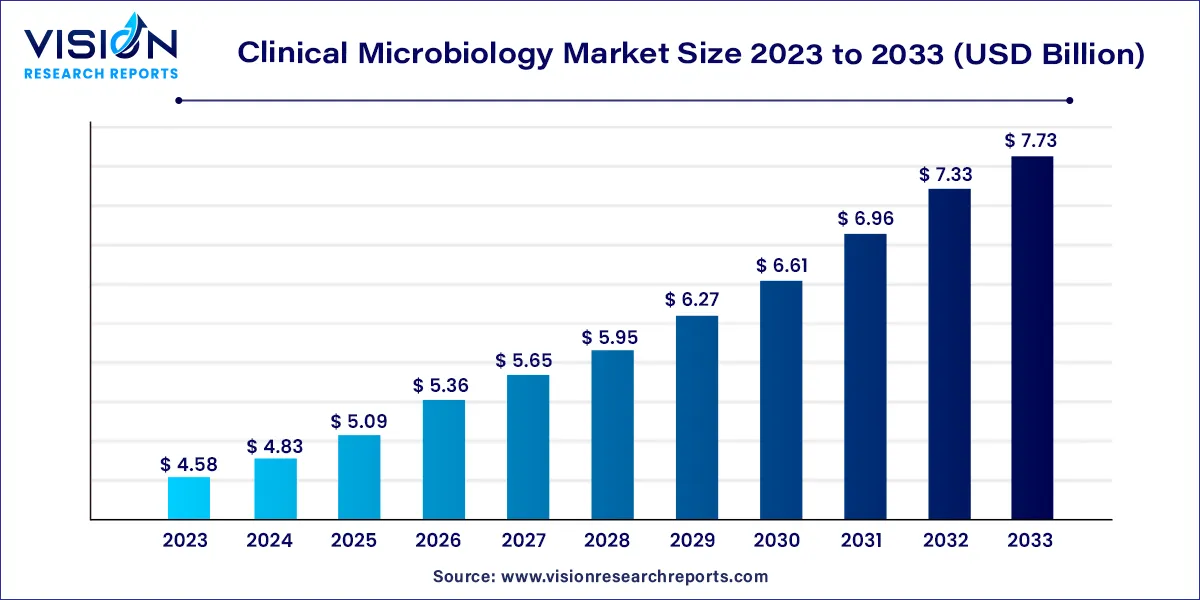

The global clinical microbiology market size was estimated at around USD 4.58 billion in 2023 and it is projected to hit around USD 7.73 billion by 2033, growing at a CAGR of 5.37% from 2024 to 2033.

The field of clinical microbiology plays a vital role in healthcare by diagnosing and managing infectious diseases. As technology continues to advance, the clinical microbiology market is experiencing significant growth, driven by factors such as increasing incidences of infectious diseases, growing awareness about early disease detection, and the development of innovative diagnostic techniques. This overview provides insights into the current state and future prospects of the clinical microbiology market.

The growth of the clinical microbiology market is propelled by several key factors. Firstly, the increasing prevalence of infectious diseases worldwide contributes significantly to market expansion. As infectious pathogens evolve and spread, there is a growing demand for advanced diagnostic solutions to accurately identify and manage these diseases. Additionally, rising awareness about the importance of early disease detection and prompt treatment drives the adoption of microbiology diagnostics. Furthermore, technological advancements, particularly in molecular diagnostics and automation, enhance the efficiency and accuracy of diagnostic tests, further fueling market growth. Moreover, the COVID-19 pandemic has underscored the critical role of clinical microbiology in public health, leading to increased investment in diagnostic capabilities and infrastructure. Overall, these factors converge to create a favorable environment for the growth of the clinical microbiology market, with opportunities for innovation and expansion across various segments.

In 2023, the reagents segment emerged as the market leader, commanding a significant share of 73%. This dominance can be attributed to the continuous development and commercialization of innovative reagents tailored for clinical microbiology applications. Globally, the prevalence of chronic diseases such as cancer, diabetes, and cardiovascular disorders has surged. Reagents play a crucial role in accurately detecting and monitoring these conditions by identifying biomarkers, specific molecules, or genetic variations associated with these ailments through diverse diagnostic methods like imaging, blood tests, and genetic analysis.

Furthermore, the ready availability of advanced reagents offering enhanced solutions for simplified, precise, and rapid testing is expected to drive market expansion. Anticipated to exhibit the highest compound annual growth rate (CAGR) from 2024 to 2033, the laboratory instruments segment is poised for significant growth owing to robust demand worldwide. Laboratory instruments constitute a pivotal component in clinical microbiology, encompassing devices such as incubators, gram stainers, bacterial colony counters, autoclave sterilizers, and petri dish fillers. These instruments find widespread application across various industries including pharmaceuticals, microbiology laboratories, biotechnology firms, and research institutions, facilitating experimentation and sample analysis.

In 2023, the respiratory diseases segment emerged as the dominant force in the market. The prevalence of infectious ailments like tuberculosis is a primary driver for respiratory disease testing. According to the World Health Organization's Global Tuberculosis Report 2022, the global tuberculosis infection count stands at 10.6 million, with only 6.4 million cases diagnosed. Consequently, the upsurge in respiratory illnesses underscores the growing importance of clinical microbiology, facilitating precise diagnosis and tailored treatments. Additionally, the escalating levels of air pollution, contributing to the emission of harmful gases causing lung diseases such as Chronic Obstructive Pulmonary Disease (COPD), are fueling the growth of this segment.

On the other hand, the bloodstream infection (BSI) segment is poised to witness a notable compound annual growth rate (CAGR) from 2024 to 2033. The escalating number of BSI cases globally poses a significant concern with profound implications for public health. Multiple factors contribute to the surge in BSI instances, including the rising prevalence of antibiotic-resistant bacteria, invasive medical procedures, an aging population, and the high incidence of chronic ailments. Furthermore, the COVID-19 pandemic has left a substantial impact on the market for BSI testing. A retrospective observational study conducted at a tertiary care center in Jaipur, India, aimed to assess the prevalence and spectrum of BSIs in COVID-19 patients. Over the 5-month study period, approximately 158 blood cultures were obtained from 1,578 COVID-19-positive patients, revealing positive results in 15 patients (9.4%).

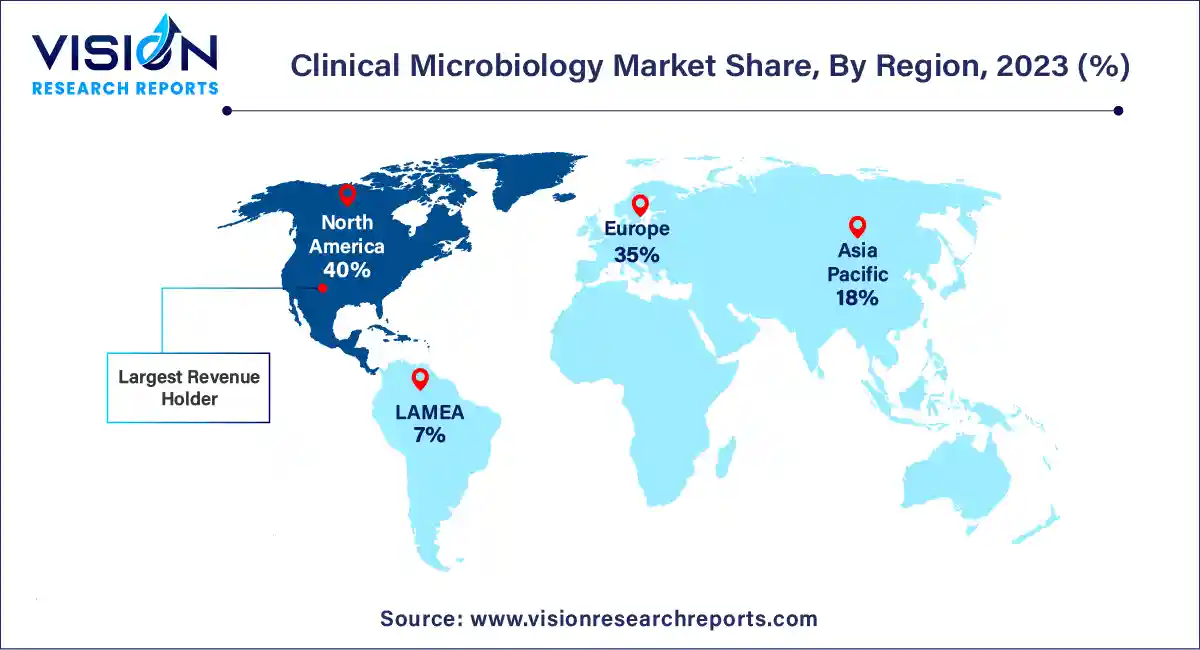

In 2023, North America emerged as the dominant market player, accounting for a substantial revenue share of 40%. The United States market, in particular, is experiencing robust growth driven by various factors influencing the healthcare landscape. The increasing prevalence of infectious diseases and ongoing challenges posed by emerging pathogens underscore the critical importance of clinical microbiology in disease diagnosis, surveillance, and management. The market is witnessing a notable shift towards molecular diagnostics, emphasizing rapid and accurate testing methods. Companies like bioMérieux, B.D., and Danaher Corporation are actively investing in research and development to introduce innovative technologies aimed at enhancing sensitivity, specificity, and reducing turnaround time in microbiological testing.

On the other hand, the Asia Pacific clinical microbiology market demonstrated the highest compound annual growth rate (CAGR) over the forecast period. This surge is attributed to the rapidly advancing healthcare sector and a strong emphasis on innovative medical technologies in the region. Additionally, strategic initiatives undertaken by local key players to enhance product capabilities are expected to further contribute to market growth.

By Product

By Disease

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Clinical Microbiology Market

5.1. COVID-19 Landscape: Clinical Microbiology Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Clinical Microbiology Market, By Product

8.1. Clinical Microbiology Market, by Product, 2024-2033

8.1.1. Laboratory Instruments

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Automated Culture System

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Reagents

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Clinical Microbiology Market, By Disease

9.1. Clinical Microbiology Market, by Disease, 2024-2033

9.1.1. Respiratory Diseases

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Bloodstream Infections

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Gastrointestinal Diseases

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Sexually transmitted Diseases

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Urinary Tract Infections

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Periodontal Diseases

9.1.6.1. Market Revenue and Forecast (2021-2033)

9.1.7. Other Diseases

9.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Clinical Microbiology Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by Disease (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Disease (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Disease (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.2. Market Revenue and Forecast, by Disease (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Disease (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Disease (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Disease (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Disease (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.2. Market Revenue and Forecast, by Disease (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Disease (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Disease (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Disease (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Disease (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.2. Market Revenue and Forecast, by Disease (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Disease (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Disease (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Disease (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Disease (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.2. Market Revenue and Forecast, by Disease (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Disease (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Disease (2021-2033)

Chapter 11. Company Profiles

11.1. bioMerieux SA

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Abbott

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. BD

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Danaher (Cepheid, Inc.)

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Hologic, Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. F. Hoffmann-La Roche Ltd.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Bruker

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Bio-Rad Laboratories, Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others