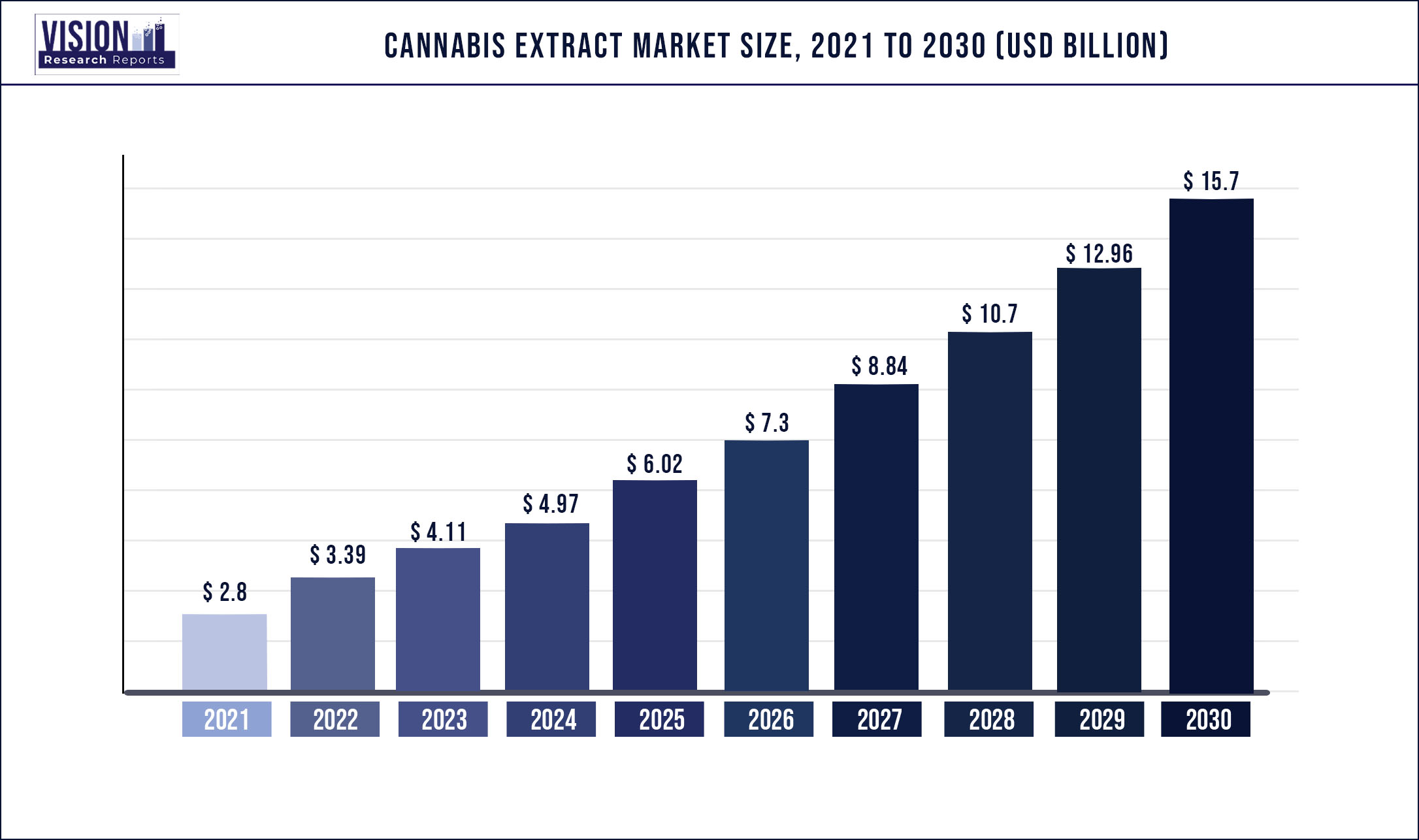

The global cannabis extract market was valued at USD 2.8 billion in 2021 and it is predicted to surpass around USD 15.7 billion by 2030 with a CAGR of 21.11% from 2022 to 2030

Report Highlights

The growth is attributed to the rising usage of cannabis for recreational and medical purposes has increased. Various nations have legalized cannabis usage which has reduced the sale in the black market and increased legal product purchases.

The industry has also opened revenue-generating opportunities for various countries through government-imposed taxes on cannabis oil and tinctures that are commonly used to treat various ailments, including anxiety, nausea, and cancer. The rising prevalence of cancer is also a significant factor. The growing burden of chronic pain has also increased the demand for treatments related to pain management and thus, positively impacting the growth.

Based on product type, the oil segment held the largest revenue share of 63.0% in 2021 and is also expected to grow at the fastest rate. The product's rising medical application is one of the supporting aspects. Based on the extract, the full spectrum segment dominated with a revenue share of 69.7% in 2021. The segment has been exploding in the overall market expansion due to the increased usage of marijuana for medical and recreational applications. Legalizing marijuana has resulted in increased product purchases through legal channels, reducing black market sales in several nations.

North America held the largest revenue share of 78.9% in 2021. The legalization of cannabis extract in many sectors, such as pharmaceutical and other industries, has increased demand for the product throughout North America, particularly in the United States.

The economic downturn brought on by the COVID-19 pandemic has affected every industry. The cannabis industry went through a series of testing. As industries seek to position themselves through the coronavirus pandemic or even beyond whenever the pandemic scenario is finally resolved, commercial contracts, financials, and customers’ responses are being scrutinized more than ever. But the pandemic also provided an opportunity for numerous manufacturers to streamline their operational models, eliminate inefficiencies, and rethink their launch or expansion plans.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 2.8 billion |

| Revenue Forecast by 2030 | USD 15.7 billion |

| Growth rate from 2022 to 2030 | CAGR of 21.11% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product type, extract type, sources, end-use, region |

| Companies Covered | Tikun Olam; CANOPY GROWTH CORPORATION; Tilray; Aurora Cannabis; The Cronos Group; Maricann Inc.; Organigram Holdings Inc.; Aphria Inc. |

Product Type Insights

The market is divided into tincture and oil segments based on product type. The oil sector held the largest revenue share of 63.06% in 2021. Furthermore, the benefits of cannabis and its derivatives are widely perceived. For instance, individuals in Canada are educated about the benefits and bad effects of smoking marijuana and the human body's reasonable limits by the drug stores themselves. Cannabis-derived oils are used to relieve nausea and vomiting brought on by cancer.

Cannabis oil aids in the treatment of sleep disorders and the reduction of stress and anxiety. The market for cannabis oils is expected to rise over the forecast period owing to a significant increase in the number of patients who prefer oil to flowers. The cannabinoids in isolates collected through isolation and extracts are the most reliable. Furthermore, these isolates have a number of benefits that have led to their growing adoption throughout time. Their truest expression tests negative for THC and has no psychoactive impact because of the low/no THC level.

Cannabis tinctures are made by dissolving the substance in alcohol and are taken sublingually. Tinctures can begin functioning in as little as 15 minutes, whereas oils can take up to 45 minutes to begin working. As a result, tincture demand is predicted to increase significantly over the projection period. The tinctures category is expected to grow at the highest rate. The product demand is expected to be driven by healthcare practitioners’ changing perspectives on safer ingesting approaches such as oral intake, beverages, or gummies.

Due to rapid growth in end-use industries such as medicines, nutraceuticals, cosmetics, drinks, and consumables, the majority of companies have begun to increase their extract portfolios. These items are advertised with detailed details on them. For medical purposes, these products are offered with particular information on the content of THC and CBD, or solely CBD.

Source Insights

Based on source, the market is segmented into marijuana and hemp. Among them, marijuana held the highest revenue share of 84.4% in 2021 and is also expected to grow with the fastest CAGR value in the forecast period. The growth of this segment is attributed to its medicinal value. Marijuana contains more than 100 active compounds out of which THC chemical causes the high, whereas, the CBD-dominant strain has little or no amount of THC and thus, has little or no effect on the consciousness of the user.

Marijuana is highly used for treating anxiety, stress, and depression and is majorly used as a pain reliever. Growing acceptance of marijuana for medical and recreational activities are positively impacting the market growth. Factors such as the growing awareness about cannabis products and increasing R&D activities in cannabis extract are further driving the growth.

Childhood epilepsy known as Dravet syndrome is difficult to control but responds intensely well to the CBD-dominant strain of cannabis. For instance, Charlotte’s Web, effective in Dravet’s syndrome, was developed by the Stanley brothers by crossing industrial hemp with a strain of marijuana. This variety produces more amount of CBD and less THC.

Hemp is also expected to showcase lucrative growth over the forecast period as it is highly used for high cholesterol, constipation, arthritis, and others. Hemp contains a small amount of THC of less than 0.3%, even the 2018’s Farm Bill contains a specific definition of hemp versus cannabis where the THC content is limited to 0.3%. Growing usage of hemp by industries is expected to drive the market in the forecast period.

Extract Type Insights

The global market is divided into two types of extracts, namely, full-spectrum and isolates. The full-spectrum extract contains the entire range of cannabinoids taken from a cannabis plant. The segment held the largest share of 69.82% in 2021. Apart from CBD, there are over 100 additional cannabinoids that exist in their natural forms. Full-spectrum extracts provide an entourage effect, which is a collaborative link between terpenes and cannabinoids that enhances the therapeutic qualities of cannabinoids due to their availability.

Cannabis isolates obtained through isolation and extraction are the most dependable forms of their cannabinoids. They offer fewer health advantages than full-spectrum cannabis extracts. Furthermore, these isolates have several advantages that have led to their increased acceptance throughout time. Because of the low/no THC content, their truest expression tests negative for THC and has no psychoactive effect.

Regional Insights

North America accounted for a high revenue share of 78.96 % in 2021. According to recent statistics, around 57.0% of adults in the United States support the use of marijuana for medical purposes such as pain, inflammation, and cancer therapy. As a result, factors such as cannabis legalization, greater citizen acceptance, and rising product use for therapeutic purposes are promoting regional market growth.

Cannabis has been used in the pharmaceutical business in a few European countries. This is especially true in Spain, the U.K., Germany, and other countries. Europe was the second-largest revenue contributor. However, legalization in European countries, coupled with strict laws and regulations governing sales and cultivation, could limit overall growth in Europe and hence the worldwide industry. Australia, Germany, Poland, Colombia, Uruguay, and Israel are potential marijuana markets, signifying growth potential in the upcoming years.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Cannabis Extract Market

5.1. COVID-19 Landscape: Cannabis Extract Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Cannabis Extract Market, By Product Type

8.1. Cannabis Extract Market, by Product Type, 2022-2030

8.1.1. Oils

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Tinctures

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Cannabis Extract Market, By Extract Type

9.1. Cannabis Extract Market, by Extract Type e, 2022-2030

9.1.1. Full Spectrum Extracts

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Cannabis Isolates

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Cannabis Extract Market, By Sources

10.1. Cannabis Extract Market, by Sources, 2022-2030

10.1.1. Hemp

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Marijuana

10.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Cannabis Extract Market, By End-use

11.1. Cannabis Extract Market, by End-use, 2022-2030

11.1.1. Medical Use

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Recreational Use

11.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Cannabis Extract Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.1.2. Market Revenue and Forecast, by Extract Type (2017-2030)

12.1.3. Market Revenue and Forecast, by Sources (2017-2030)

12.1.4. Market Revenue and Forecast, by End-use (2017-2030)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.1.5.2. Market Revenue and Forecast, by Extract Type (2017-2030)

12.1.5.3. Market Revenue and Forecast, by Sources (2017-2030)

12.1.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.1.6.2. Market Revenue and Forecast, by Extract Type (2017-2030)

12.1.6.3. Market Revenue and Forecast, by Sources (2017-2030)

12.1.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.2.2. Market Revenue and Forecast, by Extract Type (2017-2030)

12.2.3. Market Revenue and Forecast, by Sources (2017-2030)

12.2.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.2.5.2. Market Revenue and Forecast, by Extract Type (2017-2030)

12.2.5.3. Market Revenue and Forecast, by Sources (2017-2030)

12.2.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.2.6.2. Market Revenue and Forecast, by Extract Type (2017-2030)

12.2.6.3. Market Revenue and Forecast, by Sources (2017-2030)

12.2.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.2.7.2. Market Revenue and Forecast, by Extract Type (2017-2030)

12.2.7.3. Market Revenue and Forecast, by Sources (2017-2030)

12.2.7.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.2.8.2. Market Revenue and Forecast, by Extract Type (2017-2030)

12.2.8.3. Market Revenue and Forecast, by Sources (2017-2030)

12.2.8.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.3.2. Market Revenue and Forecast, by Extract Type (2017-2030)

12.3.3. Market Revenue and Forecast, by Sources (2017-2030)

12.3.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.3.5.2. Market Revenue and Forecast, by Extract Type (2017-2030)

12.3.5.3. Market Revenue and Forecast, by Sources (2017-2030)

12.3.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.3.6.2. Market Revenue and Forecast, by Extract Type (2017-2030)

12.3.6.3. Market Revenue and Forecast, by Sources (2017-2030)

12.3.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.3.7.2. Market Revenue and Forecast, by Extract Type (2017-2030)

12.3.7.3. Market Revenue and Forecast, by Sources (2017-2030)

12.3.7.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.3.8.2. Market Revenue and Forecast, by Extract Type (2017-2030)

12.3.8.3. Market Revenue and Forecast, by Sources (2017-2030)

12.3.8.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.4.2. Market Revenue and Forecast, by Extract Type (2017-2030)

12.4.3. Market Revenue and Forecast, by Sources (2017-2030)

12.4.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.4.5.2. Market Revenue and Forecast, by Extract Type (2017-2030)

12.4.5.3. Market Revenue and Forecast, by Sources (2017-2030)

12.4.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.4.6.2. Market Revenue and Forecast, by Extract Type (2017-2030)

12.4.6.3. Market Revenue and Forecast, by Sources (2017-2030)

12.4.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.4.7.2. Market Revenue and Forecast, by Extract Type (2017-2030)

12.4.7.3. Market Revenue and Forecast, by Sources (2017-2030)

12.4.7.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.4.8.2. Market Revenue and Forecast, by Extract Type (2017-2030)

12.4.8.3. Market Revenue and Forecast, by Sources (2017-2030)

12.4.8.4. Market Revenue and Forecast, by End-use (2017-2030)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.5.2. Market Revenue and Forecast, by Extract Type (2017-2030)

12.5.3. Market Revenue and Forecast, by Sources (2017-2030)

12.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.5.5.2. Market Revenue and Forecast, by Extract Type (2017-2030)

12.5.5.3. Market Revenue and Forecast, by Sources (2017-2030)

12.5.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Product Type (2017-2030)

12.5.6.2. Market Revenue and Forecast, by Extract Type (2017-2030)

12.5.6.3. Market Revenue and Forecast, by Sources (2017-2030)

12.5.6.4. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 13. Company Profiles

13.1. Tikun Olam

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. CANOPY GROWTH CORPORATION

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Tilray

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Aurora Cannabis

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. The Cronos Group

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Maricann Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Organigram Holdings Inc.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Aphria Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others