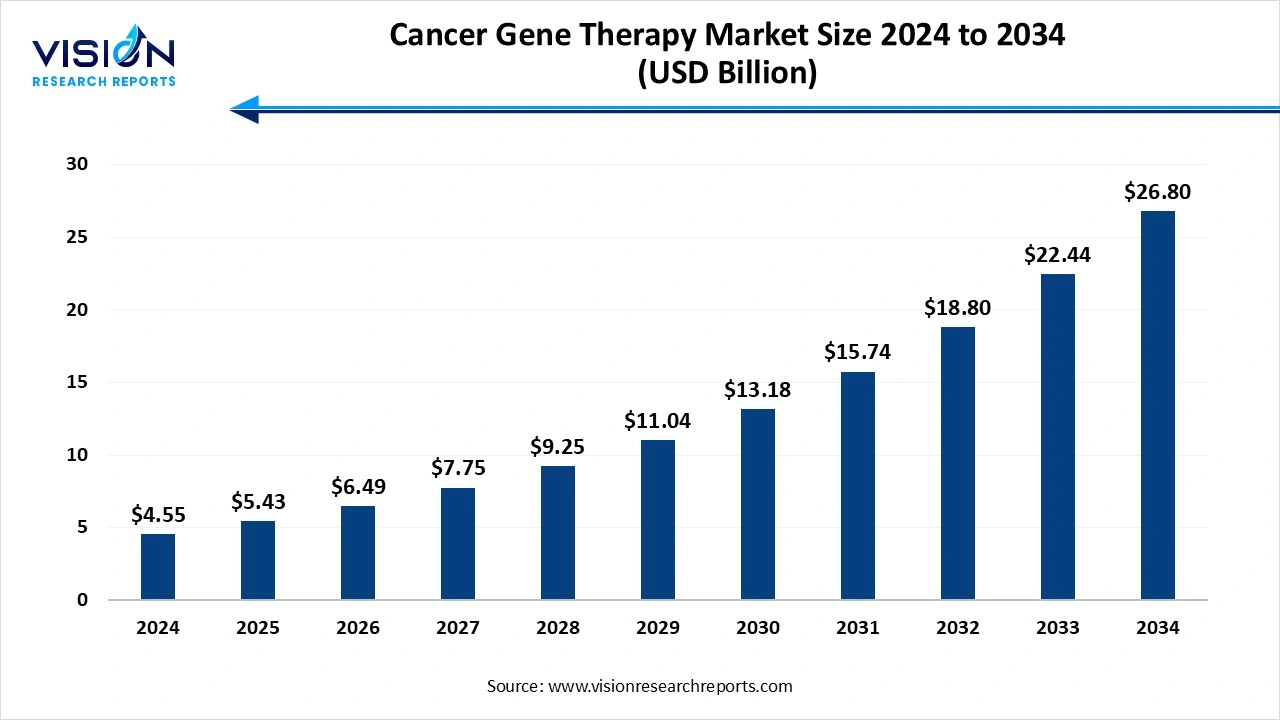

The global cancer gene therapy market size was evaluated at around USD 4.55 billion in 2024 and it is projected to hit around USD 26.80 billion by 2034, growing at a CAGR of 19.40% from 2025 to 2034.

The cancer gene therapy market has witnessed notable growth in recent years, driven by advancements in genetic engineering technologies and the increasing prevalence of various types of cancer worldwide. Gene therapy for cancer involves the modification or manipulation of genetic material within a patient’s cells to treat or prevent cancer. This can include replacing mutated genes with healthy copies, inactivating malfunctioning genes, or introducing new genes to help fight the disease. These therapies offer a targeted approach compared to traditional cancer treatments such as chemotherapy and radiation, reducing side effects and improving treatment outcomes.

The growth of the cancer gene therapy market is primarily fueled by the increasing incidence of cancer globally, coupled with a rising demand for more effective and targeted treatment solutions. Traditional cancer treatments often come with significant side effects and limited long-term efficacy, prompting the healthcare industry to explore gene therapy as a promising alternative. Innovations in genomics and biotechnology have enabled researchers to identify cancer-causing genetic mutations, paving the way for therapies that can correct or silence these faulty genes.

Another major growth driver is the expanding investment landscape in gene therapy research and development. Both public and private sectors are actively funding gene therapy startups and projects, leading to a robust pipeline of clinical trials and potential product approvals. Advancements in gene delivery technologies, such as viral and non-viral vectors, have also improved the safety and efficiency of these therapies.

One of the most prominent trends in the cancer gene therapy market is the rapid adoption of CRISPR and other gene-editing technologies, which are revolutionizing how genetic mutations linked to cancer are targeted and corrected. These tools allow for precise editing of DNA, offering the potential to directly modify or silence oncogenes. Another key trend is the integration of artificial intelligence and bioinformatics in the development of personalized cancer gene therapies, helping researchers predict therapeutic outcomes and optimize treatment protocols based on patient-specific genetic data.

Another emerging trend is the increasing focus on combination therapies, where gene therapy is used alongside immunotherapy, chemotherapy, or radiation to achieve synergistic effects. For instance, using gene therapy to enhance the immune system’s ability to recognize and destroy cancer cells has shown promising results in clinical trials. Furthermore, non-viral delivery methods, such as nanoparticles and lipid-based systems, are gaining traction as safer and more scalable alternatives to viral vectors.

Despite its promising potential, the cancer gene therapy market faces several significant challenges that could impede its widespread adoption. One of the primary hurdles is the complexity and high cost associated with developing and manufacturing gene therapies. These treatments often require highly specialized infrastructure, rigorous testing, and strict quality control, making them financially burdensome for companies and healthcare providers. In addition, the regulatory landscape for gene therapy is still evolving, with strict safety standards and lengthy approval processes that can delay the introduction of new therapies to the market.

Another major challenge lies in the delivery of gene therapies to target cells within the body. Effective and safe delivery remains a critical barrier, particularly in solid tumors where reaching cancer cells deep within tissues is difficult. While viral vectors are commonly used, they can pose risks such as immune reactions or insertional mutagenesis. Non-viral vectors, though safer, often lack the same level of efficiency. Moreover, there are ethical concerns and public apprehension related to genetic manipulation, which can hinder patient acceptance and regulatory support.

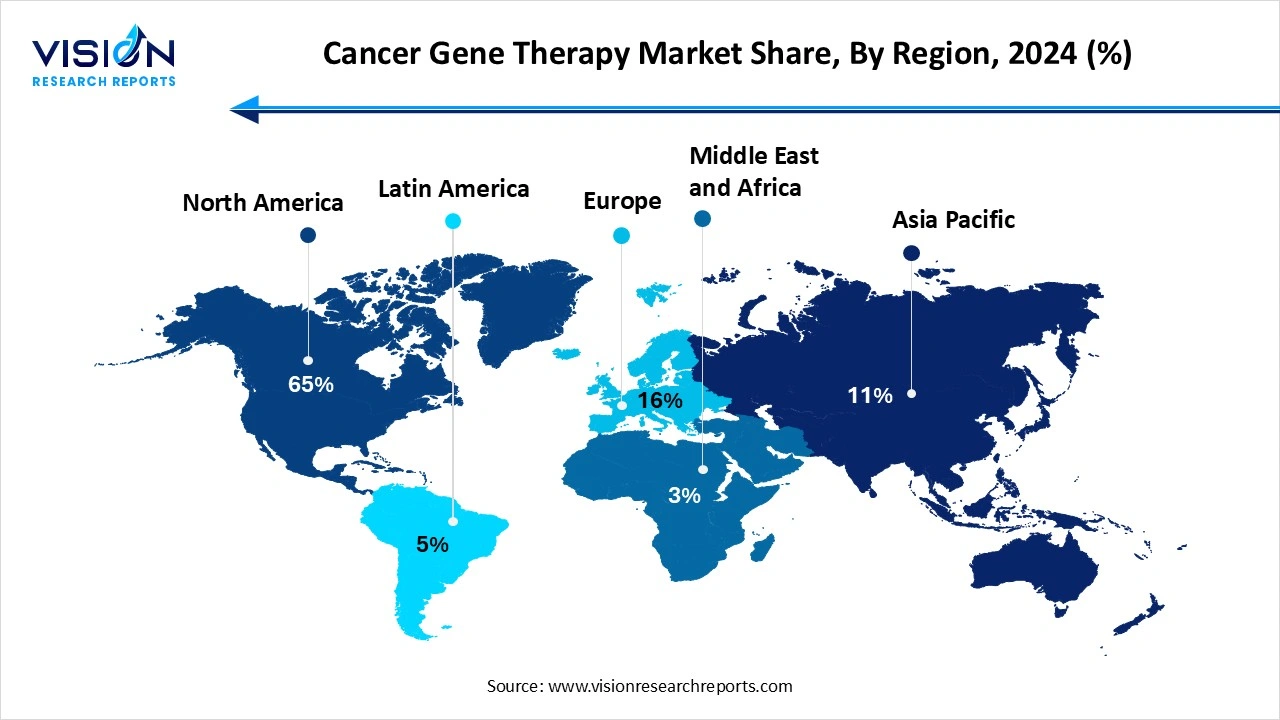

North America accounted for the highest market share, reaching 65% in 2024. This dominance is largely attributed to the region’s advanced healthcare infrastructure, high levels of investment in biomedical research, and early adoption of innovative treatment technologies. The United States plays a central role in driving growth, supported by favorable regulatory pathways, substantial public and private sector funding, and the presence of key industry players. The region also hosts a large number of clinical trials for cancer gene therapies, particularly in the field of CAR-T cell therapy and CRISPR-based treatments, which further accelerates the commercialization of these technologies.

In the Asia Pacific region, the cancer gene therapy market is experiencing rapid growth due to the rising incidence of cancer, increasing healthcare expenditures, and significant advancements in biotechnology. Countries such as China, Japan, and South Korea are investing heavily in gene therapy research and development, with government initiatives aimed at supporting innovation in genomics and cell therapy. The presence of a large patient population and expanding biopharmaceutical manufacturing capabilities also contribute to the region’s market potential.

In the Asia Pacific region, the cancer gene therapy market is experiencing rapid growth due to the rising incidence of cancer, increasing healthcare expenditures, and significant advancements in biotechnology. Countries such as China, Japan, and South Korea are investing heavily in gene therapy research and development, with government initiatives aimed at supporting innovation in genomics and cell therapy. The presence of a large patient population and expanding biopharmaceutical manufacturing capabilities also contribute to the region’s market potential.

The large B-cell lymphoma segment led the market, capturing the highest revenue share of 54% in 2024.The development of CAR-T cell therapies, which have shown promising results in treating relapsed or refractory B-cell lymphomas, has significantly driven growth within this segment. Regulatory approvals for gene therapies targeting B-cell malignancies, such as axicabtagene ciloleucel and tisagenlecleucel, have also contributed to market expansion, as these therapies offer new hope to patients with limited treatment options.

The others segment is projected to witness the highest compound annual growth rate of 21.28% throughout the forecast period. These segments are also experiencing growth as research progresses in identifying genetic mutations and pathways associated with different cancer types. Innovative delivery technologies and increasing investment in oncology research are accelerating the development of gene-based therapies for these indications.

The lentivirus segment led the market, capturing the highest revenue share of 48% in 2024. Lentiviral vectors are derived from the human immunodeficiency virus (HIV) and are widely used in gene therapy research and clinical applications for various cancers, including hematologic malignancies and solid tumors. Their ability to infect both dividing and non-dividing cells offers a major advantage over other vector types, making them particularly useful in targeting cancer cells.

The others category within the vector type segment includes a variety of non-viral and alternative viral vectors such as retroviruses (non-lentiviral), plasmid DNA, adeno-associated viruses (AAV), and herpes simplex viruses (HSV). These vectors are being explored for their unique properties in delivering therapeutic genes into cancer cells. Non-viral vectors, in particular, are gaining attention due to their lower immunogenicity and ease of production. Although they may currently have lower transfection efficiency compared to viral vectors, advancements in nanoparticle technology and electroporation methods are enhancing their potential in cancer gene therapy.

The intravenous segment held the leading position in the market, accounting for the highest revenue share. This approach is particularly effective for treating hematologic malignancies and metastatic cancers, where the widespread circulation of therapeutic vectors is necessary. IV administration offers advantages such as precise dosage control and consistent bioavailability, which are crucial for achieving optimal therapeutic outcomes.

The AAV (adeno-associated virus) segment is projected to register the fastest CAGR of 45% during the forecast period. AAV vectors are frequently administered via systemic routes like intravenous infusion, but they are also adaptable to local delivery depending on the target tissue. Their ability to infect both dividing and non-dividing cells with low immunogenicity makes them suitable for in vivo gene transfer. In cancer gene therapy, AAVs are being explored for targeted delivery to tumors, often requiring precise administration techniques to maximize efficacy and minimize off-target effects.

By Indication

By Route of Administration

By Vector Type

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Indication Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Cancer Gene Therapy Market

5.1. COVID-19 Landscape: Cancer Gene Therapy Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Cancer Gene Therapy Market, By Indication

8.1. Cancer Gene Therapy Market, by Indication

8.1.1 Large B-Cell Lymphoma

8.1.1.1. Market Revenue and Forecast

8.1.2. Multiple Myeloma

8.1.2.1. Market Revenue and Forecast

8.1.3. Acute Lymphoblastic Leukemia (ALL)

8.1.3.1. Market Revenue and Forecast

8.1.4. Melanoma (lesions)

8.1.4.1. Market Revenue and Forecast

8.1.5. Others

8.1.5.1. Market Revenue and Forecast

Chapter 9. Global Cancer Gene Therapy Market, By Route of Administration

9.1. Cancer Gene Therapy Market, by Route of Administration

9.1.1. Intravenous

9.1.1.1. Market Revenue and Forecast

9.1.2. Others

9.1.2.1. Market Revenue and Forecast

Chapter 10. Global Cancer Gene Therapy Market, By Vector Type

10.1. Cancer Gene Therapy Market, by Vector Type

10.1.1. Lentivirus

10.1.1.1. Market Revenue and Forecast

10.1.2. RetroVirus & gamma RetroVirus

10.1.2.1. Market Revenue and Forecast

10.1.3. AAV

10.1.3.1. Market Revenue and Forecast

10.1.4. Modified Herpes Simplex Virus

10.1.4.1. Market Revenue and Forecast

10.1.5. Adenovirus

10.1.5.1. Market Revenue and Forecast

10.1.6. Others

10.1.6.1. Market Revenue and Forecast

Chapter 11. Global Cancer Gene Therapy Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Indication

11.1.2. Market Revenue and Forecast, by Route of Administration

11.1.3. Market Revenue and Forecast, by Vector Type

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Indication

11.1.4.2. Market Revenue and Forecast, by Route of Administration

11.1.4.3. Market Revenue and Forecast, by Vector Type

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Indication

11.1.5.2. Market Revenue and Forecast, by Route of Administration

11.1.5.3. Market Revenue and Forecast, by Vector Type

11.2. Europe

11.2.1. Market Revenue and Forecast, by Indication

11.2.2. Market Revenue and Forecast, by Route of Administration

11.2.3. Market Revenue and Forecast, by Vector Type

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Indication

11.2.4.2. Market Revenue and Forecast, by Route of Administration

11.2.4.3. Market Revenue and Forecast, by Vector Type

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Indication

11.2.5.2. Market Revenue and Forecast, by Route of Administration

11.2.5.3. Market Revenue and Forecast, by Vector Type

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Indication

11.2.6.2. Market Revenue and Forecast, by Route of Administration

11.2.6.3. Market Revenue and Forecast, by Vector Type

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Indication

11.2.7.2. Market Revenue and Forecast, by Route of Administration

11.2.7.3. Market Revenue and Forecast, by Vector Type

11.3. APAC

11.3.1. Market Revenue and Forecast, by Indication

11.3.2. Market Revenue and Forecast, by Route of Administration

11.3.3. Market Revenue and Forecast, by Vector Type

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Indication

11.3.4.2. Market Revenue and Forecast, by Route of Administration

11.3.4.3. Market Revenue and Forecast, by Vector Type

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Indication

11.3.5.2. Market Revenue and Forecast, by Route of Administration

11.3.5.3. Market Revenue and Forecast, by Vector Type

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Indication

11.3.6.2. Market Revenue and Forecast, by Route of Administration

11.3.6.3. Market Revenue and Forecast, by Vector Type

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Indication

11.3.7.2. Market Revenue and Forecast, by Route of Administration

11.3.7.3. Market Revenue and Forecast, by Vector Type

11.4. MEA

11.4.1. Market Revenue and Forecast, by Indication

11.4.2. Market Revenue and Forecast, by Route of Administration

11.4.3. Market Revenue and Forecast, by Vector Type

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Indication

11.4.4.2. Market Revenue and Forecast, by Route of Administration

11.4.4.3. Market Revenue and Forecast, by Vector Type

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Indication

11.4.5.2. Market Revenue and Forecast, by Route of Administration

11.4.5.3. Market Revenue and Forecast, by Vector Type

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Indication

11.4.6.2. Market Revenue and Forecast, by Route of Administration

11.4.6.3. Market Revenue and Forecast, by Vector Type

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Indication

11.4.7.2. Market Revenue and Forecast, by Route of Administration

11.4.7.3. Market Revenue and Forecast, by Vector Type

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Indication

11.5.2. Market Revenue and Forecast, by Route of Administration

11.5.3. Market Revenue and Forecast, by Vector Type

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Indication

11.5.4.2. Market Revenue and Forecast, by Route of Administration

11.5.4.3. Market Revenue and Forecast, by Vector Type

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Indication

11.5.5.2. Market Revenue and Forecast, by Route of Administration

11.5.5.3. Market Revenue and Forecast, by Vector Type

Chapter 12. Company Profiles

12.1. Novartis AG.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Bristol Myers Squibb (Juno Therapeutics).

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Bluebird Bio, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Adaptimmune Therapeutics plc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Intellia Therapeutics, Inc..

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Intellia Therapeutics, Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. CRISPR Therapeutics AG.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Poseida Therapeutics, Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Sorrento Therapeutics, Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. GenSight Biologics

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others