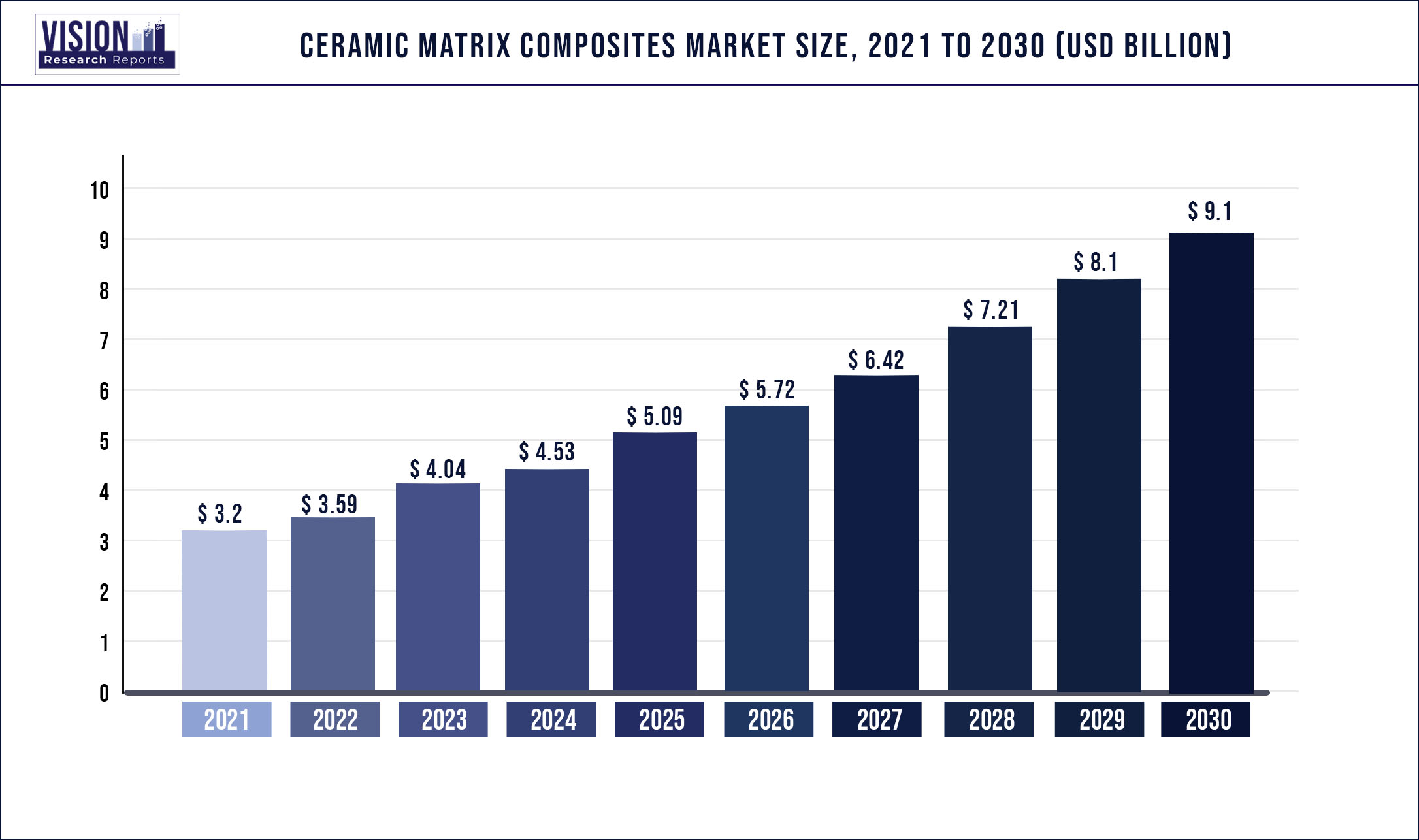

The global ceramic matrix composites market was surpassed at USD 3.2 billion in 2021 and is expected to hit around USD 9.1 billion by 2030, growing at a CAGR of 12.31% from 2022 to 2030.

Increasing demand for ceramic matrix composites is being driven by their superior properties, such as high-temperature stability, reduced weight, and high strength.

Ceramic matrix composites have evoked keen interest from the aerospace and automotive sectors, owing to their superior mechanical properties, high strength-to-weight ratio, and vast application scope. Increasing fuel prices have triggered the need for lightweight components to boost fuel efficiency. The majority of automobiles today run on conventional fuel, so fuel-efficient products are in high demand. However, applications for CMCs are restricted due to their high prices. CMCs are mainly used in aerospace, automotive, and electronic or thermal management applications. CMC users come from industries such as Boeing, Airbus S.A.S., NASA, GE Global Research, etc.

Market players focus on expanding their product portfolio and implementing faster product delivery strategies to gain a competitive advantage in various regional markets. The industry's rivalry is expected to be moderate with major players adopting strategies such as new product developments, acquisitions, partnerships, and joint ventures.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 3.2 billion |

| Revenue Forecast by 2030 | USD 9.1 billion |

| Growth rate from 2022 to 2030 | CAGR of 12.31% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product, application, region |

| Companies Covered | 3M Company; COI Ceramics, Inc.; Coorstek, Inc.; General Electric Company; Kyocera Corporation; Lancer Systems LP; SGL Carbon Company; Inc.; Ultramet, Inc.; Ube Industries, Ltd. |

Product Insights

The oxides product segment led the market and accounted for more than 29.97% share of the global revenue in 2021. Improved properties of oxide composites such as no oxidation and high fracturing toughness, and a less expensive production process, are expected to trigger the demand for aerospace, defense, and energy & power applications.

Sic segment is projected to register a CAGR of 12.8% in terms of value during the forecast period. The higher initial cost of SiC ceramic matrix composites is the most prominent growth barrier for the segment. Other costs indulged during usage and transportation, such as cleaning costs and repositioning costs, also restrain the demand growth.

Carbon products held a significant revenue share in 2021 due to the large-scale production of carbon fibers to fulfill the increased demand for CF and CFRP products globally. The costs of carbon/carbon ceramic matrix composites are significantly cheaper than silicon carbide/silicon carbide and oxide/oxide ceramic matrix composites.

The other segment is anticipated to expand at a CAGR of 12.2% during the forecast period, owing to advantages such as lightweight, excellent wear and corrosion resistance, high strength to weight ratio, high strength retention at elevated temperatures, and high chemical stability, and hardness.

Application Insights

The aerospace application segment led the market and accounted for more than 36.19% of the global revenue share in 2021. Factors such as the rising preference of consumers for manufacturing nose, rudder, fins, leading edges, body flaps, hot structure, tiles, and panels for aircraft are anticipated to expand the demand in the aerospace segment during the forecast period.

Their excellent impact strength coupled with high hardness makes these composites suitable for manufacturing bullet-proof armor and insulation in small arms weapons platforms. Ceramic materials are mostly transparent to certain types of energy, and light. As a result, they are widely used for infrared domes, sensor protection, and multi-spectral windows.

Energy and power are expected to emerge as the fastest-growing application segment for CMC materials. CMC properties such as high-temperature stability coupled with greater oxidation resistance and ability to withstand radiation make it suitable for fission and fusion applications.

Ceramic matrix composites are widely used as isolators in the electronics industry. They are also used in electronic circuits due to their high thermal conductivity. Other applications include ceramics for laser diodes, LED, artificial teeth, fuel cells, etc., which are also expected to drive the market.

Regional Insights

North America region led the market and accounted for over 44.9% share of global revenue in 2021. The presence of major aviation industries, their investment in developing ceramic matrix components for manufacturing aviation components, and collaborations with government agencies for upgrading defense equipment are some of the essential factors anticipated to propel the CMC demand in North America.

Over consumption of oil in the Asia Pacific has stimulated the need for energy security with a focus on deriving energy from alternate sources, which include natural gas. Ceramic matrix composites are thus likely to play a major role in this segment. In addition, the growing need for fuel-efficient aircraft engines is also going to boost the market to reduce operational costs.

Central and South America are expected to gain from technological advancements in the aerospace industry, resulting in the establishment of the region as one of the important manufacturing hubs for the U.S. aviation industry. The increase in demand from aerospace, automotive, electrical & electronics, and energy & power industries is going to propel the market.

Lower production costs in Africa have attracted huge foreign investments in the region, which will have a positive impact on the market. In addition, technological developments are also expected to aid aerospace production in the region, which is, in turn, expected to drive the market in the region.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Ceramic Matrix Composites Market

5.1. COVID-19 Landscape: Ceramic Matrix Composites Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Ceramic Matrix Composites Market, By Product

8.1. Ceramic Matrix Composites Market, by Product, 2022-2030

8.1.1. Oxides

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Silicon Carbide

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Carbon

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Ceramic Matrix Composites Market, By Application

9.1. Ceramic Matrix Composites Market, by Application, 2022-2030

9.1.1. Aerospace

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Defense

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Energy & Power

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Electrical & Electronics

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Ceramic Matrix Composites Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.2. Market Revenue and Forecast, by Application (2017-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

Chapter 11. Company Profiles

11.1. 3M Company

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. COI Ceramics, Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Coorstek, Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. General Electric Company

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. Recent Initiatives

11.5. Kyocera Corporation

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Lancer Systems LP

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. SGL Carbon Company

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Ultramet, Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Ube Industries, Ltd.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others