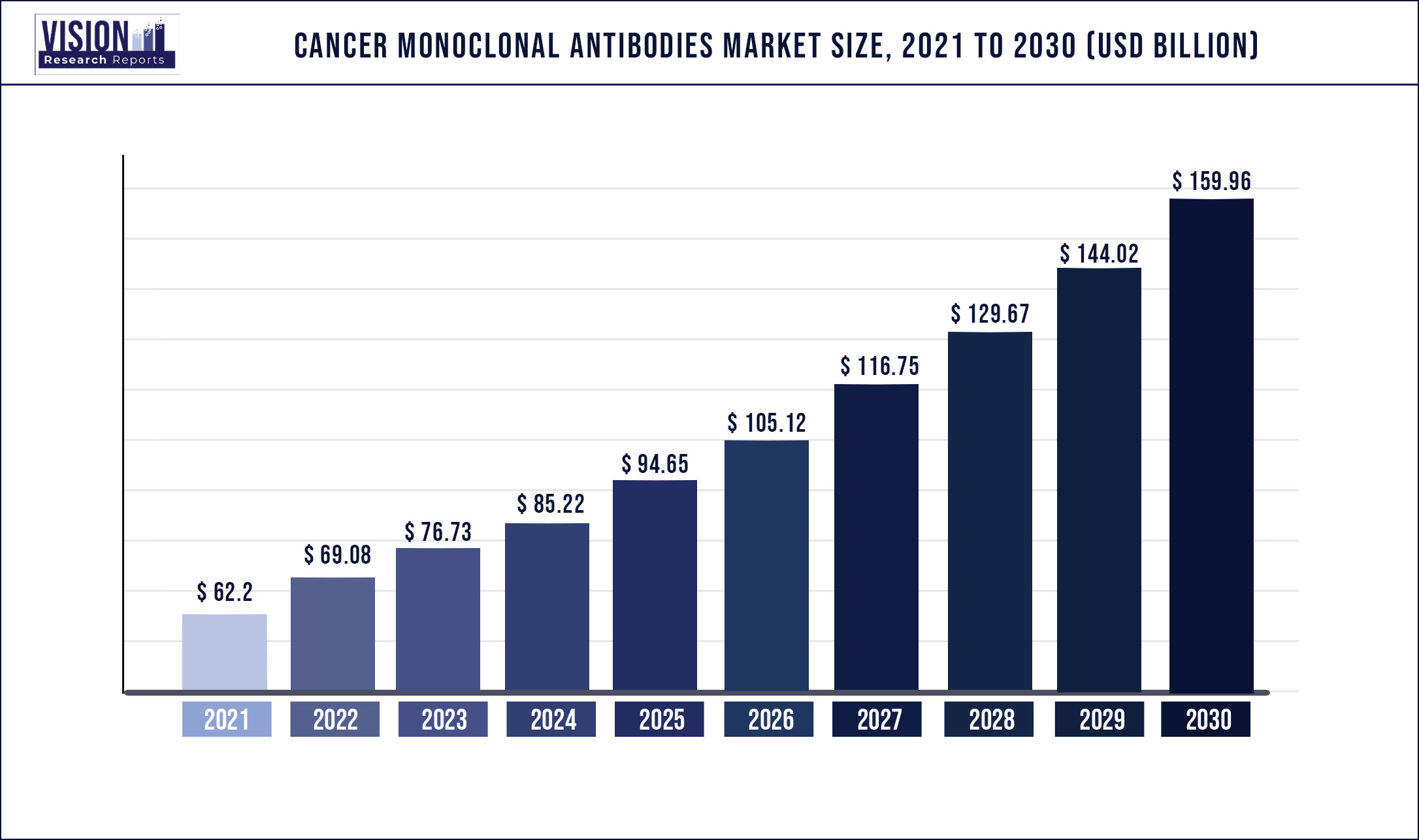

The global cancer monoclonal antibodies market was surpassed at USD 62.2 billion in 2021 and is expected to hit around USD 159.96 billion by 2030, growing at a CAGR of 11.07% from 2022 to 2030

Report Highlights

The increasing prevalence of cancer, and product approvals along with a robust pipeline are the key factors augmenting the market growth. Furthermore, an increase in funding for R&D in this sector is expected to impact industrial growth. Moreover, the booming biosimilar market will further offer lucrative opportunities during the forecast period.

Non-small Cell Lung Cancer (NSCLC) is a common type of lung cancer. For patients with metastatic NSCLC, the prognosis is mostly poor, as only about 8% will live beyond 5 years after the diagnosis. Moreover, at present, there are no HER2-directed therapies approved precisely for treating HER2-mutant non-small cell lung cancer, which occurs in almost 2-4% of patients with non-squamous NSCLC. However, progress has been made over the last two years, mainly in the first-line setting, leaving a substantial unmet medical need. For instance, in April 2022, Daiichi Sankyo and AstraZeneca received acceptance of supplemental Biologics License Application (sBLA) of Enhertu in the U.S. for treating adult patients with unresectable NSCLC.

The development of monoclonal antibodies has been great both in clinical and technical research applications over the past three years. Given their advantages of safety, specificity, and efficacy, there is now prevalent acceptance of mAbs as advanced therapeutic agents. Cancer is the most dominating and important area of medicinal application, accounting for almost 50% of all monoclonal antibodies-related R&D programs.

In addition, in June 2021, the European Commission approved Bristol Myers Squibb’s combination therapy of Yervoy and OPDIVO to treat patients for malignant pleural mesothelioma. In June 2022, Regeneron Pharmaceuticals, Inc. announced its plan to purchase Sanofi's stake in the Sanofi and Regeneron partnership on Libtayo, providing the company with exclusive global development, manufacturing, and commercialization rights to the medicine. Furthermore, in May 2020, Gilead Sciences, Inc. and Arcus Biosciences, Inc. entered into a 10-year partnership to co-commercialize and co-develop recent and future therapeutic candidates in Arcus’s pipeline. Arcus has 10 current clinical studies of molecules in its range with three monoclonal antibodies.

As COVID-19 reached a tipping point in the U.S. and Europe during the last two weeks of March 2020, its far-reaching consequences were observed across industries and businesses, with hospitals postponing or canceling treatment procedures for cancer and halting clinical trials. This has hampered the market growth to an extent. However, as treatment procedures resumed, manufacturers observed a steady improvement in business in the second half of 2021.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 62.2 billion |

| Revenue Forecast by 2030 | USD 159.96 billion |

| Growth rate from 2022 to 2030 | CAGR of 11.07% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Type, application, end-user, region |

| Companies Covered | F. Hoffmann-La Roche Ltd.; Bristol Myers Squibb Co.; Merck & Co.; GlaxoSmithKline plc; Johnson & Johnson; Amgen, Inc.; Novartis AG; AstraZeneca plc; Eli Lilly and Company; AbbVie |

Type Insights

The humanized segment held the highest market share of 39.66% in 2021. Humanized monoclonal antibodies are engineered to replace the mouse-related immunogenic or epitope structures. Due to the low cost, availability, and quick production time for mouse monoclonal antibodies, the humanization of mouse monoclonal antibodies has been applied on a large scale, thereby driving the growth of the market. In addition, 50% of newly approved mAbs are humanized monoclonal antibodies.

Furthermore, innovative genetic engineering technology engaged in its production is another potential growth driver for this segment. Several humanized antibodies have now been constructed and designed, and many are at present being evaluated in clinical trials. However, the human segment is expected to be the fastest growing during the forecast period. An increase in the number of product approvals and product launches of human mAbs will positively impact the growth of the segment during the assessment years.

Application Insights

The blood cancer segment held the highest market share of 23.4% in 2021. There has been a tremendous increase in demand for hematological disorder treatments over the last three years, which has led pharmaceutical industries to develop novel medications, including cancer monoclonal antibodies. For instance, in August 2020, the FDA approved GSK’s BLENREP for treating patients with refractory or relapsed multiple myeloma.

However, lung cancer is expected to be the fastest-growing segment during the forecast period with the highest CAGR. The increasing prevalence of lung cancer will drive the product demand in near future. NSCLC is the most common type of lung cancer, and it accounts for about 85% of all lung cancer cases, with more than 2 million new cases in 2020 globally. Moreover, to cater growing burden of the disease, significant market players are implementing developmental activities that will offer growth opportunities in the near future. For instance, in June 2022, FDA accepted the application for Merck’s KEYTRUDA as an Adjuvant Therapy for Stage IB-IIIA Non-Small Cell Lung Cancer after the completion of surgical resection.

End-user Insights

The hospitals segment held the highest revenue share of 39.8% in 2021. Some of the factors that can be attributed to the segmental share include the rising prevalence of cancer along with an upsurge in the number of patient hospitalizations. In addition, the availability of innovative drug therapies in hospitals drives patient preference. Furthermore, skilled professionals offering specialty treatments will drive the product demand in the hospitals.

Additionally, strategic activities by research organizations are going to generate lucrative growth opportunities during the review period. For instance, IRBM signed an agreement with The University of Texas MD Anderson Cancer Center in 2019. The contract focuses on the development of therapeutic mAbs against novel immune checkpoint targets. Similarly, in 2021, Celltrion Healthcare signed an agreement with the Brazilian Ministry of Health to supply two of its anticancer therapeutics - Truxima and Herzuma - to the market.

Regional Insights

North America dominated the cancer monoclonal antibodies market with a share of 37.7% in 2021. Strategic activities are key factors influencing the market growth. For instance, in September 2020, AbbVie and I-Mab signed a broad, international partnership agreement for the commercialization and development of lemzoparlimab, an advanced anti-CD47 monoclonal antibody discovered and developed by I-Mab for multiple cancers treatment. The partnership also allows for future collaboration on CD47-associated therapeutic agents.

Asia Pacific is estimated to be the fastest-growing region owing to increasing efforts by global firms to penetrate this emerging market to capture a higher share. An increasing number of international and national collaborations among entities, especially those in developed and developing countries, is expected to propel the market. In addition, an increase in the adoption of biosimilars in the region will further offer lucrative opportunities in the review period. For instance, in recent years, China’s biosimilar drug industry has established rapidly. By the end of 2019, the country had the maximum number of biosimilar drugs in research, with 391 biosimilar drugs in the research and development pipeline. As of December 2020, 11 biosimilar drugs had been accepted for marketing in China, comprising 6 drugs for oncology.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Cancer Monoclonal Antibodies Market

5.1. COVID-19 Landscape: Cancer Monoclonal Antibodies Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Cancer Monoclonal Antibodies Market, By Type

8.1. Cancer Monoclonal Antibodies Market, by Type, 2022-2030

8.1.1 Humanized

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Human

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Chimeric

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Murine

8.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Cancer Monoclonal Antibodies Market, By Application

9.1. Cancer Monoclonal Antibodies Market, by Application, 2022-2030

9.1.1. Blood Cancer

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Breast Cancer

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Lung Cancer

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Melanoma

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Colorectal Cancer

9.1.5.1. Market Revenue and Forecast (2017-2030)

9.1.6. Liver Cancer

9.1.6.1. Market Revenue and Forecast (2017-2030)

9.1.7. Others

9.1.7.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Cancer Monoclonal Antibodies Market, By End-user

10.1. Cancer Monoclonal Antibodies Market, by End-user, 2022-2030

10.1.1. Hospitals

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Research Institutes

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Cancer Monoclonal Antibodies Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.3. Market Revenue and Forecast, by End-user (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.4.3. Market Revenue and Forecast, by End-user (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.5.3. Market Revenue and Forecast, by End-user (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.3. Market Revenue and Forecast, by End-user (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.4.3. Market Revenue and Forecast, by End-user (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.5.3. Market Revenue and Forecast, by End-user (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.6.3. Market Revenue and Forecast, by End-user (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.7.3. Market Revenue and Forecast, by End-user (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.3. Market Revenue and Forecast, by End-user (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.4.3. Market Revenue and Forecast, by End-user (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.5.3. Market Revenue and Forecast, by End-user (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.6.3. Market Revenue and Forecast, by End-user (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.7.3. Market Revenue and Forecast, by End-user (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.3. Market Revenue and Forecast, by End-user (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.4.3. Market Revenue and Forecast, by End-user (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.5.3. Market Revenue and Forecast, by End-user (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.6.3. Market Revenue and Forecast, by End-user (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.7.3. Market Revenue and Forecast, by End-user (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.3. Market Revenue and Forecast, by End-user (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.4.3. Market Revenue and Forecast, by End-user (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.5.3. Market Revenue and Forecast, by End-user (2017-2030)

Chapter 12. Company Profiles

12.1. F. Hoffmann-La Roche Ltd.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Bristol Myers Squibb Co.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Merck & Co.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. GlaxoSmithKline plc

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Johnson & Johnson

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Amgen, Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Novartis AG

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. AstraZeneca plc

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Eli Lilly and Company

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. AbbVie

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others