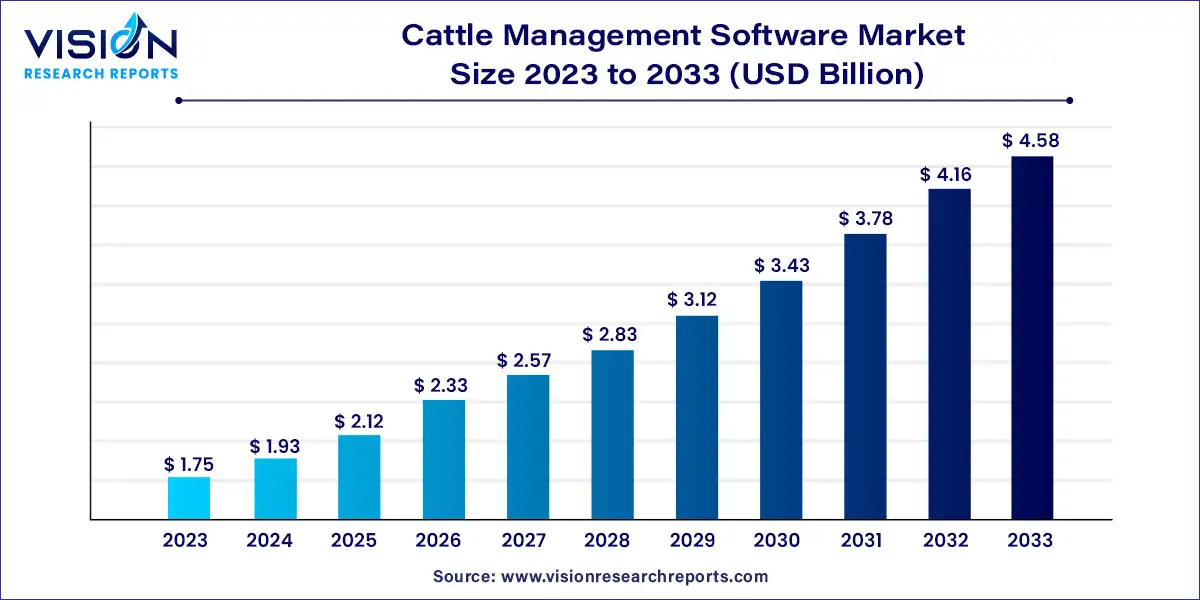

The cattle management software market size was estimated at around USD 1.75 billion in 2023 and it is projected to hit around USD 4.58 billion by 2033, growing at a CAGR of 10.09% from 2024 to 2033.

Cattle management software encompasses a suite of digital tools and applications designed to facilitate the efficient management of cattle farms and ranches. These software solutions offer a range of functionalities, including livestock tracking, health monitoring, financial management, and data analytics. By digitizing various aspects of cattle farming, these tools empower farmers to enhance productivity, improve animal health, and make informed decisions.

The Cattle Management Software Market is experiencing robust growth due to a confluence of key factors. Firstly, the increasing need for operational efficiency in cattle farms and ranches drives the adoption of software solutions that streamline tasks, reduce errors, and enhance productivity. Secondly, the emergence of precision livestock management practices is promoting the use of software for real-time monitoring of individual animals, ensuring their health and well-being. Additionally, data-driven decision-making has become paramount in modern agriculture, and cattle management software equips farmers with valuable insights for informed choices in areas such as breeding, feeding, and healthcare. Lastly, the imperative for compliance with regulatory standards and the growing consumer demand for traceability in food production further propel the market's growth. Together, these factors underscore the pivotal role of cattle management software in revolutionizing the livestock industry.

| Report Coverage | Details |

| Revenue Share of North America in 2023 | 38% |

| CAGR of Asia Pacific from 2024 to 2033 | 11.34% |

| Revenue Forecast by 2033 | USD 4.58 billion |

| Growth Rate from 2024 to 2033 | CAGR of 10.09% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The daily segment led the global market with the largest market share of 63% in 2023. The segment is expected to expand at the remarkable CAGR of 10.36% over the forecast period. The Global Cattle Management Software Market plays a pivotal role in the dairy and meat sectors, serving as a cornerstone for modern livestock farming practices. In the dairy industry, these software solutions offer comprehensive tools for managing and optimizing the production of milk and dairy products. Dairy farmers utilize cattle management software to track individual cow data, monitor milk production, and ensure the health and well-being of their herds. Real-time data analytics enable farmers to make informed decisions regarding breeding, nutrition, and healthcare, ultimately increasing milk yield and quality. Moreover, compliance with stringent quality standards and traceability requirements is streamlined through the digitization of records, enhancing the overall safety and quality of dairy products for consumers.

Similarly, in the meat sector, cattle management software contributes significantly to improving the efficiency and sustainability of meat production. Meat producers and ranchers utilize these software solutions to monitor the health and growth of their livestock, ensuring the optimal development of meat animals. Through data-driven insights, such as feeding patterns and weight gain, farmers can make precise decisions regarding when to send animals to market, reducing resource wastage and increasing profitability. Furthermore, these software systems aid in maintaining compliance with food safety regulations, enabling the meat industry to meet the rigorous standards set forth by regulatory authorities and satisfy consumer demands for product traceability.

The farm owners segment held the highest share of over 42% of the market in 2023. Farm owners and managers/operators represent a critical segment in the Global Cattle Management Software Market, as they are the primary users and beneficiaries of these sophisticated digital tools. Cattle management software caters to the diverse needs of farm owners and operators, providing them with an array of functionalities to enhance the efficiency and productivity of their operations. For farm owners, these software solutions offer a comprehensive overview of their livestock, enabling them to make informed decisions about resource allocation, breeding, and financial planning. Through real-time data and analytics, they can monitor the health and performance of individual animals, ensuring the well-being of their herds and optimizing their investments.

The managers/operators end-user segment is expected to expand at a fastest CAGR of 8.04% during the projected period. Farm managers and operators, on the other hand, rely on cattle management software for day-to-day farm management tasks. These solutions streamline processes related to livestock tracking, feeding schedules, and health monitoring. They empower farm staff to efficiently record and retrieve critical data, reducing manual record-keeping errors and administrative burdens. By providing easy access to accurate and up-to-date information, cattle management software enhances communication and collaboration among farm teams, ultimately improving the overall workflow and reducing operational costs.

The monitoring segment accounted for the largest share of 64% of the market. These software systems are instrumental in modernizing and enhancing the care of cattle herds, ensuring their health and well-being. Monitoring software enables farmers and ranchers to track individual animal data in real-time, providing critical insights into each animal's performance, behavior, and health status. By leveraging sensors and data analytics, these solutions facilitate early detection of health issues, allowing for timely interventions and reducing the risk of disease outbreaks within the herd.

The medication tracking segment generated the largest revenue share of 10.93% in 2023. Medication tracking software, on the other hand, plays a vital role in managing the health and treatment of cattle. It enables precise recording and management of medication schedules, ensuring that each animal receives the appropriate treatment. This not only enhances the health and longevity of the herd but also contributes to the production of safe and healthy meat and dairy products for consumers. Moreover, medication tracking software aids in regulatory compliance by maintaining comprehensive records of treatments, supporting transparency and traceability in the supply chain.

North America accounted for the largest share of 38% of the market in 2023. North America is a prominent region in the market, owing to its large-scale commercial farming operations. The region benefits from advanced technology adoption and a focus on precision agriculture, making cattle management software indispensable for optimizing production, ensuring herd health, and meeting stringent regulatory standards. The North American market is characterized by a robust ecosystem of software providers catering to diverse farm sizes and needs.

Asia Pacific is expected to expand at a fastest CAGR of 11.34% over the forecast period. Asia-Pacific, with its diverse agricultural landscape, presents both opportunities and challenges for the cattle management software market. In countries like India and China, where small-scale farming is predominant, the adoption of these solutions is on the rise as farmers recognize the benefits of improved productivity and data-driven decision-making. In contrast, developed agricultural economies in the region, such as Australia and New Zealand, prioritize precision farming, leading to the integration of advanced software systems in cattle management.

By Sector

By Software Type

By End-user

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Sector Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Cattle Management Software Market

5.1. COVID-19 Landscape: Cattle Management Software Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Cattle Management Software Market, By Sector

8.1. Cattle Management Software Market, by Sector, 2024-2033

8.1.1 Dairy

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Meat

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Cattle Management Software Market, By Software Type

9.1. Cattle Management Software Market, by Software Type, 2024-2033

9.1.1. Monitoring

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Trading/ Marketing

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Medication Tracking

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Cattle Management Software Market, By End-user

10.1. Cattle Management Software Market, by End-user, 2024-2033

10.1.1. Farm Owners

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Managers/ Operators

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Others (e.g., consultants)

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Cattle Management Software Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Sector (2021-2033)

11.1.2. Market Revenue and Forecast, by Software Type (2021-2033)

11.1.3. Market Revenue and Forecast, by End-user (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Sector (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Software Type (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End-user (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Sector (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Software Type (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End-user (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Sector (2021-2033)

11.2.2. Market Revenue and Forecast, by Software Type (2021-2033)

11.2.3. Market Revenue and Forecast, by End-user (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Sector (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Software Type (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End-user (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Sector (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Software Type (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End-user (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Sector (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Software Type (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End-user (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Sector (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Software Type (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End-user (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Sector (2021-2033)

11.3.2. Market Revenue and Forecast, by Software Type (2021-2033)

11.3.3. Market Revenue and Forecast, by End-user (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Sector (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Software Type (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End-user (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Sector (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Software Type (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End-user (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Sector (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Software Type (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End-user (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Sector (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Software Type (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End-user (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Sector (2021-2033)

11.4.2. Market Revenue and Forecast, by Software Type (2021-2033)

11.4.3. Market Revenue and Forecast, by End-user (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Sector (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Software Type (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End-user (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Sector (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Software Type (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End-user (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Sector (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Software Type (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End-user (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Sector (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Software Type (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End-user (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Sector (2021-2033)

11.5.2. Market Revenue and Forecast, by Software Type (2021-2033)

11.5.3. Market Revenue and Forecast, by End-user (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Sector (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Software Type (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End-user (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Sector (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Software Type (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End-user (2021-2033)

Chapter 12. Company Profiles

12.1. Merck & Co., Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Afimilk Ltd.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. GEA Group.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Aktiengesellschaft.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Livestock Improvement Corporation (LIC).

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Nedap Livestock Management

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Datamars SA.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Inpixon

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Breedr.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Performance Livestock Analytics

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others