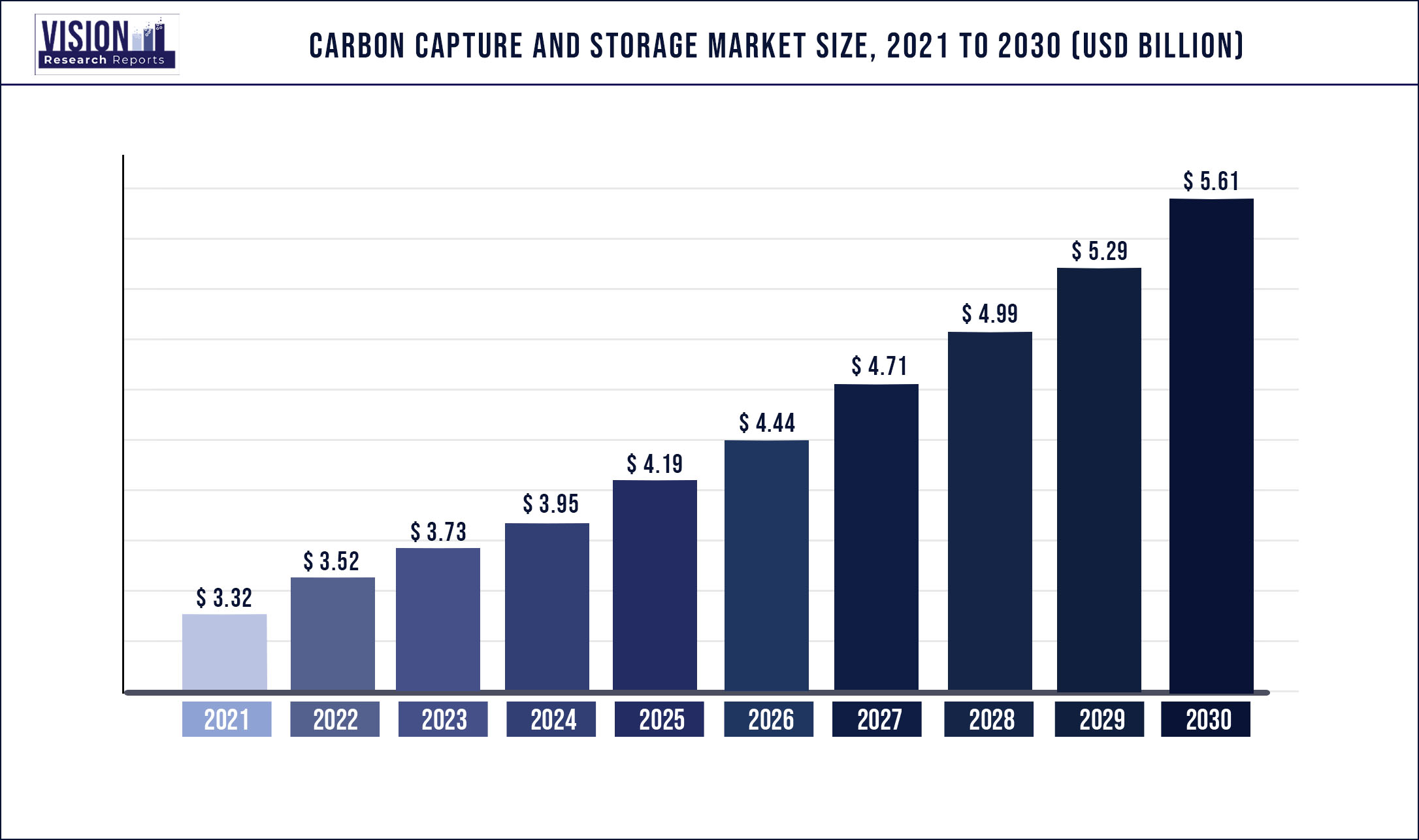

The global carbon capture and storage market was valued at USD 3.32 billion in 2021 and it is predicted to surpass around USD 5.61 billion by 2030 with a CAGR of 6.0% from 2022 to 2030

Report Highlights

Increasing concerns regarding the detrimental effect of carbon emissions on the environment have prompted the adoption of carbon capture and storage (CCS) technology. Various governments are encouraging the implementation of technology through pilot projects across various industries due to the ability of carbon capture & storage technology to serve as a large-scale solution for achieving the high CO2 emission reduction targets and climate control goals.

The pre-combustion segment led the market in 2021. The pre-combustion segment was the dominant segment in 2021. However, the post-combustion segment is anticipated to take over in the forecast period by a small margin. Post-combustion carbon dioxide capture technology removes the diluted CO2 from the flue gases which are produced after the combustion of fossil fuels.

In application, the power generation segment accounted for the largest revenue share of more than 40% in 2021. Coal-fired power plants are the most dominant emitters of carbon dioxide. Due to imposed restrictions on power plants, the utilization of CCS facilities has become mandatory to reduce carbon emissions up to the required standards. Adoption of these technologies is essential, to potentially permit the continued use of coal resources for power generation, whilst reducing CO2 emissions.

Carbon dioxide is increasingly being used for crop growth enhancement inside closed greenhouses; as well as applications in the fields, for growth enhancement. It is commonly used compressed gases for pneumatic systems (pressurized gas) in portable pressure tools that are ubiquitous in the construction industry. Carbon dioxide is also used to create dry ice pellets which can be used to replace sandblasting for removing paint from surfaces.

The market is anticipated to have a steady growth in the medical segment. Carbon dioxide is used in surgeries, such as arthroscopy laparoscopy, and endoscopy, to stabilize body cavities and enlarge the surgical surface area. It is also used to maintain the cryotherapy temperatures of approximately -76-degree Celsius.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 3.32 billion |

| Revenue Forecast by 2030 | USD 5.61 billion |

| Growth rate from 2022 to 2030 | CAGR of 6.0% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Capture technology, application, region |

| Companies Covered | Aker Solutions; Dakota Gasification Company; Equinor ASA; Fluor Corporation; Linde plc; Maersk Oil; Mitsubishi Heavy Industries Ltd.; Royal Dutch Shell PLC; Siemens AG; Sulzer Ltd.; Japan CCS Co. Ltd; HTC CO2 Systems Corp. |

Capture Technology Insights

The pre-combustion capture technologies constituted the largest share accounting for over 54.86% in 2021 and are anticipated to witness considerable growth over the forecast period. Pre-combustion CO2 capture utilizing water gas shift reaction and removal with acid gas removal (AGR) process is currently being commercially practiced globally. The advantage of using this capture technology under pressure is that it incurs less of an energy penalty, i.e., approximately 20% than current PCC technology (approx. 30%) at 90% CO2 capture.

The post-combustion capture technology is anticipated to grow at the highest CAGR of 6.7% from 2021 to 2030. Increased energy generation, newly developed advanced amine systems, and heat integration systems are expected to be the main factors driving its demand over the forecast period.

Application Insights

The power generation segment accounted for the largest revenue share of more than 40.5% in 2021. Coal-fired power plants are the most dominant emitters of carbon dioxide. Due to imposed restrictions on power plants, the utilization of CCS facilities has become mandatory to reduce carbon emissions up to the required standards. Adoption of these technologies is essential, to potentially permit the continued use of coal resources for power generation, whilst reducing CO2 emissions. Moreover, CCS facilities can be retrofitted to the existing power plants without hampering their efficiency. Due to these factors, the adoption of CCS technologies in the power generation industry is anticipated to grow over the forecast period.

The market is anticipated to have a steady growth in the medical segment. Carbon dioxide is used in surgeries, such as arthroscopy laparoscopy, and endoscopy, to stabilize body cavities and enlarge the surgical surface area. It is also used to maintain the cryotherapy temperatures of approximately -76-degree Celsius. Carbon dioxide gas grades are used in other application segments such as rubber, firefighting, wastewater treatment, fertilizer production, electronics manufacturing, and industrial cleaning.

Post-combustion technologies are easily implemented to capture CO2 from flue gases escaping from the sinter plant, flue gas exiting the lime kiln, stove, coke oven plant, basic oxygen furnace, and blast furnace. On account of a wide range of CCS applications at various stages in metal production industry, the market is expected to grow at a significant pace over the forecast period.

Carbon dioxide is increasingly being used for crop growth enhancement inside closed greenhouses; as well as applications in the fields, for growth enhancement. It is commonly used compressed gases for pneumatic systems (pressurized gas) in portable pressure tools that are ubiquitous in the construction industry. Carbon dioxide is also used to create dry ice pellets which can be used to replace sandblasting for removing paint from surfaces.

Regional Insights

North America accounted for the largest revenue share of over 36.88%. It dominated the market for carbon capture & storage, owing to the increasing demand from the oil & gas sector coupled with stringent government regulations to reduce carbon emissions, and the trend is expected to continue over the forecast period. Canada accounts for the second-largest share of the CCS market in the region. The first-ever CCS project in Canada was operational in 2000 by Cenovus Energy in Weyburn and Midale oil fields. The pre-combustion method of carbon capture was utilized in this project. Further, large-scale CCS projects are under construction in Canada which will be operational in the forecast period.

In terms of revenue, Europe accounted for the second-largest share of 27.97% in the global market in 2021. These support mechanisms of the European Union have the aim to enhance the development of commercial-scale CCS projects in the region and to accelerate R&D activities for technologies related to carbon capture and carbon storage in the region.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Carbon Capture And Storage Market

5.1. COVID-19 Landscape: Carbon Capture And Storage Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Carbon Capture And Storage Market, By Capture Technology

8.1. Carbon Capture And Storage Market, by Capture Technology, 2022-2030

8.1.1. Pre-Combustion

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Industrial Process

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Oxy-Combustion

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Post-Combustion

8.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Carbon Capture And Storage Market, By Application

9.1. Carbon Capture And Storage Market, by Application, 2022-2030

9.1.1. Power Generation

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Oil & Gas

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Metal Production

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Cement

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Carbon Capture And Storage Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Capture Technology (2017-2030)

10.1.2. Market Revenue and Forecast, by Application (2017-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Capture Technology (2017-2030)

10.1.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Capture Technology (2017-2030)

10.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Capture Technology (2017-2030)

10.2.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Capture Technology (2017-2030)

10.2.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Capture Technology (2017-2030)

10.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Capture Technology (2017-2030)

10.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Capture Technology (2017-2030)

10.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Capture Technology (2017-2030)

10.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Capture Technology (2017-2030)

10.3.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Capture Technology (2017-2030)

10.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Capture Technology (2017-2030)

10.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Capture Technology (2017-2030)

10.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Capture Technology (2017-2030)

10.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Capture Technology (2017-2030)

10.4.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Capture Technology (2017-2030)

10.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Capture Technology (2017-2030)

10.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Capture Technology (2017-2030)

10.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Capture Technology (2017-2030)

10.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Capture Technology (2017-2030)

10.5.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Capture Technology (2017-2030)

10.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

Chapter 11. Company Profiles

11.1. Aker Solutions

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Dakota Gasification Company

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Equinor ASA

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Fluor Corporation

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Linde plc

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Maersk Oil

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Mitsubishi Heavy Industries Ltd.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Royal Dutch Shell PLC

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Siemens AG

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Sulzer Ltd.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others