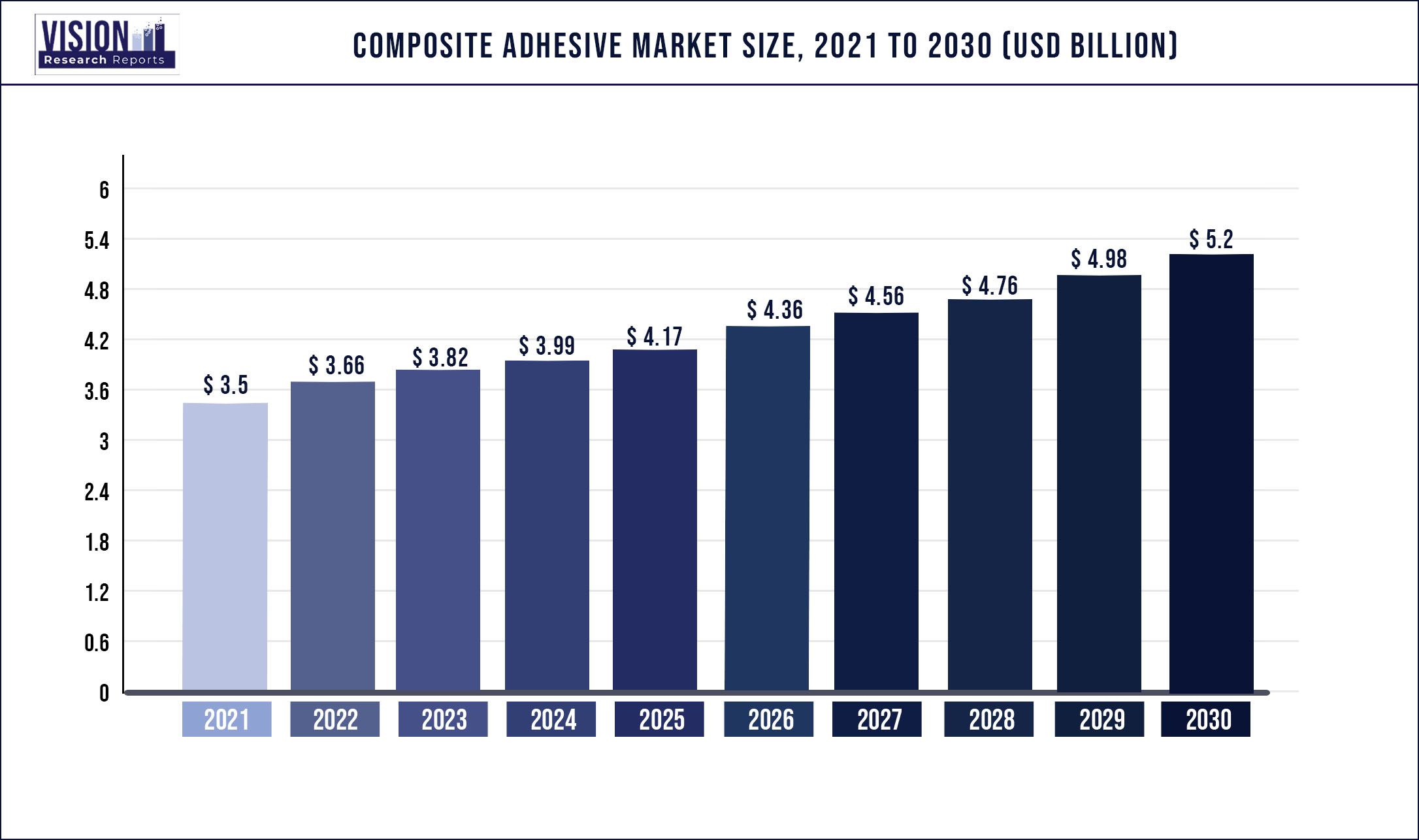

The global composite adhesive market was valued at USD 3.5 billion in 2021 and it is predicted to surpass around USD 5.2 billion by 2030 with a CAGR of 4.5% from 2022 to 2030.

The increasing investments in the construction & infrastructure industry and favorable government policies propelling the manufacturing sector are driving the market growth.

In 2021, most economies around the world invested extensively to rebuild their infrastructure to recover from the COVID-19 pandemic. For instance, in 2021, the U.S passed a USD 1 trillion infrastructure bill to boost the infrastructure sector in the coming years. Such investments in the infrastructure industry are anticipated to propel the need for composite products and benefit adhesives demand over the forecast period.

The composite adhesive is a compound that bonds or adheres two or more substrates together. They are usually produced from either synthetic or natural sources. There are a variety of products available in the market such as epoxy, acrylic, polyurethane, and cyanoacrylate, which are used according to their application requirements. Based on product, epoxy held the largest revenue share of the global market in 2021 and this trend is expected to continue across the forecast period. Epoxy is preferred owing to the benefits it offers such as high strength, durability, and heat & chemical resistance.

Construction & infrastructure is one of the key end-use industries of epoxy adhesives owing to their high preferability in structural applications. Based on region, Asia Pacific accounted for the highest revenue share of the global market in 2021. In the region, China was the major market in 2021 but India is anticipated to register the fastest growth rate across the forecast period. The increasing demand for composite adhesive from various application industries such as construction, automotive, and electronics has pushed manufacturers to expand their capacity in the region.

For instance, in December 2021, Sika AG announced the opening of a new technology center and manufacturing plant to produce high-quality adhesives and sealants in Pune, Maharashtra, India. The investment is aimed to meet the growing demand from the transportation, construction, and renewable energy sectors.

The global market is highly competitive in nature. Key players of the industry are carrying out downstream integration for the development of their business. For instance, in April 2021, Comi Group acquired Neoflex SL, a manufacturer of polyurethane adhesives. This is expected to help Comi Group expand its presence in all those regions of the world wherein Neoflex SL has operations.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 3.5 billion |

| Revenue Forecast by 2030 | USD 5.2 billion |

| Growth rate from 2022 to 2030 | CAGR of 4.5% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product, application, region |

| Companies Covered | 3M; Bostik; Dow; Henkel AG & Co.KGaA; H.B Fuller Company; Huntsman Corporation LLC; Illinois Tool Work Inc; Sika AG |

Product Insights

Epoxy held the largest revenue share of more than 36.0% in the product segment in 2021 in the global market. It is a widely used product owing to benefits such as low cost, high strength, durability, mechanical shock resistance, high-temperature resistance, low shrinkage, and cryogenic resistance.

On the other hand, the acrylic segment is expected to witness the fastest growth rate of 5.5%, in terms of revenue, during the forecast period. The product is used for adhesion in various rigid and semi-rigid bonding applications in the automotive and medical industries. It provides high-strength bonds to composites along with high peel strength. It is highly preferred in a wide range of end-use industries owing to characteristics such as fast curing time and acid & solvent resistance.

The cyanoacrylate product segment is anticipated to witness a CAGR of 5.1%, in terms of revenue, across the projection period. It offers faster curing than epoxy and acrylic because of its ionic nature. Owing to its fast curing and ability to adhere to most surfaces, it is also known as superglue. It is often used for bonding small plastic parts and is suitable for situations where instant strong bonds are needed, and high impact or peel resistance is not required.

Application Insights

Aerospace & defense held a revenue share of over 17.0% in 2021 of the global market regarding the application. The deployment of composite adhesives increases assembly productivity, reduces weight, and also helps in cost management, as most of the major parts of an aircraft use composite materials. For instance, in October 2021, Saab AB opened an aerospace facility in West Lafayette, U.S., which will produce the aft airframe section for T-7A Red Hawk trainer aircraft. The plant will manufacture various composite parts.

Automotive was the second-largest application segment of the market, in terms of revenue, in 2021. Penetration of adhesives in the industry is increasing significantly owing to the rising trend of lightweight vehicles. To achieve this, automotive companies are inclining towards the incorporation of composites. For instance, in April 2021, SFHL entered into a partnership with Mind S.r.l., marking the entry of SFHL into the composites industry to reduce the weight of vehicles.

Electrical & electronics is another vital application segment of the market. Composites have various applications in the industry, including electromagnetic shielding, wearable devices, batteries, electrical switching & insulations, and sensors. The growing penetration of composites in this segment is propelling the demand for adhesives for the assembling of the components.

Regional Insights

Asia Pacific held a revenue share of more than 47.0% in 2021 of the global market. The increasing requirement for composite-based products in EVs, renewables, aerospace & defense, and construction industries is anticipated to propel the demand for the product over the forecast period.

The growing demand for adhesives from industries such as automotive and electronics has pushed major players to invest in the region. For instance, in May 2021, Henkel AG & Co. KGaA invested CNY 500 million (~USD 77.58 million) to set up a special adhesive Asia Pacific innovation center in Shanghai, China. The center will develop high-quality adhesives for consumers in the Asia Pacific region.

North America is anticipated to register the fastest growth, in terms of revenue, across the forecast period. Increasing focus on the production of EVs, aircraft, and electronics is expected to drive the product demand in the region. For instance, in November 2021, Tesla Inc. announced plans to establish a new factory to produce battery manufacturing equipment in Canada. EV battery packs use a wide variety of adhesives in their production.

Europe accounted for the second-largest share, in terms of revenue, of the global market in 2021. Emphasis on using lightweight composite materials in aircraft is anticipated to benefit market growth over the forecast period. For instance, in February 2022, the Netherlands-based Venturi Aviation partnered with Airborne, a company engaged in offering solutions for advanced composites, for using lightweight structures for an all-electric commuter aircraft.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Composite Adhesive Market

5.1. COVID-19 Landscape: Composite Adhesive Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Composite Adhesive Market, By Product

8.1. Composite Adhesive Market, by Product, 2022-2030

8.1.1. Acrylic

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Epoxy

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Polyurethane

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Cyanoacrylate

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Composite Adhesive Market, By Application

9.1. Composite Adhesive Market, by Application, 2022-2030

9.1.1. Automotive & Transportation

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Aerospace & Defense

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Electrical & electronics

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Construction & Infrastructure

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Other

9.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Composite Adhesive Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.2. Market Revenue and Forecast, by Application (2017-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2017-2030)

10.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2017-2030)

10.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

Chapter 11. Company Profiles

11.1. 3M

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Bostik

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Dow

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Henkel AG & Co. KGaA

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. Recent Initiatives

11.5. H.B. Fuller Company

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Huntsman Corporation LLC

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Illinois Tool Works Inc

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Permabond LLC

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Parker Hannifin Corp

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Sika AG

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others