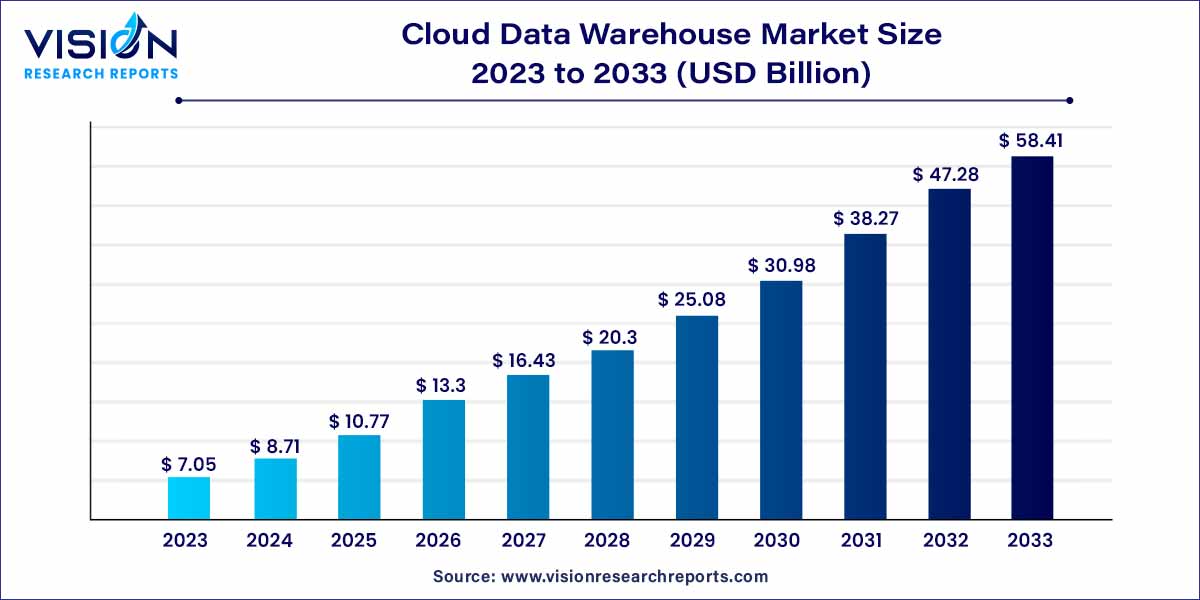

The global cloud data warehouse market size was estimated at around USD 7.05 billion in 2023 and it is projected to hit around USD 58.41 billion by 2033, growing at a CAGR of 23.54% from 2024 to 2033. The cloud data warehouse market is driven by the increasing adoption of cloud-based solutions across industries.

In recent years, the cloud data warehouse market has witnessed substantial growth, driven by the increasing adoption of cloud-based solutions across industries. As organizations seek scalable and flexible data storage and analytics solutions, cloud data warehouses have emerged as pivotal components in modern data management strategies.

The growth of the cloud data warehouse market can be attributed to several key factors. Firstly, the rapid adoption of cloud technologies across industries has significantly contributed to the market's expansion. Organizations are increasingly recognizing the advantages of cloud-based solutions, such as enhanced agility, cost-effectiveness, and improved accessibility. The scalability and flexibility offered by cloud data warehouses are crucial drivers, allowing businesses to efficiently manage and analyze ever-increasing volumes of data. Additionally, the integration of advanced analytics capabilities, including machine learning and real-time analytics, has played a pivotal role in driving demand. The cost efficiency of cloud data warehouses, often following a pay-as-you-go model, appeals to businesses seeking robust data solutions without substantial upfront investments. Moreover, the emphasis on security and compliance in cloud data warehouses addresses growing data privacy concerns, instilling trust among businesses and customers.

| Report Coverage | Details |

| Growth rate from 2024 to 2033 | CAGR of 23.54% |

| Market Size in 2023 | USD 7.05 billion |

| Revenue Forecast by 2032 | USD 58.41 billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The cloud data warehouse market is categorized into enterprise DWaaS and data storage based on offerings, with the enterprise DWaaS segment dominating the market share in 2023. As the volume of data continues to surge across diverse industries, organizations are increasingly prioritizing efficient business operations. Leveraging data from various facets within the organization, businesses are making strategic decisions. To harness extensive data output, end users are turning to Enterprise Data Warehouse as a Service (DWaaS) solutions. These solutions store data from multiple sources and applications, offering centralized accessibility throughout the enterprise. Additionally, the cloud data warehouse's low installation costs and its flexibility in managing scalability provide organizations with convenient accessibility.

The cloud data warehouse market is divided based on organization size into SMEs and large enterprises, with the latter claiming the majority of the market share in 2023. Large enterprises, managing substantial volumes of data, traditionally store historical data in dedicated data warehouses, leading to increased operational costs. In contrast, cloud data warehouse platforms eliminate the need for physical infrastructure, offering easy accessibility through a centralized repository. This feature contributes to the growth of the large enterprises segment in the market.

The cloud data warehouse market is categorized by deployment type, distinguishing between public cloud and private cloud segments. In 2023, the public cloud deployment segment dominated the market share. Organizations of various sizes, aiming to reduce operational costs, commonly opt for public cloud deployment.

The public cloud offers additional benefits, including heightened reliability, absence of maintenance requirements, and nearly limitless scalability for data warehousing. Furthermore, the growing investment in collaboration, mobility, and remote working technologies is anticipated to bolster the growth of the public cloud deployment segment.

Segmented by vertical, the cloud data warehouse market includes telecom & ITES, government, BFSI, retail & consumer, healthcare, manufacturing & automotive, and others. In 2023, the healthcare segment emerged as the leader in market share. The healthcare industry is undergoing substantial transformations, with a notable embrace of advanced technologies such as AI, ML, and IoT-driven analytics. There is an increasing emphasis on information quality and a growing interest in streamlined pharmaceutical administrations.

Initially, the adoption of cloud data warehouse solutions in the healthcare vertical faced delays due to data complexities and the diverse nature of medical data. However, in recent years, the widespread utilization of cloud data warehouse solutions has proven beneficial in both administrative and clinical settings. Historical data is now applied across various applications, ranging from enhancing patient health to facilitating medicinal testing.

Categorized by application, the cloud data warehouse market includes segments such as customer analytics, data modernization, business intelligence, predictive analytics, and others. In 2023, the business intelligence segment dominated the market share, underscoring the pivotal role of data warehouse storage in business intelligence operations.

The escalating reliance on cloud-based services has led to an increased dependence on business intelligence operations. Key functionalities of business intelligence solutions include dashboards, data visualization, and providing analytical insights. These tools are instrumental in aiding organizations to enhance data classifications and reporting. Consequently, the growing utilization of business intelligence technologies is driving the market demand for data warehouse services.

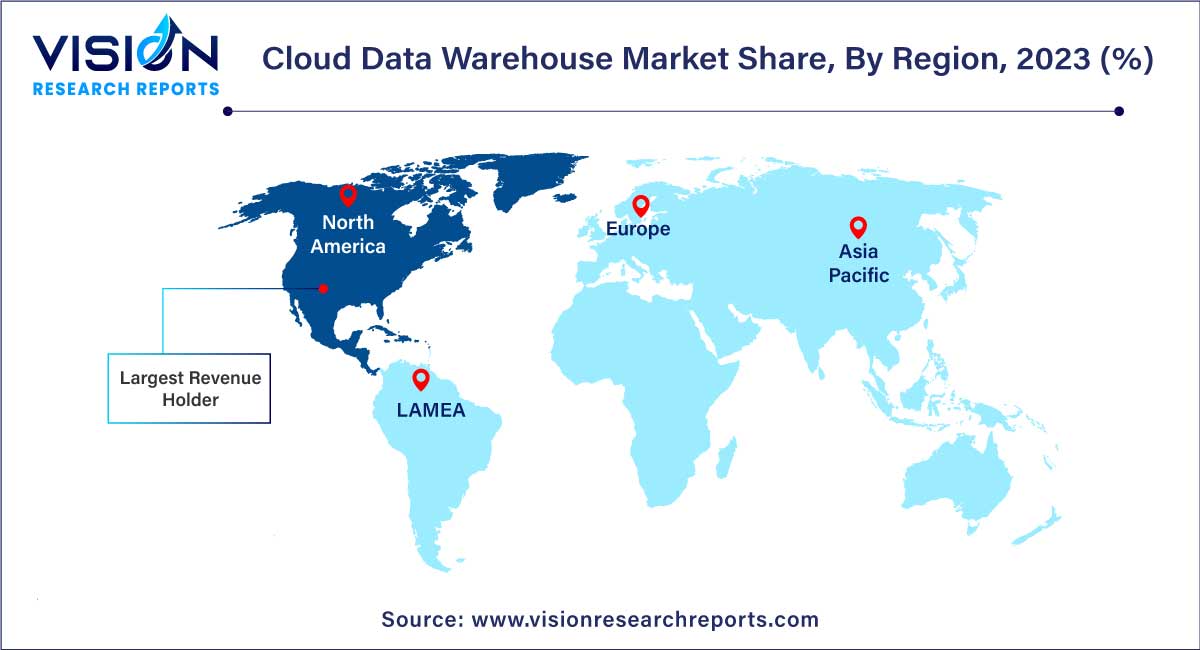

In 2023, North America asserted its dominance in the market. The proliferation of the big data trend within U.S. organizations is a key driver behind the heightened demand for analytics, consequently contributing to the overall growth of the market. Anticipated growth in the regional market is closely tied to the increasing demand for analytics, emphasizing minimal latency, and the expanding role of Business Intelligence (BI) in effective company management.

The emergence of advanced cloud warehouse facilities adds a layer of flexibility while incorporating the latest information and sources. This addresses challenges such as data complexity, diversity, volume, and velocity. The adoption of these cloud-based solutions in North America is expected to continue driving market expansion.

By Offering

By Organization Size

By Deployment Type

By Vertical

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Cloud Data Warehouse Market

5.1. COVID-19 Landscape: Cloud Data Warehouse Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Cloud Data Warehouse Market, By Offering

8.1. Cloud Data Warehouse Market, by Offering, 2024-2033

8.1.1. Enterprise DWaaS

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Data Storage

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Cloud Data Warehouse Market, By Organization Size

9.1. Cloud Data Warehouse Market, by Organization Size, 2024-2033

9.1.1. SMEs

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Large Enterprises

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Cloud Data Warehouse Market, By Deployment Type

10.1. Cloud Data Warehouse Market, by Deployment Type, 2024-2033

10.1.1. Public Cloud

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Private Cloud

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Cloud Data Warehouse Market, By Vertical

11.1. Cloud Data Warehouse Market, by Vertical, 2024-2033

11.1.1. Telecom & Ites

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Government

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. BFSI

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Retail & Consumer

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Healthcare

11.1.5.1. Market Revenue and Forecast (2021-2033)

11.1.6. Manufacturing & Automotive

11.1.6.1. Market Revenue and Forecast (2021-2033)

11.1.7. Others

11.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Cloud Data Warehouse Market, By Application

12.1. Cloud Data Warehouse Market, by Application, 2024-2033

12.1.1. Customer Analytics

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. Data Modernization

12.1.2.1. Market Revenue and Forecast (2021-2033)

12.1.3. Business Intelligence

12.1.3.1. Market Revenue and Forecast (2021-2033)

12.1.4. Predictive Analytics

12.1.4.1. Market Revenue and Forecast (2021-2033)

12.1.5. Others

12.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 13. Global Cloud Data Warehouse Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Offering (2021-2033)

13.1.2. Market Revenue and Forecast, by Organization Size (2021-2033)

13.1.3. Market Revenue and Forecast, by Deployment Type (2021-2033)

13.1.4. Market Revenue and Forecast, by Vertical (2021-2033)

13.1.5. Market Revenue and Forecast, by Application (2021-2033)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Offering (2021-2033)

13.1.6.2. Market Revenue and Forecast, by Organization Size (2021-2033)

13.1.6.3. Market Revenue and Forecast, by Deployment Type (2021-2033)

13.1.6.4. Market Revenue and Forecast, by Vertical (2021-2033)

13.1.7. Market Revenue and Forecast, by Application (2021-2033)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Offering (2021-2033)

13.1.8.2. Market Revenue and Forecast, by Organization Size (2021-2033)

13.1.8.3. Market Revenue and Forecast, by Deployment Type (2021-2033)

13.1.8.4. Market Revenue and Forecast, by Vertical (2021-2033)

13.1.8.5. Market Revenue and Forecast, by Application (2021-2033)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Offering (2021-2033)

13.2.2. Market Revenue and Forecast, by Organization Size (2021-2033)

13.2.3. Market Revenue and Forecast, by Deployment Type (2021-2033)

13.2.4. Market Revenue and Forecast, by Vertical (2021-2033)

13.2.5. Market Revenue and Forecast, by Application (2021-2033)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Offering (2021-2033)

13.2.6.2. Market Revenue and Forecast, by Organization Size (2021-2033)

13.2.6.3. Market Revenue and Forecast, by Deployment Type (2021-2033)

13.2.7. Market Revenue and Forecast, by Vertical (2021-2033)

13.2.8. Market Revenue and Forecast, by Application (2021-2033)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Offering (2021-2033)

13.2.9.2. Market Revenue and Forecast, by Organization Size (2021-2033)

13.2.9.3. Market Revenue and Forecast, by Deployment Type (2021-2033)

13.2.10. Market Revenue and Forecast, by Vertical (2021-2033)

13.2.11. Market Revenue and Forecast, by Application (2021-2033)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Offering (2021-2033)

13.2.12.2. Market Revenue and Forecast, by Organization Size (2021-2033)

13.2.12.3. Market Revenue and Forecast, by Deployment Type (2021-2033)

13.2.12.4. Market Revenue and Forecast, by Vertical (2021-2033)

13.2.13. Market Revenue and Forecast, by Application (2021-2033)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Offering (2021-2033)

13.2.14.2. Market Revenue and Forecast, by Organization Size (2021-2033)

13.2.14.3. Market Revenue and Forecast, by Deployment Type (2021-2033)

13.2.14.4. Market Revenue and Forecast, by Vertical (2021-2033)

13.2.15. Market Revenue and Forecast, by Application (2021-2033)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Offering (2021-2033)

13.3.2. Market Revenue and Forecast, by Organization Size (2021-2033)

13.3.3. Market Revenue and Forecast, by Deployment Type (2021-2033)

13.3.4. Market Revenue and Forecast, by Vertical (2021-2033)

13.3.5. Market Revenue and Forecast, by Application (2021-2033)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Offering (2021-2033)

13.3.6.2. Market Revenue and Forecast, by Organization Size (2021-2033)

13.3.6.3. Market Revenue and Forecast, by Deployment Type (2021-2033)

13.3.6.4. Market Revenue and Forecast, by Vertical (2021-2033)

13.3.7. Market Revenue and Forecast, by Application (2021-2033)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Offering (2021-2033)

13.3.8.2. Market Revenue and Forecast, by Organization Size (2021-2033)

13.3.8.3. Market Revenue and Forecast, by Deployment Type (2021-2033)

13.3.8.4. Market Revenue and Forecast, by Vertical (2021-2033)

13.3.9. Market Revenue and Forecast, by Application (2021-2033)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Offering (2021-2033)

13.3.10.2. Market Revenue and Forecast, by Organization Size (2021-2033)

13.3.10.3. Market Revenue and Forecast, by Deployment Type (2021-2033)

13.3.10.4. Market Revenue and Forecast, by Vertical (2021-2033)

13.3.10.5. Market Revenue and Forecast, by Application (2021-2033)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Offering (2021-2033)

13.3.11.2. Market Revenue and Forecast, by Organization Size (2021-2033)

13.3.11.3. Market Revenue and Forecast, by Deployment Type (2021-2033)

13.3.11.4. Market Revenue and Forecast, by Vertical (2021-2033)

13.3.11.5. Market Revenue and Forecast, by Application (2021-2033)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Offering (2021-2033)

13.4.2. Market Revenue and Forecast, by Organization Size (2021-2033)

13.4.3. Market Revenue and Forecast, by Deployment Type (2021-2033)

13.4.4. Market Revenue and Forecast, by Vertical (2021-2033)

13.4.5. Market Revenue and Forecast, by Application (2021-2033)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Offering (2021-2033)

13.4.6.2. Market Revenue and Forecast, by Organization Size (2021-2033)

13.4.6.3. Market Revenue and Forecast, by Deployment Type (2021-2033)

13.4.6.4. Market Revenue and Forecast, by Vertical (2021-2033)

13.4.7. Market Revenue and Forecast, by Application (2021-2033)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Offering (2021-2033)

13.4.8.2. Market Revenue and Forecast, by Organization Size (2021-2033)

13.4.8.3. Market Revenue and Forecast, by Deployment Type (2021-2033)

13.4.8.4. Market Revenue and Forecast, by Vertical (2021-2033)

13.4.9. Market Revenue and Forecast, by Application (2021-2033)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Offering (2021-2033)

13.4.10.2. Market Revenue and Forecast, by Organization Size (2021-2033)

13.4.10.3. Market Revenue and Forecast, by Deployment Type (2021-2033)

13.4.10.4. Market Revenue and Forecast, by Vertical (2021-2033)

13.4.10.5. Market Revenue and Forecast, by Application (2021-2033)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Offering (2021-2033)

13.4.11.2. Market Revenue and Forecast, by Organization Size (2021-2033)

13.4.11.3. Market Revenue and Forecast, by Deployment Type (2021-2033)

13.4.11.4. Market Revenue and Forecast, by Vertical (2021-2033)

13.4.11.5. Market Revenue and Forecast, by Application (2021-2033)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Offering (2021-2033)

13.5.2. Market Revenue and Forecast, by Organization Size (2021-2033)

13.5.3. Market Revenue and Forecast, by Deployment Type (2021-2033)

13.5.4. Market Revenue and Forecast, by Vertical (2021-2033)

13.5.5. Market Revenue and Forecast, by Application (2021-2033)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Offering (2021-2033)

13.5.6.2. Market Revenue and Forecast, by Organization Size (2021-2033)

13.5.6.3. Market Revenue and Forecast, by Deployment Type (2021-2033)

13.5.6.4. Market Revenue and Forecast, by Vertical (2021-2033)

13.5.7. Market Revenue and Forecast, by Application (2021-2033)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Offering (2021-2033)

13.5.8.2. Market Revenue and Forecast, by Organization Size (2021-2033)

13.5.8.3. Market Revenue and Forecast, by Deployment Type (2021-2033)

13.5.8.4. Market Revenue and Forecast, by Vertical (2021-2033)

13.5.8.5. Market Revenue and Forecast, by Application (2021-2033)

Chapter 14. Company Profiles

14.1. Amazon Web Services Inc.

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. International Business Machines Corp. (IBM)

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Microsoft Corporation

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Google LLC

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Oracle Corporation

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. SAP SE

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Snowflake Inc.

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. Yellowbrick Data

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Teradata Corporation

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Cloudera Inc.

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others