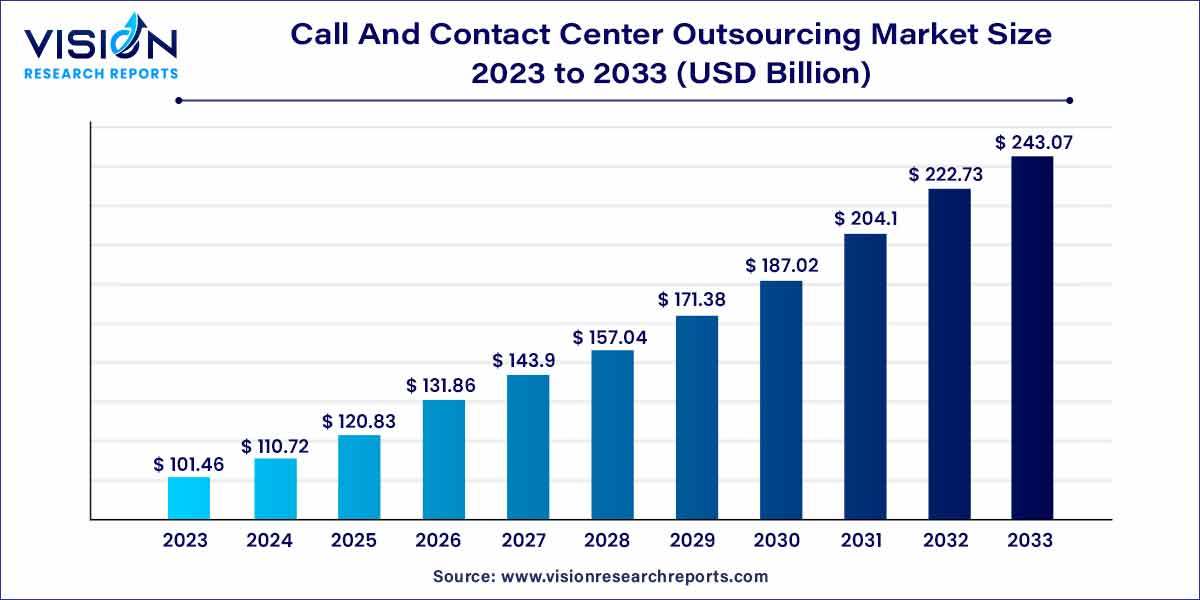

The global call and contact center outsourcing market size was estimated at around USD 101.46 billion in 2023 and it is projected to hit around USD 243.07 billion by 2033, growing at a CAGR of 9.13% from 2024 to 2033.

The global call and contact center outsourcing marke market is witnessing significant growth and transformation, driven by evolving business landscapes, technological advancements, and the rising demand for enhanced customer experiences. This overview delves into key aspects of the market, shedding light on its current state, notable trends, and future prospects.

The growth of the call and contact center outsourcing market is propelled by several key factors. Firstly, businesses increasingly turn to outsourcing as a strategic approach to achieving cost efficiency. By entrusting customer service functions to specialized providers, companies can streamline operations and allocate resources more effectively. Secondly, the continuous integration of advanced technologies, such as artificial intelligence and automation, plays a pivotal role in reshaping the industry. These technologies enhance operational efficiency and optimize customer interactions, contributing to the overall growth of the outsourcing market. Additionally, the globalization of businesses fuels the demand for multilingual and culturally diverse customer support services, a need effectively addressed by outsourcing providers.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 243.07 billion |

| Growth Rate from 2024 to 2033 | CAGR of 9.13% |

| Revenue Share of North America in 2023 | 31% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The voice segment held the largest market share, accounting for approximately 31% in 2023. This growth is primarily driven by the adoption of voice biometrics and secure authentication procedures in transactions involving voice-enabled services. These measures address security concerns while upholding customer data privacy. The integration of secure phone solutions not only enables outsourcing firms to meet regulatory standards but also fosters trust among clients and end users. In the call and contact center outsourcing sector, voice technology has emerged as a transformative element, reshaping how companies interact with consumers and manage their operations.

The growth of the chat support segment is attributed to the shift towards remote and flexible working hours, influencing the delivery of customer support services. The increasing prevalence of advanced AI-powered chatbots, coupled with predictive analysis and natural language processing, is anticipated to enhance the efficiency and intelligence of customer interactions in the forecasted period. The future of chat assistance in call and contact center outsourcing operations is marked by a focus on data-driven decision-making.

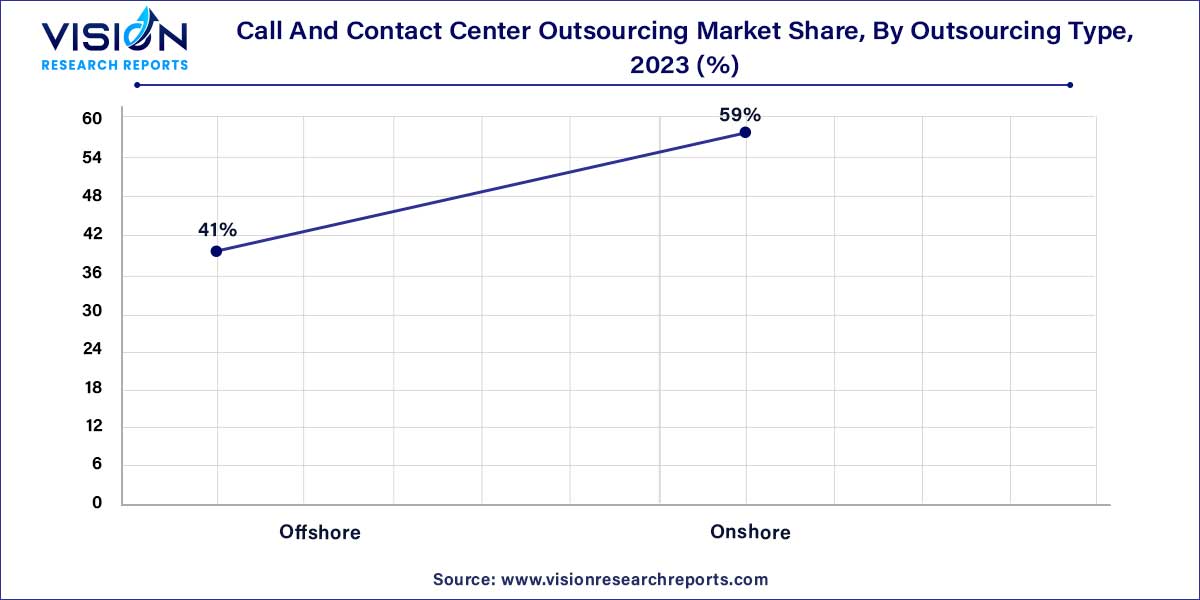

In 2023, the onshore segment commanded the largest market share at approximately 59%. Onshore call and contact outsourcing centers have adeptly adapted to the proliferation of remote work by leveraging technology to facilitate seamless communication and elevate service levels. The integration of analytics empowers onshore vendors to make informed decisions, enhancing operational flexibility and service quality. AI-powered chatbots, voice analytics, and automation applications play a pivotal role in optimizing operations and reducing response times. As data security concerns evolve, the onshore market is poised to be shaped by robust cybersecurity measures and an unwavering commitment to data privacy.

Conversely, the offshore segment is projected to register the fastest CAGR during the forecast period. Offshore providers in call and contact center outsourcing are investing in training programs, technological advancements, and procedures to ensure personalized, efficient consumer engagements aligned with evolving client demands. The future of offshore call and contact center outsourcing anticipates a growing adoption of automation technologies such as AI-powered chatbots, robotic process automation (RPA), predictive analytics, and machine learning (ML). This strategic shift aims to enhance operational efficiency, streamline repetitive tasks, and reduce overall expenses.

Inbound services segment accounted for the largest market share around 61% in 2023. Inbound services are driven by the capacity to manage client contacts efficiently across multiple channels. Efficient skills-based routing indicates that client requests are routed to the most skilled agents, reducing resolution times and improving overall service quality. The potential of a call or contact center outsourcing to fix customer issues during the initial engagement is measured by first-contact resolution (FCR), which is prompting the market growth of the inbound call and contact center outsourcing market. Advanced analytics are being used in call and contact centers to obtain useful insights from customer data.

The outbound services segment is projected to witness the fastest CAGR over the forecast period. Outbound services gain from data-driven segmentation, which allows firms to identify clients based on behaviors, demographics, or purchasing history. Personalized communications specific to client segments increase engagement and response rates. Implementing quality assurance methods in outbound services, such as call surveillance and inspections for compliance, reduces the risk of regulatory infringement. Furthermore, outbound services contribute to all stages of the client lifecycle, from onboarding to after-purchase assistance.

In 2023, the healthcare segment held the largest market share at approximately 26%. The healthcare global market's dominance is further reinforced by the integration of advanced technologies into outsourcing operations. Contact centers in outsourcing play a pivotal role in facilitating online consultations, appointment bookings, and post-consultation support. Anticipated developments in outsourcing operations include an increased focus on proactive health education programs. Over the forecasted period, call and contact center agents will undergo enhanced training to deliver vital health information, preventive care recommendations, and lifestyle assistance. This approach contributes to a more integrated and proactive medical communication strategy, with a substantial expansion of telehealth services expected in the healthcare outsourcing sector.

Conversely, the Banking, Financial Services, and Insurance (BFSI) segment are projected to witness the fastest CAGR over the forecast period. BFSI outsourcing has seen the integration of advanced analytics to gain deeper insights into consumer patterns and market conditions. Analytics-driven decision-making enhances risk management, cross-selling opportunities, and the customization of financial services, ensuring economic stability for BFSI firms. Call and contact center outsourcing partners play a crucial role in enabling the complete digital transformation of the BFSI sector, facilitating seamless interactions across various online platforms. The future of BFSI outsourcing is expected to experience a surge in AI-driven solutions and chatbots, aiming to enhance customer interactions, automate routine tasks, and provide real-time assistance.

In 2023, North America emerged as the dominant force in the market, securing a share of around 31%. The rapid evolution of biometric authentication techniques is a significant aspect of the security infrastructure in the North American market. Companies in North America are actively incorporating innovative biometric technologies, including voice identification and facial verification, to enhance the security of consumer interactions and transactions. In the forecasted period, U.S. outsourcing providers are expected to engage more extensively in social impact operations, with intelligent virtual assistants powered by AI playing a critical role in shaping the U.S. market.

Meanwhile, Asia Pacific (APAC) is poised to witness substantial growth in this market. The APAC region has undergone exponential growth and transformation, solidifying its position as the primary hub for call and contact center outsourcing. Cloud-based contact center technologies are gaining traction in APAC, driven by the adaptability and cost-effectiveness of cloud technology. This flexibility enables call and contact center outsourcing companies in the region to deliver operations that are both flexible and adaptable.

By Type

By Outsourcing Type

By Services

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Call And Contact Center Outsourcing Market

5.1. COVID-19 Landscape: Call And Contact Center Outsourcing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Call And Contact Center Outsourcing Market, By Type

8.1. Call And Contact Center Outsourcing Market, by Type, 2024-2033

8.1.1. Email Support

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Chat Support

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Voice

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Other

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Call And Contact Center Outsourcing Market, By Outsourcing Type

9.1. Call And Contact Center Outsourcing Market, by Outsourcing Type, 2024-2033

9.1.1. Offshore

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Onshore

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Endoscopy

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Call And Contact Center Outsourcing Market, By Services

10.1. Call And Contact Center Outsourcing Market, by Services, 2024-2033

10.1.1. Inbound Services

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Outbound Services

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Call And Contact Center Outsourcing Market, By End-use

11.1. Call And Contact Center Outsourcing Market, by End-use, 2024-2033

11.1.1. IT & Telecom

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Retail

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Manufacturing

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Healthcare

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Others

11.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Call And Contact Center Outsourcing Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.2. Market Revenue and Forecast, by Outsourcing Type (2021-2033)

12.1.3. Market Revenue and Forecast, by Services (2021-2033)

12.1.4. Market Revenue and Forecast, by End-use (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Outsourcing Type (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Services (2021-2033)

12.1.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Outsourcing Type (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Services (2021-2033)

12.1.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.2. Market Revenue and Forecast, by Outsourcing Type (2021-2033)

12.2.3. Market Revenue and Forecast, by Services (2021-2033)

12.2.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Outsourcing Type (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Services (2021-2033)

12.2.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Outsourcing Type (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Services (2021-2033)

12.2.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Outsourcing Type (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Services (2021-2033)

12.2.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Outsourcing Type (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Services (2021-2033)

12.2.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.2. Market Revenue and Forecast, by Outsourcing Type (2021-2033)

12.3.3. Market Revenue and Forecast, by Services (2021-2033)

12.3.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Outsourcing Type (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Services (2021-2033)

12.3.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Outsourcing Type (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Services (2021-2033)

12.3.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Outsourcing Type (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Services (2021-2033)

12.3.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Outsourcing Type (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Services (2021-2033)

12.3.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.2. Market Revenue and Forecast, by Outsourcing Type (2021-2033)

12.4.3. Market Revenue and Forecast, by Services (2021-2033)

12.4.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Outsourcing Type (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Services (2021-2033)

12.4.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Outsourcing Type (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Services (2021-2033)

12.4.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Outsourcing Type (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Services (2021-2033)

12.4.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Outsourcing Type (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Services (2021-2033)

12.4.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.2. Market Revenue and Forecast, by Outsourcing Type (2021-2033)

12.5.3. Market Revenue and Forecast, by Services (2021-2033)

12.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Outsourcing Type (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Services (2021-2033)

12.5.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Outsourcing Type (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Services (2021-2033)

12.5.6.4. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 13. Company Profiles

13.1. Alorica, Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Arvato

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Concentrix

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Capgemini

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. CGS Inc

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. DATAMARK Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Infosys BPM

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Konecta Group

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Raya Customer Experience

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. SCICOM (MSC) BERHAD

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others