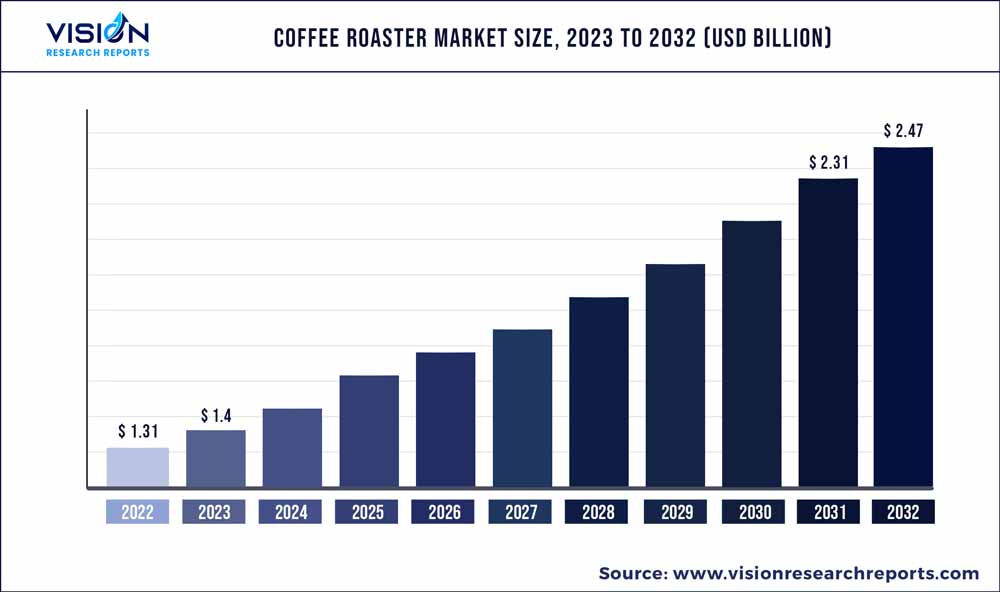

The global coffee roaster market was estimated at USD 1.31 billion in 2022 and it is expected to surpass around USD 2.47 billion by 2032, poised to grow at a CAGR of 6.53% from 2023 to 2032. The coffee roaster market in the United States was accounted for USD 287.8 million in 2022.

Key Pointers

Report Scope of the Coffee Roaster Market

| Report Coverage | Details |

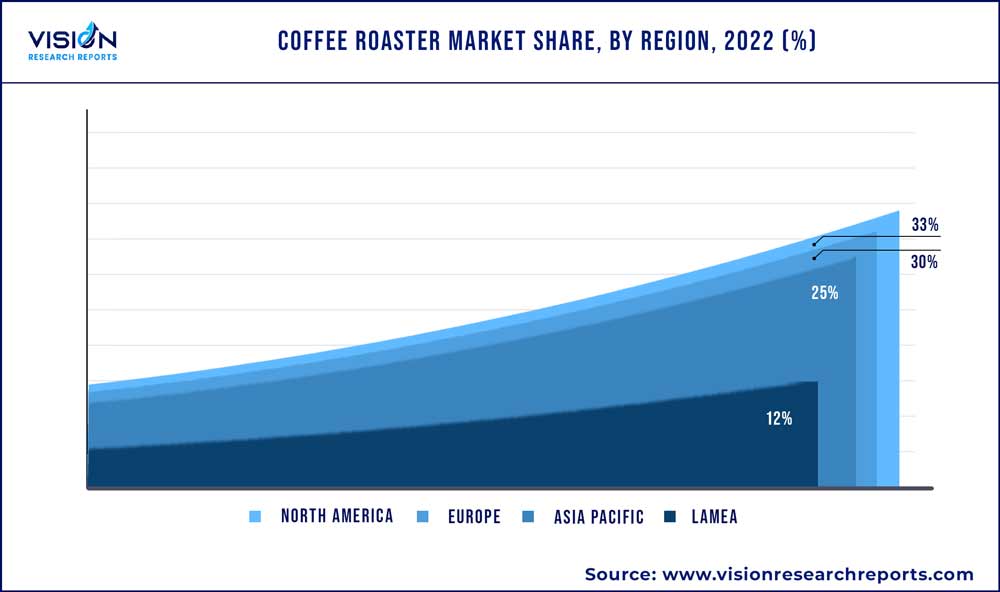

| Revenue Share of North America in 2022 | 33% |

| CAGR of Asia Pacific from 2023 to 2032 | 7.36% |

| Revenue Forecast by 2032 | USD 2.47 billion |

| Growth Rate from 2023 to 2032 | CAGR of 6.53% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Nestlé; Bühler Group; PROBAT AG; Scolari Engineering S.p.A.; Genio Roasters; Cia. Lilla de Máquinas Ind. e Com; COFFEE HOLDING; Diedrich Manufacturing Inc.; Giesen Coffee Roasters B.V.; Toper |

The rising demand and inclination of consumers towards the consumption of coffee across the globe is a primary factor driving the market growth. Moreover, consumers from the Asia Pacific region play a major role in the increasing consumption of coffee. In addition, the rising demand for fresh coffee is expected to fuel market growth in the coming years. As per the International Coffee Council, the preference of consumers in East and South Asia has been shifting towards fresh coffee consumption.

The COVID-19 pandemic negatively impacted various industries including the food & beverage industry. A fall in the coffee roaster industry has been observed during this period owing to a reduction in the consumption of coffee among consumers. The reduction in the consumption of coffee through the food service industry occurred due to various measures taken by the government such as the shutdown of cafes and restaurants along with maintaining social distancing due to the implementation of the lockdown. However, due to such factors, the sales of home roasters grew due to the preference of consumers to stay at home and roast their coffee. In addition, the online sale of coffee roasters also grew due to the pandemic.

The increasing number of coffee shop chains coupled with the rising trend of the culture of visiting cafés are other key factors anticipated to propel the market growth in the coming years. In addition to the rising consumption of coffee, the production of coffee has also been growing. For instance, as per the International Coffee Organization, the production of coffee across the globe has increased by 6.3% from 2019 to 2020. Furthermore, development in retail sections is also anticipated to drive the growth of coffee rosters in the residential segment.

The solubility of green coffee beans increases when it is roasted. This method also enhances the aroma and flavor of the coffee. Coffee, when roasted at the right temperature for a dedicated amount of time, provides perfect solubility that helps in achieving the right extraction of coffee. An interest in quality coffee among numerous consumers has been prompted by roasted coffee. Brewing coffee through innovative ways and experimenting with it has been made easy by coffee roasters. This has also been made more convenient to consumers by the availability of brewing and coffee machines and remains widely accessible on domestic as well as commercial platforms. Thus, the aforementioned factors are expected to boost market growth worldwide.

The growth of the global market is also attributed to the launch of new and innovative products by the key players operating in the market. The launches of products with better characteristics by manufacturers have been increasing resulting in attracting more consumers thus fueling the market growth over the forecast period. For instance, in January 2021, a new coffee roaster IKAWA Pro100 was introduced by IKAWA Ltd. The coffee roaster is easy to use, consistent, and has a capacity of 120 grams. Moreover, in May 2020 Revelation F5, a new solution for heat-circulating was launched by U.S. Roasters Corp.

The coffee roasters produce high heat and cause an intense working environment which pushes commercial coffee shops to avoid keeping coffee roasters in their places which are anticipated to challenge the market growth over the forecast period. However, investing in the development of rosters in compact sizes equipped with advanced technology is expected to offer lucrative opportunities in the market. Moreover, establishing the presence of the company in countries with roasters in both commercial and residential applications, especially in thriving coffee-consuming regions such as Asia Pacific is estimated to provide further key opportunities to the manufacturers.

Type Insights

The hot air segment dominated the market with a share of over 43% in 2022. Hot air coffee roasters do not generate smoke and roast the coffee beans efficiently and evenly as it has a hot air circulation system. The coffee beans are roasted at perfect temperature due to the automatic constant temperature system of hot air coffee roasters. Moreover, various features are associated with residential hot air coffee roasters such as manual adjustment of the roasting time of coffee along with dual function for roasting and cooling coffee beans. Due to such factors, hot air coffee roasters are highly used thus contributing to the higher share of the segment.

The half hot air coffee roasters are estimated to grow with the fastest CAGR of 7.33% over the forecast period. The roasting time of coffee in half hot air roasters is shorter as the heat inside such roasters are fully utilized by circulating the heat internally. Such roasters are majorly used for both residential and commercial purposes. The consumption of coffee is significantly increasing with increasing commercial offices which is propelling the segment growth over the forecast period. In addition, the trend for consuming coffee by roasting coffee at home is growing which is further driving the growth of the segment.

Batch Size Insights

With a market share of 48%, industrial batch size roasters dominate the coffee roaster market in 2022. Industrial-scale roasters are used by large coffee production facilities, including major coffee brands and commercial suppliers. They are designed to handle massive volumes of coffee beans efficiently and consistently. Industrial roasters often feature advanced technologies like precise temperature control, programmable roast profiles, and sophisticated data analysis systems. These roasters have custom-built configurations to fit specific production needs, enabling high-speed and high-volume processing, while maintaining quality.

The small batch size roaster segment is expected to grow with the fastest CAGR of 9.35%. Small roasters have features such as temperature logging to record roast parameters and evaluate and analyze the type of beans used. These roasters are crucial for coffee buyers, importers, and quality control professionals to assess the potential of different coffee beans and make informed purchasing decisions. Some of the popular roasters in this batch size are the ROEST sample roaster, Ikawa Pro50 and Pro100, and Aillio Bullet R1. Digital micro-sample roasters with integrated mobile applications are gaining popularity in the market.

Application Insights

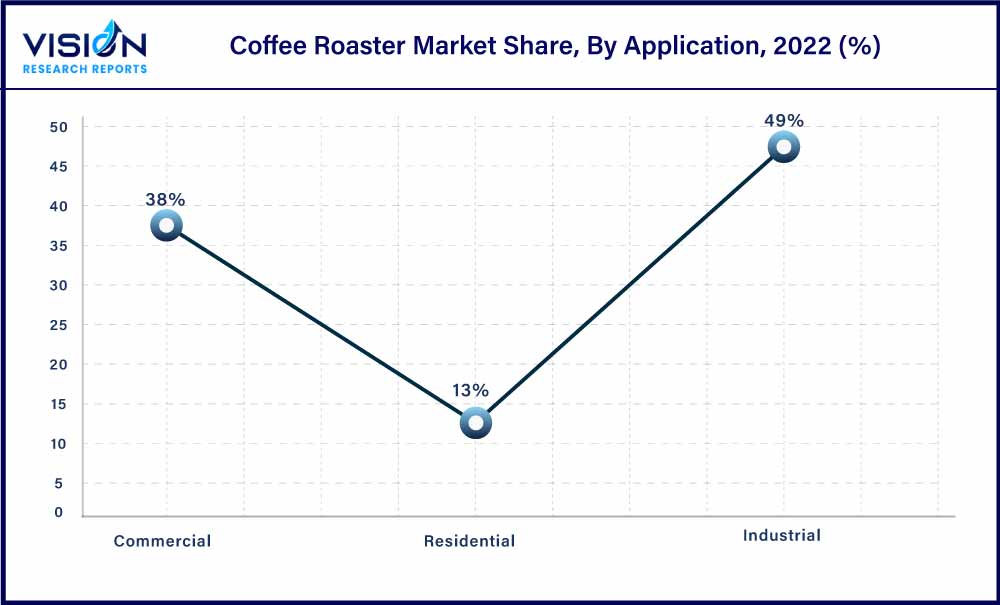

Application of coffee roasters in the industrial sector led the market and held a share of more than 49% in 2022 and is anticipated to grow at a CAGR of 6.45% over the forecast period. The rising awareness among consumers regarding the benefits of consumption of coffee-derived products and coffee coupled with its growing consumption in various emerging economies due to rapid urbanization is contributing to the segment growth. Moreover, coffee roasters used at the industrial level majorly benefitted from the rising demand for roasted coffee in the commercial and residential segments in various forms such as beans and powdered form.

The commercial segment is estimated to grow with the highest CAGR of 6.83% over the forecast period from 2023 to 2032. The increasing number of cafes or coffee shops and outlets across the globe is surging the adoption of commercial coffee roasters. Additionally, manufacturers operating in the market are launching coffee roasters suitable especially for commercial use. For instance, in February 2022 Bellwether Coffee, a manufacturer of commercial coffee roasters launched Series 2 Bellwether Automated Roasting System, the second generation of foundational machine and technology.

Regional Insights

North America held the largest share of the market accounting for 33% in 2022 and is anticipated to remain the leading region over the forecast period. The market in the region is significantly driven by the high consumption and rising popularity of roasted coffee among consumers. For instance, as per the statistics provided by the International Coffee Organization, per day approximately 1.4 billion cups of coffee are consumed and approximately 45% are consumed by U.S. consumers alone. This number totals more than 400 million cups of coffee per day. Moreover, coffee chains such as Starbucks provides roasted coffee to customers as per their preferences which is further driving the market growth in the region.

Asia Pacific is expected to grow with the fastest CAGR of 7.36% over the forecast period from 2023 to 2032. The growth of the market in the region is attributed to the increasing consumption of coffee by consumers in the region. As per the International Coffee Organization, as of 2022, coffee consumption in Asia has increased by 1.5% in the past five years. Moreover, the high consumption of roasted coffee in various countries in the Asia Pacific such as China and Japan is also contributing to the growth of the market in the region. According to an article published by Monin, as of 2022, the country in the Asia Pacific with the highest roasted coffee consumption is Japan followed by China.

Coffee Roaster Market Segmentations:

By Type

By Batch Size

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Coffee Roaster Market

5.1. COVID-19 Landscape: Coffee Roaster Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Coffee Roaster Market, By Type

8.1. Coffee Roaster Market, by Type, 2023-2032

8.1.1 Direct Fire

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Half Hot Air

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Hot Air

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Coffee Roaster Market, By Batch Size

9.1. Coffee Roaster Market, by Batch Size, 2023-2032

9.1.1. Small (100 grams to 1 kg)

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Medium (2 kg to 5 kg)

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Large (10 kg to 30 kg)

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Industrial (More than 50 kg)

9.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Coffee Roaster Market, By Application

10.1. Coffee Roaster Market, by Application, 2023-2032

10.1.1. Industrial

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Commercial

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Residential

10.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Coffee Roaster Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.2. Market Revenue and Forecast, by Batch Size (2020-2032)

11.1.3. Market Revenue and Forecast, by Application (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Batch Size (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Batch Size (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.2. Market Revenue and Forecast, by Batch Size (2020-2032)

11.2.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Batch Size (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Batch Size (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Batch Size (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Batch Size (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Application (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.2. Market Revenue and Forecast, by Batch Size (2020-2032)

11.3.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Batch Size (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Batch Size (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Batch Size (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Batch Size (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Application (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.2. Market Revenue and Forecast, by Batch Size (2020-2032)

11.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Batch Size (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Batch Size (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Batch Size (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Batch Size (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Application (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.2. Market Revenue and Forecast, by Batch Size (2020-2032)

11.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Batch Size (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Batch Size (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Application (2020-2032)

Chapter 12. Company Profiles

12.1. Nestlé

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Bühler Group

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. PROBAT AG.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Scolari Engineering S.p.A..

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Genio Roasters

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Cia. Lilla de Máquinas Ind. e Com

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. COFFEE HOLDING.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Diedrich Manufacturing Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Giesen Coffee Roasters B.V..

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Toper

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others