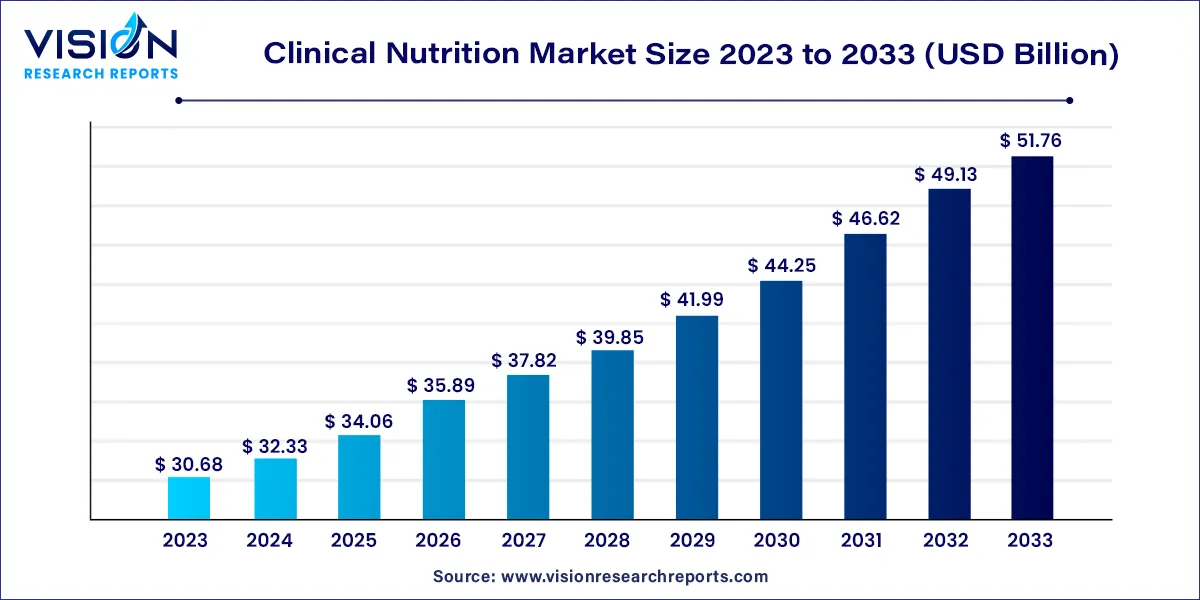

The global clinical nutrition market size was estimated at around USD 30.68 billion in 2023 and it is projected to hit around USD 51.76 billion by 2033, growing at a CAGR of 5.37% from 2024 to 2033.

The clinical nutrition market encompasses a wide array of products and services aimed at addressing the nutritional needs of patients with specific medical conditions or those undergoing medical treatment. This segment of the healthcare industry plays a vital role in supporting individuals who may have difficulty meeting their nutritional requirements through regular diet alone due to illness, surgery, or other medical interventions.

The growth of the clinical nutrition market is driven by an increasing prevalence of chronic diseases worldwide, coupled with an aging population, has led to a rising demand for specialized nutritional support among patients managing conditions such as diabetes, cardiovascular diseases, and cancer. Additionally, growing awareness about the crucial role of nutrition in disease management and prevention has spurred greater adoption of clinical nutrition products and services. Furthermore, advancements in medical technology and healthcare infrastructure have expanded access to specialized nutritional interventions, driving market growth. Moreover, the trend towards personalized nutrition solutions, supported by advancements in nutritional science and digital health technologies, is contributing to market expansion as manufacturers develop tailored products to meet the unique needs of diverse patient populations. Lastly, stringent regulatory standards governing product safety and efficacy play a pivotal role in shaping the market landscape, ensuring that quality standards are upheld and consumer confidence is maintained.

In 2023, the global oral clinical nutrition market secured the leading share, accounting for 54%. This dominance is propelled by several factors, including the escalating prevalence of malnutrition among adults and the surge in conditions like obesity, cancer, and diabetes. Market leaders and innovators are actively engaged in launching novel products aimed at enhancing productivity, durability, and quality, while simultaneously improving the nutritional content and taste. Consequently, there is a noticeable uptick in demand for oral clinical nutrition products worldwide. For instance, in March 2021, Kate Farms introduced two new products, Kate Farms Standard 1.4 Vanilla and Plain, and Kate Farms Pediatric Peptide Vanilla Flavor 1.0, designed to address nutrient deficiencies in patients with chronic ailments such as allergies, malnutrition, cancer, and gastrointestinal disorders. These innovative product launches are anticipated to further propel industry growth.

Furthermore, the parenteral nutrition segment is forecasted to exhibit the fastest Compound Annual Growth Rate (CAGR) during the projected period. This surge can be attributed to advancements in technically sophisticated parenteral nutrition (PN) products integrated with barcode assistance. Additionally, factors such as the growing preference for PN over enteral nutrition among patients, shorter hospital stays, and reduced risk of infection contribute to heightened demand, consequently driving market expansion.

In 2023, the cancer care segment contributed 19% to the global revenue. The primary driver of this segment's growth is the increasing prevalence of cancer worldwide. According to the Pan America Health Organization, in North America alone, approximately 4 million new cancer cases were diagnosed in 2020, resulting in 1.4 million deaths. Similarly, data from the American Cancer Society Journal in January 2023 projected around 609,820 cancer-related deaths in the U.S. for the same year. Furthermore, projections indicate a significant surge in global cancer cases by 2040, reaching approximately 30 million new cases, with the most substantial increases expected in low- and middle-income countries. These statistics underscore the urgent need for comprehensive strategies to address the escalating cancer burden and provide essential support to affected populations worldwide.

Additionally, the Malabsorption/GI Disorder/Diarrhea segment is projected to witness the fastest growth rate over the forecast period. Malabsorption, characterized by difficulty digesting nutrients from food, is associated with conditions like short bowel syndrome, cystic fibrosis, chronic pancreatitis, and Crohn’s disease. Without proper nutrients, malabsorption can lead to other health complications. Enteral nutrition, administered orally or through tube feeding, plays a crucial role in providing necessary nutrients and bolstering gut immunity. Numerous enteral feeds are available to address malabsorption, such as Abbott's Vital peptide 1.5 Cal, which offers a therapeutic formulation beneficial for treating malabsorption and gastrointestinal disorders.

In 2023, the institutional sales channel commanded the largest market share, accounting for 46%. Institutions purchasing clinical nutrition products encompass hospitals, long-term care centers, hospices, and disability facilities. The decision to procure enteral or parenteral nutrition products is largely influenced by medical professionals, particularly doctors. The segment's growth is further fueled by the increasing number of both private and public institutions and the expanding population of patients with chronic diseases worldwide.

Conversely, the online sales channel segment is poised for the fastest growth. There's a noticeable shift towards direct selling to consumers via e-commerce platforms. The preference for purchasing enteral feeding formula online is on the rise due to the convenience offered by this sales channel. Despite being consumed under medical supervision, these products are primarily intended for long-term nutrition management, thereby contributing to the increasing sales through e-commerce platforms.

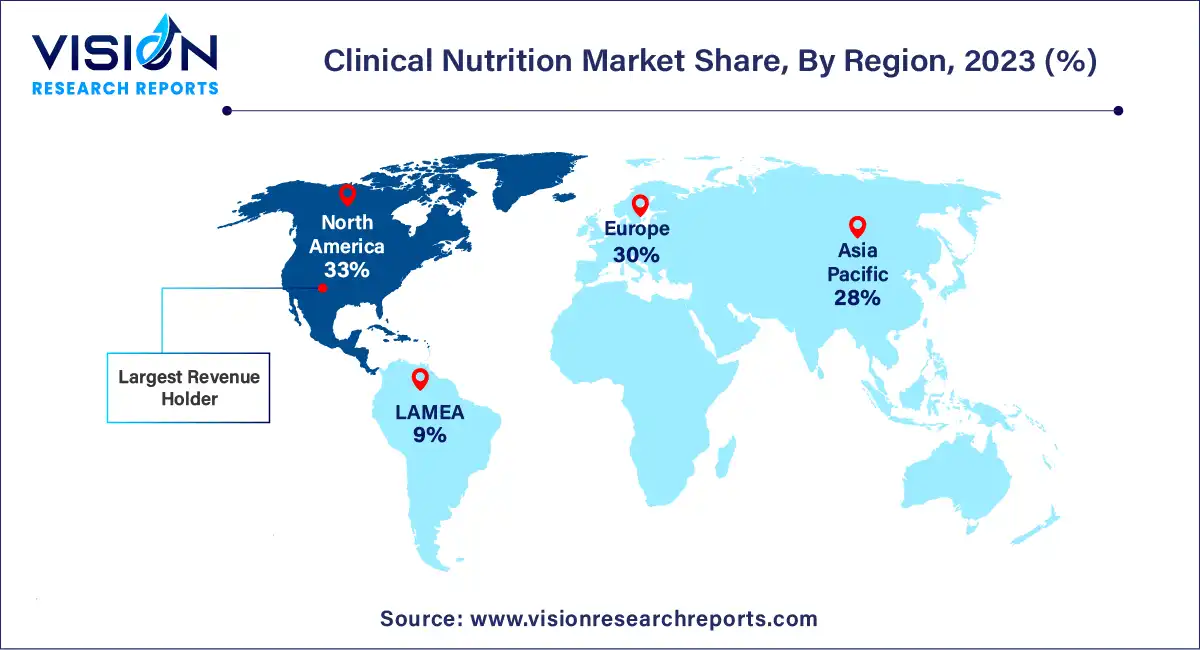

In 2023, North America emerged as the dominant force in the global clinical nutrition market, holding a substantial 33% share. This growth can be primarily attributed to the increasing geriatric population in the region, which is more susceptible to a range of chronic diseases including gastrointestinal disorders, metabolic disorders, and neurological disorders. According to data from the United Health Foundation, in 2022, approximately 17.3% of the U.S. population was aged 65 and above. Projections suggest that by 2030, around 56 million elderly individuals in the U.S. will rely on clinical nutrition to meet their nutritional requirements.

The clinical nutrition market in the Asia Pacific region is poised for substantial growth. This anticipated growth is fueled by several factors, including the region's sizable patient population and geriatric demographic. Lifestyle shifts are also contributing to a rise in the prevalence of numerous diseases such as cancer, diabetes, gastrointestinal disorders, and autoimmune conditions. Consequently, there is a growing demand for clinical nutrition solutions to support the dietary management of these chronic diseases.

By Product

By Indication

By Sales Channel

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Clinical Nutrition Market

5.1. COVID-19 Landscape: Clinical Nutrition Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Clinical Nutrition Market, By Product

8.1. Clinical Nutrition Market, by Product, 2024-2033

8.1.1 Oral Clinical Nutrition

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Parenteral Nutrition

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Enteral Feeding Formulas

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Clinical Nutrition Market, By Indication

9.1. Clinical Nutrition Market, by Indication, 2024-2033

9.1.1. Alzheimer’s

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Nutrition Deficiency

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Cancer Care

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Diabetes

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Chronic Kidney Diseases

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Orphan Diseases

9.1.6.1. Market Revenue and Forecast (2021-2033)

9.1.7. Dysphagia

9.1.7.1. Market Revenue and Forecast (2021-2033)

9.1.8. Pain Management

9.1.8.1. Market Revenue and Forecast (2021-2033)

9.1.9. Malabsorption/GI Disorder/Diarrhea

9.1.9.1. Market Revenue and Forecast (2021-2033)

9.1.10. Others

9.1.10.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Clinical Nutrition Market, By Sales Channel

10.1. Clinical Nutrition Market, by Sales Channel, 2024-2033

10.1.1. Retail Sales Channels

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Online Sales Channels

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Institutional Sales Channels

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Clinical Nutrition Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.2. Market Revenue and Forecast, by Indication (2021-2033)

11.1.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Indication (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Indication (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.2. Market Revenue and Forecast, by Indication (2021-2033)

11.2.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Indication (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Indication (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Indication (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Indication (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.2. Market Revenue and Forecast, by Indication (2021-2033)

11.3.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Indication (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Indication (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Indication (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Indication (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.2. Market Revenue and Forecast, by Indication (2021-2033)

11.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Indication (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Indication (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Indication (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Indication (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.2. Market Revenue and Forecast, by Indication (2021-2033)

11.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Indication (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Indication (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

Chapter 12. Company Profiles

12.1. Abbott Nutrition.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Pfizer Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Bayer AG.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Nestle.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Baxter International Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Otsuka Holdings Co., Ltd.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Mead Johnson & Company, LLC.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Danone (Nutricia)

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Victus, Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Fresenius Kabi

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others