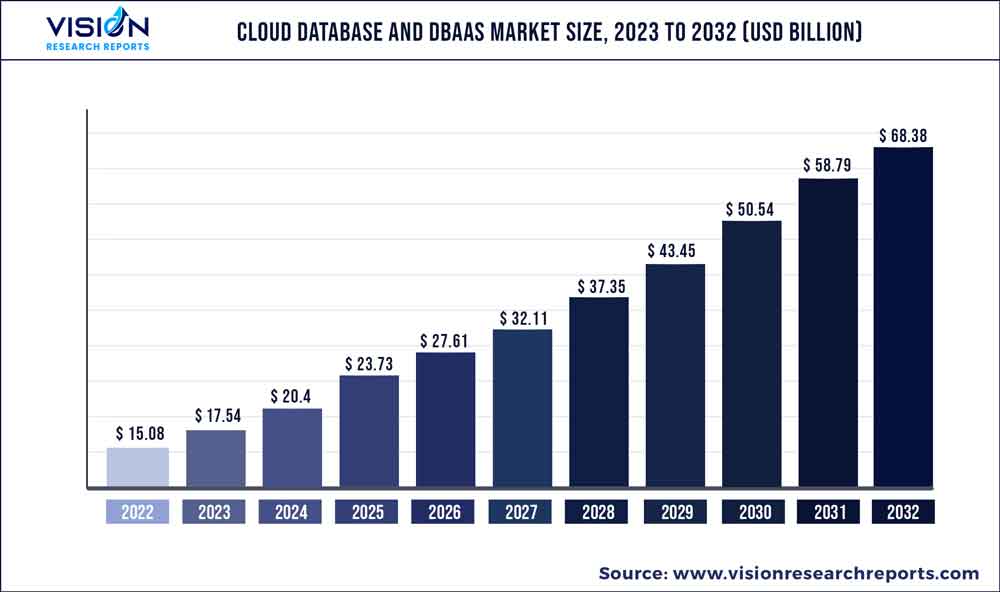

The global cloud database and DBaaS market was estimated at USD 15.08 billion in 2022 and it is expected to surpass around USD 68.38 billion by 2032, poised to grow at a CAGR of 16.32% from 2023 to 2032.

Key Pointers

Report Scope of the Cloud Database And DBaaS Market

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 35.16% |

| CAGR of Asia Pacific | 19.32% |

| Revenue Forecast by 2032 | USD 68.38 billion |

| Growth Rate from 2023 to 2032 | CAGR of 16.32% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Google LLC; Nutanix; Oracle Corp.; IBM Corp.; SAP SE; Amazon Web Services, Inc.; Alibaba Cloud; MongoDB, Inc.; Microsoft Corp.; Teradata; Ninox Software GmbH; DataStax |

The global market is expected to experience growth in the forecast period due to the surge in demand for business agility and the widespread adoption of automation solutions. The market growth will also be driven by the rising need for faster and easier application deployment using a pay-as-you-go model, along with the increasing trend of integrating cloud-based database migration in business operations.The migration of databases to the cloud allows organizations to align their IT investments more effectively with business needs, while also reaping the efficiency benefits that come with cloud economies of scale.

With modern infrastructure and cloud capabilities, an organization’s IT staff can prioritize the applications that are most crucial to their customers, freeing up valuable resources for other essential tasks. By component, the solution segment accounted for the major revenue share of 54.32% in 2022 and is anticipated to maintain its dominance over the forecast period. Cloud database and DBaaS providers provide a range of solutions to their clients, which include basic database hosting, as well as advanced analytics and data management services. One of the significant advantages of this solution is that it enables businesses to concentrate on their primary operations while leaving database management to professionals. Furthermore, the pay-as-you-go model for application deployment and the availability of advanced analytics and data management services is driving the market growth.

The service segment is expected to witness the highest growth rate of 17.31% during the forecast period owing to the constant need for regular backups, security updates, and performance optimization. In terms of deployment, the hybrid cloud segment dominated the industry and captured the highest revenue share of 47.8% in 2022. The hybrid cloud model is proving to be one of the preferred cloud database deployments among the majority of organizations as it offers them greater flexibility in data management. In addition, it allows organizations to keep their most sensitive and critical data on-premises, while leveraging cloud databases for less critical data or to handle surges in demand. The private cloud segment is anticipated to witness the highest growth rate of 19.22% during the forecast period. Enhanced control over the infrastructure & data is driving the segment growth.

Based on end-uses, the IT and telecommunication segment held a major revenue share of 17.9% in 2022. It is expected to maintain its dominance over the forecast period owing to the increasing volume of data generated by IT and telecommunication companies; and the need for more agile & scalable database infrastructure to support new business initiatives & digital transformation efforts. According to a 2021 Eurostat survey, the IT and telecommunications sector had the highest adoption rate of cloud computing services at 76%, followed by the professional, scientific, and technical operations sector at 56%. The automotive industry is expected to grow at a CAGR of 19.0% during the forecast period. The increasing volumes of data generated by connected cars are fueling the adoption of cloud databases and DBaaS solutions among automotive companies.

North America held the highest market share of 35.16% in 2022 and is anticipated to grow over the forecast period owing to the rise of big data and analytics. With more data being generated and collected than ever before, companies need a way to store and manage their data effectively. Cloud databases are particularly well-suited for migrating the company’s database as it offers powerful analytical tools that can help companies derive insights from their unstructured datasets quickly and easily. Asia Pacific is expected to grow at the highest CAGR of 19.32% during the forecast period owing to the increasing adoption of mobile and Internet of Things (IoT) technologies. These technologies generate vast amounts of data that need to be stored and analyzed in real-time, therefore cloud databases are well-suited to handling such huge workloads.

Component Insights

In terms of components, the market is further segmented into solutions and services. The solution segment is further bifurcated into database management and storage. The solution segment accounted for the largest revenue share of 54.32% in 2022 and is expected to continue to dominate the industry over the forecast period. The solution segment refers to the range of offerings cloud databases and DBaaS providers provide their customers to meet their specific database needs. The solution segment includes many services, such as data migration, backup & recovery, performance tuning, security, and scalability. These services help businesses optimize their database infrastructure, reduce costs, and improve their efficiency.

Cloud database and DBaaS providers offer a variety of solutions to their customers, ranging from primary database hosting to advanced analytics and data management services. The service segment is anticipated to witness the highest growth rate of 17.31% during the forecast period. The service segment is bifurcated into professional services and managed services. The market refers to vendor offerings help organizations implement, manage, and optimize their cloud databases. These services further encompass consultation, support, training, migration, and ongoing maintenance and monitoring.

Consultation services can help organizations determine which type of cloud database or DBaaS solution is best suited for their needs and provide guidance on implementing and integrating it with their existing systems. Support services are essential for ensuring that any issues or problems with the database are addressed quickly and effectively. Training services can help organizations get up to speed on using and optimizing their cloud database, while migration services can help them move their existing data to the cloud.

Database Type Insights

Based on the database type, the global cloud database and DBaaS market are sub-segmented into NoSQL and relational databases. The relational database segment held the largest revenue share of 59.01% in 2022. Relational databases have been a driving factor for the development of cloud databases due to their popularity in modern applications. As businesses and organizations have become more data-driven, the demand for efficient and scalable data storage solutions has significantly grown in recent years. Cloud databases provide an ideal solution for this need, as they offer flexible storage options and the ability to scale up or down as data need quick changes.

The NoSQL segment is anticipated to witness the highest growth rate of 17.37% during the forecast period. The emergence of NoSQL databases can be considered one of the driving factors behind the rise of cloud databases. NoSQL databases have been developed to address the limitations of traditional relational databases, which are designed to handle structured data in a highly consistent manner. However, with the advent of big data, social media, and the Internet of Things (IoT), there is a need for databases that could handle large amounts of unstructured data in a flexible and scalable way. Hence, such factors are driving the demand for the NoSQL database.

Deployment Insights

Based on the deployment, the global market is sub-segmented into public, private, and hybrid. The hybrid segment held the largest revenue share of 47.83% in 2022. The adoption of hybrid cloud databases has become increasingly popular as it provides businesses with the flexibility to use both on-premises and cloud-based databases. The hybrid approach allows companies to leverage the benefits of cloud-based databases, such as scalability and cost savings, while still maintaining control over their sensitive data and complying with data sovereignty regulations. In addition, a hybrid cloud database offers a flexible and cost-effective solution for businesses that want to maintain control over their sensitive data while also leveraging the benefits of cloud-based databases.

With the increasing adoption of hybrid cloud databases, it is anticipated to drive the market during the forecast period. On the other hand, the private cloud segment is expected to witness the highest CAGR of 19.22% during the forecast period. Private cloud infrastructure provides a dedicated and isolated environment for storing, processing, and managing data. Private cloud databases can be customized and optimized to meet the specific needs and requirements of the organization, such as performance, scalability, availability, and disaster recovery. Hence, such factors are expected to drive the segment growth during the forecast period.

Enterprise Size Insights

Based on enterprise size, the global market is segmented into Small- and Medium-sized Enterprises (SMEs) and large-sized enterprises. The large-sized enterprise segment held the largest revenue share of 53.06% in 2022 and is expected to maintain its position over the forecast period. Large enterprises are gaining a significant competitive edge by migrating to cloud database solutions due to rapid digital acceleration. Large-size organizations often have complex and diverse data requirements, which can be challenging to manage with traditional on-premises databases. Cloud databases offer virtually limitless scalability, allowing organizations to quickly and easily add more storage capacity or processing power quickly and efficiently as their data needs increase over time. This means they can avoid the costs and complexities of maintaining on-premises infrastructure.

In December 2022, Cockroach Labs, a cloud-native distributed SQL database company, partnered with Computacenter plc, independent technology and services provider to enhance and boost the widespread utilization of cloud-native technology. This collaboration enables large enterprises to streamline migrations, automate manual tasks, and boost effectiveness and efficiency. On the other hand, the SMEs segment is anticipated to witness the highest CAGR of 17.23% during the forecast period. SMEs are increasingly adopting cloud database and Database-as-a-Service (DBaaS) solutions. Cloud databases and DBaaS solutions can offer SMEs a cost-effective, scalable, and reliable way to manage their data without needing expensive on-premises infrastructure. One of the key benefits of cloud databases and DBaaS for SMEs is that it can provide a more cost-effective way to manage their data.

End-use Industry Insights

Based on the end-use, the global market is segmented into IT & telecommunications, BFSI, healthcare, government & public sector, manufacturing, automotive, retail & consumer goods, media & entertainment, and others. The IT & telecommunications segment held the largest revenue share of 17.92% in 2022 and is expected to maintain its position over the forecast period. Cloud database technologies and DBaaS offerings allow IT & telecommunication companies to quickly provision and scale their database infrastructure without needing physical hardware.

This can significantly reduce the time and resources required to manage and maintain databases while providing greater agility and scalability to support changing business needs. In addition to database provisioning and management, DBaaS providers offer a range of features and services to help IT & telecommunication companies optimize their database infrastructure. These include backup and recovery services, automatic scaling, load balancing, and security features, such as encryption and access control. The cloud database and DBaaS market for IT & telecommunication is expected to grow in the coming years as more companies move their database infrastructure to the cloud.

The automotive segment is anticipated to witness the highest growth rate of 19.07% during the forecast period. The automotive industry increasingly adopts cloud databases and Database-as-a-Service (DBaaS) solutions to manage their data, optimize their operations, and deliver better customer experiences. With cloud databases, automotive companies can store and process vast amounts of data generated by their vehicles, customers, and operations. Cloud databases and DBaaS solutions can store and process data from various sources, including sensors, IoT devices, and customer interactions, which can help the industry in making better decisions based on the collected data.

Regional Insights

North America dominated the market with a share of 35.16% in 2022 and is anticipated to dominate over the forecast period. There has been a significant increase in the demand for cloud databases in North America in recent years. This growth is driven by several factors, including the increased adoption of cloud-based technologies across various industries and the rise of big data & analytics. Also, the expansion of cloud computing is one of the main factors driving the growth of cloud databases in the region. As more businesses move to the cloud, the demand for cloud-based data storage solutions is rising.

Organizations in the region are launching the latest updates to their cloud database solutions to gain a competitive edge over their competitors. For instance, in October 2022, Nutanix announced the launch of the latest update to its Nutanix Cloud Cluster hybrid cloud component, which allows organizations to operate the Nutanix Cloud Platform software on Microsoft Azure. NC2 is a hybrid multi-cloud system, supporting both the AWS and Azure clouds. It enables consumers' VNets running enterprise applications to utilize Azure services rapidly. Asia Pacific is anticipated to grow at the highest CAGR of 19.32% during the forecast period.

The regional market is driven by the rise in investments by cloud computing companies. For instance, in September 2022, Alibaba Cloud, the cloud computing subsidiary of Alibaba.com, announced its plans to invest USD 1 billion to help customers adopt cloud computing solutions, reignite growth, and bolster the company’s market position. The investment is specifically focused on offering cloud computing services, including data storage, Artificial Intelligence (AI), and analytics capabilities, to customers across various industries. The move comes amid fierce competition in the cloud computing market in China and globally, with tech giants like Tencent, Huawei Technologies Co., Ltd., and Amazon Web Services, Inc. competing over gaining market share.

Cloud Database And DBaaS Market Segmentations:

By Component

By Database Type

By Deployment

By Enterprise Size

By End-use Industry

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Cloud Database And DBaaS Market

5.1. COVID-19 Landscape: Cloud Database And DBaaS Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Cloud Database And DBaaS Market, By Component

8.1. Cloud Database And DBaaS Market, by Component, 2023-2032

8.1.1. Solution

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Service

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Cloud Database And DBaaS Market, By Database Type

9.1. Cloud Database And DBaaS Market, by Database Type, 2023-2032

9.1.1. NoSQL

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Relational Database

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Cloud Database And DBaaS Market, By Deployment

10.1. Cloud Database And DBaaS Market, by Deployment, 2023-2032

10.1.1. Public

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Private

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Hybrid

10.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Cloud Database And DBaaS Market, By Enterprise Size

11.1. Cloud Database And DBaaS Market, by Enterprise Size, 2023-2032

11.1.1. Large Size Enterprises

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Small and Medium Sized Enterprises (SMEs)

11.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Cloud Database And DBaaS Market, By End-use Industry

12.1. Cloud Database And DBaaS Market, by End-use Industry, 2023-2032

12.1.1. IT & Telecommunications

12.1.1.1. Market Revenue and Forecast (2020-2032)

12.1.2. BFSI

12.1.2.1. Market Revenue and Forecast (2020-2032)

12.1.3. Healthcare

12.1.3.1. Market Revenue and Forecast (2020-2032)

12.1.4. Government & Public Sector

12.1.4.1. Market Revenue and Forecast (2020-2032)

12.1.5. Manufacturing

12.1.5.1. Market Revenue and Forecast (2020-2032)

12.1.6. Automotive

12.1.6.1. Market Revenue and Forecast (2020-2032)

12.1.7. Retail & Consumer Goods

12.1.7.1. Market Revenue and Forecast (2020-2032)

12.1.8. Media & Entertainment

12.1.8.1. Market Revenue and Forecast (2020-2032)

12.1.9. Others

12.1.9.1. Market Revenue and Forecast (2020-2032)

Chapter 13. Global Cloud Database And DBaaS Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Component (2020-2032)

13.1.2. Market Revenue and Forecast, by Database Type (2020-2032)

13.1.3. Market Revenue and Forecast, by Deployment (2020-2032)

13.1.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.1.5. Market Revenue and Forecast, by End-use Industry (2020-2032)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Component (2020-2032)

13.1.6.2. Market Revenue and Forecast, by Database Type (2020-2032)

13.1.6.3. Market Revenue and Forecast, by Deployment (2020-2032)

13.1.6.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.1.7. Market Revenue and Forecast, by End-use Industry (2020-2032)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Component (2020-2032)

13.1.8.2. Market Revenue and Forecast, by Database Type (2020-2032)

13.1.8.3. Market Revenue and Forecast, by Deployment (2020-2032)

13.1.8.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.1.8.5. Market Revenue and Forecast, by End-use Industry (2020-2032)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Component (2020-2032)

13.2.2. Market Revenue and Forecast, by Database Type (2020-2032)

13.2.3. Market Revenue and Forecast, by Deployment (2020-2032)

13.2.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.2.5. Market Revenue and Forecast, by End-use Industry (2020-2032)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Component (2020-2032)

13.2.6.2. Market Revenue and Forecast, by Database Type (2020-2032)

13.2.6.3. Market Revenue and Forecast, by Deployment (2020-2032)

13.2.7. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.2.8. Market Revenue and Forecast, by End-use Industry (2020-2032)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Component (2020-2032)

13.2.9.2. Market Revenue and Forecast, by Database Type (2020-2032)

13.2.9.3. Market Revenue and Forecast, by Deployment (2020-2032)

13.2.10. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.2.11. Market Revenue and Forecast, by End-use Industry (2020-2032)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Component (2020-2032)

13.2.12.2. Market Revenue and Forecast, by Database Type (2020-2032)

13.2.12.3. Market Revenue and Forecast, by Deployment (2020-2032)

13.2.12.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.2.13. Market Revenue and Forecast, by End-use Industry (2020-2032)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Component (2020-2032)

13.2.14.2. Market Revenue and Forecast, by Database Type (2020-2032)

13.2.14.3. Market Revenue and Forecast, by Deployment (2020-2032)

13.2.14.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.2.15. Market Revenue and Forecast, by End-use Industry (2020-2032)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Component (2020-2032)

13.3.2. Market Revenue and Forecast, by Database Type (2020-2032)

13.3.3. Market Revenue and Forecast, by Deployment (2020-2032)

13.3.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.3.5. Market Revenue and Forecast, by End-use Industry (2020-2032)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Component (2020-2032)

13.3.6.2. Market Revenue and Forecast, by Database Type (2020-2032)

13.3.6.3. Market Revenue and Forecast, by Deployment (2020-2032)

13.3.6.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.3.7. Market Revenue and Forecast, by End-use Industry (2020-2032)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Component (2020-2032)

13.3.8.2. Market Revenue and Forecast, by Database Type (2020-2032)

13.3.8.3. Market Revenue and Forecast, by Deployment (2020-2032)

13.3.8.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.3.9. Market Revenue and Forecast, by End-use Industry (2020-2032)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Component (2020-2032)

13.3.10.2. Market Revenue and Forecast, by Database Type (2020-2032)

13.3.10.3. Market Revenue and Forecast, by Deployment (2020-2032)

13.3.10.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.3.10.5. Market Revenue and Forecast, by End-use Industry (2020-2032)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Component (2020-2032)

13.3.11.2. Market Revenue and Forecast, by Database Type (2020-2032)

13.3.11.3. Market Revenue and Forecast, by Deployment (2020-2032)

13.3.11.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.3.11.5. Market Revenue and Forecast, by End-use Industry (2020-2032)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Component (2020-2032)

13.4.2. Market Revenue and Forecast, by Database Type (2020-2032)

13.4.3. Market Revenue and Forecast, by Deployment (2020-2032)

13.4.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.4.5. Market Revenue and Forecast, by End-use Industry (2020-2032)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Component (2020-2032)

13.4.6.2. Market Revenue and Forecast, by Database Type (2020-2032)

13.4.6.3. Market Revenue and Forecast, by Deployment (2020-2032)

13.4.6.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.4.7. Market Revenue and Forecast, by End-use Industry (2020-2032)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Component (2020-2032)

13.4.8.2. Market Revenue and Forecast, by Database Type (2020-2032)

13.4.8.3. Market Revenue and Forecast, by Deployment (2020-2032)

13.4.8.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.4.9. Market Revenue and Forecast, by End-use Industry (2020-2032)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Component (2020-2032)

13.4.10.2. Market Revenue and Forecast, by Database Type (2020-2032)

13.4.10.3. Market Revenue and Forecast, by Deployment (2020-2032)

13.4.10.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.4.10.5. Market Revenue and Forecast, by End-use Industry (2020-2032)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Component (2020-2032)

13.4.11.2. Market Revenue and Forecast, by Database Type (2020-2032)

13.4.11.3. Market Revenue and Forecast, by Deployment (2020-2032)

13.4.11.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.4.11.5. Market Revenue and Forecast, by End-use Industry (2020-2032)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Component (2020-2032)

13.5.2. Market Revenue and Forecast, by Database Type (2020-2032)

13.5.3. Market Revenue and Forecast, by Deployment (2020-2032)

13.5.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.5.5. Market Revenue and Forecast, by End-use Industry (2020-2032)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Component (2020-2032)

13.5.6.2. Market Revenue and Forecast, by Database Type (2020-2032)

13.5.6.3. Market Revenue and Forecast, by Deployment (2020-2032)

13.5.6.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.5.7. Market Revenue and Forecast, by End-use Industry (2020-2032)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Component (2020-2032)

13.5.8.2. Market Revenue and Forecast, by Database Type (2020-2032)

13.5.8.3. Market Revenue and Forecast, by Deployment (2020-2032)

13.5.8.4. Market Revenue and Forecast, by Enterprise Size (2020-2032)

13.5.8.5. Market Revenue and Forecast, by End-use Industry (2020-2032)

Chapter 14. Company Profiles

14.1. Google LLC

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Nutanix

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Oracle Corp.

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. IBM Corp.

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. SAP SE

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Amazon Web Services, Inc.

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Alibaba Cloud

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. MongoDB, Inc.

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Microsoft Corp.

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Teradata

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others