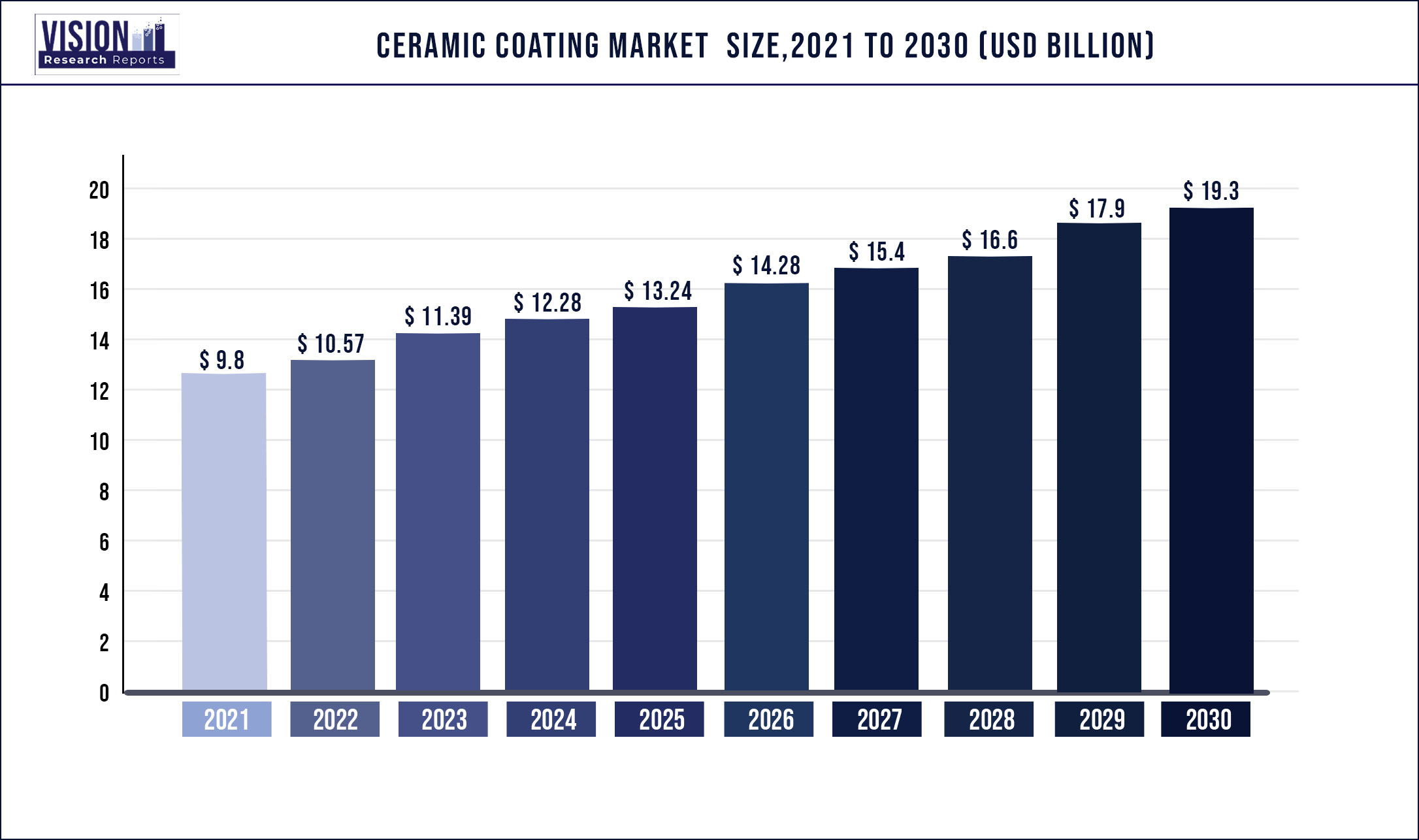

The global ceramic coating market was valued at USD 9.8 billion in 2021 and it is predicted to surpass around USD 19.3 billion by 2030 with a CAGR of 7.82% from 2022 to 2030.

This is due to the increasing utilization of automobile engine components and the aerospace & defense industry, which is projected to propel the market growth during the forecast period. Furthermore, ceramic coatings are being extensively used in the automobile and transportation industry, owing to their anti-corrosion properties and offering resistance to abrasion and heat. Ceramic coatings are also used for providing a finished polish look on the exterior body of cars slowly replacing wax.

With growing research and development activities, ceramic coatings are venturing into wider application segments. Currently, automobiles and transportation are expected to be the largest application for ceramic coatings. However, with further product innovations, ceramic coating is likely to have a larger application share than its counterparts, such as PTFE or regular coatings. For instance, in 2021, IGL Coatings launched graphene reinforced product Eco coat Kenzo. Eco coat Kenzo revolutionized the ceramic coatings industry by developing a zero-VOC, high-solids recipe. Its unique high solids recipe distinguishes it, resulting in global demand for the smooth and bright ceramic coating.

The COVID-19 pandemic significantly impacted the ceramic coatings industry. Demand for all categories dropped drastically in 2020 due to manufacturing disruptions in key end-use industries. As the ceramic coating industry does not fall under essential services, it experienced a negative impact on the year-on-year growth rate due to reduced demand from key sectors such as automotive, aerospace, steel, electronics, and others.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 9.8 billion |

| Revenue Forecast by 2030 | USD 19.3 billion |

| Growth rate from 2022 to 2030 | CAGR of 7.82% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product, technology, application, region |

| Companies Covered | Bodycote, Praxair Surface Technologies, Inc., Aremco Products, Inc., APS Materials, Inc., Cetek Cermaic Technologies Ltd., Keronite Group Ltd., Saint-Gobain S.A., Element 119, NanoShine Ltd., Ultramet, Inc. |

Product Insights

The oxide segment accounted for 57.2% of the global revenue share in 2021. Oxides are cheaper in comparison to other coatings such as carbide and nitride. This type of coating is used in the steel industry, where it is applied to refractory bricks, chimneys, guide bars, pumps, and bearings. Oxide & carbide coats are also heavily consumed in the oil & gas industries, where it is utilized in mud rotors, pump sleeves, MWD equipment, and valve components. Applying coatings on service components in this industry helps oil & gas exploring companies reduce exploration costs and increase production.

The carbide segment is expected to expand at a CAGR of 7.7% during the forecast period. Carbide coatings are expensive due to the high raw material and process costs. Carbide coatings are gradually venturing into the sports industry, where it is used on applications such as horse hooves, golf clubs, and bicycles. In October 2020, XPEL, Inc. revealed product line expansion for its FUSION PLUS automotive ceramic coating. The automotive ceramic coating line-up now includes unique materials created to protect brake calipers, glass, and wheels, along with trim surfaces, plastic, and upholstery.

Technology Insights

Thermal spray is the most popular means of deploying ceramic coatings on the surface. Thermal spray accounted for around 74% of the revenue share in the global market. This mode of application is the most popular choice among ceramic coating producers as it can be used for almost every material composition and has high density. In April 2020, Bodycote completed the acquisition of Ellison Surface Technologies. This acquisition led to the creation of the largest engineered coating surface technology and thermal spray services in the world. Physical Vapor Deposition or PVD is also likely to demonstrate significant growth in this segment. The primary factor associated with the increase in consumption is its cheaper cost.

Furthermore, along with the cost, this method is also more energy-efficient than the rest. However, PVD has some limitations, as the velocity of spraying of this method is low. Coatings applied through PVD have less resistance to high temperatures and surface pressures. Therefore, making them unsuitable for heavy industries and aerospace applications.

Application Insights

Ceramic coating is finding broad applications in transportation & automotive, energy, aerospace & defense, industrial goods, and healthcare. Global consumption was majorly derived from industrial goods. The Environmental Protection Agency (EPA) reported a rise in spending on anti-corrosion as well as efficiency enhancer coatings, which will further aggravate the demand. Ceramic coatings are also sprayed on industrial goods, such as refractory bricks, chimneys, and iron rods. Its properties of abrasion resistance and heat resistance, along with its added protective layer, will make it widely in demand in the steel and power generation industries in the near future.

Ceramic coatings in recent years are finding application scope in surgical instruments, where it is used to harden the tool. This is the final and essential form of a coating in prosthetic hips as it proportionately decreases the wear rates in prosthetic hips. In the U.S. alone, around 330,000 hip replacement surgery takes place each year. These coatings increase the efficiency of the gas turbine engines, which invariantly combats high operating temperatures. Ceramic coatings enable aircraft engines to operate at elevated temperatures, thus enhancing performance. Product demand is expected to witness an exponential increase owing to its extensive utilization in the aerospace and defense industry.

Regional Insights

Asia Pacific dominated the market with more than 40% of the global consumption in 2021, owing to the low cost in the region. Lower costs are mainly associated with inferior grade products and not lower operational costs. The local demand can be characterized by humongous consumption from developing countries, such as China, India, and Japan. In April 2021, Oerlikon Balzers opened its first customer center in Vietnam, expanding its coating operations in Asia. The company has made strategic investments to increase its footprint in the booming Asian market.

Increasing engineering component production in the region will probably trigger the regional demand during the forecast period. Most of the regional need comes from China, which is also a leading ceramic coating manufacturer. Japan accounts for around 25% of the regional consumption and is expected to maintain its dominance during the forecast period as well.

Europe and North America together are responsible for around half of the global needs. Well-established automobile and aerospace industries have helped the regions to achieve this level of ceramic coating consumption. The automotive and healthcare products sectors are expected to drive future market growth.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Ceramic Coating Market

5.1. COVID-19 Landscape: Ceramic Coating Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Ceramic Coating Market, By Product

8.1. Ceramic Coating Market, by Product, 2022-2030

8.1.1 Oxide

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Carbide

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Nitride

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Ceramic Coating Market, By Technology

9.1. Ceramic Coating Market, by Technology, 2022-2030

9.1.1. Thermal Spray

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Physical Vapor Deposition

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Chemical Vapor Deposition

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Ceramic Coating Market, By Application

10.1. Ceramic Coating Market, by Application, 2022-2030

10.1.1. Transportation & Automotive

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Energy

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Aerospace & Defense

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Industrial Goods

10.1.4.1. Market Revenue and Forecast (2017-2030)

10.1.5. Healthcare

10.1.5.1. Market Revenue and Forecast (2017-2030)

10.1.6. Others

10.1.6.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Ceramic Coating Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.2. Market Revenue and Forecast, by Technology (2017-2030)

11.1.3. Market Revenue and Forecast, by Application (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Technology (2017-2030)

11.1.4.3. Market Revenue and Forecast, by Application (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Technology (2017-2030)

11.1.5.3. Market Revenue and Forecast, by Application (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.2. Market Revenue and Forecast, by Technology (2017-2030)

11.2.3. Market Revenue and Forecast, by Application (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Technology (2017-2030)

11.2.4.3. Market Revenue and Forecast, by Application (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Technology (2017-2030)

11.2.5.3. Market Revenue and Forecast, by Application (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Technology (2017-2030)

11.2.6.3. Market Revenue and Forecast, by Application (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Technology (2017-2030)

11.2.7.3. Market Revenue and Forecast, by Application (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.2. Market Revenue and Forecast, by Technology (2017-2030)

11.3.3. Market Revenue and Forecast, by Application (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Technology (2017-2030)

11.3.4.3. Market Revenue and Forecast, by Application (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Technology (2017-2030)

11.3.5.3. Market Revenue and Forecast, by Application (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Technology (2017-2030)

11.3.6.3. Market Revenue and Forecast, by Application (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Technology (2017-2030)

11.3.7.3. Market Revenue and Forecast, by Application (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.2. Market Revenue and Forecast, by Technology (2017-2030)

11.4.3. Market Revenue and Forecast, by Application (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Technology (2017-2030)

11.4.4.3. Market Revenue and Forecast, by Application (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Technology (2017-2030)

11.4.5.3. Market Revenue and Forecast, by Application (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Technology (2017-2030)

11.4.6.3. Market Revenue and Forecast, by Application (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Technology (2017-2030)

11.4.7.3. Market Revenue and Forecast, by Application (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.2. Market Revenue and Forecast, by Technology (2017-2030)

11.5.3. Market Revenue and Forecast, by Application (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Technology (2017-2030)

11.5.4.3. Market Revenue and Forecast, by Application (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Technology (2017-2030)

11.5.5.3. Market Revenue and Forecast, by Application (2017-2030)

Chapter 12. Company Profiles

12.1. Bodycote

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Praxair Surface Technologies, Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Aremco Products, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. APS Materials, Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Cetek Cermaic Technologies Ltd.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Keronite Group Ltd.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Saint-Gobain S.A.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Element 119

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. NanoShine Ltd.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Ultramet, Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others