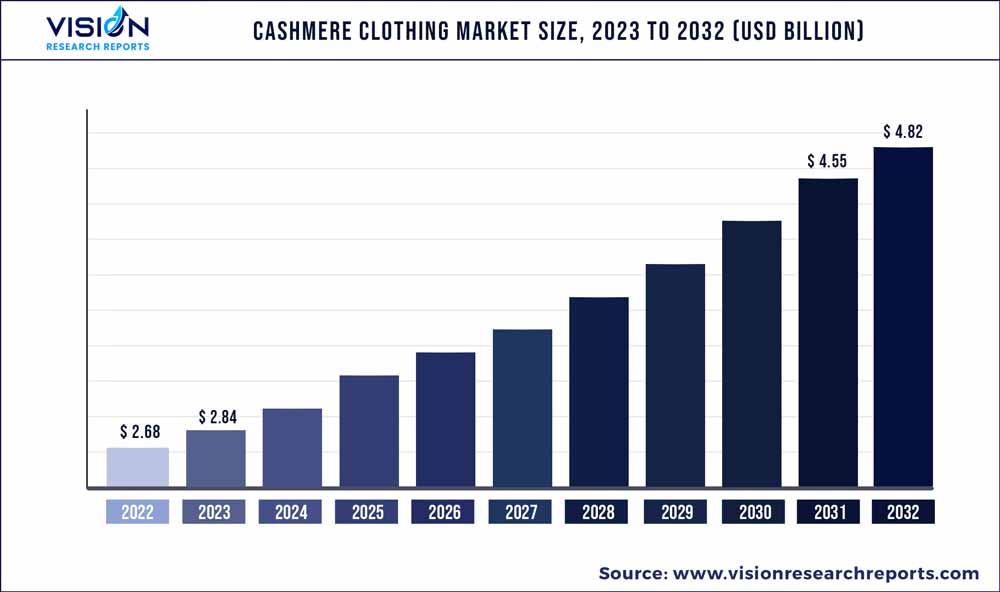

The global cashmere clothing market size was estimated at around USD 2.68 billion in 2022 and it is projected to hit around USD 4.82 billion by 2032, growing at a CAGR of 6.05% from 2023 to 2032.

Key Pointers

Report Scope of the Cashmere Clothing Market

| Report Coverage | Details |

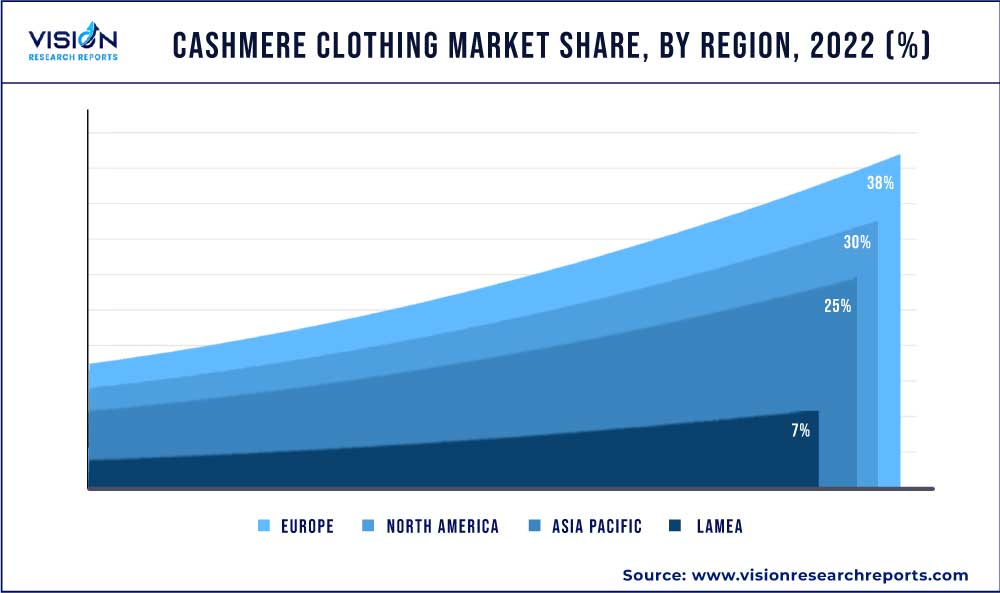

| Revenue Share of Europe in 2022 | 38% |

| CAGR of North America from 2023 to 2032 | 6.43% |

| Revenue Forecast by 2032 | USD 4.82 billion |

| Growth Rate from 2023 to 2032 | CAGR of 6.05% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Loro Piana S.P.A.; Brunello Cucinelli S.p.A.; Alyki - Felice De Palma & Co.; Pringle of Scotland Limited; Ermenegildo Zegna Holditalia S.p.A.; SofiaCashmere; Autumn Cashmere; Malo; Corso Italia S.p.A.; TSE Cashmere |

The cashmere clothing market is expected to expand due to the rising popularity of products such as fine and ideal woolen clothing which is driving the demand and supporting market growth. Cashmere clothing products are made using cashmere yarn. This type of wool is finer, softer, lighter, as well as stronger than other types of wool. It also has high moisture content and hence it is easily adjustable to different temperatures and helps to enhance the aesthetic appeal. Thus, all these factors are expected to augment the product demand in the forecast period.

According to data from the World Health Organization (WHO), the annual death toll from the flu ranges from 290,000 to 650,000 individuals. As a result, there has been an increased demand for Cashmere Clothing among consumers, driven by their desire to strengthen their immune systems and prevent such illnesses. The primary purpose of consuming Cashmere Clothing is to enhance individual immunity, and the market for these products is expected to grow steadily due to rising consumer awareness regarding their benefits.

The COVID-19 outbreak forced governments across the world to impose strict lockdowns, leading to severe supply chain disruptions in the cashmere clothing market. The pandemic disrupted both the production and sale of cashmere across the globe through both online and offline channels, due to factors such as social distancing, and stay-home policies. For instance, ShipBob, a tech-enabled third-party logistics service provider that caters to e-commerce orders for direct-to-consumer brands, and online apparel sales of more than 3000 merchants, witnessed a 20% month-over-month fall in volume from February to April 2020.

Consumers have become more conscious about their spending habits and prefer to either avoid purchasing premium-priced, non-essential products such as cashmere or use the existing ones as much as possible. This factor has been one of the most prominent reasons for a reduction in product demand. According to entrepreneur.com, the U.K. apparel sector is projected to be negatively impacted with more than 41% decline in the usual spending by consumers since the outbreak of COVID-19.

However, with the inception of the global economy, the cashmere clothing market is expected to bounce back post the COVID-19 era. The popularity of online distribution channels is expected to create a steady demand for cashmere clothes in the foreseeable future. According to a survey by Retail Systems Research on 1,200 U.S. consumers in late April 2020, close to 65% of people expected online shopping to be a necessity for them during the crisis. This trend foretells sales from online channels. Though the sale of cashmere clothing slowed down throughout 2020, the demand is anticipated to gradually increase post-2020 as the conditions become favorable. In addition, given that the COVID-19 vaccination drive is in full swing globally, the market is expected to resuscitate well in the upcoming years.

The rising product popularity and demand for premium quality clothing across the globe due to increased disposable income levels are also estimated to enhance the market growth. On the other hand, a costly production process coupled with a limited supply of raw materials may diminish the market growth. Sweaters and coats, pants and trousers, and tees and polo are the major types of cashmere clothing.

These products are comparatively costly and thus are considered luxury clothing apparel. North America is expected to be the fastest-growing regional market during the forecast period due to the increased sales of these products. Europe being the fashion hub of the world is estimated to account for the largest market share by 2032. Moreover, the presence of several prominent global luxury brands in Europe will drive regional market growth.

Product Insights

Based on the product, the cashmere clothing market has been divided into sweaters and coats, pants and trousers, and tees and polo. The sweaters and coats product segment accounted for the largest share of the global market more than 52% in the year 2022. The segment is anticipated to expand further at a steady CAGR of 5.54% in the forecast period.

This growth can be attributed to the rising demand for different types of premium sweaters and coats, such as casual, and formal wear. The tees and polo product type segment is projected to register the fastest growth rate of 7.64% during the forecast period. The segment foresees growth due to the high demand for tees and polos as they are cheaper as compared to premium coats, jackets, and sweaters.

End-user Insights

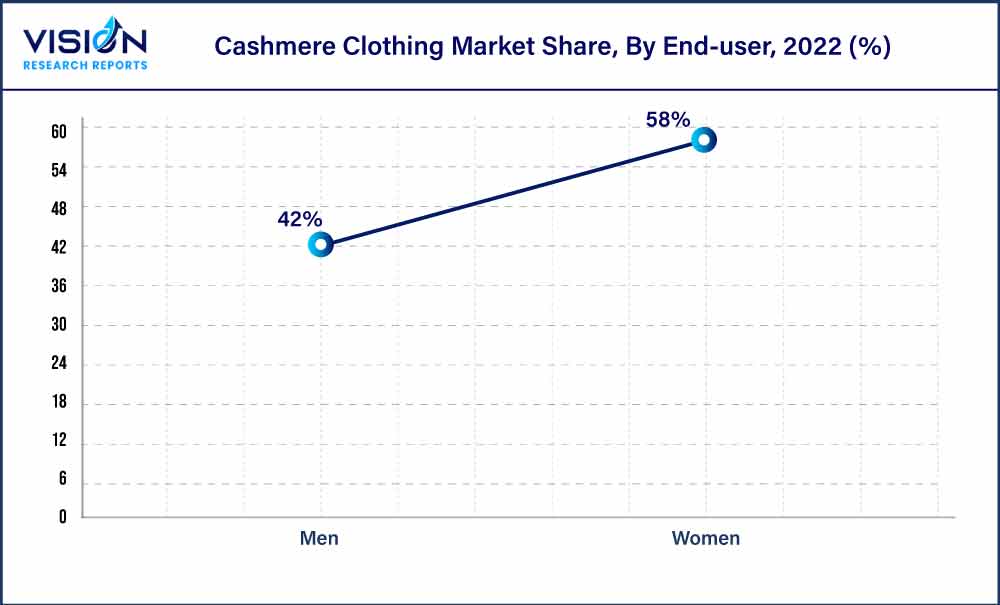

Based on end-users, the cashmere clothing market is bifurcated into men and women segments. The men's end-user segment is expected to witness the fastest CAGR of 6.54% in the forecast period. The growth is attributed to the improving standards of living, and increasing demand for cashmere clothing, such as coats and trousers, as fashion apparel.

The women's end-user segment, on the other hand, is projected to uphold the largest share of the global industry and is expected to reveal a CAGR of 5.77% in the forecast period. This is mainly due to the increasing demand for cashmere shawls and scarves across the globe. Various manufacturers are introducing innovative designs and patterns, which will further boost growth. Additionally, companies are on the verge to introduce unique accessories made from this fabric, thus likely to drive market growth.

Regional Insights

Europe dominated the market in 2022 and accounted for more than 38% of the global share and is projected to exhibit a CAGR of 4.64% during the forecast period. The market is driven by rising demand for different types of cashmere clothing in countries, such as Germany, Italy, and the U.K.

Moreover, Europe is considered the world’s fashion hub due to the strong presence of several luxury brands in the region, which also drives market growth. However, North America is projected to be the fastest-growing regional market at a CAGR of 6.43% in the forecast period. The U.S. is the major market in this region due to the high demand for luxury clothing.

Cashmere Clothing Market Segmentations:

By Product

By End-User

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Cashmere Clothing Market

5.1. COVID-19 Landscape: Cashmere Clothing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Cashmere Clothing Market, By Product

8.1. Cashmere Clothing Market, by Product, 2023-2032

8.1.1. Sweaters & Coats

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Pants & Trousers

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Tees & Polo

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Cashmere Clothing Market, By End-User

9.1. Cashmere Clothing Market, by End-User, 2023-2032

9.1.1. Men

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Women

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Cashmere Clothing Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.2. Market Revenue and Forecast, by End-User (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.3.2. Market Revenue and Forecast, by End-User (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.4.2. Market Revenue and Forecast, by End-User (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.2. Market Revenue and Forecast, by End-User (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.3.2. Market Revenue and Forecast, by End-User (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.4.2. Market Revenue and Forecast, by End-User (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.5.2. Market Revenue and Forecast, by End-User (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.6.2. Market Revenue and Forecast, by End-User (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.2. Market Revenue and Forecast, by End-User (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.3.2. Market Revenue and Forecast, by End-User (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.4.2. Market Revenue and Forecast, by End-User (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.5.2. Market Revenue and Forecast, by End-User (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.6.2. Market Revenue and Forecast, by End-User (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.2. Market Revenue and Forecast, by End-User (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.3.2. Market Revenue and Forecast, by End-User (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.4.2. Market Revenue and Forecast, by End-User (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.5.2. Market Revenue and Forecast, by End-User (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.6.2. Market Revenue and Forecast, by End-User (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.2. Market Revenue and Forecast, by End-User (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.3.2. Market Revenue and Forecast, by End-User (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.4.2. Market Revenue and Forecast, by End-User (2020-2032)

Chapter 11. Company Profiles

11.1. Loro Piana S.P.A.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Brunello Cucinelli S.p.A.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Alyki - Felice De Palma & Co.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Pringle of Scotland Limited

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Ermenegildo Zegna Holditalia S.p.A.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. SofiaCashmere

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Autumn Cashmere

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Malo

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Corso Italia S.p.A.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. TSE Cashmere

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others