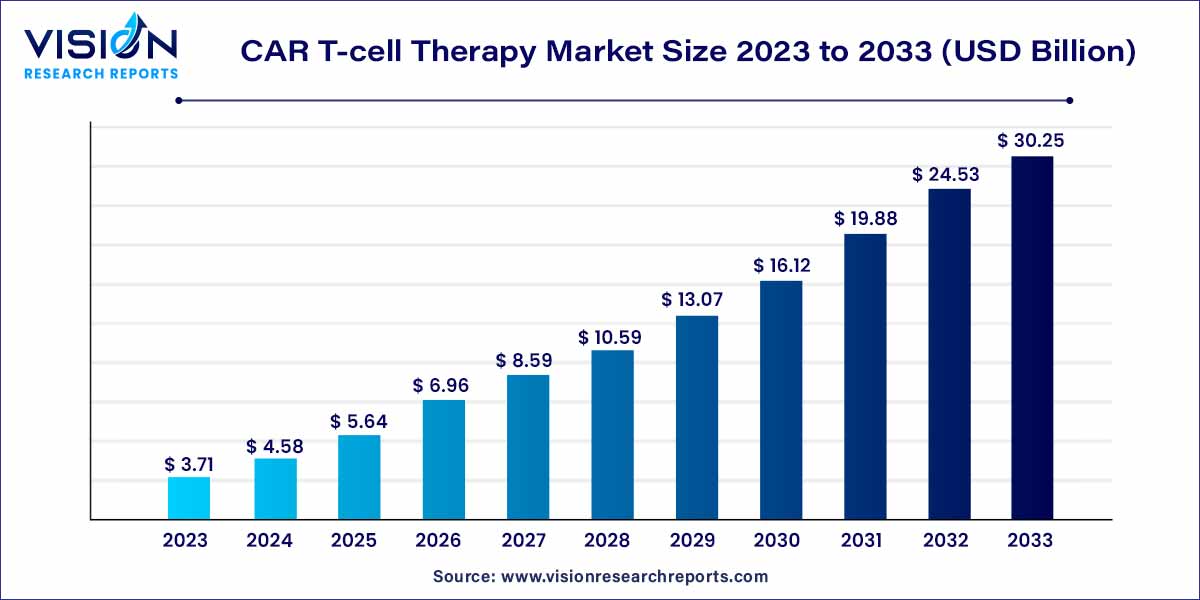

The global CAR T-cell therapy market size was estimated at around USD 3.71 billion in 2023 and it is projected to hit around USD 30.25 billion by 2033, growing at a CAGR of 23.35% from 2024 to 2033. The CAR T-cell therapy market is driven by rising cancer prevalence, clinical success and regulatory approvals, and expanded indications.

The CAR T-cell therapy market has witnessed remarkable growth in recent years, revolutionizing the treatment landscape for various cancers. This groundbreaking approach harnesses the power of the immune system by genetically modifying patients' T cells to target and destroy cancer cells. As we delve into the overview of the CAR T-cell therapy market, it becomes evident that this innovative treatment holds significant promise in reshaping the future of cancer care.

The growth of the CAR T-cell therapy market is underpinned by several key factors. Firstly, the escalating incidence of cancer globally has stimulated a heightened demand for innovative and effective treatment modalities, positioning CAR T-cell therapy as a promising solution. Additionally, substantial investments by pharmaceutical companies in research and development have propelled the field forward, resulting in a surge of investigational therapies entering clinical trials. Moreover, the proactive stance of regulatory agencies in expediting the approval process for CAR T-cell therapies has instilled confidence in the market, facilitating quicker access to groundbreaking treatments for patients. These factors collectively contribute to the robust expansion of the CAR T-cell therapy market, ushering in a new era of advanced and personalized cancer care.

Drivers

Restraints

Opportunities

The Yescarta segment dominated the CAR T-cell therapy market in 2023, holding a significant share of 44%. This particular product segment is poised to be the fastest-growing during the forecast period. Yescarta, also known as axicabtagene ciloleucel, specifically targets the CD19 antigen. Prescribed primarily for large B-cell lymphoma cases where initial treatment proves ineffective, or cancer recurrence occurs within the first year of treatment, or when at least two treatments for follicular lymphoma have failed, Yescarta's strong market share is attributed to its demonstrated improvement in survival rates for adults with relapsed large B-cell lymphoma.

Anticipated to experience substantial growth in the CAR T-cell therapy market by 2033, the Carvykti segment is projected to achieve a remarkable CAGR of 15.69% during the period from 2023 to 2033. Carvykti operates as an autologous immunotherapy designed to identify and eliminate B cell maturation antigen (BCMA)-expressing cells. The product's exponential growth is facilitated by robust regulatory support, including clinical trials and approvals. Notably, the U.S. FDA approved Ciltacabtagene autoleucel on February 28, 2023, broadening its application, especially for patients dealing with multiple myeloma in relapsed or refractory conditions. Clinical trials have demonstrated compelling results, with approximately 98% of participants responding to treatment, and 78% showing no detectable signs of cancer in bone marrow or blood.

In 2023, the Lymphoma segment commanded the largest share, accounting for 58% of the CAR T-cell therapy market. This segment is also anticipated to be the fastest-growing application. The significant market dominance is attributed to the availability of various CAR-T drugs explicitly designed to target lymphoma. Notable examples such as Breyanzi, Kymirah, Tecartus, and Yescarta focus on the CD-19 antigen, facilitating the elimination of large B-cell lymphoma in both adults and children. The prevalence of lymphoma worldwide contributes to the dominance of CAR T-cell therapy in mitigating and eliminating life-threatening conditions. According to Globocon 2020, approximately 544,000 new cases of non-Hodgkin lymphoma were reported globally, with nearly 259,000 deaths recorded in the same year.

Multiple Myeloma is poised to be the second fastest-growing segment in the CAR T-cell therapy market by 2033, with an expected CAGR of 22.07% from 2024 to 2033. The global incidence of multiple myeloma has been on the rise, as highlighted in a report by Lancet Hematology 2020, indicating an age-standardized rate of 1.78 per 100,000 people worldwide. The research underscores a notable increase in overall incidence, particularly in countries with a relatively high population of men aged 50 or older. The continued support from the U.S. FDA in approving CAR T therapy drugs aims to reduce mortality rates associated with multiple myeloma. For example, in April 2021, idecabtagene vicleucel (Abecma) received U.S. FDA approval for individuals with multiple myeloma, especially those who have not responded to or have experienced a recurrence after four different cancer treatments.

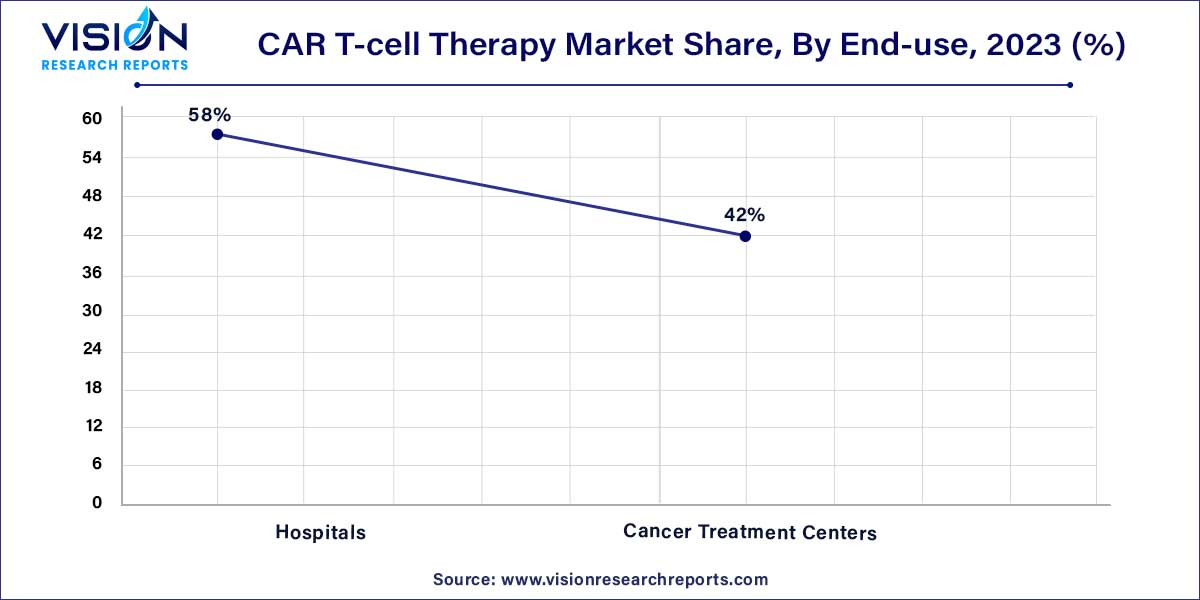

In 2023, the hospital segment dominated the CAR T-cell therapy industry, holding a substantial share of 58%. The prevalence of robust technology, well-equipped operating facilities, such as theatres, and the considerable purchasing power of hospitals globally contribute to this dominant market share. Hospitals that employ in-house CAR T processes can effectively reduce overall therapy costs, expanding their presence in this field. For instance, Sheba Hospital in Israel utilizes in-house processes, streamlining treatment time to less than 10 days and significantly cutting costs by at least 50%. The hospital has treated nearly 250 patients with CAR T therapy since 2015, drawing individuals from around the world.

Cancer Treatment Centers are projected to be the fastest-growing segment in the CAR T-cell therapy industry by 2033, with an anticipated CAGR of 24.28% from 2024 to 2033. This growth is attributed to the availability of diverse treatment options and patient-friendly amenities. Treating patients within their communities expands the overall reach of CAR T treatment. Additionally, strategic initiatives undertaken by prominent healthcare institutions will further enhance patient coverage. For example, in February 2023, the UVM Cancer Center in Vermont, U.S., announced the availability of a new CAR T-cell treatment for patients dealing with blood cancer.

In 2023, North America held the largest share of the CAR T-cell therapy industry, representing approximately 67% of total market revenues. The region's dominant position is attributed to the presence of major companies, augmented government funding, ongoing research activities, and comprehensive coverage through various insurance policies. Given the considerable cost associated with CAR T therapies, averaging $400,000 and above, robust insurance policies play a crucial role in ensuring patient comfort and fostering market proliferation.

Asia-Pacific is forecasted to be the fastest-growing region in the CAR T-cell therapy industry by 2033, with an estimated CAGR of 27.68% from 2024 to 2033. This accelerated growth is fueled by the expanding patient pool in the region, coupled with statutory support for products and market players. Additionally, the market benefits from the concerted efforts of major players in developing technologically advanced therapies. For example, according to the Clinical Trials Database 2023, China has approximately 103 active clinical phases for CAR T Therapies, while Australia has nearly 5 studies in the pipeline for CAR T Therapy, indicating a robust landscape of ongoing research and development in the Asia-Pacific region.

By Product

By Disease Indication

By End-Use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on CAR T-Cell Therapy Market

5.1. COVID-19 Landscape: CAR T-Cell Therapy Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global CAR T-Cell Therapy Market, By Drug Type

8.1. CAR T-Cell Therapy Market, by Drug Type, 2024-2033

8.1.1 Axicabtagene Ciloleucel

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Tisagenlecleucel

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Brexucabtagene Autoleucel

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global CAR T-Cell Therapy Market, By Indication

9.1. CAR T-Cell Therapy Market, by Indication, 2024-2033

9.1.1. Lymphoma

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Acute Lymphocytic Leukemia

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Chronic Lymphocytic Leukemia (CLL)

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Multiple Myeloma (MM)

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global CAR T-Cell Therapy Market, By End User

10.1. CAR T-Cell Therapy Market, by End User, 2024-2033

10.1.1. Hospitals

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Cancer Treatment Centers

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global CAR T-Cell Therapy Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Indication (2021-2033)

11.1.3. Market Revenue and Forecast, by End User (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Indication (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End User (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Indication (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End User (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.2.2. Market Revenue and Forecast, by Indication (2021-2033)

11.2.3. Market Revenue and Forecast, by End User (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Indication (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End User (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Indication (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End User (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Indication (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End User (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Indication (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End User (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.3.2. Market Revenue and Forecast, by Indication (2021-2033)

11.3.3. Market Revenue and Forecast, by End User (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Indication (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End User (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Indication (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End User (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Indication (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End User (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Indication (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End User (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.4.2. Market Revenue and Forecast, by Indication (2021-2033)

11.4.3. Market Revenue and Forecast, by End User (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Indication (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End User (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Indication (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End User (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Indication (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End User (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Indication (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End User (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.5.2. Market Revenue and Forecast, by Indication (2021-2033)

11.5.3. Market Revenue and Forecast, by End User (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Indication (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End User (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Drug Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Indication (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End User (2021-2033)

Chapter 12. Company Profiles

12.1. Kolon TissueGene, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. JCR Pharmaceuticals Co., Ltd.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Kolon TissueGene, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. JCR Pharmaceuticals Co., Ltd.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. MEDIPOST

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. PHARMICELL Co., Ltd.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. ANTEROGEN. CO., LTD

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Bristol-Myers Squibb Company

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Novartis AG

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Gilead Sciences, Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others