The global cold gas spray coating market was estimated at USD 1.05 billion in 2022 and it is expected to surpass around USD 1.62 billion by 2032, poised to grow at a CAGR of 4.43% from 2023 to 2032. The cold gas spray coating market in the United States was accounted for USD 203 million in 2022.

Key Pointers

Report Scope of the Cold Gas Spray Coating Market

| Report Coverage | Details |

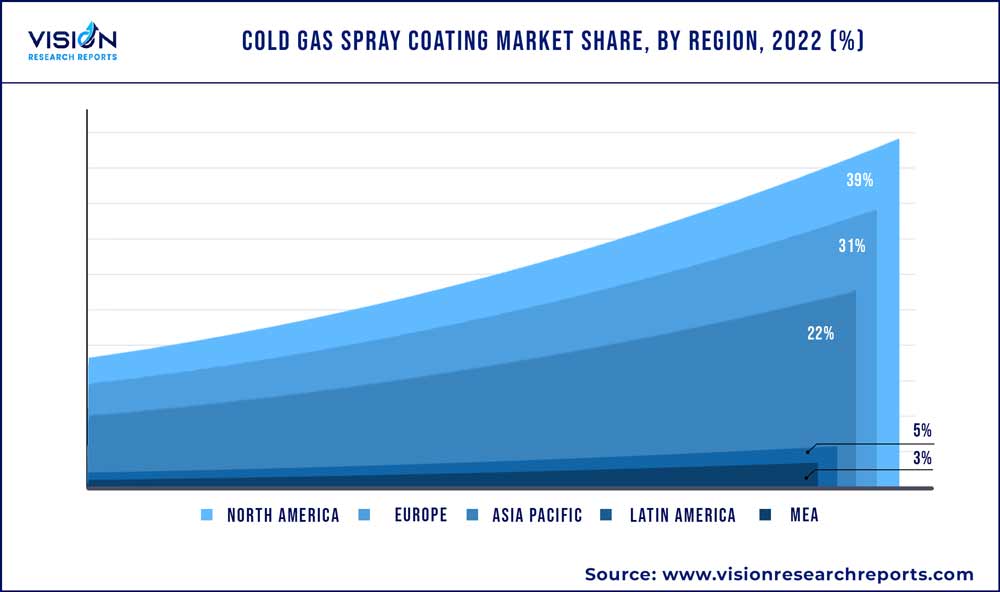

| Revenue Share of North America in 2022 | 39% |

| Revenue Forecast by 2032 | USD 1.62 billion |

| Growth Rate from 2023 to 2032 | CAGR of 4.43% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Plasma Giken Co., Ltd.; VRC Metal Systems, LLC; Curtiss-Wright Surface Technologies; Bodycote; Praxair S.T. Technology, Inc.; ASB Industries, Inc. |

The rising adoption of cold gas spray coating in aerospace and automotive aftermarket repair and maintenance activities is projected to assist the growth of the market over the forecast period. Cold gas spray coatings, used for decades as coatings, have recently revolutionized component repair in various industries, especially in the aerospace industry. These coatings have a significant impact on reducing the sustainment costs in the aerospace industry, thereby gaining the attention of manufacturers and end users in the market. The high replacement costs of damaged and corroded aircraft components and the long lead times associated with their replacement have resulted in a growing preference for repairing aircraft components to reduce their maintenance costs.

Cold gas spray coatings had a profound impact on reducing sustainment costs in the aerospace industry, thus gaining the attention of manufacturers and end-users in the market. The growing application of the product in a wide range of materials for specific applications, including repair and surface finishing, is expected to drive the product demand in the coming years. In addition, the growing demand for consumer electronics owing to the factors, such as increasing disposable income, rapid urbanization, expanding middle class, and shifting spending priorities of consumers in the emerging countries, such as China and India, is further expected to propel the product demand in the coming years.

Furthermore, the rising application of advanced nanostructured and amorphous materials in various end-use industries, including electrical and electronics and medical, is expected to create lucrative growth opportunities for the manufacturers of cold gas spray coatings. Since nano-crystalline materials are temperature-sensitive, the cold gas spray coating can effectively be used without hampering their beneficial microstructure. These materials are now being widely used for manufacturing various advanced electrical equipment, such as sensors, electric boards, and data management systems.

The prices of raw materials used for developing cold gas spray coatings are impacted by the high costs of ore extraction processes and the presence of several stringent government regulations related to the metals and mining industries. This acts as a major restraint for the growth of cold gas spray coating market. Moreover, several import tariffs imposed by the Government of the U.S. owing to its ongoing trade war with China are expected to bring further volatility in the prices of raw materials in the coming years. All these factors are expected to restrain the growth of cold spray coating market over the forecast period.

End-use Insights

The transportation end-use dominated the market with a revenue share of more than 45% in 2022. This is attributable to the growing demand for cold gas spray coatings for application in coating and repairing of various components in the aerospace and automotive industries. Cold gas spray coatings offer low porosity, excellent bonding, and oxide-free coating in the solid-state as well as at low temperatures, which make them suitable for application in the automotive and aerospace industries.

In addition, it helps increase the service life as well as improve the vehicle's performance by protecting the parts against wear, corrosion, fretting, and erosion. Most automotive manufacturers use cold gas spray coating as an alternative method to offer a high level of reliability, quality, and durability in low-cost base materials.

The rising demand for lightweight and high-performance materials in the automotive industry is projected to boost product demand over the forecast period. In addition, favorable government regulations regarding the application of lightweight materials to improve fuel efficiency are expected to drive the product demand in the automotive industry.

In recent years, the cold gas spray coating technology has witnessed significant demand in the restoration and repair of housings for Integrated Drive Generators (IDG), which are used in commercial aircraft, such as Boeing 747, 737NG, and 777 and Airbus A330, A320, and A340. This is attributed to the high feasibility and economic viability of the cold gas spray coating technology in complexly designed components made of magnesium or aluminum alloys.

Technology Insights

High-pressure technology dominated the market with a revenue share of more than 53% in 2022. This is attributable to its wide usage as a surface repair and coating technology in a broad range of industries, such as aerospace, automotive, and electronics. It is majorly used in repairing metallic components to improve the performance and extend the working life of equipment in the aforementioned industries. High-pressure cold gas spray coating technology utilizes the pressure of up to 50 bar with an axial injection of feedstock particles that are heated to a temperature of 11000 C, which allows higher metal deposition rate with exceptionally low oxide and porosity levels during the material build-up process.

High pressure cold gas spray coatings offer a range of advantages over other coating processes. The process operates at relatively low temperatures, reducing the risk of substrate distortion or damage. The coatings produced by this process are dense and offer excellent mechanical properties due to the high-speed impact of the powder particles. The high-speed impact also creates a strong bond between the coating and the substrate, resulting in improved adhesion. Additionally, the process can be used to deposit a wide range of materials, making it versatile and suitable for use in various industries, including aerospace, automotive, biomedical, and electronics.

Low-pressure cold gas spraying is a coating technique, which is generally considered for repairing light and high-ductile metallic components used in various end-use industries. It utilizes ambient air as the propellant and operates at low pressure and low operating temperature conditions. These features make it a low-cost surface repair and coating technology and provide a competitive edge from the high-pressure cold gas spray technology. However, the rising usage of metal alloys and low-ductile components in the aerospace and automotive industries is expected to limit the growth of the low-pressure cold gas spray technology in the coming years.

Regional Insights

North America dominated the market with a revenue share of 39% in 2022. Favorable government regulations pertaining to the use of a lightweight and high-performance components in the automotive sector as an alternative to alloys and metals are expected to drive the regional demand for cold gas spray coatings over the forecast period. However, the shifting of manufacturing industries, such as the electrical and electronics industry, to the Asian countries with low wages, especially India and China, has hampered the regional demand, particularly in non-automotive end-use sectors.

Europe emerged as a significant region for the cold gas spray coatings market owing to the presence of major countries with high military and defense spending, such as Russia, Germany, France, and the U.K., especially for protection purposes of aircraft and satellite components. This is likely to create significant opportunities for the manufacturers of cold gas spray coatings in the region.

In the Asia Pacific region, the increase in the use of cold gas spray coating in the medical and transportation industries is the primary driving force. The mounting demand for lightweight components in various industries such as aerospace, electrical and electronics, and medical, backed by the secure production infrastructure of the automotive industry in China, Japan, and India, represents new opportunities for growth among cold gas spray coating manufacturers in the region. They are utilized primarily for the repair and coating of metal and polymer components and for extending their operational life and durability. Thus, due to the increasing adoption of lightweight components in the automotive and aerospace sectors, a surge in demand for cold gas spray coating products is likely in the forecast period.

Cold Gas Spray Coating Market Segmentations:

By Technology

By End-use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Cold Gas Spray Coating Market

5.1. COVID-19 Landscape: Cold Gas Spray Coating Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Cold Gas Spray Coating Market, By Technology

8.1. Cold Gas Spray Coating Market, by Technology, 2023-2032

8.1.1. High Pressure

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Low Pressure

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Cold Gas Spray Coating Market, By End-use

9.1. Cold Gas Spray Coating Market, by End-use, 2023-2032

9.1.1. Transportation

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Electrical & Electronics

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Oil & Gas

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Utility

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Medical

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Others

9.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Cold Gas Spray Coating Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Technology (2020-2032)

10.1.2. Market Revenue and Forecast, by End-use (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Technology (2020-2032)

10.1.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Technology (2020-2032)

10.1.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Technology (2020-2032)

10.2.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Technology (2020-2032)

10.2.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Technology (2020-2032)

10.2.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Technology (2020-2032)

10.2.5.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Technology (2020-2032)

10.2.6.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Technology (2020-2032)

10.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Technology (2020-2032)

10.3.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Technology (2020-2032)

10.3.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Technology (2020-2032)

10.3.5.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Technology (2020-2032)

10.3.6.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Technology (2020-2032)

10.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Technology (2020-2032)

10.4.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Technology (2020-2032)

10.4.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Technology (2020-2032)

10.4.5.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Technology (2020-2032)

10.4.6.2. Market Revenue and Forecast, by End-use (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Technology (2020-2032)

10.5.2. Market Revenue and Forecast, by End-use (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Technology (2020-2032)

10.5.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Technology (2020-2032)

10.5.4.2. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 11. Company Profiles

11.1. Plasma Giken Co., Ltd.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. VRC Metal Systems, LLC

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Curtiss-Wright Surface Technologies

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Bodycote

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Praxair S.T. Technology, Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. ASB Industries, Inc.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others