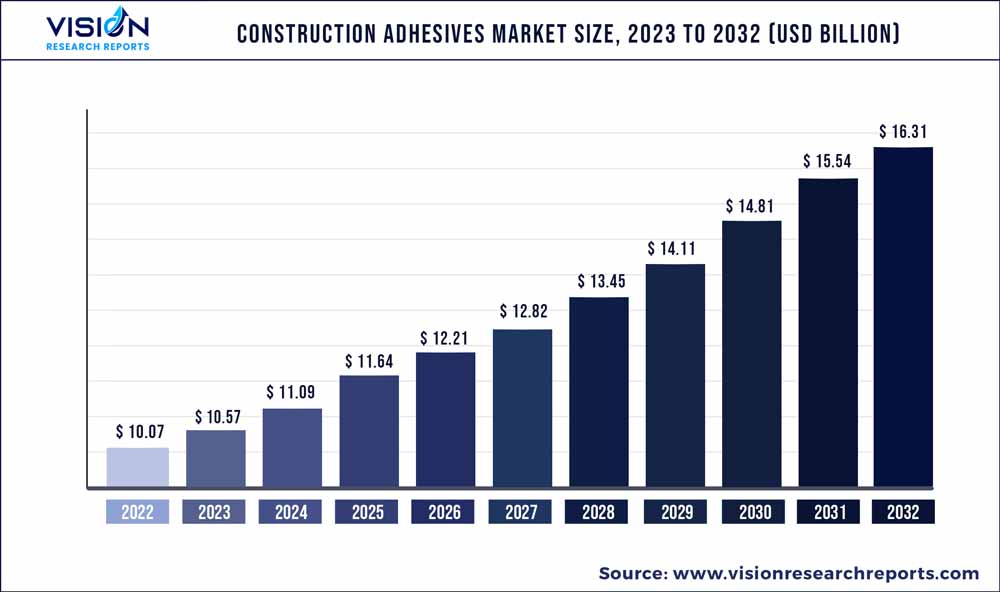

The global construction adhesives market was surpassed at USD 10.07 billion in 2022 and is expected to hit around USD 16.31 billion by 2032, growing at a CAGR of 4.94% from 2023 to 2032.

Key Pointers

Report Scope of the Construction Adhesives Market

| Report Coverage | Details |

| Market Size in 2022 | USD 10.07 billion |

| Revenue Forecast by 2032 | USD 16.31 billion |

| Growth rate from 2023 to 2032 | CAGR of 4.94% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | H.B. Fuller Company; 3M; Sika AG; Dow; Bostik SA; Henkel AG & Co. KGaA; Franklin International, Inc; Avery Dennison Corporation; Illinois Tool Works Incorporation; DAP Products, Inc. |

The emergence of COVID-19 affected the construction industry around the world in 2020, and its impact continued in 2021 and 2022 as well in certain countries.

Construction represents close to a 13% share of the global GDP. Thus, a short impact on the sector affects the materials demand, thereby reducing the growth of the market. Most of the construction sites during the first half of 2020 faced numerous challenges associated with operations and supply chains. However, the market started recovering in 2021. Construction spending on infrastructure projects is likely to rise in 2022, on account of the passage of public and private investments.

Focus on sustainable construction and infrastructure projects is anticipated to assist the market growth during the coming years. Governments may provide stimulation to the economy by encouraging carbon reduction targets. These incentives might come in the form of direct public funds and policy changes. Companies expect demand for sustainable buildings and communities that promote healthier lifestyles, which is anticipated to drive the demand for construction adhesives.

The adoption of digitization and emerging technologies is another key factor, which is likely to provide a boost to the building & construction sector and associated materials over the long term. Contractors are likely to use remote collaboration at various stages of projects using digital models. Distributors of adhesives and other building materials are focusing on minimal physical interactions, especially with e-commerce sites for which sales teams can handle customers and orders with digital tools.

Investments in construction and infrastructure projects are anticipated to drive market growth in the long run. For instance, the Indian government has plans to double its infrastructure investments in sectors such as communication, commercial infrastructure, energy, and water & sanitation over the next five years, as of 2021. Also, as per the National Infrastructure Pipeline, there are over 6,800 identified projects worth USD 15 million in the country. Projects such as airport development in smart cities and Pradhan Mantri Sadak Yojna Project are likely to offer new opportunities for market players.

Resin Type Insights

The acrylic adhesive resin segment dominated the market with the highest revenue share of over 44.03% in 2022. The preference for acrylic adhesives is increasing in the construction sector mainly due to exceptional bonding properties, good impact strength, and excellent water resistance. The segment is projected to witness a growth rate of 4.8% from 2023 to 2032.

Epoxies are structural adhesives and are likely to observe a growth of 4.41%, in terms of revenue, during the forecast period. These adhesives can be used on various substrates in the construction industry, wherein a strong bond is required. They are used in laminated woods for roofs, decks, walls, and other applications. These have high heat and chemical resistance and are used to bond stone, glass, metal, wood, and some plastics.

In terms of volume, the polyurethanes segment accounted for a volume share of over 11.05% in 2022 and is likely to grow at a lucrative pace. Polyurethane adhesives are paintable, have water resistance, low odor, low VOC content, and the ability to work in cold and hot environments. They are used in interior as well as exterior construction applications.

Technology Insights

Water-based technology segment dominated the market with the highest revenue share of over 44.06% in 2022. Products made using this technology have higher moisture resistance compared to other adhesives, which is likely to contribute to the growth of the segment. New product development along with an increase in R&D spending is likely to offer new avenues for vendors of water-based construction adhesives.

Solvent-based products are used in high-performance applications in the construction industry and are likely to witness lucrative growth during the projection period. Demand from structural and non-structural applications is projected to keep a positive momentum for this segment.

The market players are focusing on the development of advanced solutions to increase their market share through R&D investments. Reactive adhesives are projected to witness healthy growth on account of their high bond strength and excellent durability in harsh environmental circumstances.

Application Insights

The commercial application segment dominated the market with the highest revenue share of over 34.07% in 2022. Incentives for first-time house buyers are projected to assist the residential construction sector around the globe. For instance, in the 2022 budget, the Canadian government introduced Tax-Free First Home Savings Account. This will assist first-home buyers to save up to USD 40,000.

The commercial segment is likely to observe a growth rate of 5.45%, in terms of revenue, from 2022 to 2032. Government packages and incentives are projected to boost infrastructure and residential sectors, thereby positively influencing the growth of the construction adhesive market. For instance, the Mexican government is preparing a multi-billion infrastructure package for investment in highways, ports, energy, and telecommunications.

The industrial application segment accounted for a revenue share of over 30.08% in 2022. Increasing FDIs in emerging countries, particularly for manufacturing industries, is likely to bolster the market growth of the industrial segment. For instance, in December 2021, the Maharashtra government in India signed MoUs worth around USD 659.7 million for various sectors such as steel, electric vehicles, space research, biofuel, food processing, and ethanol production, among others.

Regional Insights

The Asia Pacific region dominated the market with the highest revenue share of 39.12% in 2022. China is the leading consumer of construction adhesives and accounted for a volume share of over 20.0% of the global market in 2022. Massive investments in the infrastructure sector of the country are projected to promote the use of construction adhesives. For instance, in August 2020, the state railway operator of China announced its plans to double the high-speed railway network over the next 15 years.

Europe’s infrastructure spending was flat in 2020; however, it observed a y-o-y growth of 1.5% in November 2021, compared to the same period from the previous year. As per the latest EU Construction Outlook Report, the construction sector is poised to grow by 2.5% in 2022, compared to 2021.

The construction sector of North America is one of the leading sectors globally and contributes significantly to the global GDP. Strong economic growth, an increase in household formation, and low mortgage rates are expected to be the key factors aiding the growth in residential construction. However, the demand for multi-family housing is expected to decline during the forecast period, which may have a moderate effect on residential construction.

Construction Adhesives Market Segmentations:

By Resin Type

By Technology

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Resin Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Construction Adhesives Market

5.1. COVID-19 Landscape: Construction Adhesives Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Construction Adhesives Market, By Resin Type

8.1. Construction Adhesives Market, by Resin Type, 2023-2032

8.1.1 Acrylic

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Polyurethanes

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Polyvinyl Acetate

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Epoxy

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Construction Adhesives Market, By Technology

9.1. Construction Adhesives Market, by Technology, 2023-2032

9.1.1. Water-based

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Solvent-based

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Reactive & Others

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Construction Adhesives Market, By Application

10.1. Construction Adhesives Market, by Application, 2023-2032

10.1.1. Residential

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Commercial

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Industrial

10.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Construction Adhesives Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Resin Type (2020-2032)

11.1.2. Market Revenue and Forecast, by Technology (2020-2032)

11.1.3. Market Revenue and Forecast, by Application (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Resin Type (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Technology (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Resin Type (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Technology (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Resin Type (2020-2032)

11.2.2. Market Revenue and Forecast, by Technology (2020-2032)

11.2.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Resin Type (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Technology (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Resin Type (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Technology (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Resin Type (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Technology (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Resin Type (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Technology (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Application (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Resin Type (2020-2032)

11.3.2. Market Revenue and Forecast, by Technology (2020-2032)

11.3.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Resin Type (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Technology (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Resin Type (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Technology (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Resin Type (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Technology (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Resin Type (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Technology (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Application (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Resin Type (2020-2032)

11.4.2. Market Revenue and Forecast, by Technology (2020-2032)

11.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Resin Type (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Technology (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Resin Type (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Technology (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Resin Type (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Technology (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Resin Type (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Technology (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Application (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Resin Type (2020-2032)

11.5.2. Market Revenue and Forecast, by Technology (2020-2032)

11.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Resin Type (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Technology (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Resin Type (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Technology (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Application (2020-2032)

Chapter 12. Company Profiles

12.1. H.B. Fuller Company

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. 3M

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Sika AG

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Dow

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Bostik SA

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Henkel AG & Co. KGaA

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Franklin International, Inc

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Avery Dennison Corporation

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Illinois Tool Works Incorporation

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. DAP Products, Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others