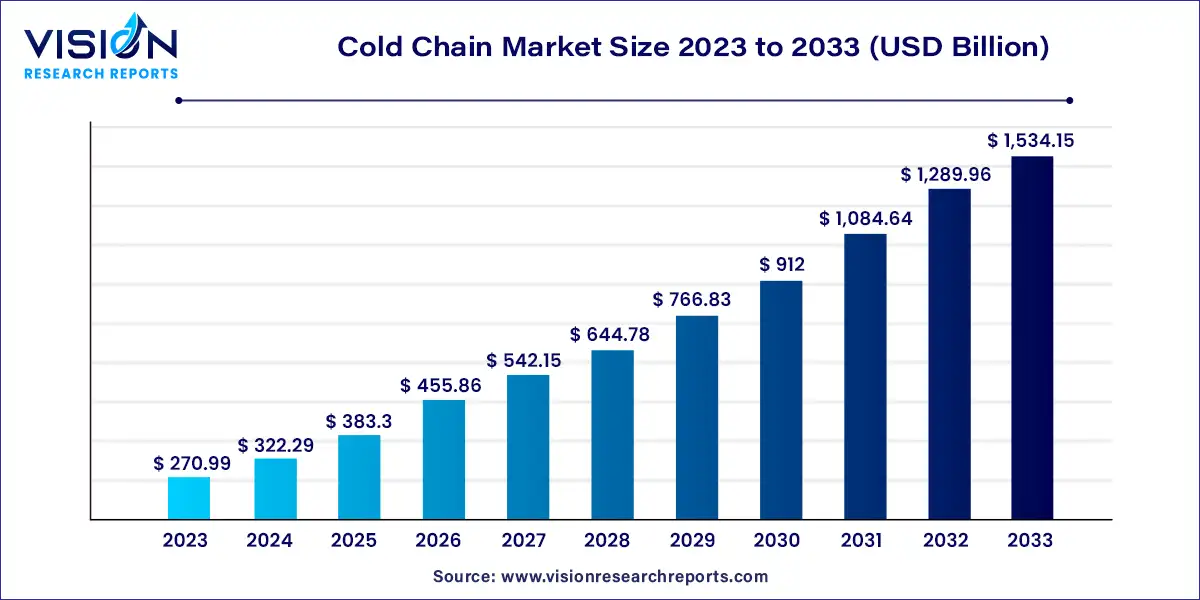

The global cold chain market was estimated at USD 270.99 billion in 2023 and it is expected to surpass around USD 1,534.15 billion by 2033, poised to grow at a CAGR of 18.93% from 2024 to 2033.

The cold chain market encompasses the transportation and storage of temperature-sensitive products, maintaining their integrity throughout the supply chain. This vital industry ensures the safe delivery of perishable goods such as food, pharmaceuticals, and chemicals, among others. With increasing globalization and consumer demand for fresh products year-round, the cold chain plays a crucial role in ensuring product quality and safety.

The growth of the cold chain market is propelled an increasing demand for perishable goods, including fresh food products and pharmaceuticals, drives the need for efficient temperature-controlled transportation and storage solutions. Additionally, stringent regulations pertaining to food safety and pharmaceutical quality further stimulate market growth, as companies invest in advanced cold chain infrastructure to comply with these standards. Moreover, the expansion of international trade and globalization has fueled the demand for cold chain logistics services to ensure the seamless transport of temperature-sensitive products across borders. Furthermore, the recent global health crisis, particularly the COVID-19 pandemic, has underscored the critical role of the cold chain in vaccine distribution and medical supply chains, leading to heightened investment and innovation in the sector.

The cold chain industry is segmented based on type into storage, transportation, packaging, and monitoring components. In 2023, the storage segment emerged as the dominant force in the cold chain sector, capturing over 51% of the market share. It is projected to maintain this trajectory, exhibiting a robust CAGR of 17.83% throughout the forecast period. This growth is primarily fueled by the global shift towards packaged foods, driven by evolving consumer dietary preferences and lifestyles. As demand for frozen foods continues to rise, there is a corresponding surge in the need for efficient storage solutions. Consequently, industry players are expanding their storage capacities to meet the escalating demand for cold storage facilities.

Furthermore, the transportation segment, essential for the safe delivery of healthcare and food & beverage products, is anticipated to witness substantial growth over the forecast period. This growth will be driven by increasing demand for cold chain transportation solutions, including refrigerated containers and vehicles, to ensure the integrity of temperature-sensitive goods during transit.

Meanwhile, the monitoring components segment is poised to register the highest CAGR of 22.72% throughout the forecast period. This remarkable growth can be attributed to ongoing technological advancements aimed at enhancing shipment integrity, efficiency, and safety. Notably, advancements span both backend IT infrastructure and frontend devices utilized for real-time collection and reporting of shipment information.

The cold chain market is segmented based on temperature range into chilled (0°C to 15°C), frozen (-18°C to -25°C), and deep-frozen (below -25°C) categories. In 2023, the frozen segment (-18°C to -25°C) emerged as the dominant player, capturing over 62% of the market revenue. This segment is poised to maintain its leading position, projected to grow at the fastest CAGR of 20.04% throughout the forecast period. The demand for frozen cold chain solutions is primarily driven by the necessity to preserve the freshness of perishable food & beverage and pharmaceutical products such as poultry, cakes & bread, and meat. The widespread availability of storage and transportation solutions tailored for frozen temperature ranges further propels the growth of this segment.

Meanwhile, the chilled segment (0°C to 15°C) is expected to witness significant growth, with a projected CAGR of 16.93% over the forecast period. Many vegetables, fruits, and meats require chilled temperature ranges, typically between 2°C to 4°C, during transportation to maintain freshness. Chilled storage of perishable products, including dairy items, serves to prevent deterioration and extend shelf life, thereby reducing wastage. The imperative to uphold the quality of perishable goods and minimize product spoilage drives the growth of this segment.

The cold chain market is categorized by application into pharmaceuticals, food & beverages, and others. In 2023, the food & beverages segment emerged as the dominant force in the cold chain industry, capturing over 78% of the market share. This segment is expected to maintain its stronghold, growing at a steady CAGR of 18.7% throughout the forecast period. Technological advancements in the storage, packaging, and processing of seafood are anticipated to fuel the growth of this segment. Additionally, the processed food sector is projected to witness significant growth in the coming years, driven by ongoing innovations in packaging materials aimed at extending shelf life. The proliferation of such advancements has notably boosted the sales of processed foods in recent years.

Conversely, the pharmaceuticals segment is forecasted to experience substantial growth, with a projected CAGR of 20.84% over the forecast period. The heightened demand for pharmaceutical cold chain solutions stems from their critical role in maintaining the efficacy and safety of pharmaceutical products. This demand is further bolstered by stringent regulatory norms, such as the Goods Distribution Practices (GDP) in the European Union (EU), driving the standardization of regulations globally to enhance transportation systems for healthcare-related products.

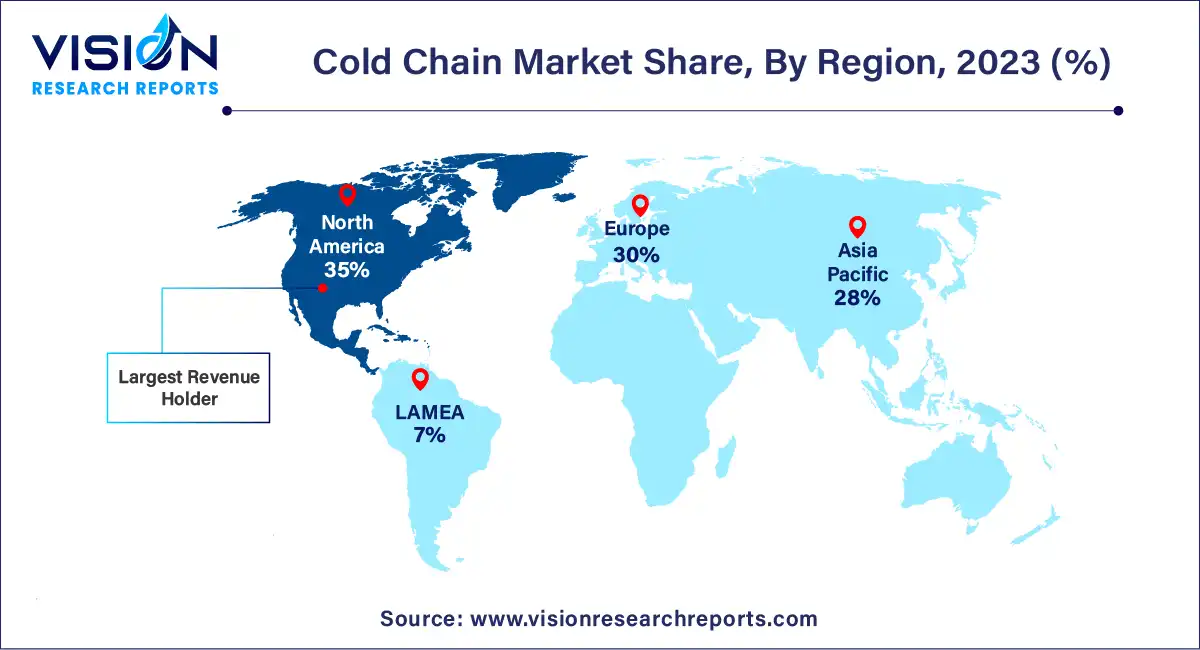

In 2023, North America secured the largest revenue share, surpassing 35%. This region is poised to maintain its leadership position throughout the forecast period, offering substantial growth prospects for companies eyeing long-term investments. The market is expected to thrive further due to the rising adoption of connected devices and a sizable consumer base.

Asia Pacific is forecasted to emerge as the fastest-growing regional market, boasting a remarkable CAGR of 21.14%. This surge is attributed to escalating government investments in logistics infrastructure development and the increasing adoption of Warehouse Management Systems (WMS) across the region.

By Type

By Temperature Range

By Application

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others