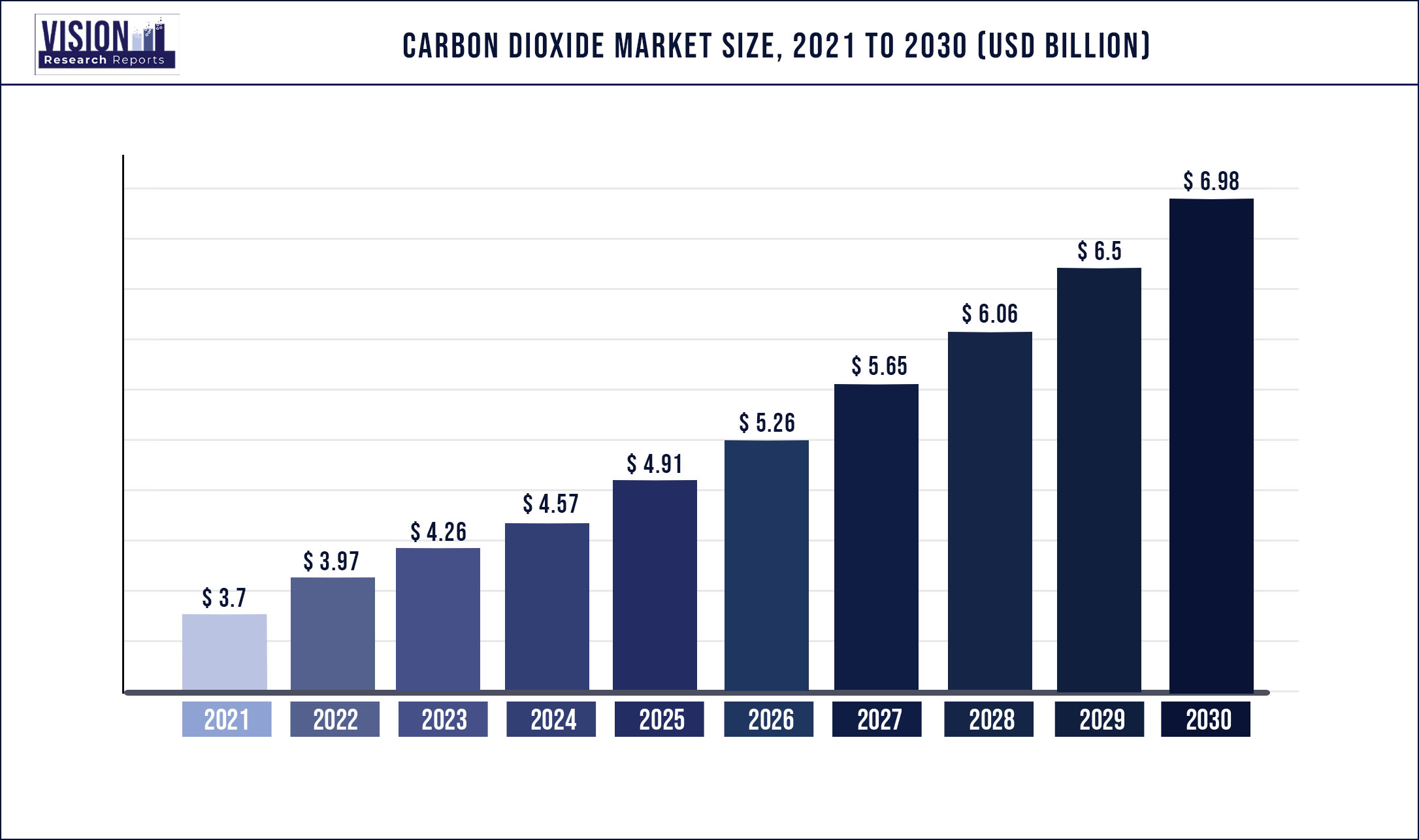

The global carbon dioxide market was estimated at USD 3.7 billion in 2021 and it is expected to surpass around USD 6.98 billion by 2030, poised to grow at a CAGR of 7.31% from 2022 to 2030

Report Highlights

Increasing usage of carbon dioxide for Enhanced Oil Recovery (EOR), and in the food & beverages and medical industries, is anticipated to fuel the growth of the global market during the forecast period. Depleting oil reserves and increasing dependence of different regions, mainly Asia Pacific, on crude oil imports, have surged the deployment of EOR technology, thereby contributing to the increased demand for Carbon Dioxide (CO2).

Based on source, the ethyl alcohol segment is expected to continue dominating the market from 2022 to 2030. The growth of this segment can be attributed to the high reliability of ethyl alcohol as an easily available long-term source for carbon dioxide, along with its increased commercial value for producing carbon dioxide as a byproduct. The surge in demand for food-grade carbon dioxide across the world during the forecast period is expected to increase the utilization of ethyl alcohol for producing carbon dioxide.

Among sources, the Substitute Natural Gas (SNG) segment is anticipated to register the fastest CAGR over the forecast period. SNG is utilized to obtain carbon dioxide. It is subjected to electrolysis with water to again formulate substitute natural gas. Thus, the fact that SNG can be reutilized is expected to drive the growth of the segment from 2022 to 2030. Other sources are also expected to contribute significantly to the growing demand for carbon dioxide in various application segments. Constant R&D efforts to carry out cost-effective manufacturing of CO2 from various other sources are anticipated to fuel its production across the world.

Based on application, the market has been segmented into food & beverages, oil & gas, medical, rubber, firefighting, and others. Food & beverages is the largest segment of the market. It is anticipated to be the fastest-growing application segment from 2022 to 2030. Food-grade carbon dioxide is mostly used in carbonated beverages while industrial-grade carbon dioxide is widely used for preserving the cryogenic temperature of frozen products.

Increasing consumption of carbon dioxide in medical applications and its surging demand for EOR also contribute to the market growth. The expansion of the industrial sector in North America is anticipated to fuel the demand for carbon dioxide in the region. This, in turn, is expected to contribute to market growth in North America from 2022 to 2030. In addition, the flourishing oil & gas industry in the region is projected to promote the demand for carbon dioxide owing to its increased usage in enhanced oil recovery processes.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 3.7 billion |

| Revenue Forecast by 2030 | USD 6.98 billion |

| Growth rate from 2022 to 2030 | CAGR of 7.31% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Source, application, region |

| Companies Covered | Air Liquide; Linde AG; Air Products and Chemicals, Inc.; Taiyo Nippon Sanso Corporation; Messer Group; SOL Group; Sicgil India Limited; Strandmøllen A/S; Acail Gás; Greco Gas Inc. |

Source Insights

The ethyl alcohol segment dominated the market in 2021 by accounting for a market share of about 33.4% in terms of revenue. The growth of this segment can be attributed to the easy availability of ethyl alcohol as a long-term and reliable source for producing high-commercial value carbon dioxide as a by-product. Moreover, the surged global demand for food-grade carbon dioxide is projected to fuel the production of carbon dioxide from ethyl alcohol in the coming years.

Carbon dioxide is often obtained as a byproduct during hydrogen production. Various processes used for the enhanced hydrogen production include thermochemical processes (natural gas reforming or steam methane reforming and biomass-derived liquid reforming, as well as coal gasification, and biomass gasification); electrolytic processes; direct solar water splitting process (photoelectrochemical); and biological processes (microbial biomass conversion and photobiological conversion). Carbon dioxide is produced through numerous raw materials.

The Substitute Natural Gas (SNG) segment of the market is anticipated to grow at the highest CAGR over the forecast period. Substitute natural gas is utilized to obtain carbon dioxide. It is subjected to electrolysis with water to again formulate substitute natural gas. Thus, the fact that substitute natural gas can be reutilized is expected to drive the growth of the substitute natural gas segment of the market from 2022 to 2030.

Various other sources are also used for generating carbon dioxide used in different applications. The ongoing R&D activities to cost-effectively manufacture carbon dioxide from different sources are also expected to contribute to the growth of the market over the forecast period.

Application Insights

The food & beverages application segment dominated the market in 2021 with a revenue share of about 38.07%. The growth of this segment can be attributed to the increasing global demand for carbonated drinks. Carbon dioxide is often used in Modified Atmospheric Packaging (MAP) to extend the shelf life of food products. In addition, it is used in cryogenic freezing systems, which offer more temperature flexibility than mechanical refrigeration systems. These factors are also expected to significantly contribute to the consumption of carbon dioxide in food & beverage applications in the foreseeable future.

Carbon dioxide is used in a wide range of applications in the food & beverages industry. In the food industry, it is used in modified atmospheric packaging (MAP) and chilling & freezing applications. Carbon dioxide is also used to control the temperature of food products during their transportation and storage to maintain their quality and increase their shelf life.

The consumption of carbon dioxide in medical applications is increasingly gaining significance worldwide. It is also used for the development of new medicines to minimize invasive surgeries. The carbon dioxide gas is primarily used as an insufflation component for several surgical procedures, including laparoscopy, endoscopy, and arthroscopy. In medicinal baths, it induces warm sensations and acts as a vasodilator for the skin by stimulating its heat receptors. In addition, insufflation with carbon dioxide makes it easy to perform endoscopic procedures on patients.

Ongoing innovations and R&D activities worldwide have led to the utilization of carbon dioxide for the production of fuels, chemicals, and building materials. These factors are expected to enhance the consumption of carbon dioxide in a number of applications, including oil & gas, medical, rubber, firefighting, crop growth enhancement, renewable fuel production, etc. over the forecast period. This, in turn, is anticipated to enhance the demand for carbon dioxide across the world in the coming years.

Medical-grade carbon dioxide is used as a pure gas or mixed with other gases to form specialized mixtures for various purposes including anesthesia, breathing stimulation, and equipment sterilization. It is also used for minimally invasive surgeries, including endoscopy, arthroscopy, and laparoscopy, as an insufflation gas, where CO2 helps expand and stabilize the operating areas for better visibility. It is also used for local anesthesia and in transient respiratory stimulation applications.

The presence of a large number of high-end hospitals and medical facilities in developed countries and the increase in the number of healthcare facilities in developing countries are contributing to the growth of the medical segment. The medical industry is anticipated to grow over the forecast period owing to the increasing old age population and growing health concerns among the people due to the ongoing COVID-19 crisis. These factors are expected to boost the utilization of carbon dioxide in the medical application segment in the forecast period.

Regional Insights

North America dominated the global carbon dioxide market in 2021 by accounting for the largest revenue share of over 50.21% of the market. The expansion of the industrial sector in North America is anticipated to fuel the market growth in the region. The flourishing healthcare industry in the countries of North America is anticipated to promote the usage of carbon dioxide in surgeries to stabilize body cavities and enlarge the surgical surface areas. The surging consumption of carbon dioxide in different applications is anticipated to further propel its demand over the forecast period.

In terms of revenue, Asia Pacific accounted for the second-largest revenue share in 2021. The region is a key consumer of carbon dioxide in the world. Food & beverages is the leading application segment in Asia Pacific. The growing usage of carbon dioxide in food products and beverages is also contributing to its increased production in the region. The ongoing industrialization in Asia Pacific has promoted the usage of firefighting equipment in the region to avoid industrial hazards. Equipment such as fire extinguishers use carbon dioxide to extinguish the flames.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Carbon Dioxide Market

5.1. COVID-19 Landscape: Carbon Dioxide Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Carbon Dioxide Market, By Source

8.1. Carbon Dioxide Market, by Source, 2022-2030

8.1.1. Hydrogen

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Ethyl Alcohol

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Ethylene Oxide

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Substitute Natural Gas

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Carbon Dioxide Market, By Application

9.1. Carbon Dioxide Market, by Application, 2022-2030

9.1.1. Food & Beverages

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Oil & Gas

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Medical

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Rubber

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Firefighting

9.1.5.1. Market Revenue and Forecast (2017-2030)

9.1.6. Others

9.1.6.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Carbon Dioxide Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Source (2017-2030)

10.1.2. Market Revenue and Forecast, by Application (2017-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Source (2017-2030)

10.1.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Source (2017-2030)

10.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Source (2017-2030)

10.2.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Source (2017-2030)

10.2.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Source (2017-2030)

10.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Source (2017-2030)

10.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Source (2017-2030)

10.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Source (2017-2030)

10.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Source (2017-2030)

10.3.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Source (2017-2030)

10.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Source (2017-2030)

10.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Source (2017-2030)

10.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Source (2017-2030)

10.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Source (2017-2030)

10.4.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Source (2017-2030)

10.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Source (2017-2030)

10.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Source (2017-2030)

10.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Source (2017-2030)

10.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Source (2017-2030)

10.5.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Source (2017-2030)

10.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

Chapter 11. Company Profiles

11.1. Acail Gás

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Air Liquide

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Air Products and Chemicals, Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Greco Gas Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Linde AG

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Messer Group

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Sicgil India Limited

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. SOL Group

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Strandmøllen A/S

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Taiyo Nippon Sanso Corporation

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others