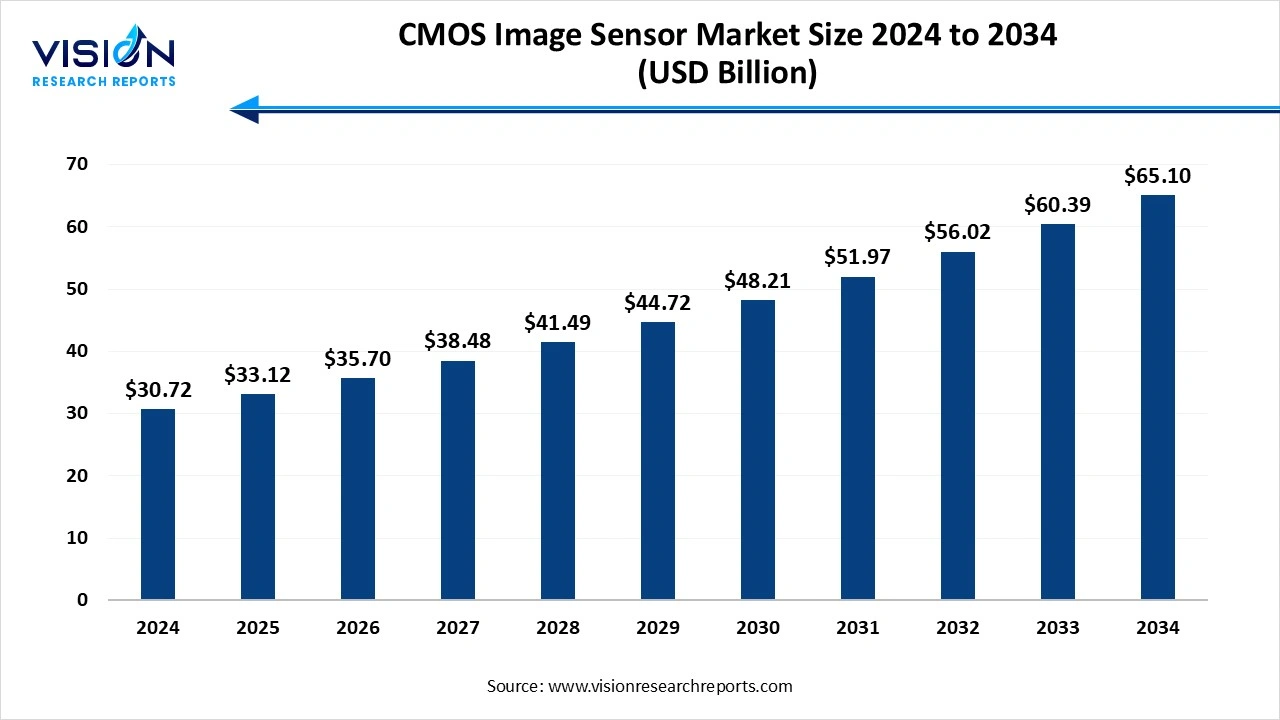

The global CMOS image sensor market size was valued at around USD 30.72 billion in 2024 and it is projected to hit around USD 65.10 billion by 2034, growing at a CAGR of 7.80% from 2025 to 2034.

The CMOS image sensor market has experienced significant growth in recent years, driven by increasing demand for high-resolution imaging across a range of industries, including consumer electronics, automotive, healthcare, and industrial sectors. CMOS (Complementary Metal-Oxide-Semiconductor) technology enables compact, energy-efficient, and cost-effective image sensors, making it the preferred choice over traditional CCD (Charge-Coupled Device) sensors in many applications. The growing integration of advanced camera systems in smartphones, surveillance systems, and autonomous vehicles is fueling the adoption of CMOS image sensors globally.

The growth of the CMOS image sensor market is primarily driven by the rising demand for high-performance imaging in smartphones, tablets, and digital cameras. As consumers increasingly prioritize camera quality in mobile devices, manufacturers are focusing on incorporating advanced CMOS sensors with higher resolution, better low-light performance, and improved power efficiency. The expansion of social media and digital content creation has further accelerated this trend, making high-quality imaging a key competitive feature in consumer electronics.

Another key growth factor is the rapid adoption of CMOS sensors in automotive and industrial applications. Advanced Driver Assistance Systems (ADAS), autonomous vehicles, and machine vision systems rely heavily on real-time, high-resolution imaging to function effectively. CMOS sensors provide the fast readout speeds and reliability required for these safety-critical and automation-driven applications.

One of the primary challenges faced by the CMOS image sensor market is the increasing complexity and cost of manufacturing advanced sensors. As demand grows for higher resolution, better low-light performance, and enhanced features like AI processing, manufacturers must invest heavily in research, development, and precision fabrication technologies. This creates high entry barriers for new players and adds financial pressure on existing companies to continuously innovate while maintaining competitive pricing. Additionally, yield issues during the production of ultra-small and complex sensors can result in higher costs and delayed time-to-market.

Another significant challenge is the growing competition and market saturation, especially in consumer electronics like smartphones and cameras. With many manufacturers offering similar performance levels, differentiation becomes difficult, pushing companies to compete primarily on price. This can lead to shrinking profit margins and limit the scope for investment in long-term innovation.

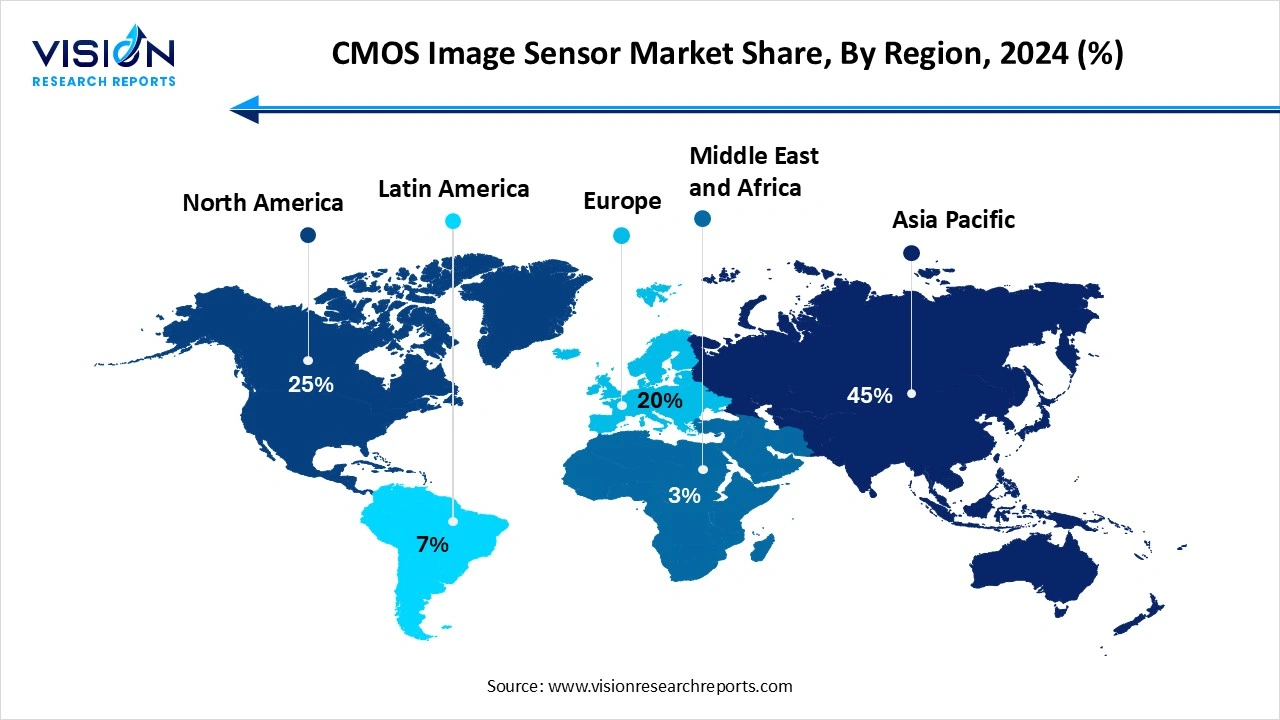

The Asia Pacific CMOS image sensor market led the global industry, accounting for a 45% share of the total revenue in 2024. The region benefits from the presence of major semiconductor and electronics companies that lead in the development and mass production of CMOS image sensors. Additionally, the rising demand for smartphones, surveillance systems, and automotive applications in emerging economies within Asia Pacific continues to drive the growth of the market. Government initiatives to promote industrial automation and smart cities further boost the adoption of advanced imaging technologies across the region.

The North America CMOS image sensor market is projected to experience substantial growth at a notable CAGR during the forecast period from 2025 to 2034. The region is witnessing increased adoption of CMOS sensors in autonomous vehicles, wearable medical devices, and industrial robotics. Technological advancements and a robust research and development infrastructure support innovation in imaging solutions, contributing to market expansion. Meanwhile, Europe also plays a vital role in the global CMOS image sensor landscape, with emphasis on automotive safety systems, industrial inspection, and surveillance technologies.

The North America CMOS image sensor market is projected to experience substantial growth at a notable CAGR during the forecast period from 2025 to 2034. The region is witnessing increased adoption of CMOS sensors in autonomous vehicles, wearable medical devices, and industrial robotics. Technological advancements and a robust research and development infrastructure support innovation in imaging solutions, contributing to market expansion. Meanwhile, Europe also plays a vital role in the global CMOS image sensor landscape, with emphasis on automotive safety systems, industrial inspection, and surveillance technologies.

The visible segment held the largest market share, accounting for 70% of the total in 2024. Visible spectrum CMOS image sensors are the most widely used, particularly in consumer electronics such as smartphones, digital cameras, laptops, and webcams. These sensors are engineered to capture images that mimic human vision, making them ideal for photography, video recording, and real-time video communication. Continuous advancements in pixel technology, resolution, and low-light performance have enhanced the quality of visible light sensors, further fueling their integration into a wide range of devices across both personal and professional use cases.

The non-visible segment is expected to register the fastest CAGR throughout the forecast period. are gaining traction in specialized applications. These sensors are increasingly used in automotive safety systems, industrial automation, healthcare diagnostics, surveillance, and scientific research. For instance, infrared CMOS sensors are integral to night vision cameras, thermal imaging, and proximity sensing. In healthcare, non-visible imaging enables more accurate diagnostics through advanced medical imaging systems. Although currently serving niche markets, the demand for non-visible spectrum sensors is expected to rise significantly with the growth of smart technologies, autonomous systems, and contactless monitoring solutions.

The 3D segment led the market with the highest revenue share in 2024, driven by the growing use of augmented reality (AR) and virtual reality (VR) technologies. These sensors are designed to capture spatial data, enabling applications such as facial recognition, gesture control, AR/VR experiences, robotics, and autonomous vehicles. The integration of 3D imaging technology is becoming a critical feature in smartphones and security systems, particularly with the rise of biometric authentication and immersive interfaces.

The 2D segment is anticipated to witness substantial growth at a notable CAGR over the forecast period. 2D CMOS image sensors are preferred for their cost-effectiveness, fast response times, and compatibility with a wide range of devices such as smartphones, digital cameras, and medical equipment. These sensors offer excellent image quality under standard lighting conditions and are ideal for applications where depth information is not critical.

The above 16 MP segment captured the highest revenue share in the market in 2024. The demand for high-resolution sensors is also increasing in sectors such as medical imaging, drone technology, and AR/VR applications, where precision and high data fidelity are critical. These sensors are capable of capturing fine details and producing sharp images even when zoomed or cropped, which is vital for content creators and industries relying on detailed visual analysis.

The 5 MP to 12 MP segment is projected to register the fastest CAGR throughout the forecast period. The 5 MP to 12 MP segment holds a significant share in the market due to its wide adoption in mainstream applications such as mid-range smartphones, tablets, webcams, automotive cameras, and industrial imaging systems. These sensors strike a balance between image quality, processing efficiency, and cost, making them suitable for devices that require reliable performance without the high power consumption or processing load associated with ultra-high-resolution sensors.

The consumer electronics segment held the largest share of market revenue in 2024. This is primarily driven by the widespread integration of these sensors in smartphones, tablets, laptops, digital cameras, and wearable devices. As camera quality has become a key differentiator in consumer electronics, manufacturers continue to adopt advanced CMOS sensors that offer high resolution, low power consumption, and superior image processing capabilities. The rise of social media, mobile photography, and video streaming has further fueled demand for improved imaging performance, especially in mid-range and premium smartphones.

The healthcare and life sciences segment is anticipated to experience the highest CAGR during the forecast period. These sensors provide high-resolution imaging and real-time video capture, which are crucial for accurate diagnostics and minimally invasive procedures. Their compact size and high-speed performance make them ideal for integration into portable medical devices and point-of-care systems. Furthermore, the growing adoption of telemedicine and digital healthcare platforms has expanded the demand for high-quality medical imaging solutions.

By Spectrum

By Image Processing Technology

By Resolution

By End-use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on CMOS Image Sensor Market

5.1. COVID-19 Landscape: CMOS Image Sensor Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global CMOS Image Sensor Market, By Spectrum

8.1. CMOS Image Sensor Market, by Spectrum

8.1.1. Visible

8.1.1.1. Market Revenue and Forecast

8.1.2. Non-visible

8.1.2.1. Market Revenue and Forecast

Chapter 9. Global CMOS Image Sensor Market, By Image Processing Technology

9.1. CMOS Image Sensor Market, by Image Processing Technology

9.1.1. 2D

9.1.1.1. Market Revenue and Forecast

9.1.2. 3D

9.1.2.1. Market Revenue and Forecast

Chapter 10. Global CMOS Image Sensor Market, By Resolution

10.1. CMOS Image Sensor Market, by Resolution

10.1.1. Up to 5 MP

10.1.1.1. Market Revenue and Forecast

10.1.2. 5 MP to 12 MP

10.1.2.1. Market Revenue and Forecast

10.1.3. 12 MP to 16 MP

10.1.3.1. Market Revenue and Forecast

10.1.4. Above 16 MP

10.1.4.1. Market Revenue and Forecast

Chapter 11. Global CMOS Image Sensor Market, By End-use

11.1. CMOS Image Sensor Market, by End-use

11.1.1. Aerospace & Defense

11.1.1.1. Market Revenue and Forecast

11.1.2. Automotive

11.1.2.1. Market Revenue and Forecast

11.1.3. Consumer Electronics

11.1.3.1. Market Revenue and Forecast

11.1.4. Healthcare & Lifesciences

11.1.4.1. Market Revenue and Forecast

11.1.5. Industrial

11.1.5.1. Market Revenue and Forecast

11.1.6. Security & Surveillance

11.1.6.1. Market Revenue and Forecast

11.1.7. Others

11.1.7.1. Market Revenue and Forecast

Chapter 12. Global CMOS Image Sensor Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Spectrum

12.1.2. Market Revenue and Forecast, by Image Processing Technology

12.1.3. Market Revenue and Forecast, by Resolution

12.1.4. Market Revenue and Forecast, by End-use

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Spectrum

12.1.5.2. Market Revenue and Forecast, by Image Processing Technology

12.1.5.3. Market Revenue and Forecast, by Resolution

12.1.5.4. Market Revenue and Forecast, by End-use

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Spectrum

12.1.6.2. Market Revenue and Forecast, by Image Processing Technology

12.1.6.3. Market Revenue and Forecast, by Resolution

12.1.6.4. Market Revenue and Forecast, by End-use

12.2. Europe

12.2.1. Market Revenue and Forecast, by Spectrum

12.2.2. Market Revenue and Forecast, by Image Processing Technology

12.2.3. Market Revenue and Forecast, by Resolution

12.2.4. Market Revenue and Forecast, by End-use

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Spectrum

12.2.5.2. Market Revenue and Forecast, by Image Processing Technology

12.2.5.3. Market Revenue and Forecast, by Resolution

12.2.5.4. Market Revenue and Forecast, by End-use

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Spectrum

12.2.6.2. Market Revenue and Forecast, by Image Processing Technology

12.2.6.3. Market Revenue and Forecast, by Resolution

12.2.6.4. Market Revenue and Forecast, by End-use

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Spectrum

12.2.7.2. Market Revenue and Forecast, by Image Processing Technology

12.2.7.3. Market Revenue and Forecast, by Resolution

12.2.7.4. Market Revenue and Forecast, by End-use

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Spectrum

12.2.8.2. Market Revenue and Forecast, by Image Processing Technology

12.2.8.3. Market Revenue and Forecast, by Resolution

12.2.8.4. Market Revenue and Forecast, by End-use

12.3. APAC

12.3.1. Market Revenue and Forecast, by Spectrum

12.3.2. Market Revenue and Forecast, by Image Processing Technology

12.3.3. Market Revenue and Forecast, by Resolution

12.3.4. Market Revenue and Forecast, by End-use

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Spectrum

12.3.5.2. Market Revenue and Forecast, by Image Processing Technology

12.3.5.3. Market Revenue and Forecast, by Resolution

12.3.5.4. Market Revenue and Forecast, by End-use

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Spectrum

12.3.6.2. Market Revenue and Forecast, by Image Processing Technology

12.3.6.3. Market Revenue and Forecast, by Resolution

12.3.6.4. Market Revenue and Forecast, by End-use

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Spectrum

12.3.7.2. Market Revenue and Forecast, by Image Processing Technology

12.3.7.3. Market Revenue and Forecast, by Resolution

12.3.7.4. Market Revenue and Forecast, by End-use

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Spectrum

12.3.8.2. Market Revenue and Forecast, by Image Processing Technology

12.3.8.3. Market Revenue and Forecast, by Resolution

12.3.8.4. Market Revenue and Forecast, by End-use

12.4. MEA

12.4.1. Market Revenue and Forecast, by Spectrum

12.4.2. Market Revenue and Forecast, by Image Processing Technology

12.4.3. Market Revenue and Forecast, by Resolution

12.4.4. Market Revenue and Forecast, by End-use

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Spectrum

12.4.5.2. Market Revenue and Forecast, by Image Processing Technology

12.4.5.3. Market Revenue and Forecast, by Resolution

12.4.5.4. Market Revenue and Forecast, by End-use

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Spectrum

12.4.6.2. Market Revenue and Forecast, by Image Processing Technology

12.4.6.3. Market Revenue and Forecast, by Resolution

12.4.6.4. Market Revenue and Forecast, by End-use

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Spectrum

12.4.7.2. Market Revenue and Forecast, by Image Processing Technology

12.4.7.3. Market Revenue and Forecast, by Resolution

12.4.7.4. Market Revenue and Forecast, by End-use

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Spectrum

12.4.8.2. Market Revenue and Forecast, by Image Processing Technology

12.4.8.3. Market Revenue and Forecast, by Resolution

12.4.8.4. Market Revenue and Forecast, by End-use

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Spectrum

12.5.2. Market Revenue and Forecast, by Image Processing Technology

12.5.3. Market Revenue and Forecast, by Resolution

12.5.4. Market Revenue and Forecast, by End-use

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Spectrum

12.5.5.2. Market Revenue and Forecast, by Image Processing Technology

12.5.5.3. Market Revenue and Forecast, by Resolution

12.5.5.4. Market Revenue and Forecast, by End-use

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Spectrum

12.5.6.2. Market Revenue and Forecast, by Image Processing Technology

12.5.6.3. Market Revenue and Forecast, by Resolution

12.5.6.4. Market Revenue and Forecast, by End-use

Chapter 13. Company Profiles

13.1. Sony Group Corporation

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Samsung Electronics Co., Ltd.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. OmniVision Technologies, Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. ON Semiconductor Corporation

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. STMicroelectronics N.V.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Canon Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Panasonic Corporation

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. SK Hynix Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. GalaxyCore Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Teledyne Technologies Incorporated

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others