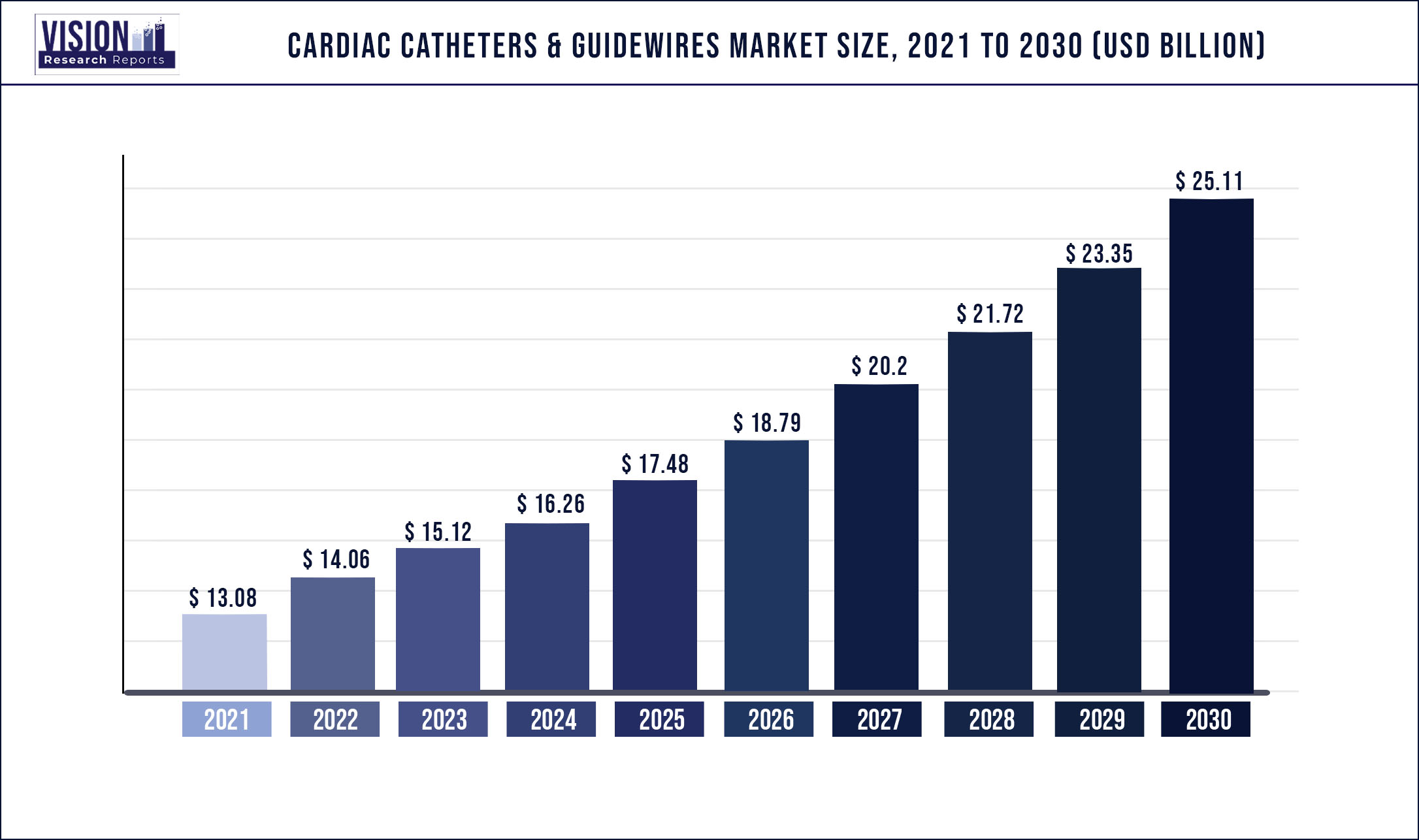

The global cardiac catheters & guidewires market was surpassed at USD 13.08 billion in 2021 and is expected to hit around USD 25.11 billion by 2030, growing at a CAGR of 7.52% from 2022 to 2030.

Report Highlights

The industry is expected to grow due to the increasing geriatric population, lack of substitutes in the market, rising incidence of diabetes across the globe, and technological advancements. Diabetic patients are more prone to develop certain health conditions, such as high cholesterol, high blood pressure, heart diseases, and stroke. In addition, long-term diabetes damages the blood vessels and nerves that directly control the heart muscles. This also increases the chances of developing Cardiovascular Diseases (CVDs).

Moreover, people suffering from diabetes also tend to develop heart disease and stroke at a very young age. Furthermore, diabetes triggers the risk of developing obesity, which, in turn, increases the predisposition to CVDs. The high incidence of diabetes is one of the major reasons for the increased prevalence of CVDs across the globe. For instance, according to the American Diabetes Association, around 37.3 million Americans, which was around 11.3% of the total population, were estimated to be suffering from diabetes. Moreover, as per the 10th edition of the International Diabetes Federation, 537 million people worldwide have diabetes, which is anticipated to reach 700 million by 2045. Furthermore, in recent years, the Caribbean, Middle East, Latin America regions, and some nations of the Pacific Islands marked the highest prevalence of diabetes in the world.

Moreover, technological advancements in cardiac catheters & guidewires devices can support clinicians in identifying patients with a high risk of disease, which is anticipated to spur the industry growth. For instance, in February 2022, Medtronic received FDA expanded approval for cryoablation cardiac catheters for pediatric patients for the treatment of a common heart rhythm disorder. Hence, such product launches provide growth opportunities. The COVID-19 pandemic had a negative impact on the industry due to a decrease in surgical procedure volumes. However, due to the ease in restrictions, countries have resumed elective procedures, suggesting that the industry will keep growing during the projected period.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 13.08 billion |

| Revenue Forecast by 2030 | USD 25.11 billion |

| Growth rate from 2022 to 2030 | CAGR of 7.52% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product, end-use, region |

| Companies Covered |

Abbott; Boston Scientific, Corp.; Getinge AB; Biosense Webster, Inc. (Part of Johnson & Johnson); Terumo Medical Corp..; BIOTRONIK SE & Co. KG; Medtronic, CORDIS (A, Cardinal Health Company); QXMédical; Teleflex Inc.; B. Braun; C. R., Bard, Inc. (has joined BD); Cardinal Health; Merit Medical Systems; NIPRO; BrosMed Medical Co., Ltd. |

Product Insights

The cardiac catheters segment led the global industry in 2021 and accounted for the highest share of more than 85.77% of the overall revenue. The segment is also expected to witness the fastest growth during the forecast years. Cardiac catheters are generally used to open blocked blood vessels allowing enhanced blood flow. It gets inflated when inserted inside the blood vessels and thereby, increases the blood flow. Cardiac catheters are majorly used in cardiac catheterization, angioplasty, PCI, and other interventional procedures. In cardiac catheterization, it is used to evaluate heart muscle function, estimate the need for further treatment, and evaluate the presence of valve disease & coronary artery disease.

Similarly, in the case of angioplasty and other interventional procedures, the insertion of a catheter is the initial step of these procedures. The increasing cases of cardiovascular diseases across the globe are one of the major factors contributing to the segment's growth. For instance, as per the report published by the World Heart Federation in 2018, 80.0% of the deaths in low- to middle-income countries are caused due to cardiovascular diseases. Similarly, as per the World Health Organization (WHO) in 2018, around 17.9 million deaths occur globally due to CVDs.

Therefore, such factors are anticipated to propel the demand for cardiac catheterization, angioplasty, and other interventional procedures, which, in turn, boost the demand for cardiac catheters. Moreover, currently, no substitutes for cardiac catheters are available in the market, which is also a major driving factor for the segment's growth. Recently, the market for cardiovascular catheters has witnessed notable industry events, which are expected to significantly increase product demand during the forecast period. For instance, in April 2019, Oscor, Inc., a U.S.-based implantable devices manufacturer, announced a strategic alliance with Micro Interventional Devices, Inc. (MID) to commercialize minimally invasive annuloplasty technology.

End-use Insights

The hospital segment dominated the global industry in 2021 with a revenue share of over 40.98% due to the high incidence of cardiovascular diseases across the globe. For instance, as per the report published by the Centers for Disease Control & Prevention (CDC) in 2018, coronary heart disease is the most common type of cardiovascular disease and more than 370,000 people die every year in the U.S. due to it. It also reported that every year, around 735,000 Americans have a heart attack. Angioplasty, PCI, and cardiac catheterization are majorly recommended for the treatment of such problems, thus, an increase in cases of such diseases is expected to boost the hospital admission rate.

In addition, the rising number of hospitals across the globe is also anticipated to support the segment growth over the forecast period. For instance, as per the report published by the American Hospital Association in 2019, there were around 6,210 hospitals in the U.S. in 2018, of which 2,968 are nongovernment not-for-profit community hospitals and 972 are state and local government community hospitals. The Ambulatory Surgical Centers (ASCs) segment is expected to register the highest CAGR during the forecast period. Ambulatory surgery facilities sometimes referred to as outpatient surgery centers, are frequently chosen by patients having less involved surgeries that only need a brief hospital stay.

Rapid healing is possible with minimally invasive interventional techniques, which also have a short hospital stay. Thus, patients opting for such procedures generally prefer to choose ASCs. For instance, Percutaneous Transluminal Coronary Angioplasty (PTCA) and Percutaneous Transluminal Angioplasty (PTA) are minimally invasive interventional procedures, which allows rapid healing, and the patients can get back to their normal life within a short period. Currently, the demand for minimally invasive procedures is increasing across the globe owing to its several advantages, which, in turn, boost the demand for ASCs.

Regional Insights

North America dominated the global industry with a revenue share of over 45.67% in 2021. This can be attributed to several factors, such as increased adoption of cardiac catheters and guidewire technology in primary care settings, improved accessibility, and high healthcare spending in countries with efficient reimbursement policies. Technological innovations and the growing incidence of chronic conditions are anticipated to further propel the region’s growth. The increasing incidence of chronic diseases in this region, such as cardiovascular disorders, has created a high demand for imaging analysis. For instance, according to the CDC, each year, around 805,000 people in the U.S. suffer from a heart attack. The region is expected to maintain its dominance throughout the forecast period.

Moreover, the annual per capita healthcare expenditure in the U.S. is the highest in the world (USD 11,172, on average, in 2018), with healthcare costs growing between 4.2% and 5.8% annually over the past five years. This is likely to propel regional market growth. Asia Pacific is expected to register the fastest CAGR during the forecast period. The rising prevalence of cardiac diseases has created a demand for cardiac catheters & guidewires equipment in APAC countries. Furthermore, with some of the highest diabetes rates in the world, India and China have been the most afflicted countries. Diabetes claimed the lives of about 1.5 million people in 2019, according to WHO estimates. The population of ASEAN countries is expected to reach 693,000 by 2025. According to the British Medical Journal, the incidence rate of diabetes and cardiovascular disease would likely reach 20% by 2025.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Cardiac Catheters & Guidewires Market

5.1. COVID-19 Landscape: Cardiac Catheters & Guidewires Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Cardiac Catheters & Guidewires Market, By Product

8.1. Cardiac Catheters & Guidewires Market, by Product, 2022-2030

8.1.1. Cardiac Catheters

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Cardiac Guidewires

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Cardiac Catheters & Guidewires Market, By End-use

9.1. Cardiac Catheters & Guidewires Market, by End-use, 2022-2030

9.1.1. Hospitals

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Clinics

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Ambulatory Surgical Centers

9.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Cardiac Catheters & Guidewires Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.2. Market Revenue and Forecast, by End-use (2017-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.5.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.6.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.5.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.6.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.5.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.6.2. Market Revenue and Forecast, by End-use (2017-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.2. Market Revenue and Forecast, by End-use (2017-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.4.2. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 11. Company Profiles

11.1. Abbott

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Boston Scientific Corp.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Getinge AB

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Biosense Webster, Inc (Part of Johnson & Johnson)

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Terumo Medical Corp.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. BIOTRONIK SE & Co. KG

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Medtronic

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. CORDIS (A, Cardinal Health Company)

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. QXMédical

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Teleflex Inc.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others