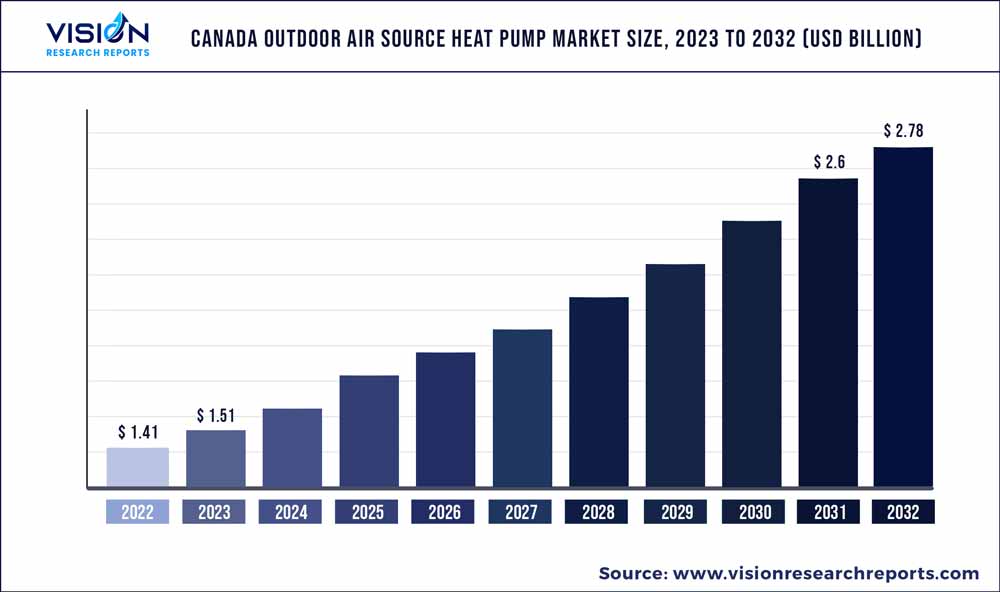

The Canada outdoor air source heat pump market was surpassed at USD 1.41 billion in 2022 and is expected to hit around USD 2.78 billion by 2032, growing at a CAGR of 7.03% from 2023 to 2032.

Key Pointers

Report Scope of the Canada Outdoor Air Source Heat Pump Market

| Report Coverage | Details |

| Market Size in 2022 | USD 1.41 billion |

| Revenue Forecast by 2032 | USD 2.78 billion |

| Growth rate from 2023 to 2032 | CAGR of 7.03% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Carrier; Daikin Industries Ltd.; Ingersoll-Rand Plc (Trane); Robert Bosch GmbH; Danfoss; Mitsubishi Electric Corporation; Panasonic Holdings Corporation; Fujitsu; LG Electronics, Inc.; Rheem Manufacturing Company; Gree Comfort; Samsung; Lennox International; Hitachi, Ltd.; Johnson Controls, Inc. |

The growth of the industry is expected to be driven by the rising need for cost-effective and energy-efficient space cooling and heating applications in the residential and commercial sectors. The various advantages of heat pumps such as low maintenance requirements, economical operations, low carbon footprint, and longer lifespan expectancy have greatly influenced their demand. Furthermore, its ability to provide water-heating solutions along with heating and cooling of space is expected to boost the demand for air source technology over the forecast years.

The Canadian government is becoming increasingly concerned with the problems associated with fossil fuels and is adopting environmental-friendly alternatives. The construction industry is undergoing substantial changes as new laws to reduce carbon footprint are being adopted. With the federal government establishing an annual carbon price and announcing that all new construction must be net-zero-ready by 2032, the industry must find new ways to reduce emissions and expenses. Using air-source heat pumps for year-round heating and cooling is a prominent approach to cutting energy usage and carbon emissions.

Electrification is regarded as a significant global contributor to climate change mitigation since low-carbon power can replace the present fossil fuel usage in buildings and surface transportation. On the supply side, ideas for achieving low carbon emissions by 2050 often emphasize the expansion of renewable energy, as well as carbon capture for fossil fuel electricity generation. This is accompanied by electrifying as much of the heating and transportation sectors as possible, necessitating the establishment of a charging network for automobiles, the installation of new heating systems in buildings, along with a slew of other technological, economic, and social changes.

With rising energy costs, the demand for efficient air-source heat pumps is expected to be on the rise. The significant initial investment for such systems will be repaid in full by reduced energy consumption. Adaptable heat pumps will help organizations seeking to broaden their exposure to new technology breakthroughs. As technology advances, heat pumps will offer increasingly more cost-effective heating and cooling solutions.

The benefits of adopting an air source heat pump are energy savings, increased automation, environmental sustainability, cost savings, and efficiency. A remote monitoring system of air source heat pump drying system based on IoT, which is designed and developed to enhance the automation capability of the drying system present in ASHP.

Product Type Insights

The air-to-air segment led the market and accounted for 88% of the Canada outdoor air source heat pump industry revenue share in 2022. The majority of air-source heat pump integrations in Canada involve air-to-air heat pumps, which warm or cool the air. An air-to-air heat pump is made up of an exterior unit, inside pipes, and individual 'blowers' that are installed in different rooms around the house. Since air-to-air heat pumps obtain their heat energy from the outside air, they are an energy-efficient option.

When the temperature difference between indoors and outdoors is low, air-to-air systems perform better. Additionally, an air-to-air heat pump is more practical in situations without the need for water heating and often when only a few rooms need to be heated, as opposed to the entire house. They are especially well suited for commercial spaces like offices and stores that do not need to heat any water.

In ductless air-to-air heat pumps, the interior coil of the heat pump is housed in an indoor unit, and the air is cooled or heated by moving over the coil before being routed through the ductwork to various places in the residence. Construction installation for ductless systems is minimal because all that is needed to connect the indoor heads and outdoor condenser is a three-inch hole through the wall. These aforementioned factors are expected to drive the demand for ductless systems over the forecast period.

The air-to-water (ATW) segment is expected to be the fastest growing at a CAGR of 8.12% during the forecast period 2023-2032. ATW heat pumps may save energy, particularly in cold climates where many other air-to-air heat pumps struggle; provide space conditioning and hot water heating; and a range of benefits to customers. These factors are expected to boost demand in the coming years.

The Nordic ATW-Series air-to-water heat pump, for example, is an air source heat pump capable of heating or cooling water for a hydronic heating/cooling system. Furthermore, the air-to-water heat pumps are more suited for radiant flooring or fan coil systems since they work more effectively while heating water to lesser temperatures, i.e., below 45° to 50°C.

Size Insights

The 15,000 BTU segment led the Canada outdoor air-to-water heat pump market and accounted for a 26% volume share in 2022. Heat pumps are a popular choice for heating homes since they are very effective and environmentally friendly. Air-to-water heat pumps are an alternative to air-to-air heat pumps in Canada. Moreover, air-to-water heat pumps may save energy, particularly in cold climates where many air-to-air heat pumps struggle, provide space conditioning and hot water heating, and give a variety of additional customer benefits. These aforementioned factors are likely to drive the demand for air-to-water heat pumps in Canada over the forecast period.

For instance, Mitsubishi Electric launched the CLIMAVENETA NX-N brand of hydronic heat pump system in the Canadian market. The system offers a variety of configurations, capacity levels & options and is capable of scaling up to meet even the largest requirements, from light commercial applications to centralized district heating and cooling facilities.

There are additional single-zone heat pumps with capacities of 6,000 BTU and 24,000 BTU; however, these are rarely installed in residential settings. They frequently form a part of a multi-zone system. For instance, a multi-zone (many inside units linked to one outside unit) heat pump is most frequently utilized with a capacity of 7,000 BTU. Most frequently, a multi-zone system with two or more interior units connected to it includes a 24,000 BTU outdoor unit. Additionally, 12,000 BTU and 15,000 BTU are the most widely used sizes for Halifax Regional Municipality (HRM) property owners.

Application Insights

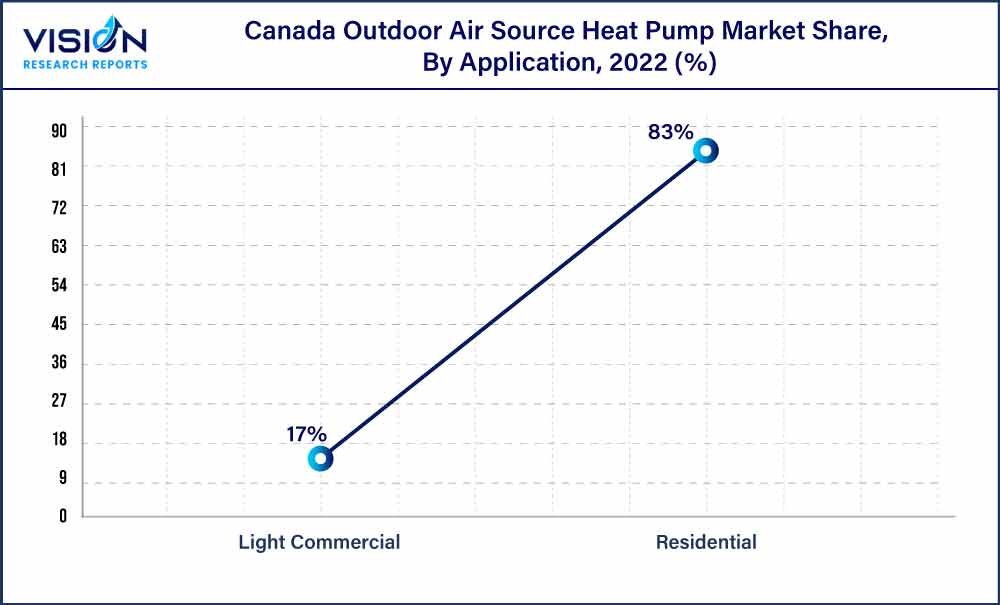

The residential segment led the Canada outdoor air-to-air heat pump market and accounted for 83% of the volume in 2022. Canada's population expansion would significantly boost the growth of the residential construction sector in the coming years. Moreover, increasing investments by the government of Canada to provide affordable housing for low-income families through the Canada Mortgage and Housing Corporation (CMHC) program and the Affordable Housing Initiative (AHI) are anticipated to further augment residential construction activities in the country.

The rapid urbanization, coupled with increasing initiatives, for energy-efficient products is expected to drive the demand for air-to-air heat pumps in the residential sector. For instance, since the launch of the Canada Greener Homes Loan program, approximately 20,000 homeowners applied for a loan, and loan commitments amounting to USD 166.5 million were made, thereby driving market expansion.

Canada's construction sector is anticipated to rise due to the country's growing population, urbanization, immigration rates, and increasing government investments in light commercial construction. An increasing number of service-providing firms in the country are expected to fuel the demand for office spaces, thus, driving light commercial construction. Thus, rising light commercial construction in Canada is expected to augment the growth of the air-to-air heat pump industry in the country.

Air-to-air heat pumps provide significant energy savings and can be installed in a wide range of commercial facilities, including office buildings, medical facilities, schools, courthouses, and training facilities. The extensive use of large heat pumps in commercial buildings for space cooling or heating applications is expected to be one of the major factors influencing market growth.

Canada Outdoor Air Source Heat Pump Market Segmentations:

By Canada Outdoor Air Source Heat Pump Type

By Canada Outdoor Air to Air Heat Pump Product

By Canada Outdoor Air to Air Heat Pump Application

By Canada Outdoor Air to Air Heat Pump Size

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Canada Outdoor Air Source Heat Pump Market

5.1. COVID-19 Landscape: Canada Outdoor Air Source Heat Pump Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Canada Outdoor Air Source Heat Pump Market, By Type

8.1. Canada Outdoor Air Source Heat Pump Market, by Type, 2023-2032

8.1.1. Air to Air

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Air to Water

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Canada Outdoor Air Source Heat Pump Market, By Product

9.1. Canada Outdoor Air Source Heat Pump Market, by Product, 2023-2032

9.1.1. Air Source Heat Pump (ASHP)

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Cold Climate ASHP (CC-ASHP)

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Canada Outdoor Air Source Heat Pump Market, By Application

10.1. Canada Outdoor Air Source Heat Pump Market, by Application, 2023-2032

10.1.1. Residential

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Light Commercial

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Canada Outdoor Air Source Heat Pump Market, By Size

11.1. Canada Outdoor Air Source Heat Pump Market, by Size, 2023-2032

11.1.1. 6,000 BTU

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. 9,000 BTU

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. 12,000 BTU

11.1.3.1. Market Revenue and Forecast (2020-2032)

11.1.4. 15,000 BTU

11.1.4.1. Market Revenue and Forecast (2020-2032)

11.1.5. 15,001 to 24,000 BTU

11.1.5.1. Market Revenue and Forecast (2020-2032)

11.1.6. 24,000 to 48,000 BTU

11.1.6.1. Market Revenue and Forecast (2020-2032)

11.1.7. Above 48,000 BTU

11.1.7.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Canada Outdoor Air Source Heat Pump Market, Regional Estimates and Trend Forecast

12.1. Canada

12.1.1. Market Revenue and Forecast, by Type (2020-2032)

12.1.2. Market Revenue and Forecast, by Product (2020-2032)

12.1.3. Market Revenue and Forecast, by Application (2020-2032)

12.1.4. Market Revenue and Forecast, by Size (2020-2032)

Chapter 13. Company Profiles

13.1. Carrier

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Daikin Industries Ltd.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Ingersoll-Rand Plc (Trane)

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Robert Bosch GmbH

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Danfoss

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Mitsubishi Electric Corporation

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Panasonic Holdings Corporation

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Fujitsu

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. LG Electronics, Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Rheem Manufacturing Company

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others