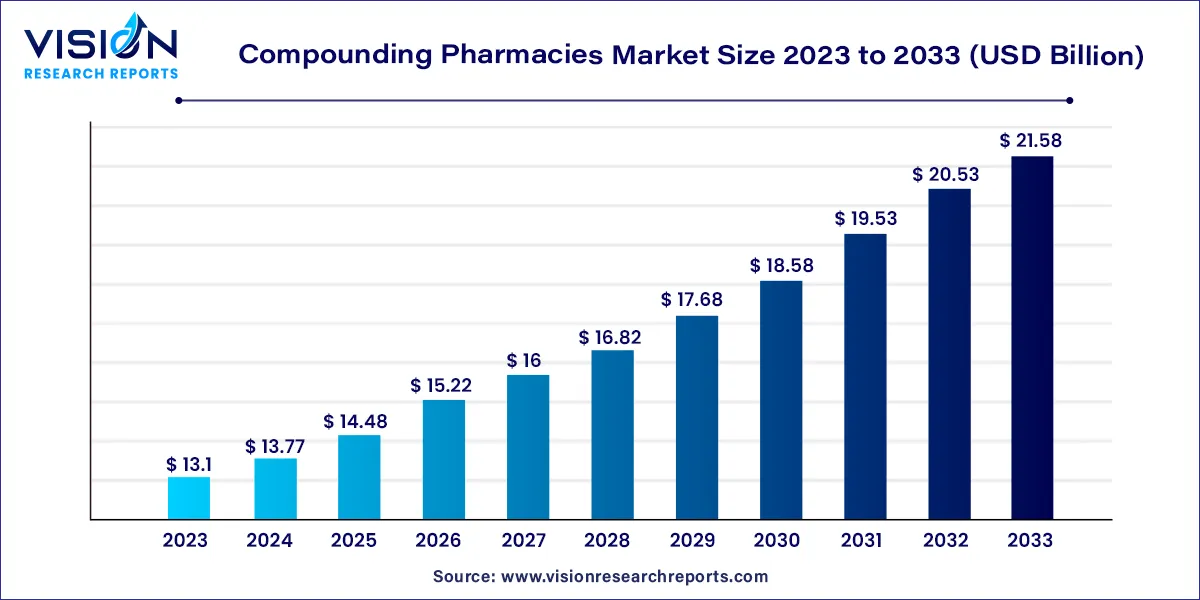

The global compounding pharmacies market was valued at USD 13.1 billion in 2023 and it is predicted to surpass around USD 21.58 billion by 2033 with a CAGR of 5.12% from 2024 to 2033. The compounding pharmacies market is witnessing significant growth and evolution driven by several factors such as increasing demand for personalized medications, advancements in pharmaceutical compounding techniques, and rising prevalence of chronic diseases. Compounding pharmacies play a crucial role in customizing medications to meet individual patient needs, offering dosage forms and formulations that are not readily available in commercially manufactured drugs.

The growth of the compounding pharmacies market is propelled by several key factors. Firstly, there is a growing demand for personalized medications tailored to individual patient needs, driving the need for compounding pharmacies to customize dosage forms and formulations. Technological advancements in compounding techniques have also contributed significantly, enabling pharmacies to produce complex medications with precision and safety. Additionally, the rising prevalence of chronic diseases worldwide necessitates alternative treatment options, with compounded medications offering a viable solution. Regulatory bodies' emphasis on quality standards and adherence to safety guidelines further bolster market growth by ensuring the efficacy and safety of compounded medications. These factors collectively contribute to the expansion of the compounding pharmacies market, positioning it as a crucial component of the healthcare landscape.

The market is segmented based on therapeutic areas, including hormone replacement therapy, pain management, specialty drugs, dermatology, and nutritional supplements. In 2023, the pain management segment emerged as the market leader, accounting for the largest revenue share at 34%. This dominance is attributed to the escalating prevalence of chronic pain and the adverse effects associated with commercially available pain medications. Compounded pain management medications offer several advantages, such as bypassing the gastrointestinal system for patients experiencing related side effects and consolidating multiple medications into a single dose.

Forecasts indicate that the nutritional supplements segment will experience the most rapid growth. This surge is driven by the increasing demand for personalized beauty and anti-aging products. Consequently, numerous companies are introducing a variety of compounded nutraceutical products to meet this demand. For instance, Medisca Inc. offers over 100 high-quality compounded nutraceutical products, rigorously tested for heavy metals. These include prenatal multivitamins, minerals, antioxidants, and various other supplements. The hormone replacement therapy segment also commanded a substantial market share in 2023.

The market is segmented based on age cohorts, including adult, pediatric, and geriatric categories. In 2023, the adult segment emerged as the market leader, capturing the largest revenue share at 45%. Adults often require personalized medication due to factors such as ingredient sensitivities and specific dosage needs. Compounding pharmacies excel in meeting these demands by crafting tailored medications in various forms such as creams, capsules, or gels.

The pediatric segment is poised to experience the fastest growth rate over the forecast period. Children frequently need customized medications due to their smaller size, taste preferences, limited dosage options, and challenges in swallowing solid forms. These personalized medications enhance medication adherence and simplify the administration process, making it easier for children to take their prescribed treatments. Consequently, numerous companies are introducing personalized compounded medications catering to these age groups.

The market is categorized based on sterility into sterile and non-sterile segments. In 2023, the sterile segment emerged as the market leader, commanding the largest share at 59%. This segment is projected to experience rapid expansion at the highest growth rate during the forecast period. The surge in demand for sterile-compounded medications across various healthcare settings drives the growth of this segment. Additionally, the increasing complexity of patient needs and advancements in medical treatments also contribute to its growth.

For instance, in October 2019, The National Association of Boards of Pharmacy announced receiving funding from the FDA to develop a data-sharing system aimed at enhancing the oversight of sterile compounding pharmacies. On the other hand, the non-sterility segment addresses therapeutic gaps where commercially available medications may not fulfill specific patient requirements. Compounded medications in non-sterile forms can be custom formulated to accommodate allergies, sensitivities, or unique patient needs not addressed by mass-produced drugs. The flexibility and adaptability of non-sterile compounding also significantly contribute to driving the market's growth.

The market is segmented based on compounding types, including Pharmaceutical Dosage Alteration (PDA), Pharmaceutical Ingredient Alteration (PIA), Currently Unavailable Pharmaceutical Manufacturing (CUPM), and others. In 2023, the PIA segment emerged as the market leader, capturing the largest share at 38%, and is anticipated to witness the fastest growth rate throughout the forecast period. The demand for compounded medications often involves modifying or adjusting pharmaceutical ingredients to cater to specific patient requirements.

PIA entails modifying the composition or concentration of active ingredients in medications, typically to tailor them for individual patients' needs. Meanwhile, the PDA segment also commanded a significant market share. PDA is a fundamental aspect of compounding pharmacies, and the dominance of specific segments within the market may fluctuate based on factors such as regional preferences, patient demands, and market dynamics.

North America dominated the market in 2023, accounting for the largest share of 44%. The region's market growth is propelled by the presence of numerous compounding pharmacies and the shortage of certain medications. According to statistics from the American Pharmacists Association in October 2021, the U.S. alone had over 56,000 community pharmacies, with 7,500 offering advanced compounding services. Meanwhile, the Asia Pacific region is poised to experience the fastest growth rate over the forecast period.

Key factors driving market growth in the Asia Pacific region include increasing demand for personalized medications, rising prevalence of chronic diseases, expansion of healthcare infrastructure, and growing awareness and demand for alternative therapies. Europe also held a significant market share in 2023, with factors such as the aging population and advancements in medical treatments contributing to its growth. Moreover, regulatory frameworks and guidelines, such as those established by the European Directorate for the Quality of Medicines (EDQM), ensure the safety, quality, and standardization of compounded medications, further supporting the industry's growth.

By Therapeutic Area

By Age Cohort

By Type

By Sterility

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others