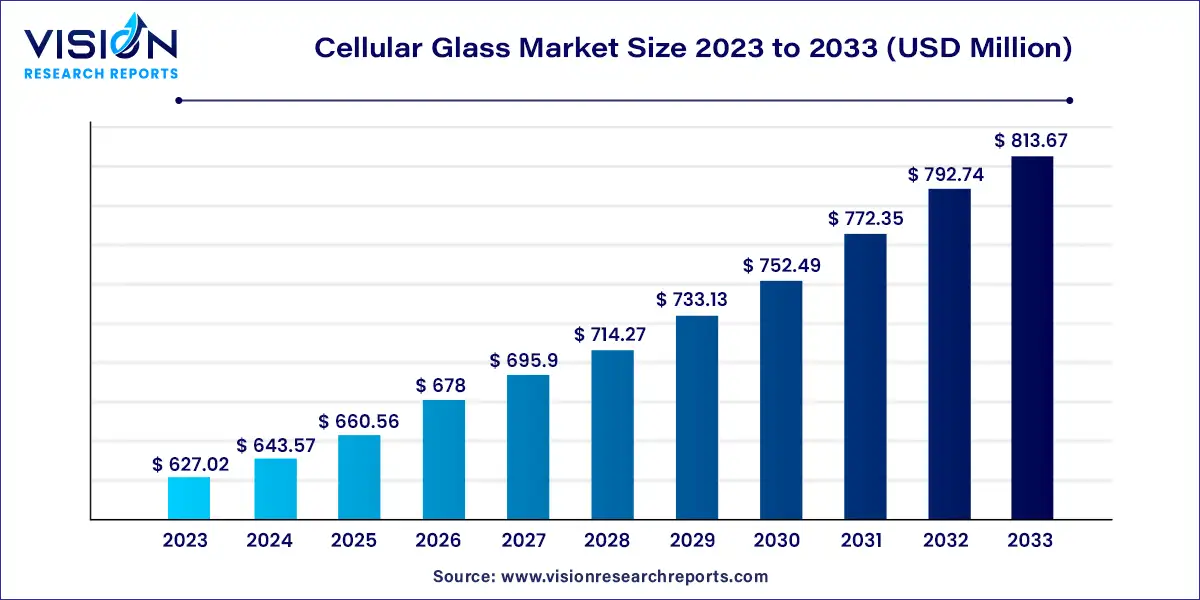

The global cellular glass market was estimated at USD 627.02 million in 2023 and it is expected to surpass around USD 813.67 million by 2033, poised to grow at a CAGR of 2.64% from 2024 to 2033.

The cellular glass market encompasses a thriving segment within the construction materials industry, characterized by the widespread use of foam glass products renowned for their exceptional thermal insulation properties and durability. This market has experienced robust growth, driven by factors such as the increasing emphasis on energy efficiency, stringent building regulations, and rising demand for sustainable construction materials.

Cellular glass, also known as foam glass, features a closed-cell structure composed of glass, rendering it resistant to moisture, chemicals, and fire. Its unique properties make it suitable for diverse applications across industries, including construction, industrial, and automotive sectors.

The growth of the cellular glass market is driven by several key factors contributing to its expansion. Firstly, increasing awareness about energy efficiency and sustainability in construction projects has propelled the demand for high-performance insulation materials like cellular glass. As governments worldwide implement stricter building codes and regulations aimed at reducing energy consumption and carbon emissions, the adoption of cellular glass as an effective thermal insulation solution continues to rise. Additionally, the growing emphasis on infrastructure development, particularly in emerging economies, fuels the demand for construction materials, including cellular glass, for use in residential, commercial, and industrial projects. Furthermore, technological advancements in manufacturing processes have led to the production of cellular glass with enhanced properties, such as improved thermal performance and greater durability, further driving market growth. Moreover, the versatility of cellular glass, with its resistance to moisture, chemicals, and fire, makes it suitable for a wide range of applications beyond construction, including industrial and automotive sectors, contributing to its increasing market penetration.

The blocks and shells segment dominated the market with the highest revenue share of 68% in 2023. These components are widely utilized for insulating walls, roofs, and floors due to their excellent resistance to fire and moisture. Cellular glass is favored for its dependable fire insulation properties, making it a preferred choice for diverse construction projects worldwide.

Sheets and panels are frequently employed for thermal insulation in various industrial settings. Meanwhile, foam glass gravel finds utility across a broad spectrum of applications including construction, civil engineering projects, and landscaping. It serves as a foundational aggregate for solid floors construction and provides insulation for baseplates. Both of these product types boast environmental sustainability, resilience, and are crafted entirely from recycled glass materials.

The global industry is segmented based on applications into construction, industrial, chemical, and others. In 2023, the construction segment dominated, holding over 48% of the global market revenue. Cellular glass is extensively utilized as an insulating material in residential, commercial, and industrial buildings, providing crucial fire safety measures.

The industrial segment is anticipated to witness significant revenue growth during the forecast period. There's a rising trend of its usage in industries such as oil & gas, chemical, and petrochemical for insulation purposes. Consequently, increased investments in these sectors are expected to drive positive growth for the overall market.

The North American cellular glass market stands as a pivotal player, commanding approximately 24% of the global share. This significant market presence is fueled by escalating construction projects and the expansion of the industrial and chemical sectors in the United States and Canada.

Meanwhile, the Asia Pacific cellular glass market held a share of approximately 31% in 2023. This growth is credited to the implementation of diverse government economic stimulus initiatives throughout the region.

By Product

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Cellular Glass Market

5.1. COVID-19 Landscape: Cellular Glass Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Cellular Glass Market, By Product

8.1. Cellular Glass Market, by Product, 2024-2033

8.1.1. Blocks & Shells

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Sheets & Panels

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Foam Glass Gravels

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Cellular Glass Market, By Application

9.1. Cellular Glass Market, by Application, 2024-2033

9.1.1. Construction

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Industrial

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Chemical

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Cellular Glass Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. Anhui Huichang New Material Co., Ltd.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Earthstone International LLC

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Geocell Schaumglas GmbH

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Glapor Werk Mitterteich GmbH

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Misapor AG

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Owens Corning

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Polydros, S.A.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. REFAGLASS S.R.O.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Stes-Vladimir

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Uusioaines OY

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others