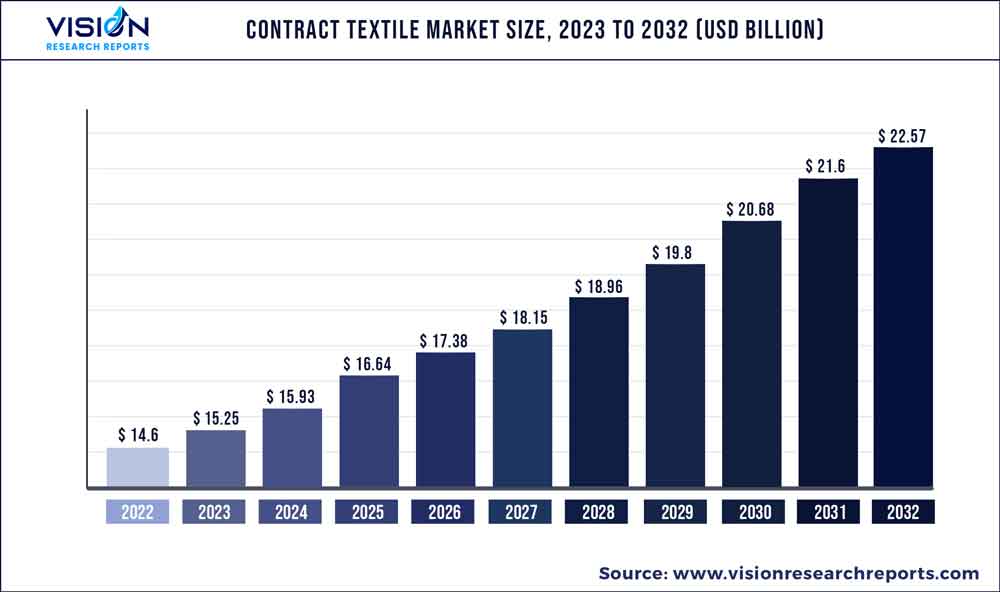

The global contract textile market was surpassed at USD 14.6 billion in 2022 and is expected to hit around USD 22.57 billion by 2032, growing at a CAGR of 4.45% from 2023 to 2032. The contract textile market in the United States was accounted for USD 2.8 billion in 2022.

Key Pointers

Report Scope of the Contract Textile Market

| Report Coverage | Details |

| Revenue Share of Asia Pacific in 2022 | 38.07% |

| CAGR of Middle East & Africa from 2023 to 2032 | 5.44% |

| Revenue Forecast by 2032 | USD 22.57 billion |

| Growth Rate from 2023 to 2032 | CAGR of 4.45% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Beaulieu International Group; Camira Fabrics Ltd.; Panaz; Sunbury Design; Successori REDA S.p.A.; MOHAWK INDUSTRIES, INC; ARC-COM; ARCHITEX; CTL LEATHER; DESIGNTEX; Agua Fabrics |

The increased need for textile contracting to satisfy the unique needs of end users from enterprises, hospitals, public buildings, and hotels is credited with this expansion.

Contract manufacturers source raw materials and manufacture textile goods in accordance with the design specifications provided by the client. These companies influence the quality of goods for the brands they make by selecting raw materials and implementing specific patterns and standards. Contract fabric manufacturing encompasses the complete supply chain, including operations such as custom design, cutting, sewing, assembly, printing, packing, warehousing, and shipping, among others.

Contract textile manufacturer’s offers products for a wide range of commercial interiors such as offices, schools, universities, theaters, auditoriums, restaurants, cafes, and hospitals. The textiles cover applications in a vast array of compositions, colors and price points offering improved aesthetics, acoustic solutions and thermal and fire resistance at commercial spaces.

The contract manufacturers provide finished textiles for companies involved into manufacturing of apparels, upholstery, wall coverings, panels among several other fabric products. These fabric products are offered to different application industries under company’s brand name and distributed through different distribution channels including direct supply, indirect supply and contractors.

Contract textiles, as opposed to domestic materials, have to endure much, more laundering and drying cycles in commercial laundries than domestic household fabrics. As a result, contract textiles are built to endure these pressures over the duration of their service life at a high quality level. The contract textile manufacturers make the choice of wide range of natural and synthetic fibers along with recycled raw materials, renewable sources such as wool, bast fibers from hemp and nettles. The fabrics are manufactured to meet international quality standards and client specifications related to design and functions thereby driving the demand from application industries.

The market players are continuously engaged in adopting strategies such as new product launches and mergers & acquisitions to gain a competitive advantage and maintain their positions in the industry. Moreover, with the growing investments in the textile sector, the demand for contract fabrics is expected to boost in the global market

Application Insights

The decorative textile segment dominated the market with the highest revenue share of 45.35% in 2022. The segment is estimated to grow at a significant CAGR over the coming years. Decorative textiles are primarily used for interior of commercial building décor rather than serving any practical function. This includes upholstery, draperies, wall hangings and curtains. These are mainly used to provide privacy in offices & hospitals, or to reduce glare due to sunlight or to create aesthetic effect in the working premises.

The textile wall and ceiling coverings segment is expected to expand at the fastest CAGR of 5.32% from 2023 to 2032. The usual backing for this fabric is spun-bonded nonwoven or paper. Macramé and tapestry are the common materials used to make wall and ceiling coverings. Good flame, dirt, and stain resistance are these coverings' main physical qualities.

End-use Insights

The office space segment dominated the market with the highest revenue share of 29.72% in 2022. The segment is estimated to grow with a significant compound annual growth rate over the coming years. Contract textile applications in office spaces comprise of seating, panels and wall coverings are expected to witness a significant growth owing to large scale office refurbishment activities. In addition, the commercial new building sector is also projected to experience relatively high growth rate owing to improving business confidence, which is further expected to drive the product demand in the market.

The healthcare sector is forecasted to expand at the fastest CAGR of 4.86% from 2023 to 2032. This is attributed to the rapidly rising number of hospitals and medical centers across the globe, thereby driving the demand of products such as panels and wall coverings. This in turn is expected to drive the growth of contract textile produced products as it provides high quality products at larger quantities.

Regional Insights

The Asia Pacific contract textile segment dominated the market and accounted for a revenue share of 38.07% in 2022. The region is also forecasted to grow with a significant growth rate over the forecast period, due to the rapidly growing population and high scale urbanization in the region.

The growing population has resulted in an increase in the number of commercial building such as hospitals, office buildings and hospitality industry buildings such as hotels, restaurants and cafés. This demand is propelling the demand for contract fabric for interior modifications and decoration purposes.

Increasing investment of major fabric manufacturers in developing economies including India, Bangladesh, Vietnam, Cambodia, Sri Lanka among several others have resulted into high potential for contract textile manufacturing in these economies. Availability of low-cost labor along with favorable government policies have increased fabric production capabilities in these regions resulting into high production volumes

The contract textile market in the Middle East & Africa is expected to expand at the fastest CAGR of 5.44% over the coming years. This is owing to the rising industrialization and tourism, which has resulted in increased investment in commercial & hospitality buildings in the region, mainly in UAE and Saudi Arabia.

Contract Textile Market Segmentations:

By Application

By End-use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Contract Textile Market

5.1. COVID-19 Landscape: Contract Textile Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Contract Textile Market, By Application

8.1. Contract Textile Market, by Application, 2023-2032

8.1.1. Decorative Textile

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Textile Floor Covering

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Textile Wall Covering

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Manufactured Products

8.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Contract Textile Market, By End-use

9.1. Contract Textile Market, by End-use, 2023-2032

9.1.1. Office Spaces

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. HORECA

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Healthcare

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Public Buildings

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Others

9.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Contract Textile Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Application (2020-2032)

10.1.2. Market Revenue and Forecast, by End-use (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Application (2020-2032)

10.1.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Application (2020-2032)

10.1.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Application (2020-2032)

10.2.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Application (2020-2032)

10.2.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Application (2020-2032)

10.2.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Application (2020-2032)

10.2.5.2. Market Revenue and Forecast, by End-use (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Application (2020-2032)

10.2.6.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Application (2020-2032)

10.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Application (2020-2032)

10.3.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Application (2020-2032)

10.3.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Application (2020-2032)

10.3.5.2. Market Revenue and Forecast, by End-use (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Application (2020-2032)

10.3.6.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Application (2020-2032)

10.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Application (2020-2032)

10.4.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Application (2020-2032)

10.4.4.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Application (2020-2032)

10.4.5.2. Market Revenue and Forecast, by End-use (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Application (2020-2032)

10.4.6.2. Market Revenue and Forecast, by End-use (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Application (2020-2032)

10.5.2. Market Revenue and Forecast, by End-use (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Application (2020-2032)

10.5.3.2. Market Revenue and Forecast, by End-use (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Application (2020-2032)

10.5.4.2. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 11. Company Profiles

11.1. Beaulieu International Group

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Camira Fabrics Ltd.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Panaz, Sunbury Design

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Successori REDA S.p.A.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. MOHAWK INDUSTRIES, INC

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. ARC-COM

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. ARCHITEX

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. CTL LEATHER

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. DESIGNTEX

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Agua Fabrics

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others