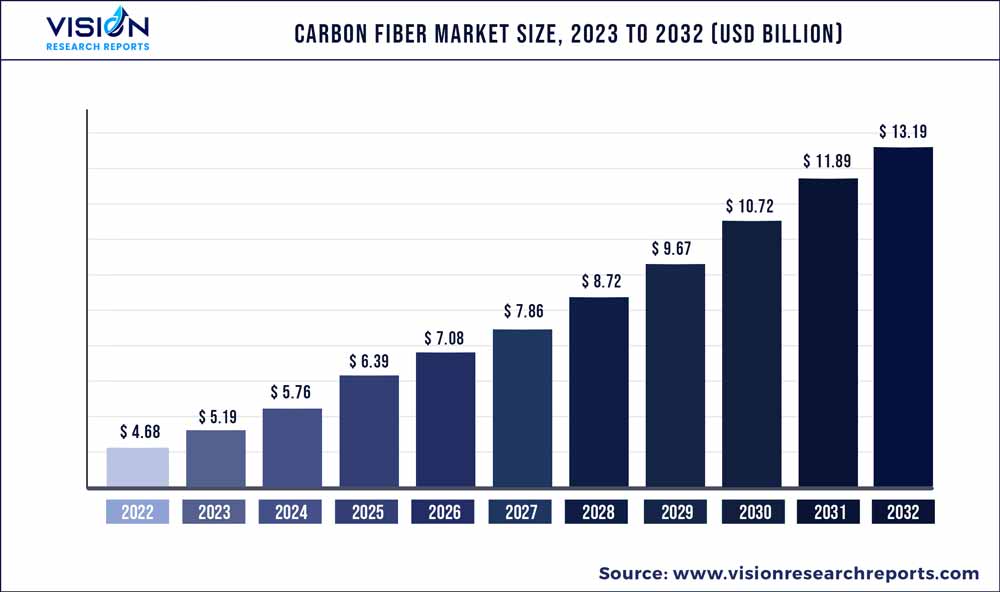

The global carbon fiber market was estimated at USD 4.68 billion in 2022 and it is expected to surpass around USD 13.19 billion by 2032, poised to grow at a CAGR of 10.92% from 2023 to 2032.

Key Pointers

Report Scope of the Carbon Fiber Market

| Report Coverage | Details |

| Market Size in 2022 | USD 4.68 billion |

| Revenue Forecast by 2032 | USD 13.19 billion |

| Growth rate from 2023 to 2032 | CAGR of 10.92% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | A&P Technology Inc.; Anshan Sinocarb Carbon Fibers Co. Ltd; DowAksa USA LLC; Formosa Plastics Corporation; Hexcel Corporation; Holding company Composite; Hyosung Advanced Materials; Jiangsu Hengshen Co. Ltd; Mitsubishi Chemical Corporation; Nippon Graphite Fiber Co. Ltd; SGL Carbon; Solvay; Teijin Limited; Toray Industries Inc.; Zhongfu Shenying Carbon Fiber Co. Ltd |

The increasing demand for commercial aviation due to rising disposable income and globalization has catered to the growth of the aerospace industry over the last few years. This trend is likely to continue over the coming years as well. Moreover, the rise in demand for sports and leisure applications due to the increasing population, particularly in the Asia Pacific region, is also likely to propel the demand for carbon fiber in the market.

The carbon fiber market has witnessed forward integration by various raw material manufacturers. In-house production and utilization of carbon fiber help manufacturers cut down on logistics costs and directly cater to end-use product manufacturers, thereby increasing profitability. Carbon fiber applications depend on the grade used and, ultimately, on the quality of the precursor.

End-use components mainly include automotive, aerospace, wind turbines, and sports & leisure products. Different manufacturers serving different application segments manufacture these products. In addition, end-users have collaborated with various product manufacturers to develop special-grade carbon fiber for specific applications.

Energy crises have forced various end-users to use carbon fiber to increase the energy efficiency of products. As a result, a surge in product demand across aerospace and wind turbine applications is expected to boost the global market growth over the forecast period. Moreover, rising governmental support for installing wind turbines is projected to positively influence the demand for carbon fiber. In addition, the development of the commercial aviation segment is also expected to propel the demand for carbon fiber in aerospace applications over the forecast period.

The growing concerns regarding fuel consumption and CO2 emission levels have urged manufacturers to use carbon fiber composite materials as substitutes for metal components.The aerospace sector demands lightweight and rigid materials for usage in aircraft, rockets, satellites, and missiles as it determines performance.

The U.S. and Europe are the key regions in the aerospace & defense industry. The carbon fiber demand is attributed to the presence of significant aircraft manufacturers such as Boeing and Airbus. The aerospace industry is led by commercial aviation and the production of large passenger and cargo jets. The primary objective of using composite materials, including carbon fiber, is to modify airplanes with less weight and make them more fuel efficient.

Raw Material Insights

Based on raw material, the polyacrylonitrile (PAN) segment dominated the market with a revenue share of 96.25% in 2022 and the segment is further forecasted to grow at the fastest CAGR of 11.91% by 2032. The superior properties of PAN results in wider acceptance in various application industries. Moreover, increasing demand for a higher strength-to-weight ratio carbon fiber, PAN precursor is widely used on account of its superior material properties.

PAN-based carbon fibers although more expensive than pitch-based are nonetheless, used widely. The wider acceptance of PAN-based fibers in the preparation of polymer matrix composites has led to a drastic difference in the production of both precursors. Owing to the growing demand for a higher strength-to-weight ratio, PAN precursor has gained popularity and enjoys higher market penetration.

Pitch-based carbon fiber is primarily used for satellite parts and sports goods due to some of its application-specific desirable properties. Pitch-based product is mainly used due to their lower manufacturing costs than PAN-based product. However, over the coming years, pitch precursor is expected to lose its market share to the PAN precursor segment on account of its lower properties than PAN-based carbon fiber.

Tow Size Insights

Based on tow size, the carbon fibers industry is categorized into small tow and large tow. The small tow market segment dominated the segment with a revenue share of 77.6% in 2022. The small tow segment is further predicted to grow significantly over the coming years. Small tow fibers are widely used in the aerospace industry owing to their high tensile strength and high modulus when used for manufacturing composites, which are used in numerous applications.

The large tow segment is forecasted to grow at a CAGR of 10.3% over the coming years. This growth is attributed to the growing adaption of carbon fiber across several application industries due to its high strength-to-weight ratio and its advantages over conventional materials including metals and their alloys.

Application Insights

Based on application, the market is segmented into automotive, aerospace & defense, wind turbines, sports/leisure, molding & compound, construction, pressure vessel, and others. The aerospace & defense segment accounted for the largest revenue share of 32.08% in 2022 and the segment is forecasted to grow at a CAGR of 11.35% over the forecast period.

A rise in fuel prices has boosted the need for fuel-efficient vehicles. A reduction in curb weight is the most effective means of improving fuel efficiency. Carbon fiber has been most widely utilized as a replacement for steel in automotive applications on account of its higher strength-to-weight ratio. Similarly, carbon fiber is also replacing metals in aerospace applications as it contributes to a reduction in the weight of the aircraft and hence, improves fuel efficiency.

The aerospace sector demands lightweight and rigid materials for usage in aircraft, rockets, satellites, and missiles as it determines performance. The U.S. and Europe are the key regions in the aerospace & defense industry, wherein the carbon fiber demand is driven by aircraft manufacturers such as Boeing and Airbus. The aerospace industry is dominated by commercial aviation and the production of large passenger and cargo jets. The primary objective of using composite materials including carbon fiber is to reduce airplane weight and introduce machines with improved performance.

The high significance associated with the use of renewable sources, owing to their environmental benefits, has triggered the growth of the wind turbine industry over the last few years. Rising government support toward the development of renewable energy resources is also expected to drive the wind turbine industry over the forecast period.

Regional Insights

The Europe region dominated the regional segment and accounted for the highest revenue share of 31.66% in 2022. The growth of the aerospace & defense industry in Europe and North America has triggered the growth of the carbon fiber industry over the past few years and this trend is expected to continue over the forecast period. The presence of aerospace giants such as Airbus and Boeing in Europe and North America has propelled the regional demand for carbon fiber.

Moreover, the growth in the commercial aviation sector across the developing countries in the Asia Pacific region including China, India, South Korea, and Vietnam is propelling the growth of the market. The presence of key aircraft manufacturers such as Airbus as well as defense equipment manufacturers such as MBDA in Europe has triggered the demand for carbon fiber across the world. The presence of automotive giants such as Volkswagen, Mercedes, and Ferrari, who emphasize low-weight high-performance cars, has further triggered the regional carbon fiber demand. Stringent regulations coupled with proactive efforts initiated by the European automotive manufacturers are anticipated to foster market growth over the forecast period.

Carbon Fiber Market Segmentations:

By Raw Material

By Tow Size

By Application Type

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Raw Material Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Carbon Fiber Market

5.1. COVID-19 Landscape: Carbon Fiber Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Carbon Fiber Market, By Raw Material

8.1. Carbon Fiber Market, by Raw Material, 2023-2032

8.1.1 PAN Based

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Pitch Based

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Carbon Fiber Market, By Tow Size

9.1. Carbon Fiber Market, by Tow Size, 2023-2032

9.1.1. Small Tow

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Large Tow

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Carbon Fiber Market, By Application Type

10.1. Carbon Fiber Market, by Application Type, 2023-2032

10.1.1. Automotive

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Aerospace & Defense

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Wind Turbines

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Sports/Leisure

10.1.4.1. Market Revenue and Forecast (2020-2032)

10.1.5. Molding & Compound

10.1.5.1. Market Revenue and Forecast (2020-2032)

10.1.6. Construction

10.1.6.1. Market Revenue and Forecast (2020-2032)

10.1.7. Pressure Vessel

10.1.7.1. Market Revenue and Forecast (2020-2032)

10.1.8. Others

10.1.8.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Carbon Fiber Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.1.2. Market Revenue and Forecast, by Tow Size (2020-2032)

11.1.3. Market Revenue and Forecast, by Application Type (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Tow Size (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Application Type (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Tow Size (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Application Type (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.2.2. Market Revenue and Forecast, by Tow Size (2020-2032)

11.2.3. Market Revenue and Forecast, by Application Type (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Tow Size (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Application Type (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Tow Size (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Application Type (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Tow Size (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Application Type (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Tow Size (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Application Type (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.3.2. Market Revenue and Forecast, by Tow Size (2020-2032)

11.3.3. Market Revenue and Forecast, by Application Type (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Tow Size (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Application Type (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Tow Size (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Application Type (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Tow Size (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Application Type (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Tow Size (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Application Type (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.4.2. Market Revenue and Forecast, by Tow Size (2020-2032)

11.4.3. Market Revenue and Forecast, by Application Type (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Tow Size (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Application Type (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Tow Size (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Application Type (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Tow Size (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Application Type (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Tow Size (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Application Type (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.5.2. Market Revenue and Forecast, by Tow Size (2020-2032)

11.5.3. Market Revenue and Forecast, by Application Type (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Tow Size (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Application Type (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Raw Material (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Tow Size (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Application Type (2020-2032)

Chapter 12. Company Profiles

12.1. A&P Technology Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Anshan Sinocarb Carbon Fibers Co. Ltd

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. DowAksa USA LLC

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Formosa Plastics Corporation

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Hexcel Corporation

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Holding company Composite

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Hyosung Advanced Materials

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Jiangsu Hengshen Co. Ltd

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Mitsubishi Chemical Corporation

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Nippon Graphite Fiber Co. Ltd

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others