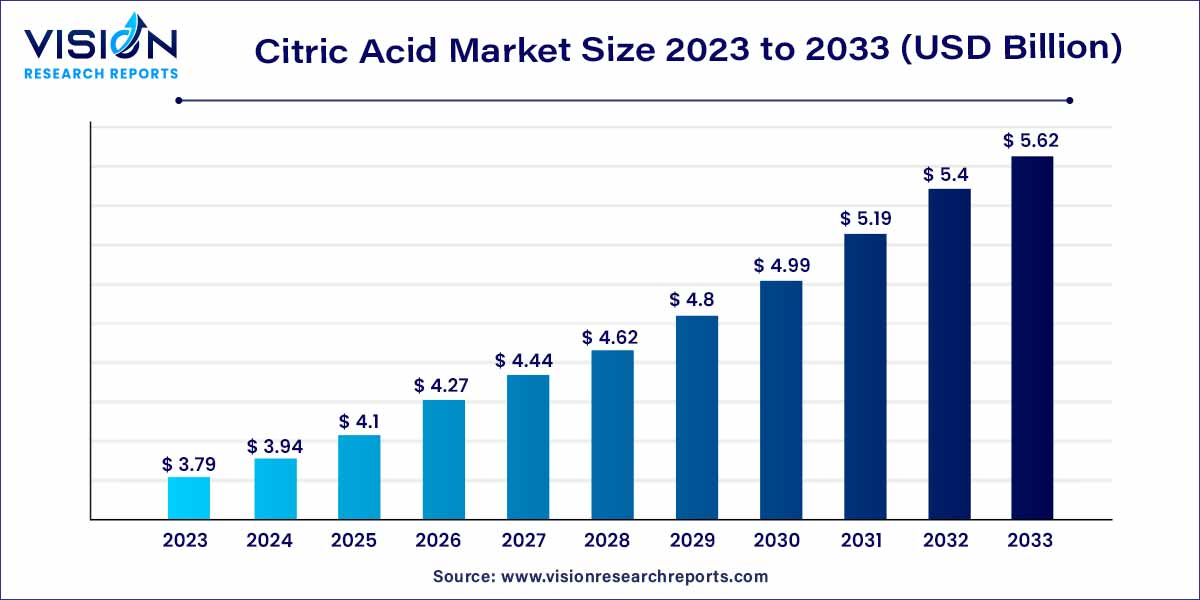

The global citric acid market size was estimated at around USD 3.79 billion in 2023 and it is projected to hit around USD 5.62 billion by 2033, growing at a CAGR of 4.02% from 2024 to 2033.

Citric acid, a naturally occurring organic acid primarily found in citrus fruits, has become a cornerstone in several industries, ranging from food and beverages to pharmaceuticals and household products. Its widespread applications and versatile properties have significantly contributed to the growth of the global citric acid market. This overview provides insights into the key aspects shaping the citric acid market, including its uses, market trends, and driving factors.

The growth of the citric acid market can be attributed to several key factors. Firstly, the increasing demand for processed and convenience foods, coupled with the expanding food and beverage industry, has significantly boosted the market. Secondly, the rising awareness among consumers regarding the harmful effects of synthetic additives has led to a preference for natural and organic ingredients, further driving the demand for citric acid. Additionally, the pharmaceutical industry's continual need for innovative formulations and the eco-friendly nature of citric acid have contributed to its widespread adoption in medicinal products. Moreover, the market benefits from the escalating demand for ready-to-drink beverages and the cleaning and descaling properties of citric acid, which find applications in household cleaners and detergents. These factors, combined with ongoing research and development efforts, position the citric acid market for continuous growth and expansion.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 5.62 billion |

| Growth Rate from 2024 to 2033 | CAGR of 4.02% |

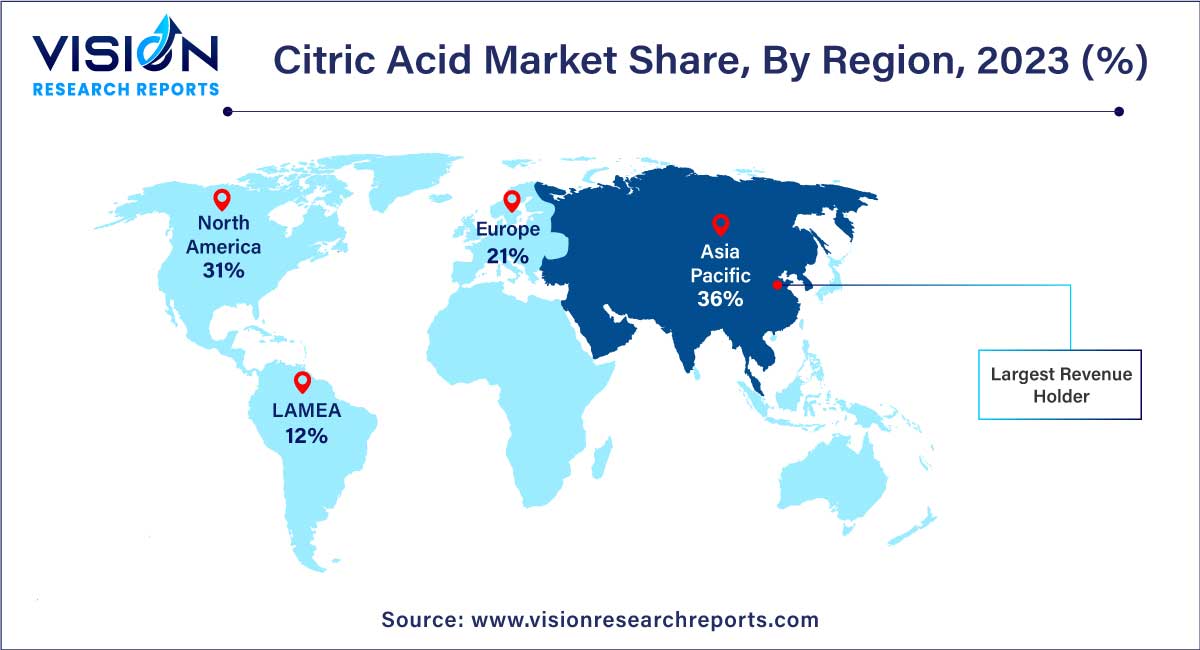

| Revenue Share of Asia Pacific in 2023 | 36% |

| CAGR of Central & South America from 2024 to 2033 | 4.74% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units)Companies Covered |

The powder segment accounted for the largest revenue share of 63% in 2023. Powdered citric acid is widely favored for its versatility and ease of storage. Its fine, dry consistency makes it convenient for various applications in the food and beverage industry. As a flavor enhancer and preservative, powdered citric acid finds extensive use in processed foods, confectionery, and soft drinks. Moreover, its soluble nature allows for easy blending and incorporation into recipes, ensuring uniform distribution of flavor and acidity.

The liquid segment is expected to grow at a fastest CAGR of 3.65% during the forecast period. Liquid citric acid, while less common than its powdered counterpart, holds its own significance in specific applications. Liquid citric acid is valued for its convenience, especially in industrial settings where precise measurements and rapid mixing are essential. It is often used in large-scale food production, pharmaceuticals, and cleaning products. Liquid citric acid's fluid consistency makes it easier to handle and dispense, facilitating accurate dosing and ensuring consistent quality in various formulations.

The food & beverages segment contributed the largest market share of 73% in 2023. Food and beverages, citric acid serves as a versatile ingredient, playing a crucial role in enhancing flavors, preserving freshness, and regulating acidity levels. It is a widely used acidulant in the food industry, imparting a tangy taste to a diverse range of products, including soft drinks, jams, candies, and processed foods. Moreover, its natural preservative properties make it invaluable for extending the shelf life of packaged foods, ensuring product quality, and meeting consumer preferences for natural additives.

The pharmaceuticals segment is expected to grow at the fastest CAGR of 4.24% over the forecast period. In the pharmaceutical sector, citric acid finds extensive application due to its chelating properties and compatibility with various medications. It is utilized as an excipient in pharmaceutical formulations, enhancing the stability and bioavailability of drugs. Citric acid’s role in pharmaceuticals is diverse, ranging from tablet formulations to effervescent solutions. Its ability to act as a buffering agent and improve the solubility of certain drugs makes it a sought-after ingredient in medicinal products. Additionally, citric acid is utilized in the production of vitamin supplements and oral healthcare products, owing to its safe and natural characteristics.

Asia Pacific dominated the market with the largest revenue share of 36% in 2023. Asia Pacific stands as a prominent market for citric acid, driven primarily by countries like China, India, and Japan. The region's thriving food processing industry, coupled with the growing demand for convenience foods and beverages, has bolstered the market for citric acid. In addition, the expanding pharmaceutical and personal care sectors in Asia Pacific have led to an augmented need for citric acid in various formulations, enhancing its market growth prospects.

Central & South America is anticipated to grow at the CAGR of 4.74% during the forecast period. Citric acid manufacturers find ample prospects in the region, owing to its varied economies, burgeoning middle-class population, and expanding food and beverage sector. As disposable incomes rise and urbanization accelerates, there is a growing inclination towards convenience foods and ready-to-drink beverages, leading to an increased demand for citric acid as a crucial ingredient in these products. Furthermore, the region's flourishing pharmaceutical and personal care industries also contribute to the consumption of citric acid in the area.

By Form

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Citric Acid Market

5.1. COVID-19 Landscape: Citric Acid Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Citric Acid Market, By Form

8.1. Citric Acid Market, by Form, 2024-2033

8.1.1. Liquid

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Powder

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Citric Acid Market, By Application

9.1. Citric Acid Market, by Application, 2024-2033

9.1.1. Pharmaceutical

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Food & Beverages

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Citric Acid Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Form (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Form (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Form (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Form (2021-2033)

10.2.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Form (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Form (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Form (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Form (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Form (2021-2033)

10.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Form (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Form (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Form (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Form (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Form (2021-2033)

10.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Form (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Form (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Form (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Form (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Form (2021-2033)

10.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Form (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Form (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. Pfizer, Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Tate & Lyle PLC

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Danisco A/S

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Cargill, Incorporated

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Kenko Corporation

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. ADM

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others