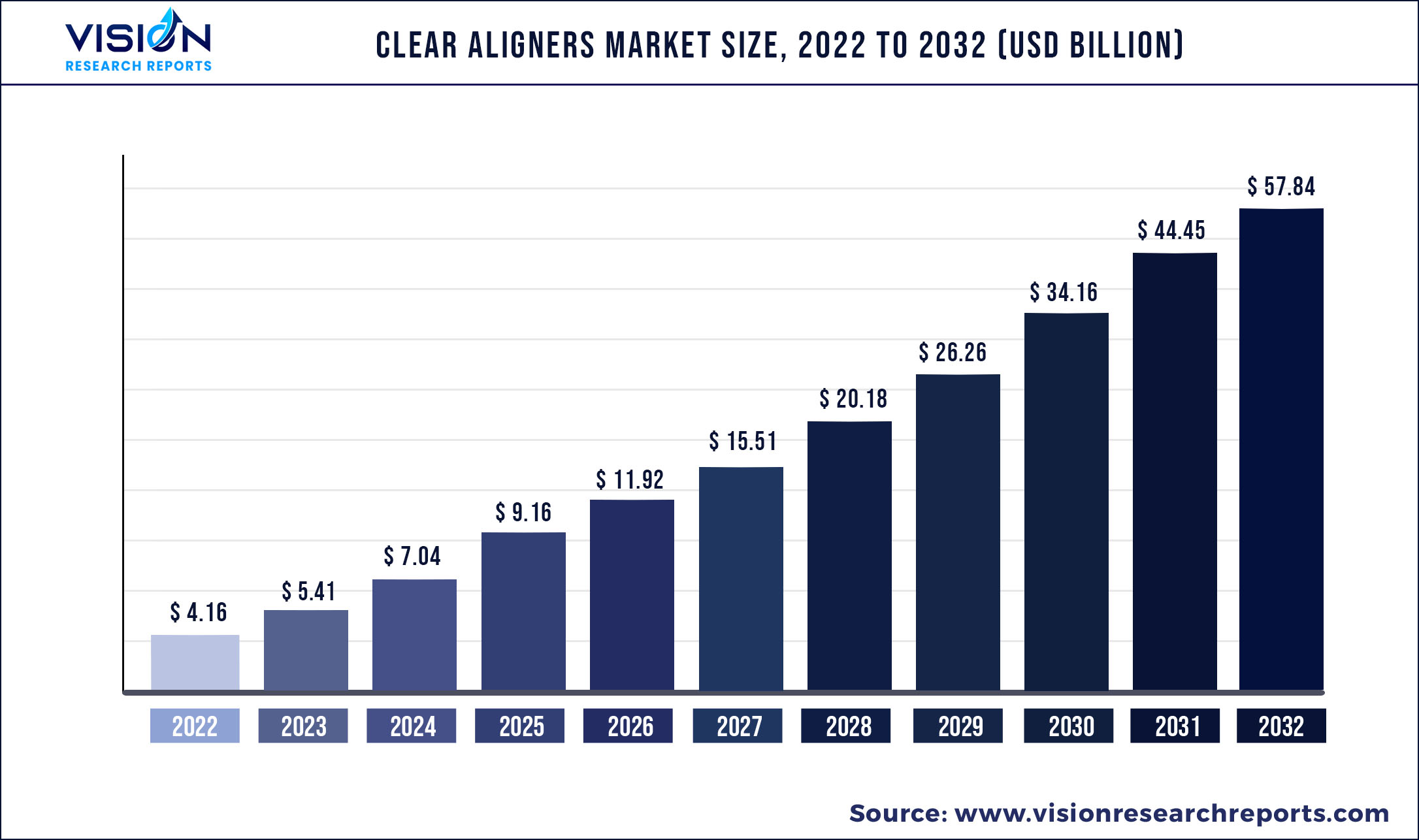

The global clear aligners market was surpassed at USD 4.16 billion in 2022 and is expected to hit around USD 57.84 billion by 2032, growing at a CAGR of 30.11% from 2023 to 2032.

Key Pointers

| Report Coverage | Details |

| Market Size in 2022 | USD 4.16 billion |

| Revenue Forecast by 2032 | USD 57.84 billion |

| Growth rate from 2023 to 2032 | CAGR of 30.11% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Align Technology; Dentsply Sirona; Institute Straumann; Envista Corporation; 3M ESPE, Argen Corporation; Henry Schein Inc; TP Orthodontics Inc; SmileDirect Club; Angel Aligner |

Clear aligners are a series of tight-fitting custom-made mouthpieces or orthodontic systems that are useful in correcting misaligned or crooked teeth. Clear aligners are virtually discreet and removable alternatives to braces designed around patients’ convenience and flexibility. Factors such as the growing patient population suffering from malocclusions, rising technological advancements in dental treatment, and growing demand for customized clear aligners are driving the overall market growth.

The pandemic had a positive impact on the market globally and key players recovered with high revenues in 2020 as compared to previous years. For instance, according to Dental Tribune, Align Technology sold a record 1.6 million cases of clear aligners in 2020 as compared to 1.5 million cases in 2019.

The company also stated that the adoption of Invisalign aligners by adults and teenagers increased by 36.7% and 38.7%, respectively in 2020 and the adoption of aligners among teens or younger patients was highest during the pandemic. The major factor for the growth of this marker was that people were more reluctant to go to an orthodontist’s office to get traditional teeth braces which increased the adoption of clear aligners. The advent of pandemics helped the industry prosper in terms of adoption, sales, and revenue, and this trend is expected to continue in the future.

In the advent of escalating dental disorders, advancements like 3D impression systems, additive fabrication, Nickel and Copper-Titanium Wires, digital scanning technology, CAD/CAM appliances, temporary anchorage devices, and incognito lingual braces, clear aligners are among the latest advancements that are making orthodontic treatments more efficient, predictable and effective. Dental treatments have become customized and technologies like a digital impression system like iTero by Align Technology is assisting in developing accurate and customized clear aligners systems to treat mild to moderate misalignment conditions.

These invisible aligners are developed through virtual digital models, computer-aided design (CAD-CAM), and thermoformed plastic materials like copolyester or polycarbonate plastic. Inconvenience caused by the metal and ceramic braces and the long-term gum sensitivity has caused an increased adoption of clear aligners by patients and dentists. The aligner is designed for the wearer’s comfort and is flexible. According to Dental Tribune, clear aligners technology has quickly become an increasingly popular alternative to fixed appliances for tooth straightening, since it is an aesthetically appealing and comfortable choice. Invisalign is the largest producer of clear aligners, and other brands include Clear Correct, Inman Aligner, and Smart Moves. However, factors like the high cost of clear aligners, less number of dentists in emerging areas, and limited insurance coverage for orthodontic treatments are likely to hinder the market growth.

Clear Aligners Market Segmentations:

| By Age | By Material Type | By End-Use | By Dentist Type | By Duration | By Distribution Channel |

|

Adults Teens |

Polyurethane Plastic Polyethylene Terephthalate Glycol Others |

Hospitals Stand Alone Practices Group Practices Others |

General Dentists Orthodontists |

Comprehensive malfunction Medium treatments Small little beauty Alignments |

Online Offline |

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Distribution Channel Procurement Analysis

4.3.2. Sales and Distribution Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Clear Aligners Market

5.1. COVID-19 Landscape: Clear Aligners Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Clear Aligners Market, By Age

8.1. Clear Aligners Market, by Age, 2023-2032

8.1.1. Adults

8.1.1.1. Market Revenue and Forecast (2019-2032)

8.1.2. Teens

8.1.2.1. Market Revenue and Forecast (2019-2032)

Chapter 9. Global Clear Aligners Market, By Material Type

9.1. Clear Aligners Market, by Material Type, 2023-2032

9.1.1. Polyurethane

9.1.1.1. Market Revenue and Forecast (2019-2032)

9.1.2. Plastic Polyethylene Terephthalate Glycol

9.1.2.1. Market Revenue and Forecast (2019-2032)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2019-2032)

Chapter 10. Global Clear Aligners Market, By End-Use

10.1. Clear Aligners Market, by End-Use, 2023-2032

10.1.1. Hospitals

10.1.1.1. Market Revenue and Forecast (2019-2032)

10.1.2. Stand Alone Practices

10.1.2.1. Market Revenue and Forecast (2019-2032)

10.1.3. Group Practices

10.1.3.1. Market Revenue and Forecast (2019-2032)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2019-2032)

Chapter 11. Global Clear Aligners Market, By Dentist Type

11.1. Clear Aligners Market, by Dentist Type, 2023-2032

11.1.1. General Dentists

11.1.1.1. Market Revenue and Forecast (2019-2032)

11.1.2. General Dentists

11.1.2.1. Market Revenue and Forecast (2019-2032)

Chapter 12. Global Clear Aligners Market, By Duration

12.1. Clear Aligners Market, by Duration, 2023-2032

12.1.1. Comprehensive malfunction

12.1.1.1. Market Revenue and Forecast (2019-2032)

12.1.2. Medium treatments

12.1.2.1. Market Revenue and Forecast (2019-2032)

12.1.3. Small little beauty Alignments

12.1.3.1. Market Revenue and Forecast (2019-2032)

Chapter 13. Global Clear Aligners Market, By Distribution Channel

13.1. Clear Aligners Market, by Distribution Channel, 2023-2032

13.1.1. Online

13.1.1.1. Market Revenue and Forecast (2019-2032)

13.1.2. Offline

13.1.2.1. Market Revenue and Forecast (2019-2032)

Chapter 14. Global Clear Aligners Market, Regional Estimates and Trend Forecast

14.1. North America

14.1.1. Market Revenue and Forecast, by Age (2019-2032)

14.1.2. Market Revenue and Forecast, by Material Type (2019-2032)

14.1.3. Market Revenue and Forecast, by End-Use (2019-2032)

14.1.4. Market Revenue and Forecast, by Dentist Type (2019-2032)

14.1.5. Market Revenue and Forecast, by Duration (2019-2032)

14.1.6. Market Revenue and Forecast, by Distribution Channel (2019-2032)

14.1.7. U.S.

14.1.7.1. Market Revenue and Forecast, by Age (2019-2032)

14.1.7.2. Market Revenue and Forecast, by Material Type (2019-2032)

14.1.7.3. Market Revenue and Forecast, by End-Use (2019-2032)

14.1.7.4. Market Revenue and Forecast, by Dentist Type (2019-2032)

14.1.8. Market Revenue and Forecast, by Duration (2019-2032)

14.1.8.1. Market Revenue and Forecast, by Distribution Channel (2019-2032)

14.1.9. Rest of North America

14.1.9.1. Market Revenue and Forecast, by Age (2019-2032)

14.1.9.2. Market Revenue and Forecast, by Material Type (2019-2032)

14.1.9.3. Market Revenue and Forecast, by End-Use (2019-2032)

14.1.9.4. Market Revenue and Forecast, by Dentist Type (2019-2032)

14.1.10. Market Revenue and Forecast, by Duration (2019-2032)

14.1.11. Market Revenue and Forecast, by Distribution Channel (2019-2032)

14.1.11.1.

14.2. Europe

14.2.1. Market Revenue and Forecast, by Age (2019-2032)

14.2.2. Market Revenue and Forecast, by Material Type (2019-2032)

14.2.3. Market Revenue and Forecast, by End-Use (2019-2032)

14.2.4. Market Revenue and Forecast, by Dentist Type (2019-2032)

14.2.5. Market Revenue and Forecast, by Duration (2019-2032)

14.2.6. Market Revenue and Forecast, by Distribution Channel (2019-2032)

14.2.7.

14.2.8. UK

14.2.8.1. Market Revenue and Forecast, by Age (2019-2032)

14.2.8.2. Market Revenue and Forecast, by Material Type (2019-2032)

14.2.8.3. Market Revenue and Forecast, by End-Use (2019-2032)

14.2.9. Market Revenue and Forecast, by Dentist Type (2019-2032)

14.2.10. Market Revenue and Forecast, by Duration (2019-2032)

14.2.10.1. Market Revenue and Forecast, by Distribution Channel (2019-2032)

14.2.11. Germany

14.2.11.1. Market Revenue and Forecast, by Age (2019-2032)

14.2.11.2. Market Revenue and Forecast, by Material Type (2019-2032)

14.2.11.3. Market Revenue and Forecast, by End-Use (2019-2032)

14.2.12. Market Revenue and Forecast, by Dentist Type (2019-2032)

14.2.13. Market Revenue and Forecast, by Duration (2019-2032)

14.2.14. Market Revenue and Forecast, by Distribution Channel (2019-2032)

14.2.14.1.

14.2.15. France

14.2.15.1. Market Revenue and Forecast, by Age (2019-2032)

14.2.15.2. Market Revenue and Forecast, by Material Type (2019-2032)

14.2.15.3. Market Revenue and Forecast, by End-Use (2019-2032)

14.2.15.4. Market Revenue and Forecast, by Dentist Type (2019-2032)

14.2.16. Market Revenue and Forecast, by Duration (2019-2032)

14.2.16.1. Market Revenue and Forecast, by Distribution Channel (2019-2032)

14.2.17. Rest of Europe

14.2.17.1. Market Revenue and Forecast, by Age (2019-2032)

14.2.17.2. Market Revenue and Forecast, by Material Type (2019-2032)

14.2.17.3. Market Revenue and Forecast, by End-Use (2019-2032)

14.2.17.4. Market Revenue and Forecast, by Dentist Type (2019-2032)

14.2.18. Market Revenue and Forecast, by Duration (2019-2032)

14.2.18.1. Market Revenue and Forecast, by Distribution Channel (2019-2032)

14.3. APAC

14.3.1. Market Revenue and Forecast, by Age (2019-2032)

14.3.2. Market Revenue and Forecast, by Material Type (2019-2032)

14.3.3. Market Revenue and Forecast, by End-Use (2019-2032)

14.3.4. Market Revenue and Forecast, by Dentist Type (2019-2032)

14.3.5. Market Revenue and Forecast, by Duration (2019-2032)

14.3.6. Market Revenue and Forecast, by Distribution Channel (2019-2032)

14.3.7. India

14.3.7.1. Market Revenue and Forecast, by Age (2019-2032)

14.3.7.2. Market Revenue and Forecast, by Material Type (2019-2032)

14.3.7.3. Market Revenue and Forecast, by End-Use (2019-2032)

14.3.7.4. Market Revenue and Forecast, by Dentist Type (2019-2032)

14.3.8. Market Revenue and Forecast, by Duration (2019-2032)

14.3.9. Market Revenue and Forecast, by Distribution Channel (2019-2032)

14.3.10. China

14.3.10.1. Market Revenue and Forecast, by Age (2019-2032)

14.3.10.2. Market Revenue and Forecast, by Material Type (2019-2032)

14.3.10.3. Market Revenue and Forecast, by End-Use (2019-2032)

14.3.10.4. Market Revenue and Forecast, by Dentist Type (2019-2032)

14.3.11. Market Revenue and Forecast, by Duration (2019-2032)

14.3.11.1. Market Revenue and Forecast, by Distribution Channel (2019-2032)

14.3.12. Japan

14.3.12.1. Market Revenue and Forecast, by Age (2019-2032)

14.3.12.2. Market Revenue and Forecast, by Material Type (2019-2032)

14.3.12.3. Market Revenue and Forecast, by End-Use (2019-2032)

14.3.12.4. Market Revenue and Forecast, by Dentist Type (2019-2032)

14.3.12.5. Market Revenue and Forecast, by Duration (2019-2032)

14.3.12.6. Market Revenue and Forecast, by Distribution Channel (2019-2032)

14.3.13. Rest of APAC

14.3.13.1. Market Revenue and Forecast, by Age (2019-2032)

14.3.13.2. Market Revenue and Forecast, by Material Type (2019-2032)

14.3.13.3. Market Revenue and Forecast, by End-Use (2019-2032)

14.3.13.4. Market Revenue and Forecast, by Dentist Type (2019-2032)

14.3.13.5. Market Revenue and Forecast, by Duration (2019-2032)

14.3.13.6. Market Revenue and Forecast, by Distribution Channel (2019-2032)

14.4. MEA

14.4.1. Market Revenue and Forecast, by Age (2019-2032)

14.4.2. Market Revenue and Forecast, by Material Type (2019-2032)

14.4.3. Market Revenue and Forecast, by End-Use (2019-2032)

14.4.4. Market Revenue and Forecast, by Dentist Type (2019-2032)

14.4.5. Market Revenue and Forecast, by Duration (2019-2032)

14.4.6. Market Revenue and Forecast, by Distribution Channel (2019-2032)

14.4.7. GCC

14.4.7.1. Market Revenue and Forecast, by Age (2019-2032)

14.4.7.2. Market Revenue and Forecast, by Material Type (2019-2032)

14.4.7.3. Market Revenue and Forecast, by End-Use (2019-2032)

14.4.7.4. Market Revenue and Forecast, by Dentist Type (2019-2032)

14.4.8. Market Revenue and Forecast, by Duration (2019-2032)

14.4.9. Market Revenue and Forecast, by Distribution Channel (2019-2032)

14.4.10. North Africa

14.4.10.1. Market Revenue and Forecast, by Age (2019-2032)

14.4.10.2. Market Revenue and Forecast, by Material Type (2019-2032)

14.4.10.3. Market Revenue and Forecast, by End-Use (2019-2032)

14.4.10.4. Market Revenue and Forecast, by Dentist Type (2019-2032)

14.4.11. Market Revenue and Forecast, by Duration (2019-2032)

14.4.12. Market Revenue and Forecast, by Distribution Channel (2019-2032)

14.4.13. South Africa

14.4.13.1. Market Revenue and Forecast, by Age (2019-2032)

14.4.13.2. Market Revenue and Forecast, by Material Type (2019-2032)

14.4.13.3. Market Revenue and Forecast, by End-Use (2019-2032)

14.4.13.4. Market Revenue and Forecast, by Dentist Type (2019-2032)

14.4.13.5. Market Revenue and Forecast, by Duration (2019-2032)

14.4.13.6. Market Revenue and Forecast, by Distribution Channel (2019-2032)

14.4.14. Rest of MEA

14.4.14.1. Market Revenue and Forecast, by Age (2019-2032)

14.4.14.2. Market Revenue and Forecast, by Material Type (2019-2032)

14.4.14.3. Market Revenue and Forecast, by End-Use (2019-2032)

14.4.14.4. Market Revenue and Forecast, by Dentist Type (2019-2032)

14.4.14.5. Market Revenue and Forecast, by Duration (2019-2032)

14.4.14.6. Market Revenue and Forecast, by Distribution Channel (2019-2032)

14.5. Latin America

14.5.1. Market Revenue and Forecast, by Age (2019-2032)

14.5.2. Market Revenue and Forecast, by Material Type (2019-2032)

14.5.3. Market Revenue and Forecast, by End-Use (2019-2032)

14.5.4. Market Revenue and Forecast, by Dentist Type (2019-2032)

14.5.5. Market Revenue and Forecast, by Duration (2019-2032)

14.5.6. Market Revenue and Forecast, by Distribution Channel (2019-2032)

14.5.7. Brazil

14.5.7.1. Market Revenue and Forecast, by Age (2019-2032)

14.5.7.2. Market Revenue and Forecast, by Material Type (2019-2032)

14.5.7.3. Market Revenue and Forecast, by End-Use (2019-2032)

14.5.7.4. Market Revenue and Forecast, by Dentist Type (2019-2032)

14.5.8. Market Revenue and Forecast, by Duration (2019-2032)

14.5.8.1. Market Revenue and Forecast, by Distribution Channel (2019-2032)

14.5.9. Rest of LATAM

14.5.9.1. Market Revenue and Forecast, by Age (2019-2032)

14.5.9.2. Market Revenue and Forecast, by Material Type (2019-2032)

14.5.9.3. Market Revenue and Forecast, by End-Use (2019-2032)

14.5.9.4. Market Revenue and Forecast, by Dentist Type (2019-2032)

14.5.9.5. Market Revenue and Forecast, by Duration (2019-2032)

14.5.9.6. Market Revenue and Forecast, by Distribution Channel (2019-2032)

Chapter 15. Company Profiles

15.1. Align Technology

15.1.1. Company Overview

15.1.2. Product Offerings

15.1.3. Financial Performance

15.1.4. Recent Initiatives

15.2. Dentsply Sirona

15.2.1. Company Overview

15.2.2. Product Offerings

15.2.3. Financial Performance

15.2.4. Recent Initiatives

15.3. Institute Straumann

15.3.1. Company Overview

15.3.2. Product Offerings

15.3.3. Financial Performance

15.3.4. Recent Initiatives

15.4. Envista Corporation

15.4.1. Company Overview

15.4.2. Product Offerings

15.4.3. Financial Performance

15.4.4. Recent Initiatives

15.5. 3M ESPE

15.5.1. Company Overview

15.5.2. Product Offerings

15.5.3. Financial Performance

15.5.4. Recent Initiatives

15.6. Argen Corporation

15.6.1. Company Overview

15.6.2. Product Offerings

15.6.3. Financial Performance

15.6.4. Recent Initiatives

15.7. Henry Schein Inc

15.7.1. Company Overview

15.7.2. Product Offerings

15.7.3. Financial Performance

15.7.4. Recent Initiatives

15.8. TP Orthodontics Inc

15.8.1. Company Overview

15.8.2. Product Offerings

15.8.3. Financial Performance

15.8.4. Recent Initiatives

15.9. SmileDirect Club

15.9.1. Company Overview

15.9.2. Product Offerings

15.9.3. Financial Performance

15.9.4. Recent Initiatives

15.10. Angel Aligner

15.10.1. Company Overview

15.10.2. Product Offerings

15.10.3. Financial Performance

15.10.4. Recent Initiatives

Chapter 16. Research Methodology

16.1. Primary Research

16.2. Secondary Research

16.3. Assumptions

Chapter 17. Appendix

17.1. About Us

17.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others