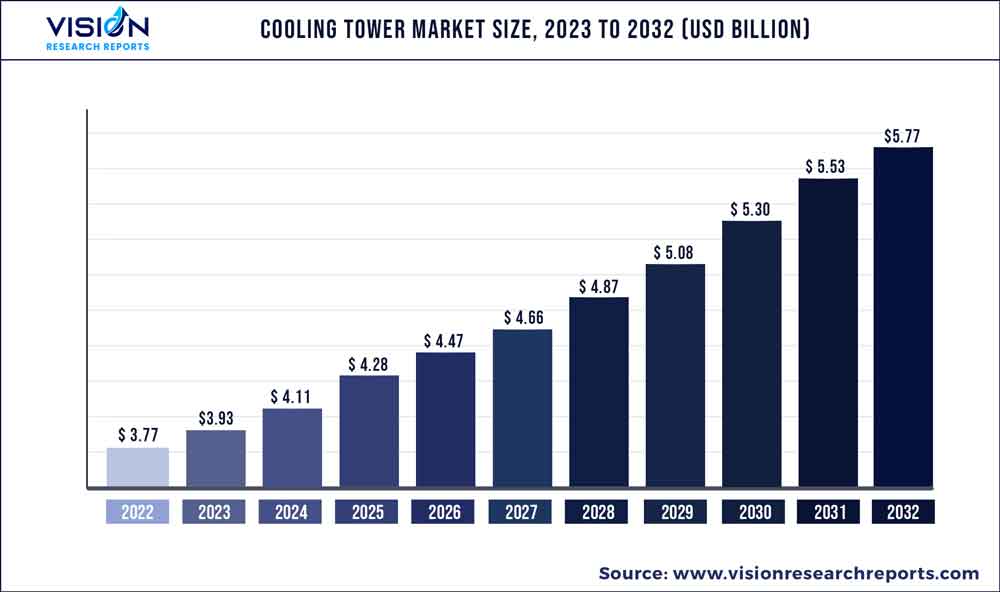

The global cooling tower market was surpassed at USD 3.77 billion in 2022 and is expected to hit around USD 5.77 billion by 2032, growing at a CAGR of 4.35% from 2023 to 2032. The cooling tower market in the United States was accounted for USD 639 million in 2022.

Key Pointers

Report Scope of the Cooling Tower Market

| Report Coverage | Details |

| Revenue Share of Asia Pacific in 2022 | 30.43% |

| Revenue Forecast by 2032 | USD 5.77 billion |

| Growth Rate from 2023 to 2032 | CAGR of 4.35% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Babcock & Wilcox Enterprises, Inc.; Baltimore Aircoil Company; Cenk Endüstri Tesisleri Imalat Ve Taahhüt A.Åž.; Cooling Tower Systems, Inc.; Delta Cooling Towers Inc.; Engie Refrigeration GmbH; EVAPCO, Inc.; S.A. Hamon; Johnson Controls International Plc.; Kelvion Holdings GmbH; Liang Chi Industry Co. Ltd. |

The stringent government environmental regulations, coupled with concerns associated with the plumes generated by power generation and chemical industries, are anticipated to drive the demand for cooling towers during the forecast period. HVAC systems ensure a cool and comfortable environment in large commercial buildings that include office buildings, airports, hospitals, conference centers, hotels, etc. These systems use cooling towers to provide optimal cooling in buildings. The consistent rise in commercial construction projects around the world, along with the gradual increase in HVAC installations, is anticipated to boost the market prospects for cooling towers over the coming years.

The construction spending for power in the U.S. increased from USD 110,610 in December 2022 to USD 111,598 in January 2023, whereas, for manufacturing, it increased from USD 131,894 in December 2022 to USD 139,770 in January 2023. The growing construction spending on power and manufacturing facilities is anticipated to drive the demand for cooling towers in the U.S. over the forecast period.

Cooling towers play an important role in eliminating excess heat generated in these facilities, contributing to safer operations, which is likely to enhance the demand for cooling towers over the forecast period. Furthermore, rising investments in the U.S. to expand the industrial sector, boost building firms, and enhance the installation of eco-friendly products to reduce pollution are expected to drive the market.

Increasing HVAC investments combined with rising demand for energy-efficient solutions are expected to drive the demand for cooling towers used in HVAC applications. According to industry reports, the HVAC industry in India is scheduled to invest USD 611.6 million in new technologies to boost efficiency. The primary advantages of adopting cooling towers in HVAC applications are low installation cost, ease of operation, energy efficiency, and low maintenance cost.

The governments of countries such as the UK and the U.S. have established energy standards that manufacturers must meet. They are expected to reduce the energy required in motor operations by a considerable amount, causing them to design high-efficiency motors rather than standard-efficiency motors. For instance, the National Emission Standards for Hazardous Air Pollutants (NESHAP) establishes standards for chromium compounds discharged into the air by the cooling towers during the cooling process. These aforementioned factors are anticipated to drive the demand for open-circuit cooling towers over the forecast period.

Product Insights

The open-circuit segment dominated the Cooling Tower Market in 2022 by accounting for a share of over 42.33% of the market in terms of revenue. The growth of this segment can be attributed to superior cooling, reduced process temperatures, and the small carbon footprint offered by open-circuit cooling towers. All these factors lead to the increased adoption of open-circuit cooling towers in the cement, chemicals, commercial and real estate, pharmaceuticals, and power generation industries, as well as in refineries.

The key advantages of open-circuit cooling towers are superior cooling, as demonstrated by lab experiments, reduced process temperatures, and a smaller carbon footprint. For instance, MITA Cooling Technologies S.r.l. provides open-circuit cooling towers, which are appropriate for facilities, such as medium and small installations to big industrial cooling towers for industries such as oil & gas and cogeneration.

The demand for the closed-circuit segment was estimated at USD 1,174.12 million in 2022. Closed-circuit cooling towers have several advantages, including less contamination of the primary circuit, reduced freezing danger, better plant construction, and improved thermal efficiency. For instance, many civic and industrial processes, including food production operations, involve keeping the process fluid free of contamination from the outside environment.

Hybrid cooling towers represent a suitable combination of wet and dry cooling with a low environmental impact, meeting stringent environmental requirements. These aforementioned factors are anticipated to propel the demand for hybrid cooling towers over the forecast period. For instance, B&W SPIG's hybrid technology reduces environmental impact by combining a wet cooling tower with a dry section. The dry section is essentially ordinary air-cooled heat exchangers positioned above the drift eliminators in the upper part of the structure.

Material Insights

The fiberglass reinforced plastic (FRP) segment accounted for the largest share of over 28.53% of the overall market in terms of revenue in 2022. The global demand for FRP is rising owing to its high resistance to corrosion, acid rain, and snow. Moreover, it is lightweight, has low maintenance costs, is suitable for dry and wet operations, and can withstand a wide range of environmental conditions. All these aforementioned factors are anticipated to propel the demand for FRP cooling towers across the world in the coming years.

Steel cooling towers are made of galvanized and stainless steel, which provides excellent structural strength. These towers are also good conductors and offer effective cooling, making them ideal for large facilities. Berg's galvanized steel cooling towers, for instance, reduce the installation, maintenance, and operation costs for both new and replacement cooling tower system projects. Moreover, the GT Series thermal performance is independently validated and completely rated across a wide variety of flow and temperature requirements.

The demand for the closed-circuit segment was estimated at USD 637.8 million in 2022. The reinforced concrete cooling tower structure is designed to withstand forceful waters. The most evident benefit of concrete towers is their structural strength and architectural versatility. Concrete structures are practically permanent due to their mass, which makes them resistant to extreme weather conditions.

The major advantages of the High-Density Polyethylene (HDPE) cooling tower design are ease of operation, upkeep, chemical balance maintenance, and tower erection. Over the forecast period, the aforementioned factors are expected to drive the demand for HPDE. For example, Patriot Forge Co. relies on modern HDPE cooling towers to maintain ideal bath temperatures for cooling hydraulic systems and quenching metal forgings. Unlike metal cooling towers, which degrade quickly in a chemical plant, HDPE provides dependable, long-lasting, and efficient process cooling.

Application Insights

The industrial type segment dominated the Market in 2022 by accounting for a share of over 28.84% of the market in terms of revenue. Cooling towers are key components installed in industrial facilities to lower the heat that is generated in excess amounts by machines and processes in these facilities. The increasing number of new industrial facilities being established worldwide is fueling the global demand for cooling towers.

The demand for the power generation application segment was estimated at USD 984.43 million in 2022. The rise in the number of electric power plants is expected to drive the cooling tower industry. The power generation plants produce enormous amounts of heat, mandating the use of cooling towers. Cooling towers play a vital role in removing the excess heat generated in power plants and hence, contribute to the safer operations of power plants, which is expected to drive the demand for cooling towers over the forecast period.

Cooling towers are primarily used for HVAC and industrial purposes, according to the U.S. Department of Health and Human Services. Cooling towers enable the cost-effective and energy-efficient operation of the HVAC system. Over 1,500 industrial enterprises consume a lot of water to keep their equipment cool. Furthermore, HVAC systems are commonly found in large office buildings, schools, and hospitals. The growing adoption of HVAC systems is anticipated to drive the demand for cooling towers over the forecast period.

Water flow rates in the oil & gas industry are extremely high. Industrial equipment in oil & gas refineries is regularly sleeved with flowing water to cool fluids and absorb process heat. Industrial equipment generates a significant amount of heat, which can disrupt operations if not managed properly. The process water is cooled using cooling towers and then reused. The cooling towers handle the heat load as well as any industry-specific issues.

For instance, Paharpur provides cooling towers with flame-retardant PVC fillings and fiberglass to maintain safety with high and low damage risk. Refineries of crude petroleum, particularly natural gas refineries, can occasionally contain dissolved H2S gas, which is exceedingly poisonous. As a result, the company provides them with hazardous gas detectors that alert operators when toxicity reaches critical levels.

Regional Insights

Asia Pacific led the market and accounted for 30.43% of the global revenue share in 2022. The improving economy of China, India, Thailand, Indonesia, and Malaysia is forcing governments to frame supportive policies to promote investments in the extraction of natural resources including crude oil and natural gas. This is expected to escalate the oil extraction units in the region and correspondingly augment the demand for cooling towers in the region.

North America, led by the U.S. and Canada, accounted for a significant share of the global Market in 2022 owing to the presence of intelligent buildings, large-scale data centers, and building automation vendors in the region. Furthermore, the rapid growth of structured and unstructured data along with the increasing demand for cloud computing is anticipated to propel the growth of the global data center market over the forecast period, subsequently driving the demand for cooling towers. Cooling towers help maintain the optimum temperature in data centers which results in lower energy consumption.

The robust presence of oil & gas reserves in Brazil, Columbia, Venezuela, and Argentina is expected to have a positive impact on the market. Factors such as industrial expansions and the development of large-scale commercial structures, especially in Brazil and Columbia, are anticipated to drive the demand for cooling towers for heat removal applications over the forecast period.

According to the World Bank, manufacturing production in the Middle East & Africa climbed from 12% in 2020 to 13% in 2021. Israel, Turkey, and Saudi Arabia are a few countries in the region that are witnessing strong industrial growth. These countries generate a considerable volume of manufacturing output. Thus, the growing manufacturing industry in the region is expected to drive demand for water cooling towers. This, in turn, is anticipated to lead to the growth of the cooling towers industry in the Middle East & Africa over the forecast period.

Cooling Tower Market Segmentations:

By Product

By Material

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Cooling Tower Market

5.1. COVID-19 Landscape: Cooling Tower Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Cooling Tower Market, By Product

8.1. Cooling Tower Market, by Product, 2023-2032

8.1.1 Open circuit

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Closed circuit

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Hybrid

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Cooling Tower Market, By Material

9.1. Cooling Tower Market, by Material, 2023-2032

9.1.1. FRP

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Steel

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Concrete

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Wood

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. HDPE

9.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Cooling Tower Market, By Application

10.1. Cooling Tower Market, by Application, 2023-2032

10.1.1. HVAC

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Power Generation

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Oil & Gas

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Industrial

10.1.4.1. Market Revenue and Forecast (2020-2032)

10.1.5. Retail

10.1.5.1. Market Revenue and Forecast (2020-2032)

10.1.6. Others

10.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Cooling Tower Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.2. Market Revenue and Forecast, by Material (2020-2032)

11.1.3. Market Revenue and Forecast, by Application (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Material (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Material (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.2. Market Revenue and Forecast, by Material (2020-2032)

11.2.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Material (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Material (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Material (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Material (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Application (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.2. Market Revenue and Forecast, by Material (2020-2032)

11.3.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Material (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Material (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Material (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Material (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Application (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.2. Market Revenue and Forecast, by Material (2020-2032)

11.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Material (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Material (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Material (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Material (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Application (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.2. Market Revenue and Forecast, by Material (2020-2032)

11.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Material (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Material (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Application (2020-2032)

Chapter 12. Company Profiles

12.1. Babcock & Wilcox Enterprises, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Baltimore Aircoil Company

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Cenk Endüstri Tesisleri Imalat Ve Taahhüt A.Åž.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Cooling Tower Systems, Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Delta Cooling Towers Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Engie Refrigeration GmbH

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. EVAPCO, Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. S.A. Hamon

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Johnson Controls International Plc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Kelvion Holdings GmbH

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others