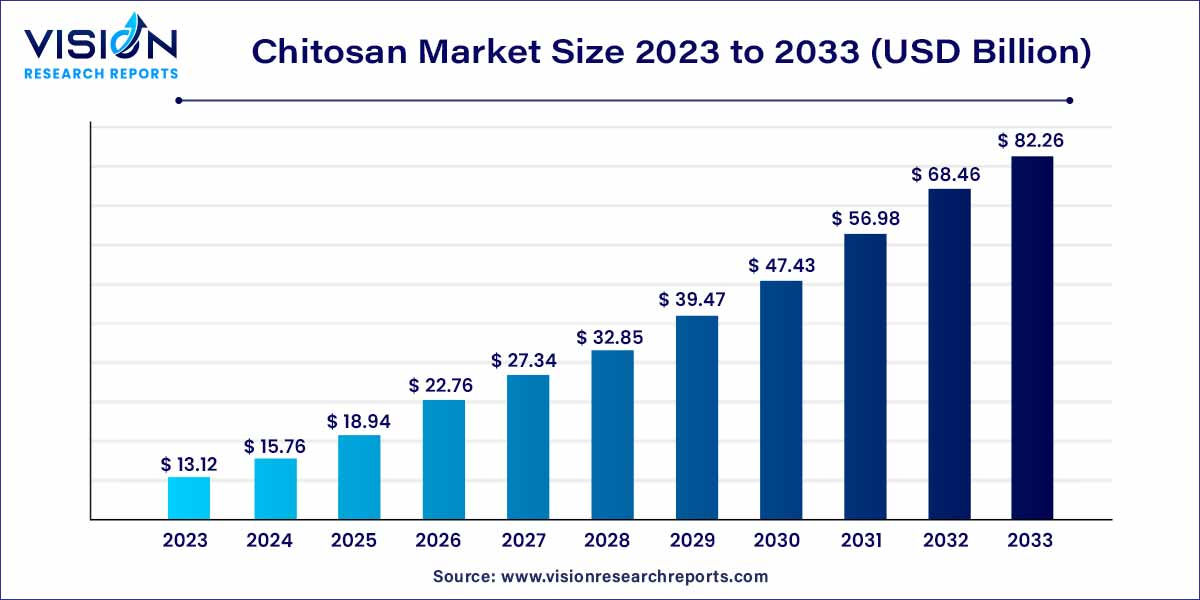

The global chitosan market size was estimated at around USD 13.12 billion in 2023 and it is projected to hit around USD 82.26 billion by 2033, growing at a CAGR of 20.15% from 2024 to 2033.

Chitosan, a biopolymer derived from chitin, has garnered substantial attention in the global market due to its diverse applications and eco-friendly characteristics. This overview provides insights into the key aspects shaping the chitosan market, including its sources, properties, applications, and market dynamics.

The growth of the chitosan market is propelled by several key factors. Firstly, the increasing demand for sustainable and eco-friendly solutions across industries has positioned chitosan as a preferred choice due to its biodegradable nature and renewable source from crustacean exoskeletons. Additionally, the versatility of chitosan in various applications, such as agriculture, pharmaceuticals, water treatment, and cosmetics, contributes to its expanding market presence. The heightened focus on health and wellness trends, with chitosan's potential benefits in weight management and cholesterol reduction, has spurred its integration into dietary supplements and functional foods. Furthermore, ongoing research and development initiatives aimed at exploring new applications and refining extraction methods play a pivotal role in propelling the growth of the chitosan market. As industries increasingly prioritize sustainable and bio-based solutions, chitosan stands out as a promising ingredient, driving its sustained growth and prominence in the global market.

| Report Coverage | Details |

| Revenue Share of Asia Pacific in 2023 | 47% |

| Market Revenue by 2033 | USD 82.26 billion |

| Growth Rate from 2024 to 2033 | CAGR of 20.15% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The biomedical sector held the largest revenue share of 33% in 2023. This dominance can be attributed to the rising demand for bio-based ingredients in drug manufacturing. Substantial investments in the pharmaceutical and medical sectors, coupled with a growing need for advanced healthcare products, are anticipated to positively impact market growth throughout the forecast period.

Numerous industry players are directing their focus toward the development of new applications, investing significantly in research and development activities. For example, in March 2020, BIOAVANTA-BOSTI, a prominent player in chitosan research, introduced a manufacturing process called Novochizol TM, designed for encapsulating various active pharmaceutical ingredients (API).

Conversely, the increasing demand for bio-derived personal care products is poised to act as a key driver for market growth. Chitosan's bacteriostatic and fungistatic properties are expected to create new opportunities in cosmetic applications. The growing demand for chitosan in the production of skin and hair care creams as a hydrating agent is likely to fuel market expansion.

The expanding application scope of chitosan in the manufacturing of dental care products, including mouthwash, toothpaste, and tooth gels, is anticipated to drive increased demand for these products. Additionally, the broadening application of chitosan in the production of color cosmetics such as lipsticks, eye shadows, and nail polishes is projected to boost demand in the foreseeable future. Moreover, the rising demand for chitosan in addressing various skin problems, including acne and scars, is expected to further drive growth.

North America dominated the market with the largest market share of 47% in 2023. This leadership is credited to the escalating consumer demand for bio-derived skin and hair care products in the developed economies of the region. Additionally, the increasing allocation of government funds towards water purification technologies, coupled with a growing preference for naturally derived and nontoxic water treatment chemicals, is anticipated to drive demand.

Canada's pharmaceutical industry stands out as one of the most lucrative sectors, ranking as the fourth fastest-growing healthcare industry globally after China, the U.S., and Spain. This positive outlook for the pharmaceutical industry in Canada is expected to further stimulate demand for chitosan. The robust manufacturing presence of global cosmetic giants such as Johnson & Johnson, Unilever, and Procter & Gamble in the U.S. is poised to contribute to the demand for chitosan, particularly in the formulation of personal care products.

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Chitosan Market

5.1. COVID-19 Landscape: Chitosan Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Chitosan Market, By Application

8.1.Chitosan Market, by Application Type, 2024-2033

8.1.1. Water Treatment

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Pharmaceutical

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Biomedical

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Cosmetics

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Food & Beverage

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Chitosan Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Application (2021-2033)

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.2. Europe

9.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.3. APAC

9.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.4. MEA

9.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by Application (2021-2033)

Chapter 10. Company Profiles

10.1. Qingdao Yunzhou Biochemistry Co.

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. Panvo Organics Pvt Ltd

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. Advanced Biopolymers AS

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. Meron Biopolymers

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. Biophrame Technologies

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. United Chitotechnologies Inc.

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. Heppe Medical Chitosan GmbH

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. KitoZyme S.A

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3.Financial Performance

10.8.4. Recent Initiatives

10.9. Foodchem International Corporation

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

10.10. Chitosanlab

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others