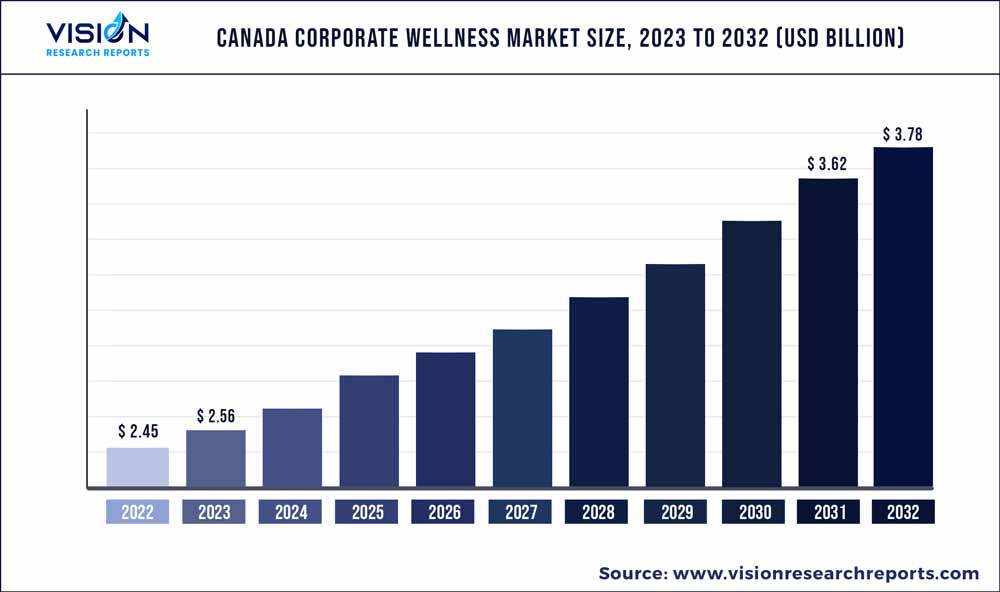

The Canada corporate wellness market was valued at USD 2.45 billion in 2022 and it is predicted to surpass around USD 3.78 billion by 2032 with a CAGR of 4.44% from 2023 to 2032.

Key Pointers

Report Scope of the Canada Corporate Wellness Market

| Report Coverage | Details |

| Market Size in 2022 | USD 2.45 billion |

| evenue Forecast by 2032 | USD 3.78 billion |

| Growth rate from 2023 to 2032 | CAGR of 4.44% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Curtis Health; Bridges Health; Pamela Dempster Wellness Consulting; Employee Wellness Solutions Network, Inc.; INLIV; Medcan; Medpoint Health Care Centre; Preventacare; Well Street; ComPsych Corporation |

The rising awareness regarding the available employee wellbeing services and the increasing onset of chronic diseases are the factors expected to drive the market growth. As per the study by the Conference Board of Canada, workplace wellness programs can lead to a return on investment of up to USD 2.62 for each dollar spent. Furthermore, as per the survey by the Mental Health Commission of Canada, around 20% of Canadian employees report suffering mental health problems in the workplace. This emphasizes the importance of focusing on mental health and supporting the employees. Chronic conditions, such as cancer, asthma, diabetes, and hypertension, are also responsible for an increase in absenteeism and loss of productivity.

Health and wellness services for employees are beneficial for organizations. According to a study published in the Journal of Occupational and Environmental Medicine, in March 2018, considerable improvements were observed after one year of implementing corporate well-being services in reducing fatigue (6 to 11%), high emotional stress (15 to 21%), and poor sleep quality (28 to 33%) among employees in Canada. Growing awareness regarding high return-on-investment on corporate health services expenditure on employees is expected to boost the adoption of these services at the workplace by employers in Canada.

The Canadian government and non-profit organizations, such as the Mental Health Commission of Canada (MHCC), are supporting initiatives to create and maintain mentally healthy workplaces. However, according to the Canadian Mental Health Association, 42% of business leaders are interested in taking initiatives for mental health at the workplace but have not acted due to a lack of time, resources, or knowledge. To address this, key companies and the government are collaborating to provide tools and information, such as the MindsMatter tool developed by CivicAction, which has already benefited 3.1 million employees in over 1500 organizations. The MHCC now manages this tool to support workplace mental health.

The pandemic negatively impacted the mental health of employees all around the world. According to a Teladoc survey conducted in 2020, 50% of Canadian employees reported that COVID-19 has had a detrimental effect on their mental health. Employees reporting excellent or very good mental health have decreased significantly in comparison to pre-pandemic levels. Hence, many companies adopted strategies to promote mental health and reduce stress among employees.

Service Insights

Based on services, the market is segmented into health risk assessment, fitness, smoking cessation, health screening, nutrition & weight management, stress management, and others. The health risk assessment segment dominated the market in 2022 with a revenue share of 21% owing to the high adoption of health risk assessment services by employers. Health Risk Assessment (HRA) analyzes information, such as height, weight, level of physical activity, smoking habits, and stress levels, of the employees to derive the risk factors affecting employee health. However, various additional factors need to be considered before performing an HRA, such as the quality of health information, the impact of risk factors on employee health, and the usability of the information.

The stress management segment is likely to witness the fastest CAGR during the forecast period. The rising adoption of remote patient monitoring devices is expected to drive the growth of the fitness segment. High incidences of smoking as well as the rising awareness about the adverse effects are major factors driving the growth of the smoking cessation segment. Health screening involves checking vital body stats such as blood sugar levels, cholesterol, and urine among others to ensure normal body functioning. It has been found that many diseases are preventable if detected at the right time. Hence, if organizations make investments in health screenings, diseases will be detected earlier and can be prevented. Thus, investing in health screening can help save costs on employee healthcare plans.

Category Insights

In terms of category, the market is segmented into fitness & nutrition consultants, psychological therapists, and organizations/employers. The organizations/employers segment held the maximum market share of 50% in 2022. These service providers offer services, such as physician and psychologist consultations, health screening, and education sessions for large- and small-scale corporations. A rise in the number of personalized health programs along with the expansion of digital wellness and well-being tools is expected to drive the segment growth. The fitness & nutrition consultants segment is anticipated to witness the fastest CAGR over the forecast years due to the increased availability of fitness services, such as yoga, massage, and nutrition consultation.

Organizations hire fitness coaches for their employees, where one-on-one coaching is offered. Some employers also provide various activities and gym services. Employers often provide their employees with meditation and yoga sessions for stress release as stress can potentially impact employee performance, thereby affecting the business. Thus, organizations provide art therapy, which is a unique technique for releasing stress. It is considered a form of expressive psychotherapy that uses art to improve a person’s emotional, physical, and mental well-being. Professionals also use this therapy for people suffering from emotional and mental disorders. The increasing demand for such therapies is propelling the growth of the psychological therapist segment.

Delivery Model Insights

Based on delivery model, the onsite segment dominated the market in 2022 and accounted for a maximum revenue share of 56%. Service providers are taking initiatives to widen the scope of onsite services made available to the employees, fueling the market growth. Onsite well-being programs generally consist of activities, such as health screening/biometric screening, lectures, and meditation sessions, among others. A few service providers have also integrated services, such as an onsite massage along with the required spa equipment in the office, reducing the wastage of employees’ time and money on spa & fitness centers.

Offsite programs include one-to-one interaction at different location that helps improve employee health. Health services are constantly upgraded with the adoption of advanced technologies. This, coupled with increased adoption of well-being services by employees, is expected to drive the growth of the offsite segment over the forecast period. Demand for offsite services witnessed high growth during the pandemic when the majority of employees were working from home. Sessions on mental health and nutrition, training, and consultations were done online during the pandemic, which boosted the segment’s growth.

End-use Insights

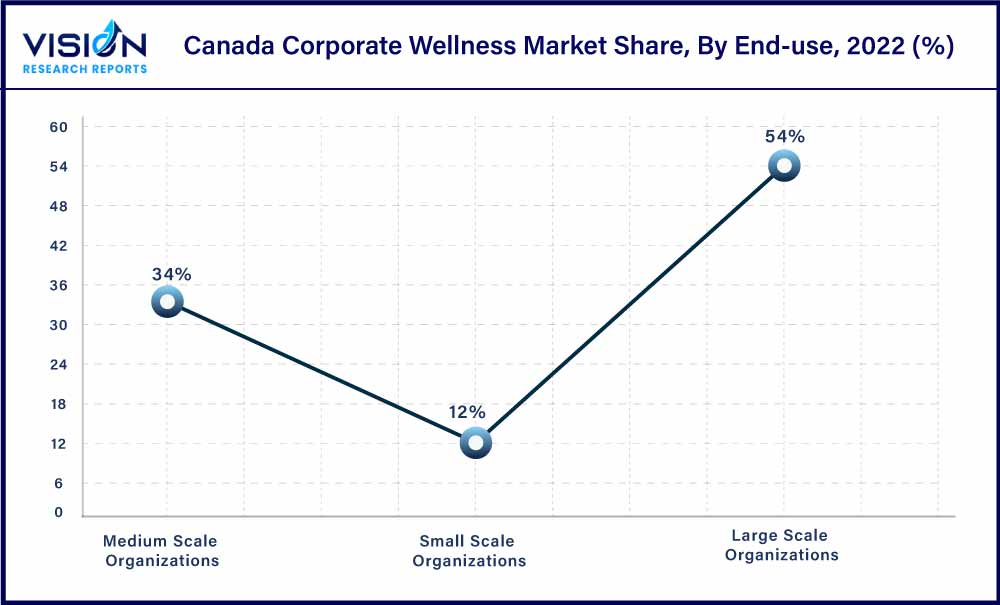

In terms of end-use, the market is segmented into large-scale organizations, medium-scale organizations, and small-scale organizations. The large-scale organizations segment dominated the market with a share of 54% in 2022. Large-scale organizations can readily invest in wellness services and can make sufficient space for service providers for onsite wellness services. Large-scale organizations offer various services on their campuses, such as therapists, chiropractors, and physicians. This eventually saves employees time and also contributes to their productivity.

The medium-scale organizations, on the other hand, is expected to register the fastest growth rate during the forecast period. This growth can be attributed to the quick adoption of corporate wellness services in medium-scale companies. These organizations are generally at a growing stage, which leads to the quick adoption of corporate wellness programs. Moreover, these require employee-friendly policies to engage and retain their employees, which, in turn, reduces the cost of attrition. In addition, healthier employees lead to fewer healthcare premiums, which bodes well for the organization.

Canada Corporate Wellness Market Segmentations:

By Service

By End-use

By Category

By Delivery Model

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Canada Corporate Wellness Market

5.1. COVID-19 Landscape: Canada Corporate Wellness Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Canada Corporate Wellness Market, By Service

8.1. Canada Corporate Wellness Market, by Service, 2023-2032

8.1.1. Health Risk Assessment

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Fitness

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Smoking Cessation

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Health Screening

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Nutrition & Weight Management

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Stress Management

8.1.6.1. Market Revenue and Forecast (2020-2032)

8.1.7. Others

8.1.7.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Canada Corporate Wellness Market, By End-use

9.1. Canada Corporate Wellness Market, by End-use, 2023-2032

9.1.1. Small Scale Organizations

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Medium Scale Organizations

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Large Scale Organizations

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Canada Corporate Wellness Market, By Category

10.1. Canada Corporate Wellness Market, by Category, 2023-2032

10.1.1. Fitness & Nutrition Consultants

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Psychological Therapists

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Organizations/Employers

10.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Canada Corporate Wellness Market, By Delivery Model

11.1. Canada Corporate Wellness Market, by Delivery Model, 2023-2032

11.1.1. Onsite

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Offsite

11.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Canada Corporate Wellness Market, Regional Estimates and Trend Forecast

12.1. Canada

12.1.1. Market Revenue and Forecast, by Service (2020-2032)

12.1.2. Market Revenue and Forecast, by End-use (2020-2032)

12.1.3. Market Revenue and Forecast, by Category (2020-2032)

12.1.4. Market Revenue and Forecast, by Delivery Model (2020-2032)

Chapter 13. Company Profiles

13.1. Curtis Health

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Bridges Health

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Pamela Dempster Wellness Consulting

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Employee Wellness Solutions Network, Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. INLIV

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Medcan

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Medpoint Health Care Centre

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Preventacare

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Well Street

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. ComPsych Corporation

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others