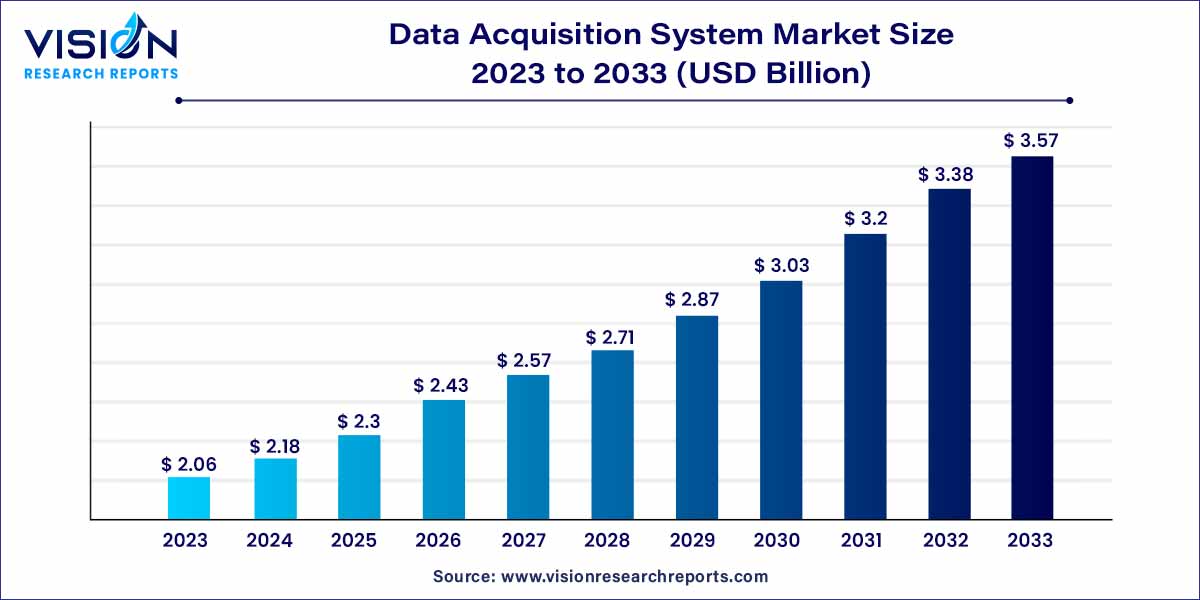

The global data acquisition system market size was estimated at around USD 2.06 billion in 2023 and it is projected to hit around USD 3.57 billion by 2033, growing at a CAGR of 5.66% from 2024 to 2033. This growth is primarily attributed to the increasing importance of data-driven decision-making across various industries.

The data acquisition system market stands as a pivotal player in the ever-evolving technological landscape, catering to the burgeoning need for efficient data gathering and analysis across diverse industries. This overview aims to shed light on the key aspects shaping this dynamic market, from its foundational concepts to the latest trends influencing its trajectory.

The growth of the data acquisition system (DAS) market is propelled by several key factors that collectively contribute to its expanding trajectory. First and foremost, the increasing demand for real-time data analysis across diverse industries is a significant driver. Organizations are recognizing the pivotal role that timely and accurate data plays in decision-making processes. Furthermore, the surge in the Internet of Things (IoT) applications is fostering the adoption of DAS, as it proves essential for efficiently capturing and processing the vast amounts of data generated by connected devices. Additionally, advancements in technology, particularly the integration of artificial intelligence and machine learning algorithms, are enhancing the capabilities of data acquisition systems, making them more predictive and responsive. This amalgamation of factors not only addresses current industry needs but also positions DAS as a crucial component in the future landscape of data-driven decision-making.

| Report Coverage | Details |

| Market Size in 2023 | USD 2.06 billion |

| Revenue Forecast by 2033 | USD 3.57 billion |

| Growth rate from 2024 to 2033 | CAGR of 5.66% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The market is categorized based on speed into two segments: high-speed (>100 KS/S) and low-speed (<100 KS/S). In 2023, the high-speed segment emerged as the dominant player, holding the largest market share. This prominence is attributed to the escalating use of high-speed data acquisition systems across diverse industries such as aerospace and defense, automotive, and healthcare. These sectors require swift and accurate data collection and processing. The surge in demand for high-speed data acquisition systems is further fueled by the continuous development of advanced technologies in this domain and the increasing adoption of industrial automation and Internet of Things (IoT)-related technologies. These factors collectively contribute to the sustained growth of the high-speed data acquisition systems market.

The market is divided by industry vertical into segments such as energy & power, automotive & transportation, aerospace & defense, wireless infrastructure, healthcare, food & beverages, and others. In 2023, the aerospace and defense sector emerged as the leading segment, holding the largest market share. This prominence is attributed to the increasing intricacy and critical nature of systems within this industry. Dealing with complex systems like aircraft and defense equipment necessitates precise and real-time data acquisition for safety and reliability. The sector's commitment to meeting rigorous regulatory and safety standards has led to the widespread adoption of advanced data acquisition systems, ensuring the accuracy and reliability of data collection. Furthermore, the aerospace and defense sector's emphasis on performance optimization has propelled the demand for data acquisition, particularly in monitoring and analyzing the efficiency and reliability of aircraft, engines, and critical components, thereby contributing significantly to the growth of this market segment.

The market is categorized by application into segments comprising research & development, field data acquisition, and manufacturing data acquisition. In 2023, the manufacturing data acquisition segment dominated the market, securing the largest market share. This ascendancy is propelled by the increasing need for automation and process control within the manufacturing industry, thereby fostering the growth of the manufacturing DAQ system market. The introduction of novel data acquisition technologies, including cloud-based data acquisition systems and industrial Internet of Things (IIoT) data acquisition systems, further contributes to the expansion of this market segment. As manufacturing processes continue to evolve, the demand for advanced data acquisition solutions is anticipated to persist, solidifying the position of the manufacturing data acquisition segment in the market.

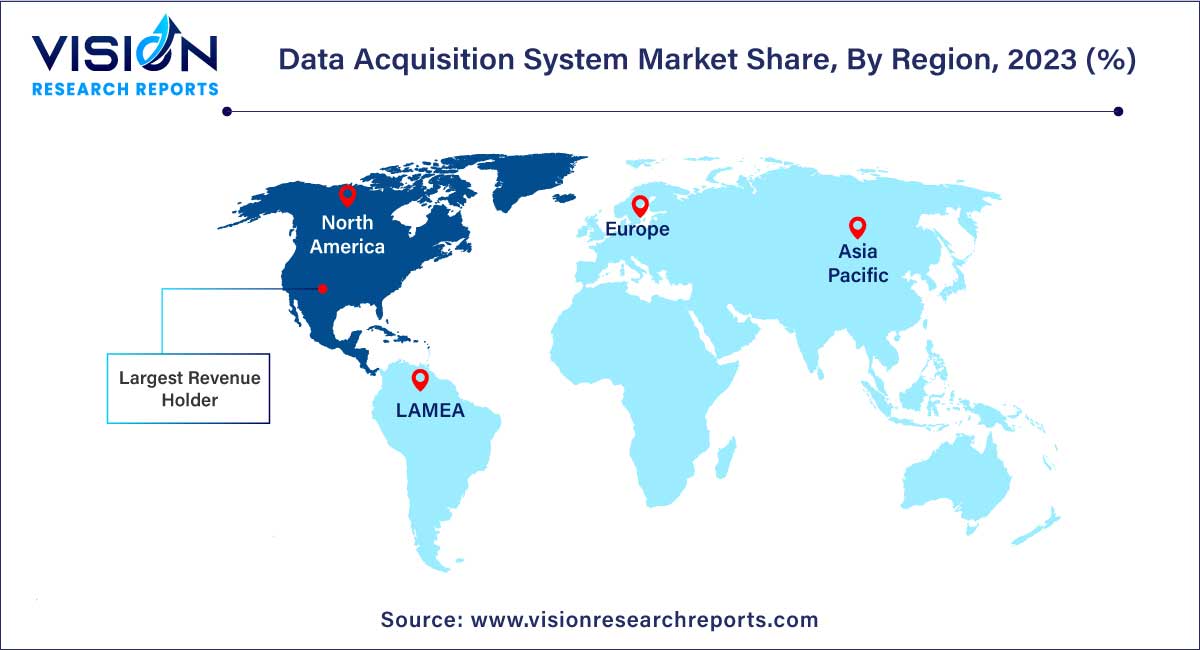

In 2023, North America emerged as the dominant force in the market, claiming the largest revenue share. This supremacy is primarily attributed to a substantial number of early technology adopters within the region, spurred by favorable governmental policy changes, a heightened adoption of industrial automation, and the initiation of intelligent manufacturing projects. Industries in North America are actively engaged in digital transformation endeavors, leveraging data acquisition systems for purposes such as process optimization, predictive maintenance, and quality control. The noteworthy trend of integrating data acquisition, automation, and analytics is further propelling market growth.

Looking ahead, Asia Pacific is poised for significant growth during the forecast period. This anticipated surge is driven by the adoption of cutting-edge technologies, including artificial intelligence (AI) and the Internet of Things (IoT), increased production capacity, stringent regulations governing product testing and measurement, and substantial government support for the manufacturing sector. Notably, China, as the largest automotive market in the Asia Pacific region, plays a pivotal role in driving this growth trajectory. The presence of numerous automotive original equipment manufacturers (OEMs) and production facilities in China contributes to the escalating demand for data acquisition (DAQ) systems in the region.

By Offering

By Speed

By Industry Vertical

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Data Acquisition System Market

5.1. COVID-19 Landscape: Data Acquisition System Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Data Acquisition System Market, By Offering

8.1. Data Acquisition System Market, by Offering, 2023-2032

8.1.1. Hardware

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Software

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Data Acquisition System Market, By Speed

9.1. Data Acquisition System Market, by Speed, 2023-2032

9.1.1. High-Speed (>100 Ks/S)

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Low-Speed (<100 Ks/S)

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Data Acquisition System Market, By Industry Vertical

10.1. Data Acquisition System Market, by Industry Vertical, 2023-2032

10.1.1. Energy & Power

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Automotive & Transportation

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Aerospace & Defense

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Wireless Infrastructure

10.1.4.1. Market Revenue and Forecast (2020-2032)

10.1.5. Healthcare

10.1.5.1. Market Revenue and Forecast (2020-2032)

10.1.6. Food & Beverages

10.1.6.1. Market Revenue and Forecast (2020-2032)

10.1.7. Others

10.1.7.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Data Acquisition System Market, By Application

11.1. Data Acquisition System Market, by Application, 2023-2032

11.1.1. Research & Development

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Field Data Acquisition

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Manufacturing Data Acquisition

11.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Data Acquisition System Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Offering (2020-2032)

12.1.2. Market Revenue and Forecast, by Speed (2020-2032)

12.1.3. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.1.4. Market Revenue and Forecast, by Application (2020-2032)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Offering (2020-2032)

12.1.5.2. Market Revenue and Forecast, by Speed (2020-2032)

12.1.5.3. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.1.5.4. Market Revenue and Forecast, by Application (2020-2032)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Offering (2020-2032)

12.1.6.2. Market Revenue and Forecast, by Speed (2020-2032)

12.1.6.3. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.1.6.4. Market Revenue and Forecast, by Application (2020-2032)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Offering (2020-2032)

12.2.2. Market Revenue and Forecast, by Speed (2020-2032)

12.2.3. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.2.4. Market Revenue and Forecast, by Application (2020-2032)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Offering (2020-2032)

12.2.5.2. Market Revenue and Forecast, by Speed (2020-2032)

12.2.5.3. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.2.5.4. Market Revenue and Forecast, by Application (2020-2032)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Offering (2020-2032)

12.2.6.2. Market Revenue and Forecast, by Speed (2020-2032)

12.2.6.3. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.2.6.4. Market Revenue and Forecast, by Application (2020-2032)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Offering (2020-2032)

12.2.7.2. Market Revenue and Forecast, by Speed (2020-2032)

12.2.7.3. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.2.7.4. Market Revenue and Forecast, by Application (2020-2032)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Offering (2020-2032)

12.2.8.2. Market Revenue and Forecast, by Speed (2020-2032)

12.2.8.3. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.2.8.4. Market Revenue and Forecast, by Application (2020-2032)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Offering (2020-2032)

12.3.2. Market Revenue and Forecast, by Speed (2020-2032)

12.3.3. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.3.4. Market Revenue and Forecast, by Application (2020-2032)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Offering (2020-2032)

12.3.5.2. Market Revenue and Forecast, by Speed (2020-2032)

12.3.5.3. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.3.5.4. Market Revenue and Forecast, by Application (2020-2032)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Offering (2020-2032)

12.3.6.2. Market Revenue and Forecast, by Speed (2020-2032)

12.3.6.3. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.3.6.4. Market Revenue and Forecast, by Application (2020-2032)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Offering (2020-2032)

12.3.7.2. Market Revenue and Forecast, by Speed (2020-2032)

12.3.7.3. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.3.7.4. Market Revenue and Forecast, by Application (2020-2032)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Offering (2020-2032)

12.3.8.2. Market Revenue and Forecast, by Speed (2020-2032)

12.3.8.3. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.3.8.4. Market Revenue and Forecast, by Application (2020-2032)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Offering (2020-2032)

12.4.2. Market Revenue and Forecast, by Speed (2020-2032)

12.4.3. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.4.4. Market Revenue and Forecast, by Application (2020-2032)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Offering (2020-2032)

12.4.5.2. Market Revenue and Forecast, by Speed (2020-2032)

12.4.5.3. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.4.5.4. Market Revenue and Forecast, by Application (2020-2032)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Offering (2020-2032)

12.4.6.2. Market Revenue and Forecast, by Speed (2020-2032)

12.4.6.3. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.4.6.4. Market Revenue and Forecast, by Application (2020-2032)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Offering (2020-2032)

12.4.7.2. Market Revenue and Forecast, by Speed (2020-2032)

12.4.7.3. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.4.7.4. Market Revenue and Forecast, by Application (2020-2032)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Offering (2020-2032)

12.4.8.2. Market Revenue and Forecast, by Speed (2020-2032)

12.4.8.3. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.4.8.4. Market Revenue and Forecast, by Application (2020-2032)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Offering (2020-2032)

12.5.2. Market Revenue and Forecast, by Speed (2020-2032)

12.5.3. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.5.4. Market Revenue and Forecast, by Application (2020-2032)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Offering (2020-2032)

12.5.5.2. Market Revenue and Forecast, by Speed (2020-2032)

12.5.5.3. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.5.5.4. Market Revenue and Forecast, by Application (2020-2032)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Offering (2020-2032)

12.5.6.2. Market Revenue and Forecast, by Speed (2020-2032)

12.5.6.3. Market Revenue and Forecast, by Industry Vertical (2020-2032)

12.5.6.4. Market Revenue and Forecast, by Application (2020-2032)

Chapter 13. Company Profiles

13.1. Emerson Electric Co.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. ABB Ltd.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. General Electric

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Teledyne Technologies Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. National Instruments Corp.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Honeywell International Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Yokogawa Electric Corporation

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Campbell Scientific Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. imc Test & Measurement GmbH

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Schneider Electric

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others