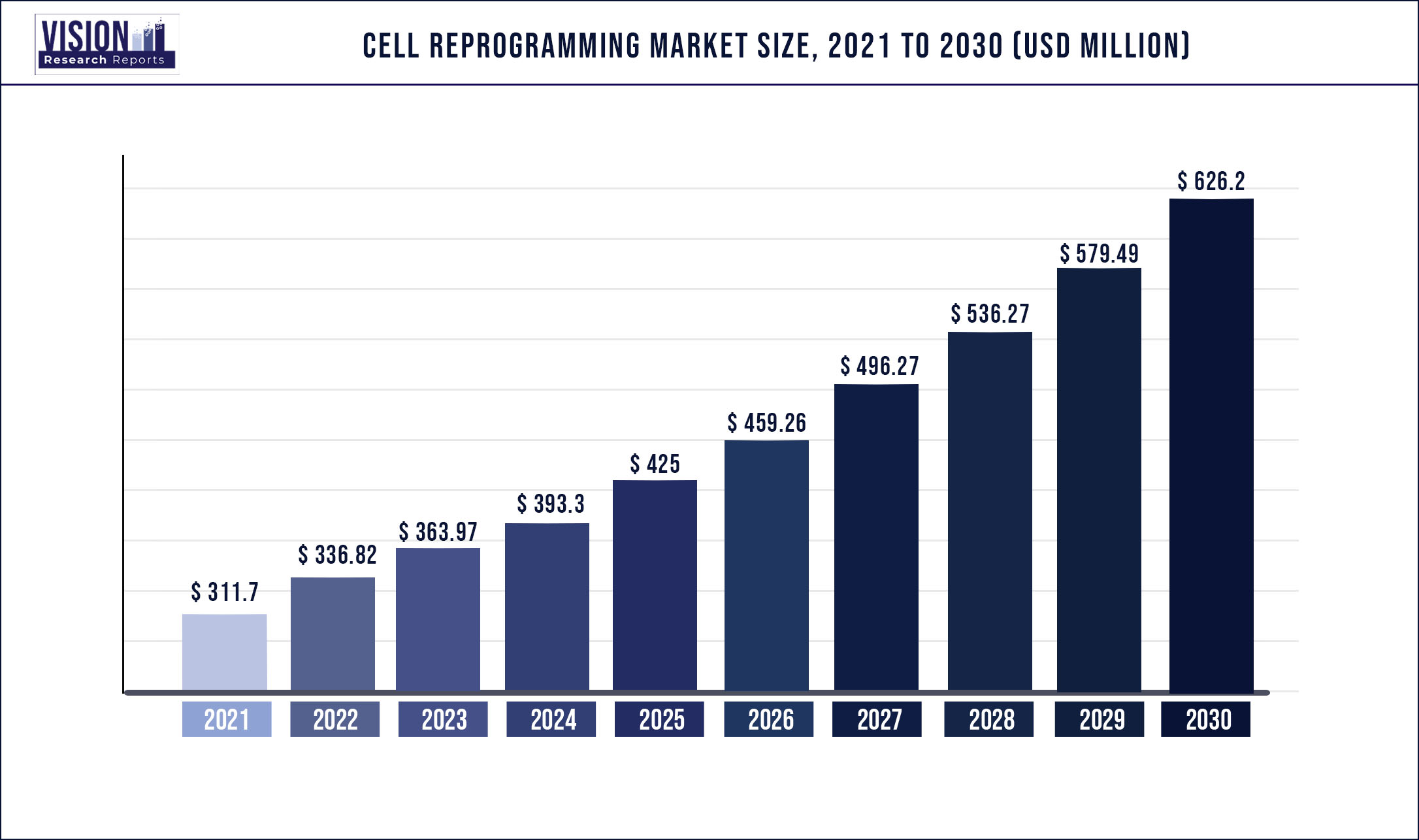

The global cell reprogramming market was valued at USD 311.7 million in 2021 and it is predicted to surpass around USD 626.2 million by 2030 with a CAGR of 8.06% from 2022 to 2030

Report Highlights

Cell reprogramming is known for its capacity to replace damaged cells or tissues, thereby reversing the negative physiological effects it causes. The industry is driven by the growing interest among researchers in the field for the reason that it makes it possible to see and evaluate molecular biological mechanisms like differentiation, epigenetics, and chromatin in ways that were formerly impossibly complex. Furthermore, cellular reprogramming also has a substantial impact on diagnosing and addressing human diseases. Moreover, reprogramming technology is being created & improved; there have also been substantial ongoing advancements in related technologies like gene editing, creation of progenitor cells, & tissue engineering.

The pharmaceutical industry is projected to use the iPSC approach widely to generate effective cell sources, such as iPSC-derived functional cells, to enable drug screening and toxicity assessment. Thus, the growing use of iPSC across the world would propel the demand for cell reprogramming resulting in industry growth. The increase in clinical trials and the wide usage of stem cell therapies around the world are fueling the industry's expansion. Various academic institutions, biotech & pharmaceutical companies, and government agencies from different nations are focusing on efficient and quick methods for the detection of COVID-19. Mesenchymal stem cells are a safe and efficient method for treating COVID-19, according to a 2020 research article that was published in the academic journal Aging and Disease (2020).

In addition, the lack of efficient treatment for COVID-19 has sparked the attention of the healthcare industry on cell reprogramming technology. As a result, the usage of cell reprogramming technologies is projected to increase during the COVID-19 pandemic. Despite the fact that mesenchymal cells and iPSCs are used in cell reprogramming, there are still several challenges that prevent the market from expanding. The main causes for concern are people’s lack of knowledge about the available treatments and their dread of the unknown therapy. On the other hand, the industry is positioned for growth as a result of the widening pipeline of stem cell therapies, growing interest in customized treatments, and rising healthcare spending. Moreover, the lenient rules that govern stem cell reprogramming in India may play a significant role in luring more businesses to invest in, develop, and market innovative technologies, fueling the continued expansion.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 311.7 million |

| Revenue Forecast by 2030 | USD 626.2 million |

| Growth rate from 2022 to 2030 | CAGR of 8.06% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Technology, application, end-use, region |

| Companies Covered | Allele Biotechnology; Alstem; Applied Biological Materials; Axol Bioscience; Creative Bioarray; DefiniGEN; Fujifilm Cellular Dynamics; Lonza; Mogrify; Reprocell; Stemnovate; Thermo Fisher Scientific |

Technology Insights

The mRNA technology segment accounted for the highest share of more than 36.21% of the overall revenue in 2021. This technology is easy to use and offers a quick, secure, & effective way to create human iPS cells of the highest quality from somatic tissue. It also provides a reprogramming efficiency of better than 1% and an advantage when working with difficult-to-reprogram samples. For instance, according to an article published in February 2021, synthetic mRNA cell reprogramming is an accurate and reliable method to generate human iPSCs. Sendai virus-based reprogramming is also anticipated to expand at a significant growth rate during the projected period.

As it generates cell reprogramming at a steady rate and has technological superiorities over other techniques, it has a high adoption rate among patients and is widely used in clinical studies of gene therapy and vaccine delivery. For instance, in May 2018, a Sendai virus reprogrammed system was developed by the International Society of Cell and Gene Therapy for use in clinical and translational studies. In addition, techniques were developed using the Sendai antibody for the detection and removal of undesirable cells, as well as qPCR-based SeV quantification to ensure that the clones produced were footprint-free. Furthermore, increased chronic disease incidences continued technological advancements in reprogramming technology, and rising awareness in emerging nations are primary growth drivers.

Application Insights

On the basis of applications, the global industry has been further bifurcated into research and therapeutic. The research application segment dominated the industry in 2021 and accounted for the highest share of more than 80.4% of the overall revenue. One of the main drivers fueling segment growth is an ongoing research area in the field of cell reprogramming with the help of stem cells. Governments as well as other private groups are funding considerable stem cell research studies, which is pushing the industry participants to carve their niches in the global sector by treating a range of chronic conditions.

For instance, 64% of Americans support federal financing for chronic disease research using stem cells from human embryos. Thus, research efforts are anticipated to supplement the segment growth. Cell reprogramming has already opened up incredible possibilities for therapeutics, such as new drug treatments that inhibit degenerative changes or encourage stem or progenitor cells to distinguish the difference in the affected lineage in a particular condition, which are both possible as a result of reprogramming studies. Some degenerative disorders might also be treatable with cell transplantation. The speed and breadth of these developments are promoting segment growth.

End-use Insights

On the basis of end-uses, the global industry has been further categorized into research & academic institutes, biotechnology & pharmaceutical companies, and hospitals & clinics. The research & academic institutes segment dominated the global industry in 2021 and accounted for the highest share of more than 36.21% of the overall revenue. Cell reprogramming has recently been transferred from the lab to the clinic by researchers. In numerous clinical and academic research projects, including those involving regenerative medicine, disease modeling, and medication toxicity/drug discovery studies, cell reprogramming has been used.

Furthermore, the clinical application of this technology is greatly facilitated by the use of cell reprogramming in regenerative medicine. This is linked to the growing research efforts examining the effectiveness and safety of cell reprogramming, which have helped the category flourish. The segment is also expected to be driven by an increase in the number of strategic efforts for research and method for innovative products from cell reprogramming. For instance, The California Institute for Regenerative Medicine has encouraged various research groups to contribute funds for cellular reprogramming’s transition to therapeutic applications and a clinical focus.

Regional Insights

North America dominated the industry in 2021 and accounted for the largest share of 35.3% of the total revenue. The high share can be attributed to the ongoing iPSC technology advancements and the availability of functional cells for pre-clinical drug testing. High throughput drug toxicity analysis and expanding knowledge of the iPSC platform both contribute to the region’s expansion. In the U.S., activities in medical research have increased as a result of the growing need for innovative treatment options. One of the main areas of attention is stem cell research, hence the requirement for cell reprogramming has been favored by this expanded study.

For instance, in April 2022, to help the iPSC reprogramming industry expansion, Ncardia announced the opening of a new company named Cellistic. Its emphasis and proficiency in differentiation, iPSC reprogramming, and other areas aid in market growth. Asia Pacific is estimated to be the fastest-growing region due to the improvements in production & the efficiency of the therapy landscape. The COVID-19 pandemic has further fueled the market growth in Asia Pacific on account of the large patient population base and there are currently no effective treatments for the infection, particularly in severe cases.

Genomic variants are the main cause of a wide variety of variability in the clinical symptoms of patients. Consequently, it is acknowledged that individualized care can effectively address these symptoms. As a result, the region is growing due to the increased adoption of cell reprogramming technologies. In addition, the expansion of medical development frameworks and better healthcare systems in developing nations like Australia and India has set the Asia Pacific region up to see lucrative growth over the period.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Cell Reprogramming Market

5.1. COVID-19 Landscape: Cell Reprogramming Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Cell Reprogramming Market, By Technology

8.1. Cell Reprogramming Market, by Technology, 2022-2030

8.1.1 Sendai virus-based Reprogramming

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. mRNA Reprogramming

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Episomal Reprogramming

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Cell Reprogramming Market, By Application

9.1. Cell Reprogramming Market, by Application, 2022-2030

9.1.1. Research

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Therapeutic

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Cell Reprogramming Market, By End-use

10.1. Cell Reprogramming Market, by End-use, 2022-2030

10.1.1. Research & Academic Institutes

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Biotechnology & Pharmaceutical Companies

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Hospitals & Clinics

10.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Cell Reprogramming Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Technology (2017-2030)

11.1.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.3. Market Revenue and Forecast, by End-use (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Technology (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Technology (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Technology (2017-2030)

11.2.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Technology (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Technology (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Technology (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Technology (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Technology (2017-2030)

11.3.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Technology (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Technology (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Technology (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Technology (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Technology (2017-2030)

11.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Technology (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Technology (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Technology (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Technology (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Technology (2017-2030)

11.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Technology (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Technology (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.5.3. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 12. Company Profiles

12.1. Allele Biotechnology

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. ALSTEM

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Applied Biological Materials

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Axol Bioscience

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Creative Bioarray

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. DefiniGEN

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Fujifilm Cellular Dynamics

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Lonza

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Mogrify

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. REPROCELL

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others