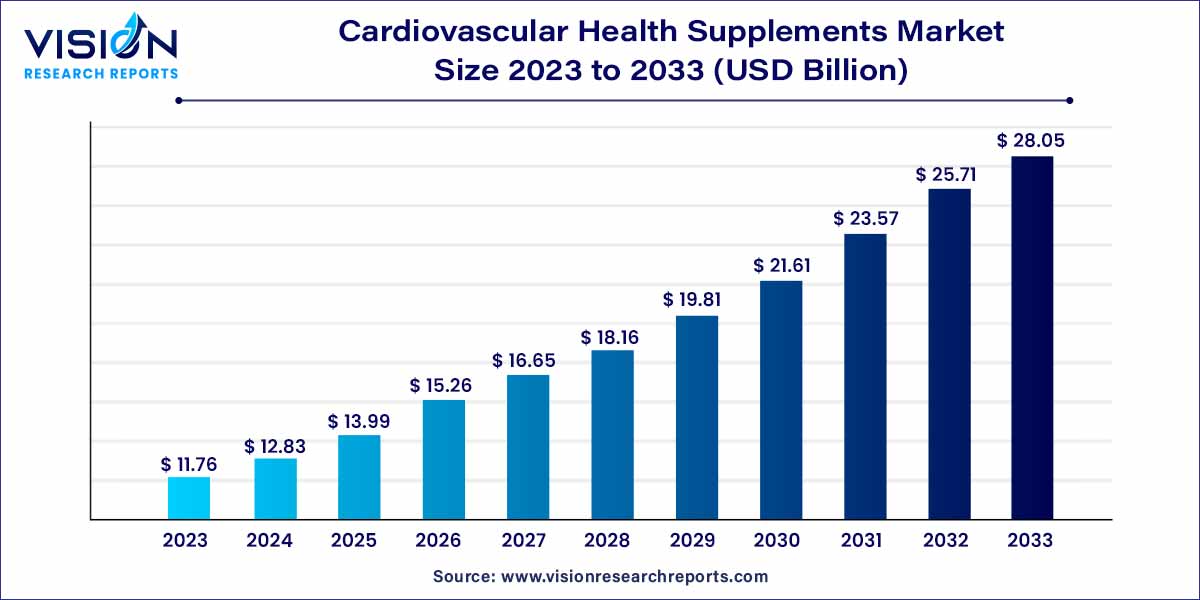

The global cardiovascular health supplements market size was estimated at around USD 11.76 billion in 2023 and it is projected to hit around USD 28.05 billion by 2033, growing at a CAGR of 9.08% from 2024 to 2033.

The cardiovascular health supplements market is witnessing a significant surge in demand owing to the growing awareness about heart health and the increasing prevalence of cardiovascular diseases globally. Cardiovascular health supplements, comprising a wide range of vitamins, minerals, antioxidants, and herbal extracts, are designed to support heart function and reduce the risk of heart-related ailments.

The growth of the cardiovascular health supplements market can be attributed to several key factors. Firstly, the increasing awareness among individuals about the importance of cardiovascular health and the rising prevalence of heart-related diseases are driving the demand for these supplements. Secondly, the aging population, which is more susceptible to heart issues, is creating a significant consumer base for cardiovascular health products. Additionally, unhealthy lifestyles, sedentary habits, and stressful work environments have contributed to a surge in heart problems, prompting people to seek preventive measures through supplements. Furthermore, advancements in research and development, leading to innovative formulations and natural ingredients, are enhancing the efficacy of these supplements, attracting health-conscious consumers.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 28.05 billion |

| Growth Rate from 2024 to 2033 | CAGR of 9.08% |

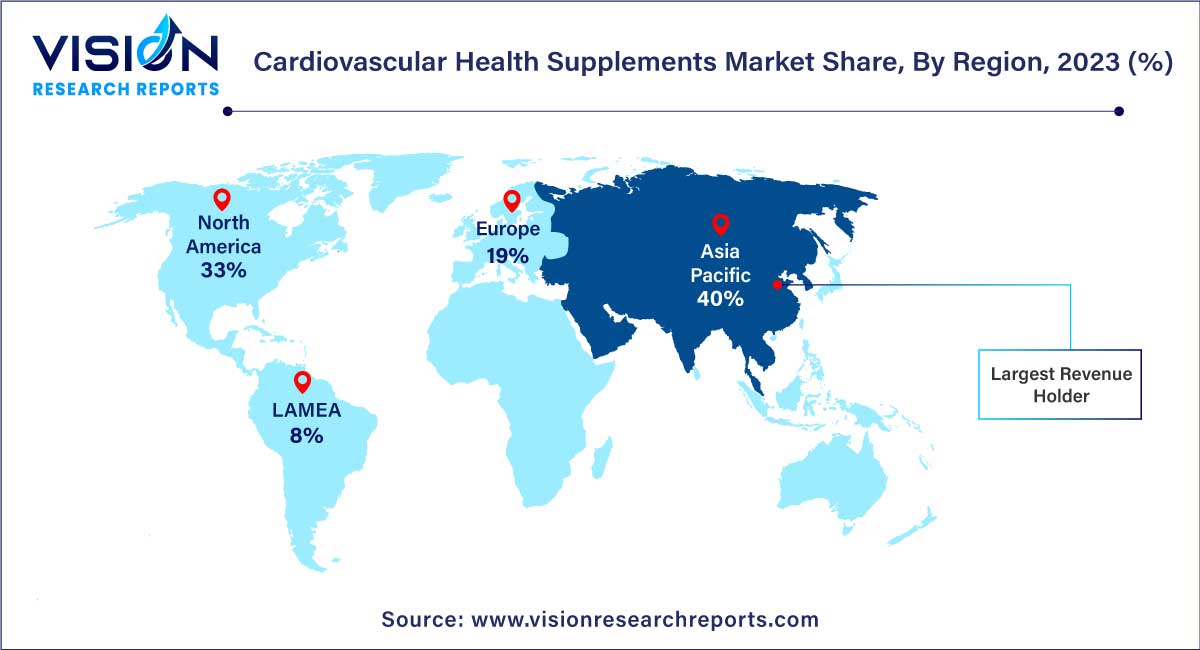

| Revenue Share of Asia Pacific in 2024 | 39% |

| CAGR of Europe from 2024 to 2033 | 8.91% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units)Companies Covered |

The natural supplements segment held the largest market share of 71% in 2023 and it is expected to grow at the fastest CAGR of 9.49% over the forecast period. Natural supplements are derived from organic sources, such as herbs, plants, and marine extracts, known for their inherent health benefits. These supplements often contain vitamins, minerals, antioxidants, and omega-3 fatty acids sourced from natural sources. Due to their organic origins, natural supplements are perceived by consumers as healthier and safer alternatives. They are favored by individuals seeking products with minimal processing and additives, aligning with the growing trend towards natural and holistic health solutions.

The synthetic supplements segment is anticipated to grow at a significant CAGR of 8.18% during forecast period. Synthetic supplements are chemically formulated in laboratories to mimic the properties of natural nutrients. These supplements are designed to provide specific vitamins, minerals, and other essential compounds essential for cardiovascular health. Synthetic supplements offer precise control over nutrient concentrations, ensuring standardized dosages. They are often recommended in clinical settings where targeted nutrient supplementation is required.

The omega fatty acids segment registered the maximum market share of 28% in 2023. Omega fatty acids, particularly omega-3, are essential polyunsaturated fats known for their profound cardiovascular benefits. Derived mainly from fish oil and certain plant sources, omega-3 fatty acids have gained immense popularity due to their ability to reduce inflammation, lower blood pressure, and enhance overall heart health. Research studies supporting their efficacy have bolstered their reputation, making them a cornerstone ingredient in cardiovascular health supplements.

The herbs & botanicals segment is expected to grow at the fastest CAGR of 10.39% from 2024 to 2033. Herbs and botanicals have been integral to traditional medicine systems for centuries, owing to their medicinal properties. In the context of cardiovascular health supplements, various herbs and botanicals have gained prominence for their heart-friendly attributes. For instance, garlic is renowned for its potential to lower blood pressure and cholesterol levels, while hawthorn extract is valued for its ability to improve blood circulation and strengthen the heart muscle.

The softgels segment held the largest market share of 38% in 2023. Softgels, characterized by their gelatinous outer coating, encase liquid or oil-based supplements. This form offers several advantages, such as improved absorption rates and enhanced bioavailability of the enclosed nutrients. Softgels are particularly favored for cardiovascular health supplements containing omega-3 fatty acids, as the encapsulation method protects these sensitive oils from oxidation, ensuring the potency of the supplement. The smooth texture and easy swallowing make softgels a convenient option, especially for individuals with difficulty in ingesting larger pills or tablets.

The capsules segment is projected to exhibit the fastest CAGR of 9.97% over the forecast period. Capsules, on the other hand, consist of a two-piece outer shell, usually made from gelatin or plant-based materials, enclosing powdered or granulated supplement ingredients. This form is versatile and allows for the encapsulation of various nutrients, including vitamins, minerals, and herbal extracts, relevant to cardiovascular health. Capsules are preferred for their flexibility in formulation, enabling manufacturers to create customized blends tailored to specific heart health needs.

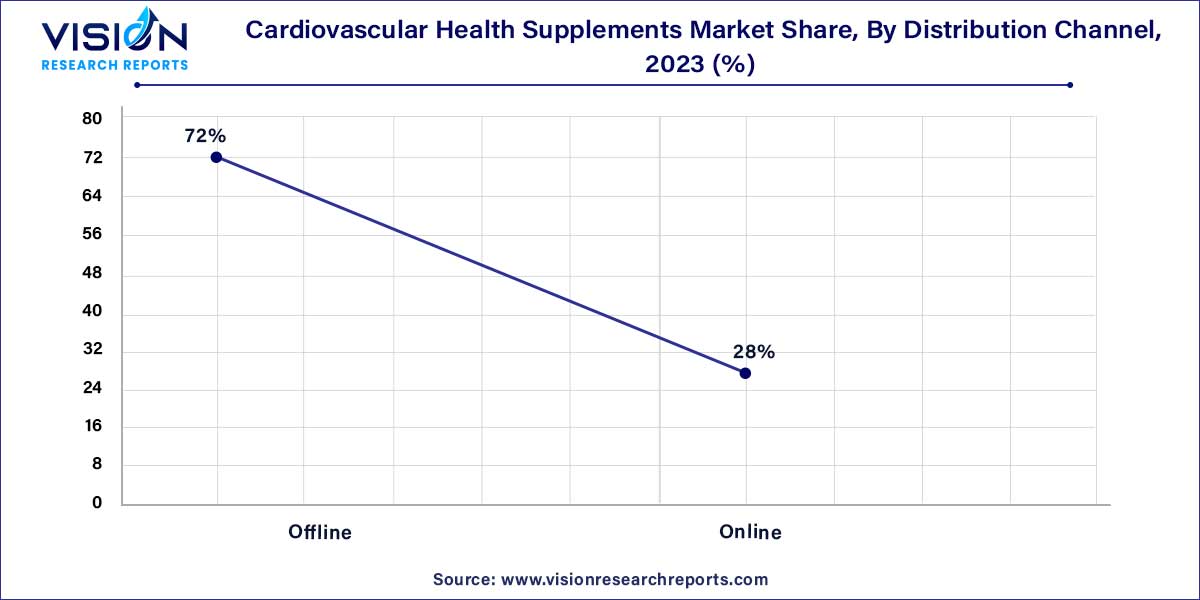

The offline segment contributed the largest market share of 72% in 2023. Offline distribution channels, which include brick-and-mortar stores, pharmacies, supermarkets, and specialty health stores, have long been the traditional way consumers purchase supplements. These physical retail outlets offer consumers the advantage of a tangible shopping experience, allowing them to see, touch, and evaluate products before making a purchase decision. Knowledgeable staff in these stores can also provide personalized recommendations and guidance, enhancing the consumer's shopping experience.

The online segment is expected to expand at the highest CAGR of 10.49% over forecast period. The online distribution channel has witnessed exponential growth with the advent of e-commerce platforms. Online retailing offers consumers unparalleled convenience and accessibility, allowing them to browse a vast array of cardiovascular health supplements from the comfort of their homes. The online marketplace provides detailed product information, customer reviews, and often offers a wider selection than physical stores. This channel appeals to the tech-savvy, time-conscious consumers seeking the ease of ordering products with just a few clicks. Additionally, online platforms enable suppliers and manufacturers to reach a global audience, breaking down geographical barriers and expanding market reach.

Asia Pacific dominated the market with a revenue share of 40% in 2023. Asia-Pacific, with countries like China, Japan, and India, represents a burgeoning market for cardiovascular health supplements. Rapid urbanization, changing lifestyles, and rising disposable incomes have elevated awareness about heart health in this region. The market in Asia-Pacific is characterized by a significant interest in herbal supplements, reflecting the rich traditional herbal medicine heritage of several countries.

In Europe, countries such as Germany, France, and the United Kingdom have witnessed a surge in demand for cardiovascular health supplements, driven by an aging population and an increasing focus on holistic well-being. European consumers often prioritize supplements made from herbal and botanical ingredients, reflecting a preference for traditional remedies.

By Type

By Ingredient

By Form

By Distribution Channel

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Cardiovascular Health Supplements Market

5.1. COVID-19 Landscape: Cardiovascular Health Supplements Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Cardiovascular Health Supplements Market, By Type

8.1. Cardiovascular Health Supplements Market, by Type, 2024-2033

8.1.1. Natural Supplements

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Synthetic Supplements

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Cardiovascular Health Supplements Market, By Ingredient

9.1. Cardiovascular Health Supplements Market, by Ingredient, 2024-2033

9.1.1. Vitamins & Minerals

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Herbs & Botanicals

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Omega Fatty Acids

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Coenzyme Q10 (CoQ10)

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Cardiovascular Health Supplements Market, By Form

10.1. Cardiovascular Health Supplements Market, by Form, 2024-2033

10.1.1. Liquid

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Tablet

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Capsules

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Softgels

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Powder

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Others

10.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Cardiovascular Health Supplements Market, By Distribution Channel

11.1. Cardiovascular Health Supplements Market, by Distribution Channel, 2024-2033

11.1.1. Offline

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Online

11.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Cardiovascular Health Supplements Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.2. Market Revenue and Forecast, by Ingredient (2021-2033)

12.1.3. Market Revenue and Forecast, by Form (2021-2033)

12.1.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Ingredient (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Form (2021-2033)

12.1.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Ingredient (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Form (2021-2033)

12.1.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.2. Market Revenue and Forecast, by Ingredient (2021-2033)

12.2.3. Market Revenue and Forecast, by Form (2021-2033)

12.2.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Ingredient (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Form (2021-2033)

12.2.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Ingredient (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Form (2021-2033)

12.2.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Ingredient (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Form (2021-2033)

12.2.7.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Ingredient (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Form (2021-2033)

12.2.8.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.2. Market Revenue and Forecast, by Ingredient (2021-2033)

12.3.3. Market Revenue and Forecast, by Form (2021-2033)

12.3.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Ingredient (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Form (2021-2033)

12.3.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Ingredient (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Form (2021-2033)

12.3.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Ingredient (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Form (2021-2033)

12.3.7.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Ingredient (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Form (2021-2033)

12.3.8.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.2. Market Revenue and Forecast, by Ingredient (2021-2033)

12.4.3. Market Revenue and Forecast, by Form (2021-2033)

12.4.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Ingredient (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Form (2021-2033)

12.4.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Ingredient (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Form (2021-2033)

12.4.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Ingredient (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Form (2021-2033)

12.4.7.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Ingredient (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Form (2021-2033)

12.4.8.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.2. Market Revenue and Forecast, by Ingredient (2021-2033)

12.5.3. Market Revenue and Forecast, by Form (2021-2033)

12.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Ingredient (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Form (2021-2033)

12.5.5.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Ingredient (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Form (2021-2033)

12.5.6.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

Chapter 13. Company Profiles

13.1. NOW Health Group, Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Bright, Lifecare Pvt Ltd (Truebasics.com)

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Natural Organics, Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. DaVinci Laboratories of Vermont

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Nordic Naturals

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Thorne HealthTech, Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Nestle (Pure Encapsulations, LLC)

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Amway

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. InVite Health

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. GNC Holdings, LLC

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others