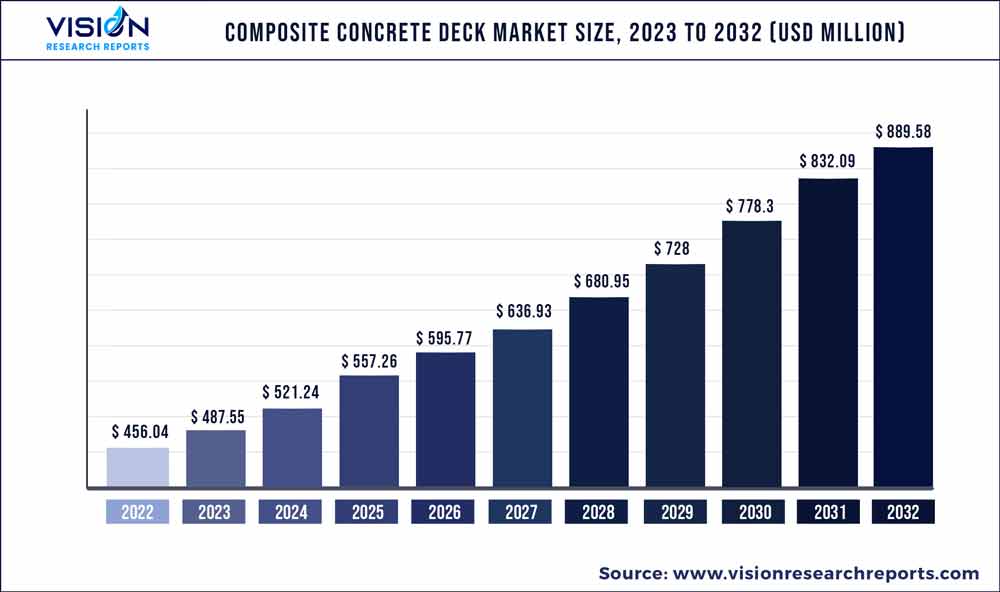

The global composite concrete deck market size was estimated at around USD 456.04 million in 2022 and it is projected to hit around USD 889.58 million by 2032, growing at a CAGR of 6.91% from 2023 to 2032.

Key Pointers

Report Scope of the Composite Concrete Deck Market

| Report Coverage | Details |

| Market Size in 2022 | USD 456.04 million |

| Revenue Forecast by 2032 | USD 889.58 million |

| Growth rate from 2023 to 2032 | CAGR of 6.91% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | ASC Steel Deck; Raised Floor Solutions Limited; Tata Steel; Prodeck-Fixing Ltd.; Structural Metal Decks; O’Donnell Metal Deck, LLC; Construction Metal Forming; Cordeck; A.C.T. Metal Deck Supply; TRUEDEK Steel Decking solutions |

The composite concrete deck is a sustainable building material that offers high strength, reinforces structural integrity, and adds durability to the structures. The rising usage of composite concrete decks in multistory residential and commercial construction is expected to fuel the market’s demand.

With the growing concerns related to the environment, stringent regulations by the governments have stimulated the use of sustainable building materials. Steel used as a reinforcement material in the composite concrete deck can be recycled repeatedly without affecting its inherent properties, making it a sustainable solution. Moreover, the reinforcement given by steel reduces the consumption of concrete in the construction of decking, thus reducing the overall cost.

The market for composite concrete deck is negatively affected by the presence of decking substitutes such as wooden decking, composite decking, bamboo decking, and concrete decking, which also provide high strength and durability. However, rising concerns about using environment-friendly building products have encouraged the use of various composite materials. In addition, the growing usage of advanced materials in developed economies such as the U.S., Canada, the U.K., and Germany is anticipated to further boost demand for the composite concrete deck during the coming years.

The market is competitive owing to the presence of manufacturers that are consolidated in North America and Europe. The strong presence of major players, along with the existence of opportunities in developing countries with huge investing powers for the continuous development, exhibits high competitive rivalry among the players. Furthermore, market players are engaged in forward integration by providing products directly to end users.

Thickness Type Insights

The 3.0” thickness type segment led the market and accounted for the largest revenue share of 42.38% in 2022. It is the most common and profound variety of composite floor deck. It is a decent flooring choice because it can support concrete slabs thicker than the 1.5" or 2.0" composite concrete deck. The majority of its applications in outdoor flooring are for larger spans. The market demand is expected to increase during the forecast period due to the expanding trends in the industrial and commercial construction industries.

2.0" thickness composite concrete decking is primarily used in various private and public sector projects, including offices, factories, hospitals, sports arenas, parking lots, etc. As a result, demand for the market is anticipated to increase during the forecast period due to the growth of commercial and industrial buildings worldwide owing to increased commercialization.

The market for a 1.5” thickness composite concrete deck is growing at the fastest CAGR of 7.31% during the forecast year 2023-2032. A 1.5" composite deck is majorly used for outdoor flooring applications. Short spans are best suited for this composite concrete deck type because of its low profile. Furthermore, the widespread use of 1.5" composite concrete deck in non-residential applications for low-rise, high-rise, and manufacturing sectors is one of the factors in the market's expansion.

Deck Type Insights

Site-built deck type led the market and accounted for the largest revenue share of 51.82% in 2022. Site-built concrete is preferable in composite concrete decks as it can provide additional structural integrity to the deck, making it more stable and resistant to movement or shifting. Furthermore, the additional benefit of site-built concrete over other segments is that it can be customized to fit the exact specifications of the deck, ensuring a perfect fit and a more cohesive overall design, because of which its demand is expected to grow during the forecast period.

The proprietary system composite concrete deck type segment is projected to grow at the fastest CAGR of 7.06% during the forecast year 2023-2032. Proprietary systems are manufactured to strict standards, ensuring consistency in the materials and dimensions. This can help ensure a consistent quality of the finished product. This consistency and quality control are critical in large or complex projects where a small error can cause significant problems. Rising use of proprietary systems in developed countries is likely to boost demand during the forecast period.

Precast deck type accounted for the second highest revenue share and was valued at 158.06 million in 2022. There has been growing use of precast concrete owing to its several benefits such as offsite manufacturing, quick installation, high strength, and durability. Moreover, the major driving factors of the material during the forecast period are that it can withstand harsh weather conditions, heavy loads, and exposure to chemicals or other corrosive materials, which can prolong the structure's lifespan.

Application Insights

The residential application segment accounted for a market share of 194.7 million in 2022 and is anticipated to grow at a CAGR of 7.25%. Composite concrete deck is highly durable and resistant to damage from weather, pests, and other environmental factors. In addition, they can last many years without requiring significant maintenance or repairs, making them a cost-effective choice for residential buildings.

Composite concrete decking may have a more significant share of the residential market as homeowners increasingly turn to composite materials as a low-maintenance and eco-friendly alternative to traditional wood decking. It is highly durable and requires less maintenance than wood, making it an attractive option for residential buildings for outdoor spaces without spending much time and money on upkeep.

In the commercial market, composite concrete decking is often used in public spaces, such as boardwalks, parks, and outdoor dining areas. Commercial applications often require high-performance materials that can withstand heavy foot traffic and exposure to the elements, and composite decking offers excellent durability and resistance to wear and tear. In addition, composite decking is often chosen for its low maintenance requirements, which can reduce maintenance costs for businesses and municipalities. These factors have anticipated an increase in the demand for composite concrete decks in commercial construction during the coming years.

Regional Insights

North America dominated the market and accounted for a revenue share of 35.68% in the global composite concrete deck demand in 2022. This growth is attributed to the rising concerns about sustainability and the environmental impact of building materials. Furthermore, composite deck are often made from recycled materials and are designed to last longer than a traditional wood deck, which reduces waste and helps protect the environment. There have been various regulations and initiatives introduced within the region to address these issues. These factors are likely to contribute to the growth of the market.

In Asia Pacific, demand for the composite concrete deck is primarily driven by the increasing construction activity in the region. Furthermore, governments in the Asia Pacific region are investing heavily in infrastructure development, including roads, bridges, and buildings, owing to urbanization and population growth. Composite concrete deck is an attractive option for infrastructure projects because they are lightweight, durable, and easy to install. The abovementioned factors are anticipated to boost demand for the composite concrete deck in the region.

Europe accounted for the second-highest revenue share in 2022, and it is growing at a CAGR of 6.12% during the forecast period. The market is driven by the increasing demand for sustainable construction materials, the growing construction industry, technological advancements, favorable government policies, and increasing infrastructure investments.

The demand for composite concrete deck in the Middle East & Africa is anticipated to be driven by the growing residential sector during the forecast period because the construction industry has a multiplier effect on the economy, creating jobs and generating demand for goods and services. Growing investments in this industry in the region are anticipated to enhance the market growth in the Middle East & Africa region.

Composite Concrete Deck Market Segmentations:

By Thickness Type

By Deck Type

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Thickness Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Composite Concrete Deck Market

5.1. COVID-19 Landscape: Composite Concrete Deck Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Composite Concrete Deck Market, By Thickness Type

8.1. Composite Concrete Deck Market, by Thickness Type, 2023-2032

8.1.1 1.5”

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. 2”

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. 3”

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Composite Concrete Deck Market, By Deck Type

9.1. Composite Concrete Deck Market, by Deck Type, 2023-2032

9.1.1. Proprietary System

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Pre-Cast

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Site-Built

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Composite Concrete Deck Market, By Application

10.1. Composite Concrete Deck Market, by Application, 2023-2032

10.1.1. Residential

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Commercial

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Composite Concrete Deck Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Thickness Type (2020-2032)

11.1.2. Market Revenue and Forecast, by Deck Type (2020-2032)

11.1.3. Market Revenue and Forecast, by Application (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Thickness Type (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Deck Type (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Thickness Type (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Deck Type (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Thickness Type (2020-2032)

11.2.2. Market Revenue and Forecast, by Deck Type (2020-2032)

11.2.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Thickness Type (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Deck Type (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Thickness Type (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Deck Type (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Thickness Type (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Deck Type (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Thickness Type (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Deck Type (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Application (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Thickness Type (2020-2032)

11.3.2. Market Revenue and Forecast, by Deck Type (2020-2032)

11.3.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Thickness Type (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Deck Type (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Thickness Type (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Deck Type (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Thickness Type (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Deck Type (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Thickness Type (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Deck Type (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Application (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Thickness Type (2020-2032)

11.4.2. Market Revenue and Forecast, by Deck Type (2020-2032)

11.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Thickness Type (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Deck Type (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Thickness Type (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Deck Type (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Thickness Type (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Deck Type (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Thickness Type (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Deck Type (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Application (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Thickness Type (2020-2032)

11.5.2. Market Revenue and Forecast, by Deck Type (2020-2032)

11.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Thickness Type (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Deck Type (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Thickness Type (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Deck Type (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Application (2020-2032)

Chapter 12. Company Profiles

12.1. ASC Steel Deck

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Raised Floor Solutions Limited

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Tata Steel

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Prodeck-Fixing Ltd.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Structural Metal Decks

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. O’Donnell Metal Deck, LLC

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Construction Metal Forming

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Cordeck

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. A.C.T. Metal Deck Supply

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. TRUEDEK Steel Decking solutions

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others