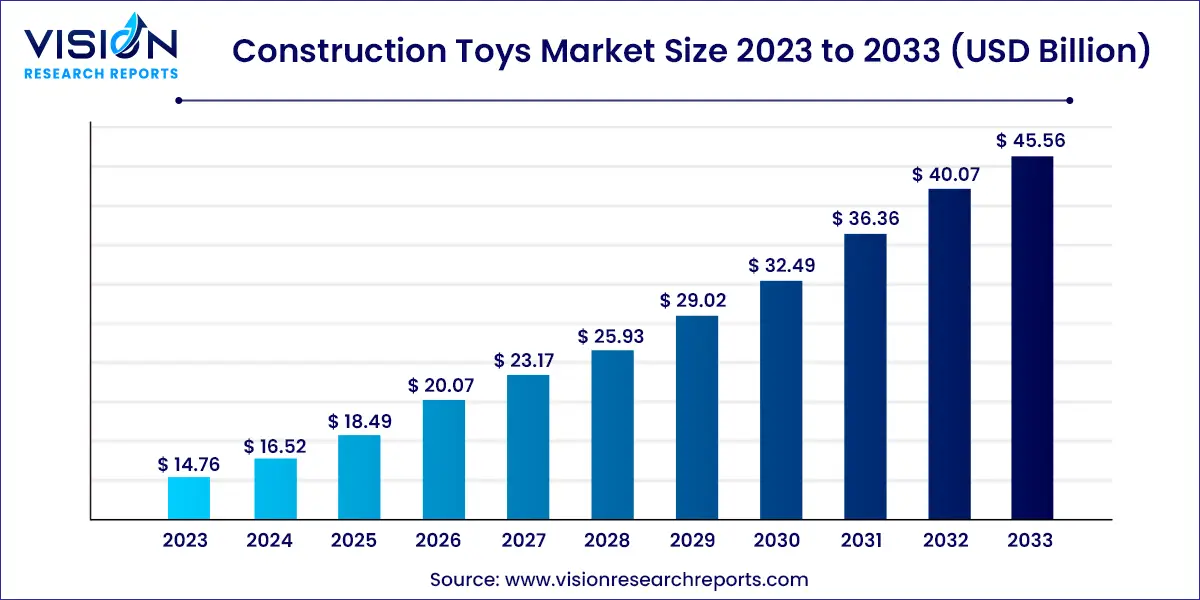

The global construction toys market size was estimated at around USD 14.76 billion in 2023 and it is projected to hit around USD 45.56 billion by 2033, growing at a CAGR of 11.93% from 2024 to 2033. The construction toys market has experienced significant growth, driven by increased consumer interest in educational and STEM (Science, Technology, Engineering, and Mathematics) toys. These toys not only provide entertainment but also foster creativity, problem-solving skills, and cognitive development in children.

The growth of the construction toys market is fueled by the educational benefits these toys offer. Parents and educators are increasingly valuing toys that promote cognitive development, creativity, and problem-solving skills, making construction toys highly sought after. Additionally, technological advancements have significantly contributed to market expansion. Modern construction toys often incorporate interactive features, such as augmented reality (AR) and smart technology, which enhance the play experience and appeal to tech-savvy children and parents alike. Rising disposable incomes also play a crucial role, as families are more willing to invest in high-quality, innovative toys. Moreover, the trend towards sustainability is influencing manufacturers to produce eco-friendly construction toys, aligning with the growing consumer preference for environmentally responsible products.

In 2023, North America held 33% of the global revenue share for construction toys. The market's growth is supported by strategic product launches and increased sales of licensed products. For example, Daron Worldwide Trading's introduction of a 66-piece Air Canada construction set caters specifically to Canadian consumers. In Mexico, the market benefits from seasonal sales peaks during Christmas, January, and Children’s Day in April, with major brands like Mattel, Hasbro, LEGO, Mega Bloks, and Spin Master driving demand.

| Attribute | North America |

| Market Value | USD 4.87 Billion |

| Growth Rate | 11.93% CAGR |

| Projected Value | USD 15.03 Billion |

The Asia-Pacific construction toys market held 27% of the global revenue share in 2023 and is projected to grow at a CAGR of 13.03% during the forecast period. This growth is fueled by increased internet penetration in countries like India, China, Indonesia, and Vietnam. E-commerce platforms such as Flipkart, Amazon, and Alibaba are promoting aggressive discounts and promotions, attracting new customers. Major players like Tegu, Mattel, Spin Master Ltd., and The LEGO Group are capitalizing on these trends with both online and offline presence. The presence of nearly 200 LEGO stores in Asia Pacific as of February 2024 underscores the region’s significant role in the global construction toys market.

In 2023, bricks and blocks held a dominant share of 58% in the construction toys market. This steady growth is driven by the growing consumer preference for toys that provide extended engagement. Manufacturers are continually innovating by introducing new designs that mimic real-life scenarios, enhancing educational value and interest among children.

Several companies are now offering bricks and blocks made from eco-friendly materials, such as recycled plastics or bamboo husk. For instance, The LEGO Group has introduced plant-based bricks made from sustainably sourced sugarcane, featuring botanical elements like leaves, trees, and bushes. This initiative is part of LEGO’s broader commitment to refurbish its manufacturing processes with plant-based and recycled materials by 2033.

Tinker toys are projected to experience a robust growth rate of 12.83% CAGR from 2024 to 2033. These toys are designed to support developmental milestones and safety for children aged three and older. Tinker toys foster creativity, problem-solving, and fine motor skills by allowing children to experiment with various combinations and designs. They are frequently used in educational settings to teach concepts related to engineering, architecture, and spatial reasoning. Additionally, tinker toys promote collaborative play, enhancing social skills, communication, and teamwork.

Polymer-based construction toys represented 37% of the revenue share in 2023. Their lightweight nature makes them safer during group activities, as children can easily handle the pieces without risk of injury from heavy or rigid materials. Polymers are also flexible, reducing breakage and extending the toys' lifespan, which is advantageous in environments where rough handling is common.

Wooden construction toys are expected to grow at a CAGR of 11.13% from 2024 to 2033. Wood is favored due to its compliance with safety guidelines and its non-toxic nature. The material’s durability and appealing texture make it a strong candidate for leading the manufacturing of construction toys over the forecast period.

In 2023, hypermarkets and supermarkets accounted for 33% of construction toy sales. These stores typically feature large, well-organized toy sections that attract shoppers and encourage impulse purchases. Regular promotions and discounts, such as buy-one-get-one-free deals and seasonal offers, further boost sales.

The online segment is projected to grow at a CAGR of 12.63% from 2024 to 2033. The convenience of online shopping allows customers to explore a wide range of construction toys from home, making it particularly appealing to busy parents and gift shoppers. A 2022 YouGov survey revealed that nearly 45% of parents in the Asia-Pacific (APAC) region prefer purchasing toys online, indicating a strong trend towards e-commerce in the region.

By Product

By Material

By Distribution Channel

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Construction Toys Market

5.1. COVID-19 Landscape: Construction Toys Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Construction Toys Market, By Product

8.1. Construction Toys Market, by Product, 2024-2033

8.1.1 Bricks & Blocks

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Tinker Toy

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Others

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Construction Toys Market, By Material

9.1. Construction Toys Market, by Material, 2024-2033

9.1.1. Wood

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Polymer

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Metal

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Construction Toys Market, By Distribution Channel

10.1. Construction Toys Market, by Distribution Channel, 2024-2033

10.1.1. Hypermarkets & Supermarkets

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Specialty Stores

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Online

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Construction Toys Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.2. Market Revenue and Forecast, by Material (2021-2033)

11.1.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Material (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Material (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.2. Market Revenue and Forecast, by Material (2021-2033)

11.2.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Material (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Material (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Material (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Material (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.2. Market Revenue and Forecast, by Material (2021-2033)

11.3.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Material (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Material (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Material (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Material (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.2. Market Revenue and Forecast, by Material (2021-2033)

11.4.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Material (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Material (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Material (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Material (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.2. Market Revenue and Forecast, by Material (2021-2033)

11.5.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Material (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Material (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

Chapter 12. Company Profiles

12.1. Hasbro

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. K’NEX (Basic Fun, Inc.)

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Tegu

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Mattel

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. BANDAI NAMCO Group

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Spin Master Ltd.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. The LEGO Group.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. PlayMonster LLC.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. KnuckleStrutz

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Magformers

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others