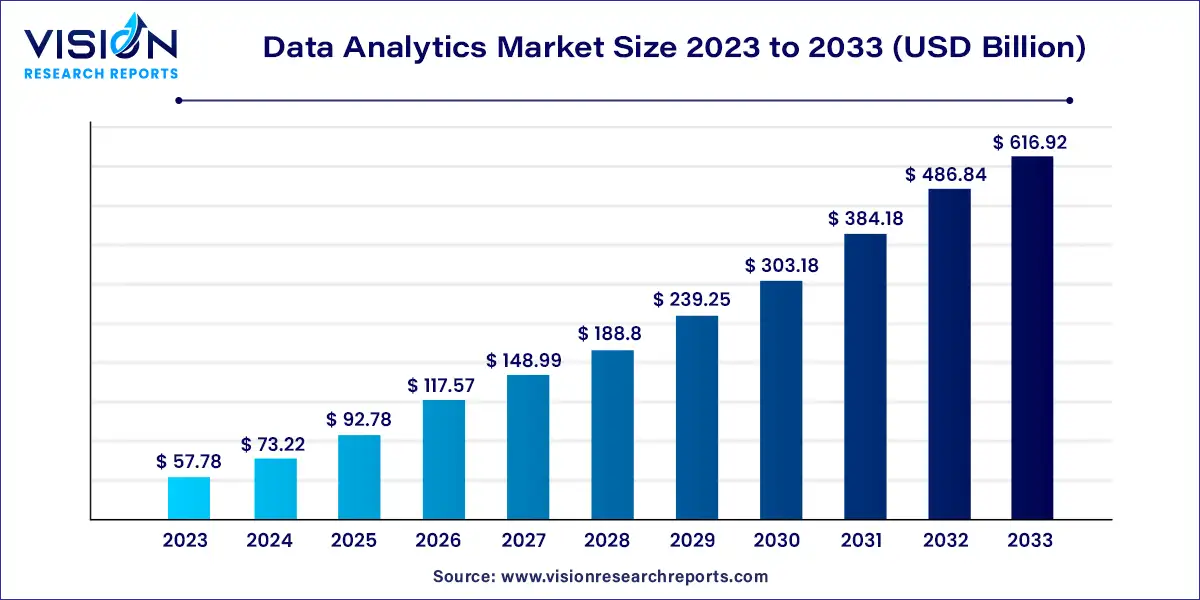

The global data analytics market size was valued at USD 57.78 billion in 2023 and it is predicted to surpass around USD 616.92 billion by 2033 with a CAGR of 26.72% from 2024 to 2033.

The growth of the data analytics market is driven by the surge in data generation from diverse sources, including social media, IoT devices, and transactional systems, has created a vast pool of information that organizations need to analyze for strategic advantage. Second, the adoption of cloud computing technologies offers scalable and cost-effective solutions for data storage and processing, which facilitates the widespread use of advanced analytics tools. Additionally, the integration of artificial intelligence and machine learning enhances analytical capabilities, enabling more sophisticated data interpretations and predictive insights. Finally, the growing emphasis on real-time analytics supports swift decision-making processes, crucial for maintaining a competitive edge in today’s fast-paced business environment.

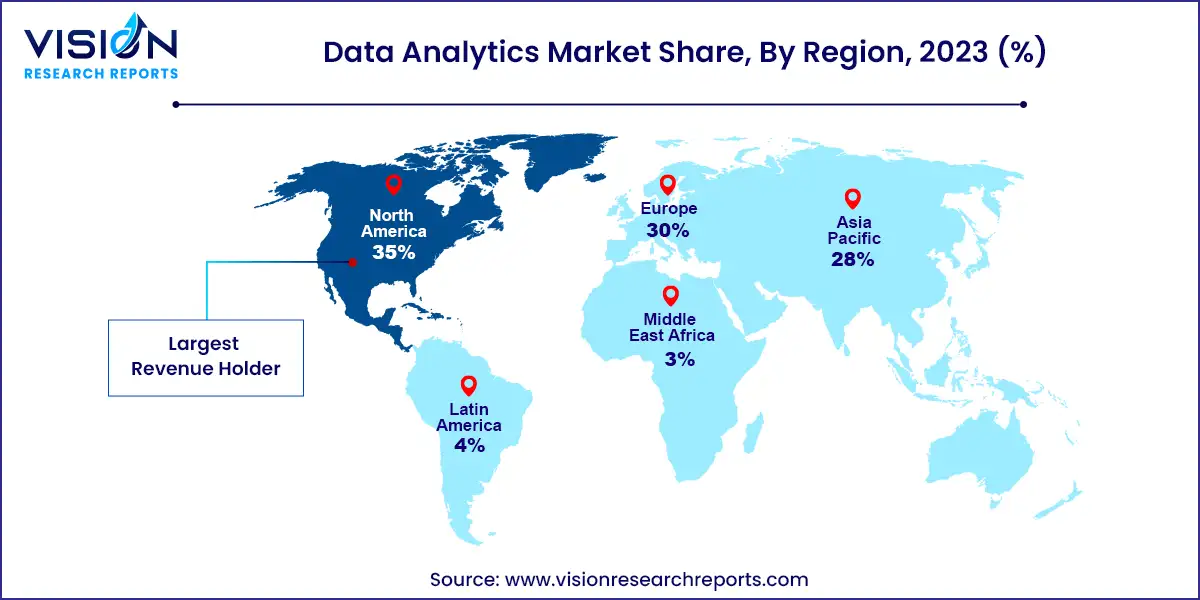

North America dominates the market with a revenue share of 35% in 2023. The region is home to prominent businesses from all industries, and the software is being widely implemented. For instance, Facebook, Twitter, and Instagram collect user information using data analytics about their preferences and send targeted advertisements. The availability of infrastructure that supports data analytics and the increased use of advanced technologies such as AI and machine learning are responsible for the market growth in North America. The U.S. is expected to experience rapid growth due to rising demand for analytics tools that provide advanced and enhanced compliance analytics, which are critical in uncovering policy, fraud violations, and other business misconduct.

Asia Pacific witnessed a significant CAGR of 34.26% during the forecast period due to the expansion of retail, BFSI, healthcare, automotive, and other industries. Moreover, the rising adoption of social media platforms, the internet, and smartphones, advancements in communication technologies, and digitalization are all expected to increase the market share of data analytics. Many Asian countries, including India, China, and Japan, are using the features of information-intensive AI and ML technologies in various industries, which leads to the growing use of data analytics. The growing adoption of big data analytics tools and solutions is also increasing market growth.

The predictive analytics segment dominates the market, with a revenue share of 34% in 2023. Predictive Analytics provides accurate and reliable insights, helping organizations to solve problems and identify opportunities, including detecting fraud, optimizing marketing campaigns, improving decision-making, and improving efficiency in operations. For instance, in June 2023, J.D. Power, U.S.-based data analytics and Artificial Intelligence Company acquired the predictive analytics business of We Predict, the UK-based company that offers hyper-vertically focused predictive analytics as a service. This acquisition is intended to provide a more comprehensive, detailed view of repair-related costs to anticipate financial risk exposure better.

With the increasing demand for client experience management, customer retention, and better lead management, the customer analytics segment is anticipated to enjoy a CAGR of 27.44%. Customer analytics is used in retail to create personalized communications and marketing campaigns. Customers' increasing demand for an omnichannel experience in the retail industry has fueled the segment's growth. Well-known companies such as Walmart and Amazon have successfully leveraged the benefits of various social media sites such as Facebook. The segment is expected to grow as more retail businesses focus on providing omnichannel services to their customers.

The security intelligence segment dominates the market, with a revenue share of 37% in 2023. The growing adoption of advanced analytics to identify fraudulent activity, optimize processes, and address data risks drives the segment's growth. Increased deployment of business intelligence software to provide control access to customer databases, transaction security, and improved customer experience is also expected to drive segment growth over the forecast period. Security intelligence is becoming more popular because it employs a risk-reduction strategy that integrates internal and external threat, security, and business intelligence across an organization.

Data mining is used in diverse applications such as marketing, banking, healthcare, telecom industries, and other areas, leading to the segment's growth. Data mining benefits manufacturing and service companies because any significant amount of data is analyzed to help the business make strategic decisions to gain a competitive advantage. Many e-commerce sites use data mining to cross-sell and upsell their products. For instance, Amazon.com, Inc. uses text mining to find the product's lowest price. Moreover, Netflix, Inc. uses data mining insights to determine how to make a movie or series popular among customers.

The supply chain management segment dominates the market, with a revenue share of 32% in 2023. Data analytics in supply chain management help organizations increase profits through efficient production planning. The use of data analytics in supply chain management encourages the use of advanced technologies such as artificial intelligence and machine learning to uncover hidden patterns and gain valuable insights from available supply chain data. Manufacturing companies can use data analytics in sales and operations planning, capacity planning, business intelligence, and demand forecasting to optimize their supply chain processes, which propels the segment's growth.

The enterprise resource planning segment is expected to grow at the fastest CAGR during the forecast period. Data analytics applications can bridge data warehouses, traditional databases, and data lakes to incorporate Big Data with business application data to improve forecasting, analysis, and planning. Moreover, as organizations increasingly rely on data-driven decision-making, there is a greater need to access and analyze databases. The rapid advancements in hybrid cloud, artificial intelligence, IoT, and edge computing led to the exponential growth of big data, generating even more complexity for businesses to manage, resulting in the segment's growth.

By Type

By Solution

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Data Analytics Market

5.1. COVID-19 Landscape: Data Analytics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Data Analytics Market, By Type

8.1. Data Analytics Market, by Type, 2024-2033

8.1.1 Prescriptive Analytics

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Predictive Analytics

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Customer Analytics

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Descriptive Analytics

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Data Analytics Market, By Solution

9.1. Data Analytics Market, by Solution, 2024-2033

9.1.1. Security Intelligence

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Data Management

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Data Monitoring

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Data Mining

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Data Analytics Market, By Application

10.1. Data Analytics Market, by Application, 2024-2033

10.1.1. Supply Chain Management

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Enterprise Resource Planning

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Database Management

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Human Resource Management

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Others

10.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Data Analytics Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Solution (2021-2033)

11.1.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Solution (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Solution (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.2. Market Revenue and Forecast, by Solution (2021-2033)

11.2.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Solution (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Solution (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Solution (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Solution (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.2. Market Revenue and Forecast, by Solution (2021-2033)

11.3.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Solution (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Solution (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Solution (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Solution (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.2. Market Revenue and Forecast, by Solution (2021-2033)

11.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Solution (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Solution (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Solution (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Solution (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.2. Market Revenue and Forecast, by Solution (2021-2033)

11.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Solution (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Solution (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

Chapter 12. Company Profiles

12.1. Amazon Web Services Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. International Business Machines Corporation.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Looker Data Sciences, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Mu Sigma, Oracle Corporation

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. SAP SE

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Sisense Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Tableau Software LLC.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Zoho Corporation Pvt. Ltd.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others