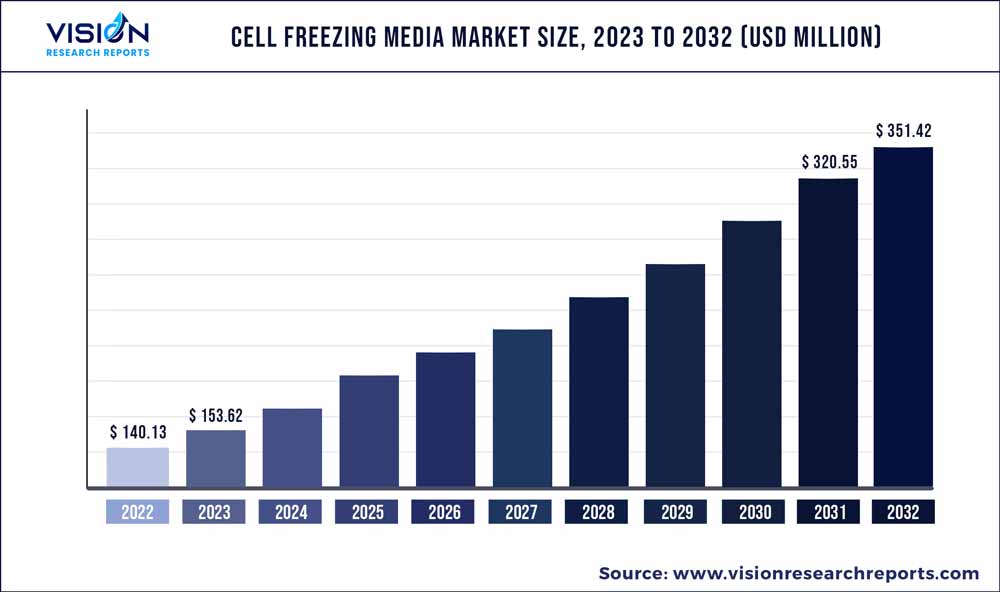

The global cell freezing media market size was estimated at around USD 140.13 million in 2022 and it is projected to hit around USD 351.42 million by 2032, growing at a CAGR of 9.63% from 2023 to 2032. The cell freezing media market in the United States was accounted for USD 46.6 million in 2022.

Key Pointers

Report Scope of the Cell Freezing Media Market

| Report Coverage | Details |

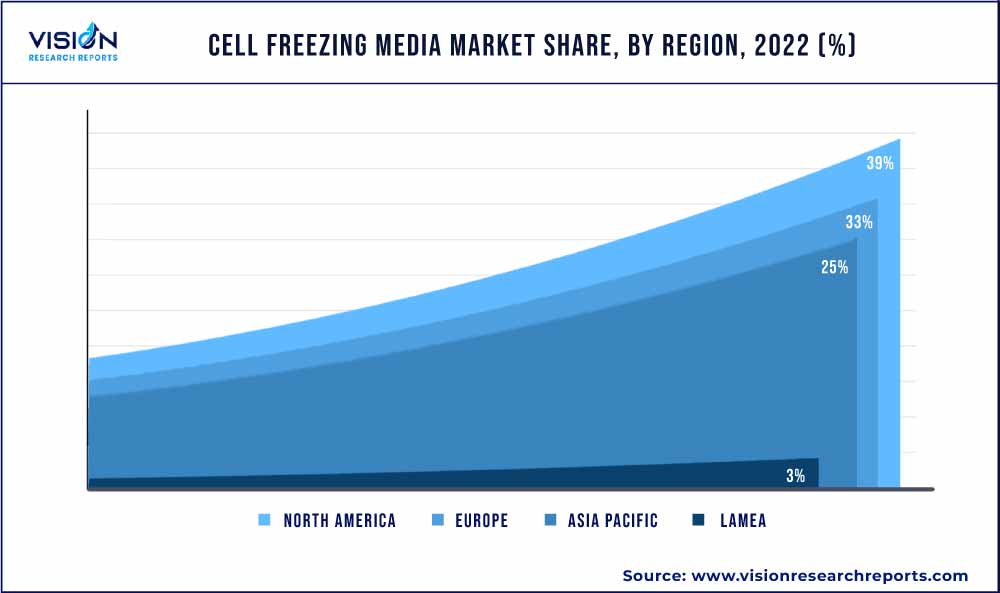

| Revenue Share of North America in 2022 | 39% |

| CAGR of Asia Pacific from 2023 to 2032 | 11.65% |

| Revenue Forecast by 2032 | USD 351.42 million |

| Growth Rate from 2023 to 2032 | CAGR of 9.63% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Thermo Fisher Scientific, Inc.; Merck KgaA; Sartorius AG; BioLife Solutions, Inc.; Bio-Techne, HiMedia Laboratories; PromoCell GmbH; Capricorn Scientific; Cell Applications, Inc.; STEMCELL Technologies.; AMSBIO; Cell Systems; BPS Bioscience, Inc. |

The growth of the market can be attributed to increasing adoption of cell freezing media as an alternative to in-house freezing preparations and the benefits from the ready to use cryo-preservative media over conventional freezing techniques. In addition, rising demand for effective freezing media across wide range of end-users and variety of new products launched from key market players is also anticipated to fuel the market growth.

The market observed a positive impact due to the COVID-19 pandemic. Cryopreservation was the need of hour for vaccine development as multiple stages of processing were involved including the transport between facilities. The need of faster turnaround time with effective solutions from research activities consequently allowed multiple research institutes and biopharmaceutical manufacturers to adopt the ready-to-use freezing media. Additionally, the research and development sector also witnessed increased investments in terms of collaboration, partnerships and expansion which also propels the market growth. For instance, in November 2021, Sartorius invested around USD 31.6 million (EUR 30 million) and launched a new 65,000-square-foot Cell Culture Technology Center in Ulm, Germany, to drive development of cell lines and optimize the company’s cell culture media portfolio.

The industry trend of adopting biopharmaceuticals for disease treatment has also played a major role in expanding the cell freezing media offerings. The flexibility, ready-to-use and cost effectiveness of these media over traditional freezing techniques has allowed their extensive adoption across the end-users. The conventional freezing techniques require handling of liquid nitrogen which involves high safety considerations. Besides this, the risk of cross-contamination, the high running cost and risk of asphyxiation due to displacing of atmospheric oxygen are some of the setbacks of nitrogen usage. Thus, the adoption of ready to use cells freezing media has increased over the past few years.

Moreover, advancements in cell freezing media formulation & cryopreservation techniques, and leveraging applications of cell freezing media in fields like tissue engineering, cellular therapy, stem cells research have driven the market at significant rate. Also, supportive government legislation for regenerative medicine and cell-based research is further projected to support the global market. For instance, in June 2021, researchers from Sydney have received funding from MRFF to pioneer stem cells research for treatment of patients with end stage heart failure.

Product Insights

The DMSO (dimethyl sulfoxide) segment accounted for the largest market share of 52% in 2022 and is even expected to witness the fastest growth during 2023-2032. This is due to the established gold standard from years of using DMSO in traditional cryopreservation for suspending the metabolic activities of cells. DMSO is the central player in cryobiology due its aprotic and solvation properties. It inhibits the ice crystal formation both intracellularly and extracellularly at sub-zero temperatures during slow freezing and thus, DMSO has observed widespread adoption as a cryoprotectant due to these antifreeze properties.

Moreover, it even provides protection from biological injuries during the process of cryopreservation. Consequently, multiple market competitors are therefore offering a range of DMSO based cell freezing media among other cell freezing media products. Various applications of DMSO based cell freezing media has also contributed to its largest market share. For example, Merck KGaA via its Sigma Aldrich brand offers multiple DMSO based cryopreservation media which are suitable to use for mammalian cancer cells lines and other cells lines.

Cryoprotective agents like glycerol are also used for cells freezing purpose. Key players are also aligning their cell freezing media products as per the market requirement of various concentrations of CPAs. This allows them to be research inclusive and increase the customer base to bolster the revenue generation. For instance, in March 2021, Thermo Fisher Scientific, Inc. launched a ‘Gibco Human Plasma-like Medium’ that has a metabolic profile similar to that of human plasma. This development has resulted in enhancing the company’s presence in cell culture media space.

Application Insights

The stem cell lines segment held the largest market share of 58% in 2022. The growing demand of biopharmaceuticals because of effective treatments like cell and gene therapy and upswing of innovation that resulted in a surge in approvals are the key contributing factors for the segment growth. It is estimated that the U.S. FDA would be approving around 10 to 20 products of cell and gene therapy each year by 2025 due to the current clinical success rates and the product pipeline. This has led the market players to ensure a successful supply network of all consumables considering the hike in demand in upcoming years. As a result, employing cell freezing media for continuous processing of these therapy products will also result in the fastest market penetration within the projected period.

The increasing prevalence of life-threatening diseases and the search for advanced therapies have resulted in intensive research in other areas such as cancer. Cell freezing media has also observed a significant market penetration for cancer cell lines and will grow steadily in the forthcoming years due to continued research activities for better healthcare.

End-use Insights

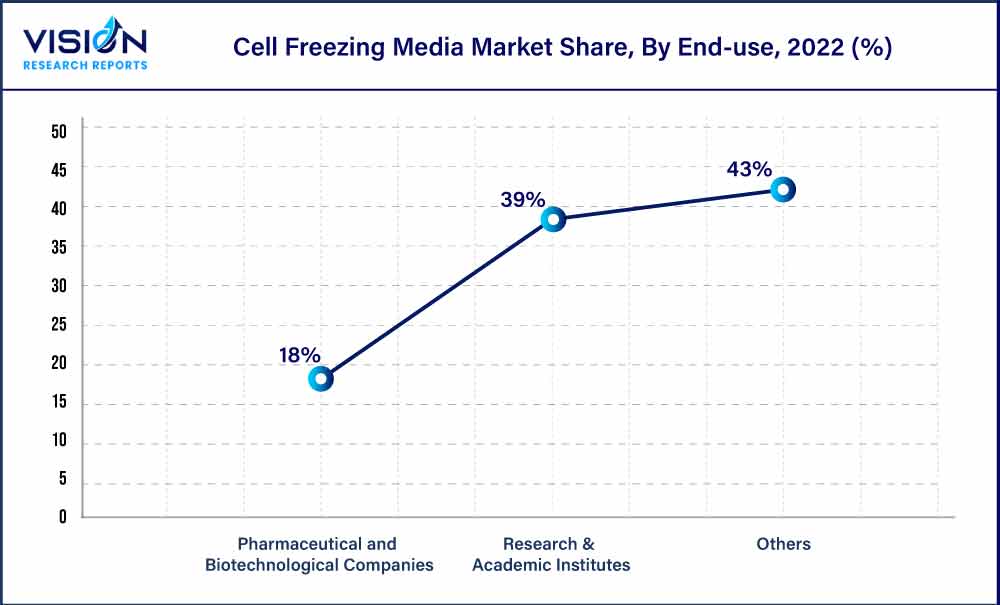

The pharmaceutical and biotechnological companies segment captured the largest market share of 43% in 2022. The continuous growth and commercial success of biopharmaceuticals coupled with the expanding portfolio of the major pharmaceutical companies has been attributed to the segment growth. The optimum protection and preservation by the cell preservation medium along with the cost effectiveness relative to traditional freezing technique has driven its adoption. The unceasing use of these consumables during research stage, clinical and even commercial stages is anticipated to contribute to market growth.

The research and academic institutes segment is expected to be fastest growing segment with a CAGR of 9.93% during 2023 - 2032. This rapid growth can be attributed to the increase in research and development activities in the forecast period. The COVID-19 pandemic has created awareness among the industry professionals along with the need of continuous research and development of existing technologies. The expected growth is also due to huge investment in terms of partnerships and collaboration with research institutes. For instance, NIBRT (National Institute of Bioprocessing Research and Training) announced in May 2022, a collaboration with Kerry Group and ValitaCell to enhance the understanding and validation of cell culture media products for the Kerry Group. ValitaCell will be providing its Chemstress platform for mimicking the biological environment in microscale. This project received funding from Enterprise Ireland to support innovation.

Regional Insights

North America dominated the cell freezing media market with a share of 39% in 2022. The market is collectively driven by the presence of advanced healthcare infrastructure, developed economies, presence of key players and established supply channels. Additionally, the prevalence of diseases and growing geriatric population has led to the race of developing advanced and efficacious therapies via biopharmaceutical industry. This has driven the demand for cell freezing media and is expected to continue revenue generation in the years to come.

Asia Pacific is expected to witness the fastest growth with a CAGR of 11.65% during 2023-2032. The Asia Pacific is a region with a supportive government, driven on low labor and operating cost and is a major hub for biologics manufacturing especially monoclonal antibodies (MAbs). The development of MAbs usually employs extensive use of mammalian cell cultures which are continuously processed and require cryopreservation.

Cell Freezing Media Market Segmentations:

By Product

By Application

By End-use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Cell Freezing Media Market

5.1. COVID-19 Landscape: Cell Freezing Media Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Cell Freezing Media Market, By Product

8.1. Cell Freezing Media Market, by Product, 2023-2032

8.1.1 DMSO

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Glycerol

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Others

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Cell Freezing Media Market, By Application

9.1. Cell Freezing Media Market, by Application, 2023-2032

9.1.1. Stem Cell lines

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Cancer Cell Lines

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Cell Freezing Media Market, By End-use

10.1. Cell Freezing Media Market, by End-use, 2023-2032

10.1.1. Pharmaceutical and Biotechnological Companies

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Research & Academic Institutes

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Cell Freezing Media Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.3. Market Revenue and Forecast, by End-use (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.6.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.7.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.6.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.7.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.6.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.7.3. Market Revenue and Forecast, by End-use (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.5.3. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 12. Company Profiles

12.1. Thermo Fisher Scientific, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Merck KgaA.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Sartorius AG

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. BioLife Solutions, Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Bio-Techne, HiMedia Laboratories

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. PromoCell GmbH

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Capricorn Scientific

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Cell Applications, Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. STEMCELL Technologies.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. AMSBIO

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others