launch has demonstrated the use of another distinct marketing tactic - product bundling to provide the individual with alluring offers like complete end-to-end coverage that covers funeral costs.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 239.83 billion |

| Revenue Forecast by 2030 | USD 416.21 billion |

| Growth rate from 2022 to 2030 | CAGR of 6.32% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Coverage type, age of end-user, Region |

| Companies Covered | Foresters Financial Services Inc (acquired by Nassau Financial Group, L.P. also known as ‘Nassau’), Royal Neighbors of America, Gerber Life Insurance Company, Zurich Insurance, Globe Life Inc. (Globe Life and Accident Insurance Company), Mutual of Omaha, Fidelity Life Association, Allianz Life, Colonial Penn, The Baltimore Life, Generali |

Coverage Type Insights

Based on coverage type, the market is segmented into three types - level death benefit, guaranteed acceptance, and modified or graded death benefit. The modified or graded death benefit market held the largest revenue share of over 46.4% in 2021. This is mainly because rates for modified life insurance change over time, frequently 5 to 10 years after the policy's commencement date. Although the death benefit insurance has not changed, the rates have. For the term of the insurance, rates often remain constant when they increase. Premium hikes often happen just once. Unlike level life insurance plans, which have premiums that are fixed over time and are locked in.

Furthermore, like all other policies, this modified or graded death benefit has its downsides but is still a good option for individuals with a range of health problems. The insurance company carries a lot of risk as a result. Thus, this market segment is anticipated to grow over the forecast period, driven by an increase in the number of persons with serious illnesses adopting such policies that cover funeral costs as well.

On the other hand, an insurance policy has a level death benefit alternative that guarantees the same life insurance policy for the whole term period of the policy. Whether the insured individual passes away within the first or final years of the policy's term, doesn't matter.

Additionally, this kind of level of death benefit coverage promptly distributes the whole death benefit in the event of a death. Furthermore, this is the only form of final expense insurance that offers the insured immediate and total coverage. Due to the comparatively low rates, level depth benefit plan acceptance would increase quickly from the consumer perspective, driving the segment's total growth.

By Age Of End-user Insights

Based on coverage type, the market is segmented into four types - over 50, over 60, over 70, and over 80. The segment of people aged over 60 and over 70 is dominating the market and accounted for the largest revenue share of around 32.2% and 33.5% respectively in 2021 and is expected to maintain its dominance throughout the forecast period.

Age is one of the key factors that affect how much a policy will cost. Since funeral costs are relatively higher in developed countries like the U.S. and Europe and can burden families when loved ones pass away, policyholders who are senior in particular start looking for policies that tend to cover all elements of expenses, including burial costs. Thus, including a benefit for funeral expenses in policyholder policies provides significant assistance to both the individual policyholder and their family.

For instance, the International Database for Population by Age for the U.S. from the U.S. Census Bureau showed that people between the ages of 60 to 69 are substantially more numerous than those in other older age groups. This suggests that since the U.S. is one of the more developed and health-aware nations, where people are generally aware of their health status and the value of health insurance, people in that age range may be more likely to select these types of policies. This is because, on the demand side, given the size of the population, they are even more likely to be policy seekers in this age group, which ultimately raises demand, supporting the market growth over the forecast period.

On the other hand, people who are close to or over 70 are probably classified as having a risk condition, which is why the price of premium is often higher for those above 70. Furthermore, the majority of people by this age are expected to have a policy, particularly in developed nations, thus the rate of policy extensions is higher than the rate of new policy purchases. For example, according to a 2016 article in the National Library of Medicine, 95 percent of people over 65 in France have voluntary health insurance. This may further suggest that people with health insurance may be updated to include funeral expenses or may already have funeral expense coverage built into their plans, further supporting the overall expansion of the market.

Regional Insights

Due to the existence of several insurance providers who offer combined health, life, and death insurance, North America held the largest revenue share of over 35.25% in 2021. Additionally, the Affordable Care Act in the U.S. makes having comprehensive coverage necessary, which will serve as one of the key drivers for the US industry, supporting the expansion of the overall North American market throughout the forecast period. Furthermore, according to a White House press release, on April 5, 2022, US President Joe Biden indicated that his administration plans to expand the Affordable Care Act (ACA) in order to increase access to coverage and lower prices, potentially increasing the proportion of people in the US who are insured. As a result, individuals in the U.S. may choose to have funeral expenses covered by their health insurance policies, resulting in rising demand for burial insurance over the forecast period.

Furthermore, government funeral aid in Canada in the form of funeral coverage is also anticipated to further support the expansion of the North American market. For instance, the Saskatchewan Government in Canada offers a basic amount to cover funeral costs for a person whose estate is unable to afford burial or cremation charges. By helping people through these types of policies/coverage, the Saskatchewan Government is aiding the growth of the overall funeral insurance market throughout the forecast period.

With increased awareness of funeral expenses, Asia Pacific (APAC), Europe, and Latin America (LATAM) are expected to be the fastest-growing region in the overall Burial Insurance Market.

In the Europe region, for instance, one of the key factors propelling the UK market for funeral insurance is the rising cost of funeral expenditures. For example, a report by SunLife Limited, a provider of financial planning, life insurance, health insurance, and other services, found that in 2021, 17% of families had significant financial difficulties when paying for a funeral, indicating a substantial need for funeral insurance over the forecast period.

On the other hand, Italy has one of the notable concentrations of old people in Europe, with 22.8 percent of the population being over 65, according to World Bank data. This elderly group could be the market-growth driver for burial insurance over the forecast period.

Furthermore, over the forecast period, increased awareness may be necessary, which is likely to fuel market expansion. For instance, according to SunLife Insurance's 2020 report, 44% of people who had recently made funeral arrangements were not aware of the direct cremation option, which appears to be the least expensive one provided by burial insurance policies. Thus, increased awareness would result in increased market growth.

In the Asia Pacific region, factors such as the aging population, prevalence of chronic diseases, large population, and rising costs are all contributing to Asia's strong growth over the forecast period. Additionally, lucrative development potential in developed countries like China and Japan, as well as to some extent in developing countries like India, are likely contributing to the global burial insurance industry's expansion.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Burial Insurance Market

5.1. COVID-19 Landscape: Burial Insurance Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Burial Insurance Market, By Coverage Type

8.1. Burial Insurance Market, by Coverage Type, 2022-2030

8.1.1. Level Death Benefit

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Guaranteed Acceptance

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Modified or Graded Death Benefit

8.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Burial Insurance Market, By Age of End-user

9.1. Burial Insurance Market, by Age of End-user, 2022-2030

9.1.1. Over 50

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Over 60

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Over 70

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Over 80

9.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Burial Insurance Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Coverage Type (2017-2030)

10.1.2. Market Revenue and Forecast, by Age of End-user (2017-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Coverage Type (2017-2030)

10.1.3.2. Market Revenue and Forecast, by Age of End-user (2017-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Coverage Type (2017-2030)

10.1.4.2. Market Revenue and Forecast, by Age of End-user (2017-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Coverage Type (2017-2030)

10.2.2. Market Revenue and Forecast, by Age of End-user (2017-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Coverage Type (2017-2030)

10.2.3.2. Market Revenue and Forecast, by Age of End-user (2017-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Coverage Type (2017-2030)

10.2.4.2. Market Revenue and Forecast, by Age of End-user (2017-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Coverage Type (2017-2030)

10.2.5.2. Market Revenue and Forecast, by Age of End-user (2017-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Coverage Type (2017-2030)

10.2.6.2. Market Revenue and Forecast, by Age of End-user (2017-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Coverage Type (2017-2030)

10.3.2. Market Revenue and Forecast, by Age of End-user (2017-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Coverage Type (2017-2030)

10.3.3.2. Market Revenue and Forecast, by Age of End-user (2017-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Coverage Type (2017-2030)

10.3.4.2. Market Revenue and Forecast, by Age of End-user (2017-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Coverage Type (2017-2030)

10.3.5.2. Market Revenue and Forecast, by Age of End-user (2017-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Coverage Type (2017-2030)

10.3.6.2. Market Revenue and Forecast, by Age of End-user (2017-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Coverage Type (2017-2030)

10.4.2. Market Revenue and Forecast, by Age of End-user (2017-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Coverage Type (2017-2030)

10.4.3.2. Market Revenue and Forecast, by Age of End-user (2017-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Coverage Type (2017-2030)

10.4.4.2. Market Revenue and Forecast, by Age of End-user (2017-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Coverage Type (2017-2030)

10.4.5.2. Market Revenue and Forecast, by Age of End-user (2017-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Coverage Type (2017-2030)

10.4.6.2. Market Revenue and Forecast, by Age of End-user (2017-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Coverage Type (2017-2030)

10.5.2. Market Revenue and Forecast, by Age of End-user (2017-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Coverage Type (2017-2030)

10.5.3.2. Market Revenue and Forecast, by Age of End-user (2017-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Coverage Type (2017-2030)

10.5.4.2. Market Revenue and Forecast, by Age of End-user (2017-2030)

Chapter 11. Company Profiles

11.1. Foresters Financial Services Inc (acquired by Nassau Financial Group, L.P. also known as ‘Nassau’)

11.1.1. Company Overview

11.1.2. Coverage Type Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Royal Neighbors of America

11.2.1. Company Overview

11.2.2. Coverage Type Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Gerber Life Insurance Company

11.3.1. Company Overview

11.3.2. Coverage Type Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Zurich Insurance

11.4.1. Company Overview

11.4.2. Coverage Type Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Globe Life Inc. (Globe Life and Accident Insurance Company)

11.5.1. Company Overview

11.5.2. Coverage Type Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Mutual of Omaha

11.6.1. Company Overview

11.6.2. Coverage Type Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Fidelity Life Association

11.7.1. Company Overview

11.7.2. Coverage Type Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Allianz Life

11.8.1. Company Overview

11.8.2. Coverage Type Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Colonial Penn

11.9.1. Company Overview

11.9.2. Coverage Type Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. The Baltimore Life

11.10.1. Company Overview

11.10.2. Coverage Type Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others