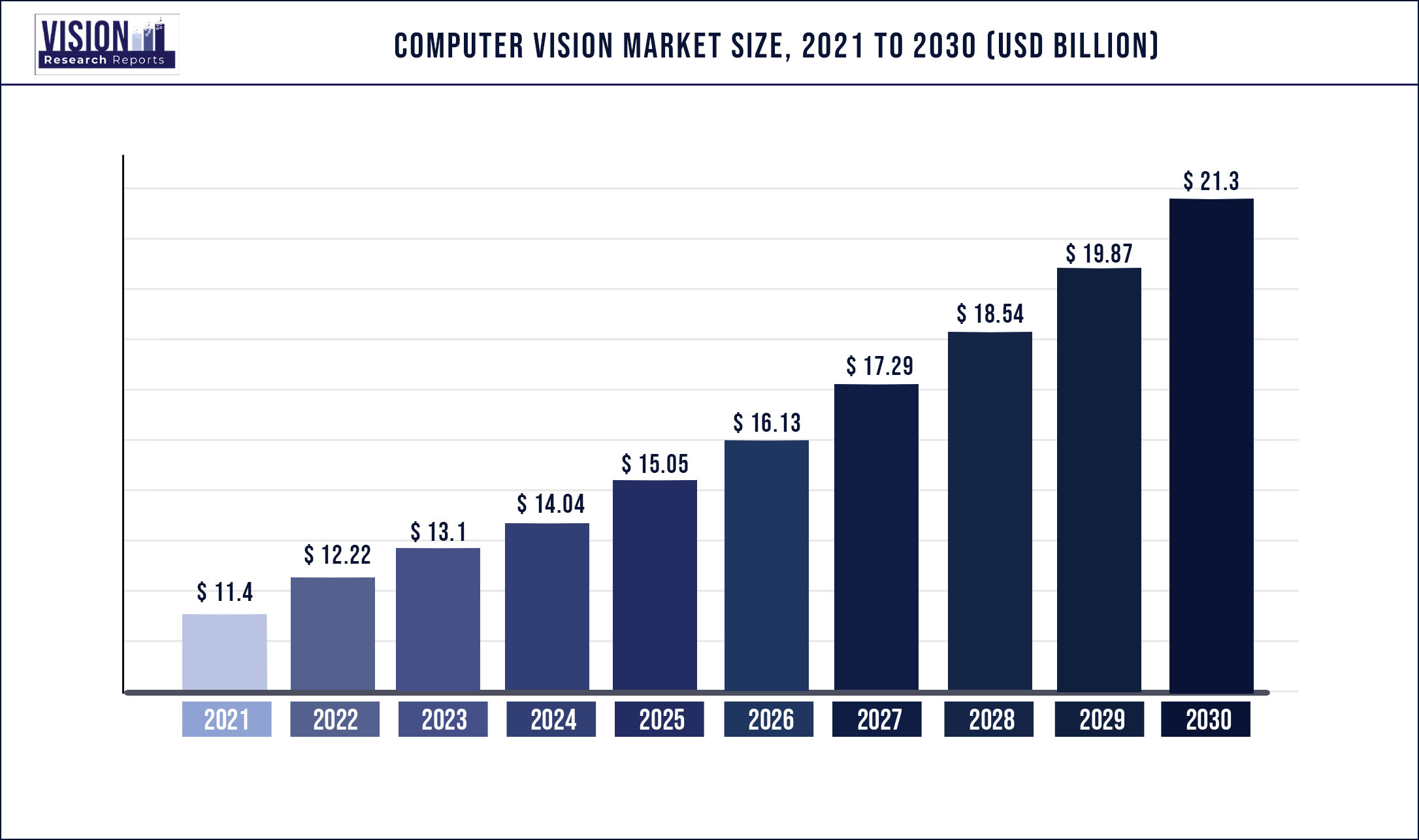

The global computer vision market size was estimated at around USD 11.4 billion in 2021 and it is projected to hit around USD 21.3 billion by 2030, growing at a CAGR of 7.19% from 2022 to 2030.

Report Highlights

This technology has emerged as an emulation of a human visual system to support the automation tasks that require visual cognition. However, image deciphering is more complicated than analyzing data in a binary form due to the vast amount of multi-dimensional data in an image for analysis.

Artificial neural networks and deep learning are being used to increase computer vision's capabilities of replicating human ideas to address such complexity in developing AI systems to recognize visual data. Besides, this technology has become more adept at pattern recognition than the human optical cognitive system with the advent of deep learning techniques. For instance, in May 2022, the University of Illinois, a public land grant university, partnered with The Allen Institute for Artificial Intelligence, also known as AI2, a non-profit institute in the U.S., to develop the "General Robust Image Task" (GRIT) for computer vision models. This collaboration aimed to help AI engineers create computer vision systems that can be utilized for various generic jobs and complex challenges.

Also, different trends are emerging in computer vision techniques and tools after the COVID-19 outbreak. It is being used for multiple purposes of fighting against COVID-19, such as medical data monitoring to diagnose patients and movement & traffic control in urban spaces, among others. For instance, in March 2022,theU.ae, an official portal of the UAE Government, introduced the Alhosn app to get information regarding health status and contact tracing related to COVID-19. With this application, one can quickly get a notification if the individual has been in contact with the COVID-19 infected person, the record of all previous COVID-19 tests with their dates, information about the vaccination types, and their data, and the dose of date.

Besides, in October 2021, BD, a U.S.-based medical technology company that manufactures instrument systems and medical devices, launched the new "BD Veritor," a rapid COVID-19 test at home that would use computer vision technology in a smartphone with a mobile app named "Scanwell." With the help of computer vision technology, the app will display the result in 15 minutes, and an automated report will be shared with state and federal health agencies.

Several major players in the market have developed various platforms that can be used for data storage and analysis using the application software. Companies such as OMRON Corporation have developed different software for applications such as automation, integration, communication, and control. Increasing adoption of various digital healthcare solutions to meet the sensitive regulatory requirements for patient safety is anticipated to drive the demand for vision systems over the forecast period.

Less stringent government regulations and lower manufacturing cost in the Asia Pacific region has led significant technology giants to establish manufacturing bases, thus driving the regional industry. For instance, in June 2022, Nexar, a computer vision technology provider of dash cams for cars, announced its expansion in the Asia Pacific by opening a new office and a manufacturing base in Singapore. The growth would let the company offer its computer vision capabilities to the hi-tech cities, and these offerings will protect the drivers, roads, and highways in the Asia Pacific.

Besides, in June 2022, Paravision, a computer vision technology provider specializing in face recognition, expanded its presence in the Asia Pacific region. The expansion would scale companies' business and strengthen its position in the market by forging new partnerships and relationships in the region. Significant applications of machine vision are in the quality and inspection of the manufacturing industry. A boom in the manufacturing sector is anticipated to enhance the market demand for machine vision in the Asia Pacific region.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 11.4 billion |

| Revenue Forecast by 2030 | USD 21.3 billion |

| Growth rate from 2022 to 2030 | CAGR of 7.19% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Component, product type, application, vertical, region |

| Companies Covered |

Cognex Corporation; Intel Corporation; KEYENCE CORPORATION; Matterport, Inc.; NATIONAL INSTRUMENTS CORP.; Omron Corporation; Sony Semiconductor Solutions Corporation; Teledyne Technologies Incorporated.; Teledyne Geospatial.; Texas Instruments Incorporated |

Component Insights

The hardware segment led the market and accounted for more than 73.11% share of the global revenue in 2021. The hardware segment covers the scope of various hardware components, including processors, cameras, lenses, frame grabbers, and LED lighting. The high share is attributed to the availability of the latest hardware platforms that provide convenient component interconnection and advanced capabilities, such as fast processing, multi-mega-pixel resolution, and fully digital data handling.

Also, high-performance hardware components have made the installation of vision systems easier and serve a broad scope of diverse applications by offering different networking architectures. For instance, in August 2022, VisualCortex Pty Ltd, a computer vision technology provider, partnered with i-PRO, a provider of security surveillance for public safety, to facilitate end-to-end implementation of enterprise-wide video analytics systems in the Asia Pacific region.

The partnership led VisualCortex Pty Ltd i-PRO's install hardware components, including vehicle camera systems, video surveillance cameras, and edge devices, to enhance the standard of video streams recorded for most computer vision applications.

Besides, the software segment is expected to register the highest CAGR over the forecast period. The segment covers the scope of various software that enables the computer vision system to deliver optimal identification and inspection. The primary tasks performed by computer vision software include image classification, object detection, object tracking, and content-based image retrieval. However, many organizations lack the resources and computing power to process a vast amount of visual data, which may hamper the software market for computer vision applications.

A few tech giants are working on addressing restraints for computer vision software development. For instance, in June 2022, Visionary.ai, a software provider of image signal processors (ISP), partnered with Innoviz Technologies Ltd, a manufacturer of LiDAR sensors. The partnership aims to provide a combined service of ISP software and LiDAR sensors to improve 3D computer vision's performance for various applications, including drones, robotics, and smart cities.

The Innoviz Technologies Ltd's LiDAR sensor and Visionary.ai's advanced software capabilities would enhance and develop a 3D image. They also allow imaging in challenging situations, including shallow light, heavy rain or fog, extensive dynamic range, and flashing headlights.

Product Type Insights

The PC-based computer vision systems segment accounted for the largest share of more than 52.3% in 2021. A PC-based vision system is generally dedicated to image processing, and it needs several peripheral devices for other tasks, such as data transfer, frame grabbing, storage, and lighting. The high share is attributed to its low cost, upgradability, and ability to be swapped to provide relative ease. For instance, in August 2020, Omron Corporation, an industrial automation solution provider, launched a new PC-based camera system. The FJ2 PC-based camera system has advanced features, with a resolution ranging from 0.4MP up to 5MP in color and monochrome visions. With the new FJ2 cameras, manufacturers can easily incorporate computer vision into their existing systems while continuing to use their PC.

The smart camera-based computer vision system segment is expected to demonstrate a notable shift in its demand over the forecast period. Smart camera-based vision systems are built with open-embedded processing technology that suppresses the requirement of peripheral devices, such as an external computer or a frame-capture card. This high growth is attributed to cost-effectiveness, compact dimensions, and simple integration of a smart camera-based computer vision system.

Also, smart cameras are built with open-embedded processing technology that suppresses the requirement of peripheral devices, such as an external computer or a frame-capture card. Open-embedded processing-based smart cameras are primarily standalone vision systems that can execute tasks with the least reliance on secondary devices. Such a streamlined system reduces the costs of the product while retaining its operational capacity.

For instance, in March 2022, Cisco Systems Inc. (Cisco Meraki), an American technology company, partnered with Cogniac, an AI computer vision platform. The collaboration would offer Cisco Systems Inc.'s MV smart cameras and cloud-based platforms to deploy Cogniac's computer vision technology. Both companies would build machine learning models that use image and video data to track the activities without needing new infrastructure or AI expertise.

Application Insights

The quality assurance & inspection segment dominated with a revenue share of 29.2% in 2021. Quality assurance is an integral part of the quality management department focused on ensuring quality requirements will be fulfilled. The assurance offered by the quality management department is twofold, first on the inside to management and second to customers, regulators, government agencies, third parties, and certifiers. This high share is attributed to the rapid adoption of process automation in the manufacturing industry to boost productivity.

Computer vision, combined with deep learning algorithms, enables inspection automation for every product in the manufacturing line. For instance, in January 2022, Drishti Technologies, Inc., an AI-driven video traceability and video analytics provider leverages computer vision and deep learning to automate the analysis of manufacturing units' floor videos. Essentially, the firm has set up cameras on production lines to record videos, which are then processed using action recognition, anomaly detection, and object detection. Industrial engineers are then given access to the data to enhance the line.

The predictive maintenance segment is anticipated to witness the fastest CAGR over the forecast period. Predictive maintenance combines machine learning algorithms with the IoT (Internet of Things) devices to monitor the machinery and related components' data. It often uses sensors for datapoint collection and signal identification to make accurate decisions before the breakdown of assets or components.

For instance, in March 2022, Intel Corporation, a U.S.-based company offering cloud computing, data center, and IoT solutions, stated that computer vision, machine learning, and predictive analytics are transforming patient rooms and critical care environments in the healthcare industry. These solutions provide advantages such as better patient outcomes, enhanced operational effectiveness, and decreased harmful exposure for patients and medical staff.

Vertical Insights

The industrial segment accounted for the largest revenue share of over 53% in 2021. The industrial segment includes verticals involving computer vision applications in manufacturing processes, such as automotive, consumer electronics, metals, wood & paper, food & packaging, machinery, and textiles. This high share is attributed to the rapid adoption of computer vision systems in the automotive and transportation industry.

Earlier, vision systems were introduced in the automotive sector to automate assembling vehicles. However, the scope of computer vision systems in this industry has widened with the advent of automotive driver assistance and traffic management systems. For instance, in July 2022, Michelin, a tire manufacturing company, acquired RoadBotics, Inc, a U.S.- based startup that transforms virtual infrastructure data with the help of computer vision technology.

The acquisition would let Michelin DDI, a Michelin company, work with the computer vision expertise of RoadBotics, Inc. the combination of both will deliver unique insights into the factors that contribute to driving behavior. Their decisions will be simpler, quicker, and more relevant, and road safety management will be more effective. Further, it would strengthen Michelin's expertise in artificial intelligence and help scale its business in the North American Region.

The non-industrial vertical is expected to showcase significant growth over the forecast period. The non-industrial segment includes security & surveillance, postal & logistics, agriculture, healthcare, consumer electronics, intelligent transportation systems, sports & entertainment, and retail, among different verticals involving machine vision applications. The applications of computer vision systems in non-industrial verticals include packaging inspection, barcode reading, product & component assembly, and defect reduction, among others.

For instance, in March 2021, Google LLC launched a new AI-driven tool," Visual Inspection." The AI-driven tool inspects each piece of equipment in a company to ensure that all mechanical parts used by that specific company are of a comparable value. Additionally, it has been created to quickly inspect hundreds of products, identify defects, and report them in under a minute. Besides, the healthcare vertical has rapidly adopted computer vision technology for several applications, such as monitoring patients in nursing care, facial recognition for visually impaired users, and medical image analysis, among others.

Regional Insights

The Asia Pacific region dominated the computer vision market and accounted for a revenue share of over 40.6% in 2021. The presence of significant players such as OMRON Corporation and Sony Semiconductor Solutions Corporation is expected to boost the market growth in the region. Further, the high share is attributable to the significantly increasing investments in Chinese companies and other countries in the APAC region.

For instance, in January 2022, Amazon Web Services, Inc., a provider of cloud computing platforms, launched its AWS Panorama, a software development kit in the Asia Pacific that improves operations with computer vision. Investing in AWS Panorama, to be available in Sydney and Singapore countries, would help businesses automate visual inspection tasks like locating bottlenecks in industrial processes, evaluating manufacturing quality, and determining worker safety within their facilities.

Further, the AWS Panorama is interconnected with Amazon SageMaker, which would let the customers train their computer vision model and deploy the model in AWS Panorama.

North America is anticipated to witness significant growth over the forecast period. This growth is attributable to favorable government initiatives to encourage the adoption of computer vision in the Region. For instance, in May 2021, NEC Corporation of America, which develops IT infrastructure, launched NEC National Security Systems, a new subsidiary of NEC Corporation of America. The new subsidiary company would provide computer vision and artificial intelligence applications, the company's biometrics, to the U.S. government.

The major clients of NEC National Security Systems are the U.S. Department of State, U.S. Department of Homeland Security, U.S. Department of Justice, U.S. Department of Defense, and the U.S. intelligence community. Besides, in March 2022, Fermatagro Technology Limited. an agritech company focusing on computer vision and data science expands its presence in the North American market.

The expanding North America regional market would let the company grow in Canada and scale its business. Further, the company would bring new computer vision tools and increase its profitability in the Region.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Computer Vision Market

5.1. COVID-19 Landscape: Computer Vision Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Computer Vision Market, By Component

8.1. Computer Vision Market, by Component, 2022-2030

8.1.1. Hardware

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Software

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Computer Vision Market, By Product Type

9.1. Computer Vision Market, by Product Type, 2022-2030

9.1.1. Smart Camera-Based Computer Vision System

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. PC-Based Computer Vision System

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Computer Vision Market, By Application

10.1. Computer Vision Market, by Application, 2022-2030

10.1.1. Quality Assurance & Inspection

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Positioning & Guidance

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Measurement

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Identification

10.1.4.1. Market Revenue and Forecast (2017-2030)

10.1.5. Predictive Maintenance

10.1.5.1. Market Revenue and Forecast (2017-2030)

10.1.6. 3D Visualization & Interactive 3D Modelling

10.1.6.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Computer Vision Market, By Vertical

11.1. Computer Vision Market, by Vertical, 2022-2030

11.1.1. Industrial

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Non-Industrial

11.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Computer Vision Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Component (2017-2030)

12.1.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.1.3. Market Revenue and Forecast, by Application (2017-2030)

12.1.4. Market Revenue and Forecast, by Vertical (2017-2030)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Component (2017-2030)

12.1.5.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.1.5.3. Market Revenue and Forecast, by Application (2017-2030)

12.1.5.4. Market Revenue and Forecast, by Vertical (2017-2030)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Component (2017-2030)

12.1.6.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.1.6.3. Market Revenue and Forecast, by Application (2017-2030)

12.1.6.4. Market Revenue and Forecast, by Vertical (2017-2030)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Component (2017-2030)

12.2.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.2.3. Market Revenue and Forecast, by Application (2017-2030)

12.2.4. Market Revenue and Forecast, by Vertical (2017-2030)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Component (2017-2030)

12.2.5.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.2.5.3. Market Revenue and Forecast, by Application (2017-2030)

12.2.5.4. Market Revenue and Forecast, by Vertical (2017-2030)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Component (2017-2030)

12.2.6.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.2.6.3. Market Revenue and Forecast, by Application (2017-2030)

12.2.6.4. Market Revenue and Forecast, by Vertical (2017-2030)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Component (2017-2030)

12.2.7.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.2.7.3. Market Revenue and Forecast, by Application (2017-2030)

12.2.7.4. Market Revenue and Forecast, by Vertical (2017-2030)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Component (2017-2030)

12.2.8.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.2.8.3. Market Revenue and Forecast, by Application (2017-2030)

12.2.8.4. Market Revenue and Forecast, by Vertical (2017-2030)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Component (2017-2030)

12.3.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.3.3. Market Revenue and Forecast, by Application (2017-2030)

12.3.4. Market Revenue and Forecast, by Vertical (2017-2030)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Component (2017-2030)

12.3.5.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.3.5.3. Market Revenue and Forecast, by Application (2017-2030)

12.3.5.4. Market Revenue and Forecast, by Vertical (2017-2030)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Component (2017-2030)

12.3.6.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.3.6.3. Market Revenue and Forecast, by Application (2017-2030)

12.3.6.4. Market Revenue and Forecast, by Vertical (2017-2030)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Component (2017-2030)

12.3.7.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.3.7.3. Market Revenue and Forecast, by Application (2017-2030)

12.3.7.4. Market Revenue and Forecast, by Vertical (2017-2030)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Component (2017-2030)

12.3.8.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.3.8.3. Market Revenue and Forecast, by Application (2017-2030)

12.3.8.4. Market Revenue and Forecast, by Vertical (2017-2030)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Component (2017-2030)

12.4.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.4.3. Market Revenue and Forecast, by Application (2017-2030)

12.4.4. Market Revenue and Forecast, by Vertical (2017-2030)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Component (2017-2030)

12.4.5.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.4.5.3. Market Revenue and Forecast, by Application (2017-2030)

12.4.5.4. Market Revenue and Forecast, by Vertical (2017-2030)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Component (2017-2030)

12.4.6.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.4.6.3. Market Revenue and Forecast, by Application (2017-2030)

12.4.6.4. Market Revenue and Forecast, by Vertical (2017-2030)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Component (2017-2030)

12.4.7.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.4.7.3. Market Revenue and Forecast, by Application (2017-2030)

12.4.7.4. Market Revenue and Forecast, by Vertical (2017-2030)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Component (2017-2030)

12.4.8.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.4.8.3. Market Revenue and Forecast, by Application (2017-2030)

12.4.8.4. Market Revenue and Forecast, by Vertical (2017-2030)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Component (2017-2030)

12.5.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.5.3. Market Revenue and Forecast, by Application (2017-2030)

12.5.4. Market Revenue and Forecast, by Vertical (2017-2030)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Component (2017-2030)

12.5.5.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.5.5.3. Market Revenue and Forecast, by Application (2017-2030)

12.5.5.4. Market Revenue and Forecast, by Vertical (2017-2030)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Component (2017-2030)

12.5.6.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.5.6.3. Market Revenue and Forecast, by Application (2017-2030)

12.5.6.4. Market Revenue and Forecast, by Vertical (2017-2030)

Chapter 13. Company Profiles

13.1. Cognex Corporation

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Intel Corporation

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. KEYENCE CORPORATION

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Matterport, Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. NATIONAL INSTRUMENTS CORP.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Omron Corporation

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Sony Semiconductor Solutions Corporation

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Teledyne Technologies Incorporated.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Teledyne Geospatial.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Texas Instruments Incorporated

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others