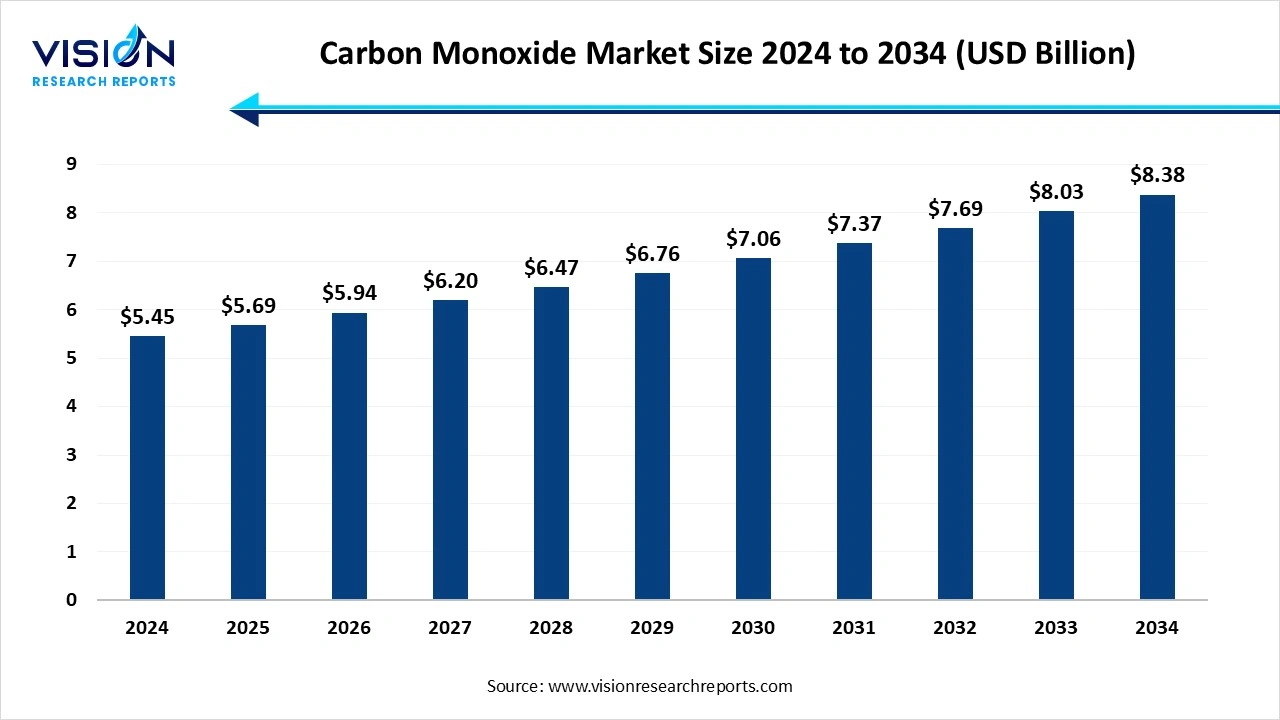

The global carbon monoxide market was estimated at USD 5.45 billion in 2024 and it is expected to surpass around USD 8.38 billion by 2034, poised to grow at a CAGR of 4.40% from 2025 to 2034.

The global carbon monoxide market is witnessing significant growth, driven by its widespread industrial applications and growing demand in various sectors such as chemicals, pharmaceuticals, and energy. Carbon monoxide (CO) is a colorless, odorless, and highly toxic gas, primarily produced through the incomplete combustion of carbon-containing materials. It plays a crucial role in the production of essential chemicals like acetic acid, methanol, and various hydrocarbons, serving as a vital feedstock for manufacturing processes. The automotive industry also contributes to the demand for CO in the production of synthetic fuels and as a reducing agent in steel manufacturing.

The growth of the carbon monoxide market is primarily driven by its extensive use in the production of chemicals such as methanol, acetic acid, and other petrochemical derivatives. These chemicals are vital in numerous industries, including automotive, pharmaceuticals, and agriculture. As the demand for these products continues to rise globally, particularly in emerging economies, the need for carbon monoxide as a feedstock grows as well.

Another key factor contributing to the market's growth is the ongoing advancements in production technologies, which allow for more efficient and cost-effective carbon monoxide generation. As industries become more focused on optimizing operations and improving profitability, the adoption of modern techniques like coal gasification, natural gas reforming, and partial oxidation of hydrocarbons is expected to increase.

The Asia Pacific region led the global carbon monoxide market, accounting for 48% of the total revenue in 2024. the region's thriving metal processing and manufacturing sectors, closely tied to the automotive industry, further bolster the demand for carbon monoxide. Government policies in these countries, aimed at promoting industrial growth, have also created a favorable environment for the carbon monoxide market. As a result, Asia-Pacific leads in terms of both production and consumption of carbon monoxide, maintaining a significant share of the global market. The region benefits from advanced technologies and strict environmental regulations that encourage the adoption of sustainable production methods.

Europe, the carbon monoxide market is characterized by strong demand from the chemical and metal industries, with leading countries such as Germany, France, and the United Kingdom playing a central role. The region is highly regulated, with strict environmental policies aimed at reducing carbon emissions, which has led to the adoption of cleaner production technologies. European manufacturers are increasingly investing in carbon capture and utilization (CCU) technologies to minimize the environmental impact of carbon monoxide production.

The electronics segment led the market, accounting for 35% of total revenue in 2024. In the electronics industry, carbon monoxide is used in the production of semiconductor materials, which are essential for electronic devices such as smartphones, computers, and renewable energy systems. CO is utilized in chemical vapor deposition (CVD) processes, a method essential for creating thin films and coatings on electronic components.

The metal fabrication industry, carbon monoxide is primarily used in the production of steel and other metals, where it serves as a reducing agent in the extraction of metals from their ores. This process, known as reduction, involves the use of carbon monoxide to strip oxygen from metal oxides, allowing the desired metal to be obtained in its pure form. The role of carbon monoxide is particularly important in the blast furnace method of iron production, where it acts as a vital component in the reduction of iron ore to produce molten iron.

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Carbon Monoxide Market

5.1. COVID-19 Landscape: Carbon Monoxide Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Carbon Monoxide Market, By Application

8.1.Carbon Monoxide Market, by Application Type

8.1.1. Chemical

8.1.1.1. Market Revenue and Forecast

8.1.2. Metal Fabrication

8.1.2.1. Market Revenue and Forecast

8.1.3. Electronics

8.1.3.1. Market Revenue and Forecast

8.1.4. Pharma & Biotechnology

8.1.4.1. Market Revenue and Forecast

8.1.5. Meat & Coloring Preservative

8.1.5.1. Market Revenue and Forecast

8.1.6. Other Applications

8.1.6.1. Market Revenue and Forecast

Chapter 9. Global Carbon Monoxide Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Application

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by Application

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by Application

9.2. Europe

9.2.1. Market Revenue and Forecast, by Application

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by Application

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by Application

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by Application

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by Application

9.3. APAC

9.3.1. Market Revenue and Forecast, by Application

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by Application

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by Application

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by Application

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by Application

9.4. MEA

9.4.1. Market Revenue and Forecast, by Application

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by Application

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by Application

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by Application

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by Application

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Application

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by Application

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by Application

Chapter 10. Company Profiles

10.1. Air Products and Chemicals, Inc.

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. Linde plc

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. Air Liquide

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. Messer Group GmbH

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. The Linde Group (Formerly Linde AG)

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. Praxair, Inc. (now part of Linde)

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. Harris Products Group

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. Matheson Tri-Gas, Inc.

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3.Financial Performance

10.8.4. Recent Initiatives

10.9. Gulf Cryo

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

10.10. Taiyo Nippon Sanso Corporation (TNSC)

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others