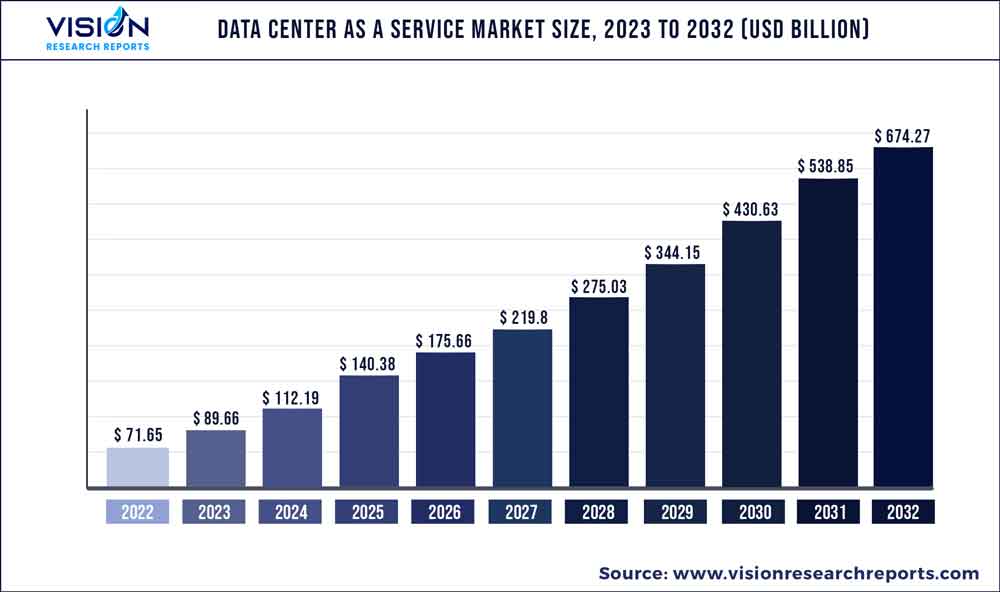

The global data center as a service market size was estimated at around USD 71.65 billion in 2022 and it is projected to hit around USD 674.27 billion by 2032, growing at a CAGR of 25.13% from 2023 to 2032. The data center as a service market in the United States was accounted for USD 11.5 billion in 2022.

Key Pointers

Report Scope of the Data Center As A Service Market

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 35.94% |

| CAGR of Asia Pacific | 30.27% |

| Revenue Forecast by 2032 | USD 674.27 billion |

| Growth Rate from 2023 to 2032 | CAGR of 25.13% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | IBM Corporation; Microsoft Corporation; Hewlett Packard Enterprise Development LP; Dell Inc.; Alibaba; AT & T; Cloudian; 365 Data Centers; Digital Reality; Cyxtera Technologies.; Digital Ocean, LLC.; Linode LLC.; Equinix, Inc.; Huawei; Amazom.com, Inc. |

The data center as a service (DCaaS) market growth can be attributed to the rising government support and higher spending by key players in the market. Further, the rising use of advanced technologies such as cloud, AI, IoT, and machine learning in data centers offer a wide array of benefits to organizations and is expected to drive the growth.

Governments across the globe are supporting the development of data centers to build energy-efficient and reliable data storage facilities. Furthermore, key players such as Amazon, IBM, Microsoft, and Equinix are making significant investments in the development of advanced data center facilities across the globe. For instance, in November 2022, Amazon Web Services, Inc. announced the launch of the AWS Europe (Spain) Region. This was the eighth AWS infrastructure Region in Europe these are the key factors expected to create lucrative opportunities for the data center as a service market over the forecast period.

Data Center service providers offer data center services on rent or lease to clients. The rapid shift of various end-use companies toward Data Center services instead of settling up expensive data centers is expected to boost the growth of the market over the forecast period. The increasing demand for Data Center solutions is encouraging various industry players to strengthen their Data Center as a service solutions portfolio to improve their brand representation. For instance, in July 2022, Data Holdings acquired Stack41 which provides data center management, cloud & virtual machines, cybersecurity, and other hosting services. The following acquisition is expected to help Data Holding in offering a group of fully outsourced data center services to the customers.

Organization Size Insights

The large organization segment accounted for a market share of 57.92% in 2022. Favorable government regulations to encourage the establishment of data centers and the aggressive investments being made by large companies in hosting private data centers are expected to open new opportunities for the growth of the segment. For instance, in March 2022, Macquarie Telecom Group launched its data center at Macquarie Park Data Centre Campus in the North Zone of Sydney, Australia are the key factors driving the data center as a service demand in the following segment.

The SMEs segment is expected to expand at the highest CAGR of 27.35% during the forecast period. Preferring a third-party data center over on-site IT infrastructure and outsourcing IT infrastructure management allows SMEs to save significantly on their capital expenditures. Government initiatives to promote digitization are prompting SMEs, especially in developing economies, to opt for data center services, which bodes well for the growth of the segment. For instance, Atal Incubation and Digital India, among other initiatives being pursued by the government of India are expected to prompt SMEs in the country to opt for market.

Vertical Insights

The IT & Telecom segment accounted for the largest market share of 23.74% in 2022. Telecommunications companies are particularly managing their infrastructure needs by establishing their own data centers using a private cloud for both core and non-core networking operations. Telecommunications companies are also partnering with data center providers to expand their business portfolio. For instance, in November 2021, Telenor partnered with Google Cloud to digitally transform its incumbent infrastructure by integrating AI and ML to enhance its technical capabilities are the key factors expected to drive the demand for data center as a service market in the following segment.

The healthcare segment is anticipated to expand at a CAGR of 30.55% during the forecast period. Aggressive development of AI-powered diagnostics tools, telemedicine solutions, and Internet of Medical Things (IoMT), is expected to create robust opportunities for data center solution providers. Hybrid multi-cloud practices are becoming more popular in the healthcare industry vertical to isolate certain workloads from the public domain, especially to ensure adequate data security and privacy protection when it comes to sensitive patient health information.

Infrastructure Insights

The servers segment accounted for the largest market share of 59.16% in 2022. Academic institutions, defense agencies, and government agencies are aggressively adopting new, innovative solutions based on the latest digital technologies, such as artificial intelligence (AI), internet of things (IoT), and machine learning (ML), thereby driving the need for sophisticated, hyper-converged IT infrastructure comprising high-performance computing servers to run complex software-defined solutions and process large volumes of data. The strong emphasis on maintaining a pool of servers to ensure adequate processing power to process large volumes of data bodes well for the growth of the segment over the forecast period.

The storage segment is anticipated to expand at a CAGR of 28.03% during the forecast period. the rising volumes of computing data across the globe are also driving the demand for storage systems to ensure quick access to the desired data. Several countries are focusing on establishing their own virtual data storage systems to reduce their reliance on overseas organizations and strengthen data security. Infrastructure software enables the digital storage system to control, monitor, secure, and manage data without incurring any excessive operational costs are the primary factors expected to drive the data center as a service market demand.

Regional Insights

North America dominated the market and accounted for revenue share of 35.94% in 2022. In North America, data center facilities are progressively expanding in line with the continued advances in the latest technologies, such as big data and the Internet of Things (IoT). These technologies require advanced facilities to store, process, and manage large volumes of data. Furthermore, the presence of key data center service providers in the region, such as Amazon Web Services, Inc.; Microsoft Corporation; IBM Corporation; and Alphabet Inc., is a major factor driving the market growth in North America.

Asia Pacific is anticipated to expand as the fastest developing regional market at a CAGR of 30.27%. The demand for data center is rising due to the growing development and infrastructure projects in the Asia Pacific region. Further, the higher volume of dat a generated by large e-commerce customer base, extensive telecom networks, and greater demand from industry players in the region to manage higher traffic flows in servers. For instance, in February 2021, Linode LLC announced its plan to expand its services for its faster-growing customer base in APAC by adding a new GPU instance to its data center facility in Singapore. The new capability offers low-latency features for near-real-time data analysis, image processing, AI, video transcoding, and other data and processing applications. Furthermore, the growing number of startups and SMEs in the region is expected to fuel the adoption of the data center as a service in the region.

Data Center As A Service Market Segmentations:

By Infrastructure

By Organization Size

By Vertical

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Infrastructure Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Data Center As A Service Market

5.1. COVID-19 Landscape: Data Center As A Service Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Data Center As A Service Market, By Infrastructure

8.1. Data Center As A Service Market, by Infrastructure, 2023-2032

8.1.1 Servers

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Storage

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Networking

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Data Center As A Service Market, By Organization Size

9.1. Data Center As A Service Market, by Organization Size, 2023-2032

9.1.1. SMEs

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Large Enterprises

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Data Center As A Service Market, By Vertical

10.1. Data Center As A Service Market, by Vertical, 2023-2032

10.1.1. Retail

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. BFSI

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. IT & Telecom

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Healthcare

10.1.4.1. Market Revenue and Forecast (2020-2032)

10.1.5. Manufacturing

10.1.5.1. Market Revenue and Forecast (2020-2032)

10.1.6. Others

10.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Data Center As A Service Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Infrastructure (2020-2032)

11.1.2. Market Revenue and Forecast, by Organization Size (2020-2032)

11.1.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Infrastructure (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Organization Size (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Infrastructure (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Organization Size (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Infrastructure (2020-2032)

11.2.2. Market Revenue and Forecast, by Organization Size (2020-2032)

11.2.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Infrastructure (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Organization Size (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Infrastructure (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Organization Size (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Infrastructure (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Organization Size (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Infrastructure (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Organization Size (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Infrastructure (2020-2032)

11.3.2. Market Revenue and Forecast, by Organization Size (2020-2032)

11.3.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Infrastructure (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Organization Size (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Infrastructure (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Organization Size (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Infrastructure (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Organization Size (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Infrastructure (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Organization Size (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Infrastructure (2020-2032)

11.4.2. Market Revenue and Forecast, by Organization Size (2020-2032)

11.4.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Infrastructure (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Organization Size (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Infrastructure (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Organization Size (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Infrastructure (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Organization Size (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Infrastructure (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Organization Size (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Infrastructure (2020-2032)

11.5.2. Market Revenue and Forecast, by Organization Size (2020-2032)

11.5.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Infrastructure (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Organization Size (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Vertical (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Infrastructure (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Organization Size (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Vertical (2020-2032)

Chapter 12. Company Profiles

12.1. IBM Corporation

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Microsoft Corporation

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Hewlett Packard Enterprise Development LP

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Dell Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Alibaba

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. AT & T

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Cloudian

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. 365 Data Centers

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Digital Reality

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Cyxtera Technologies.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others