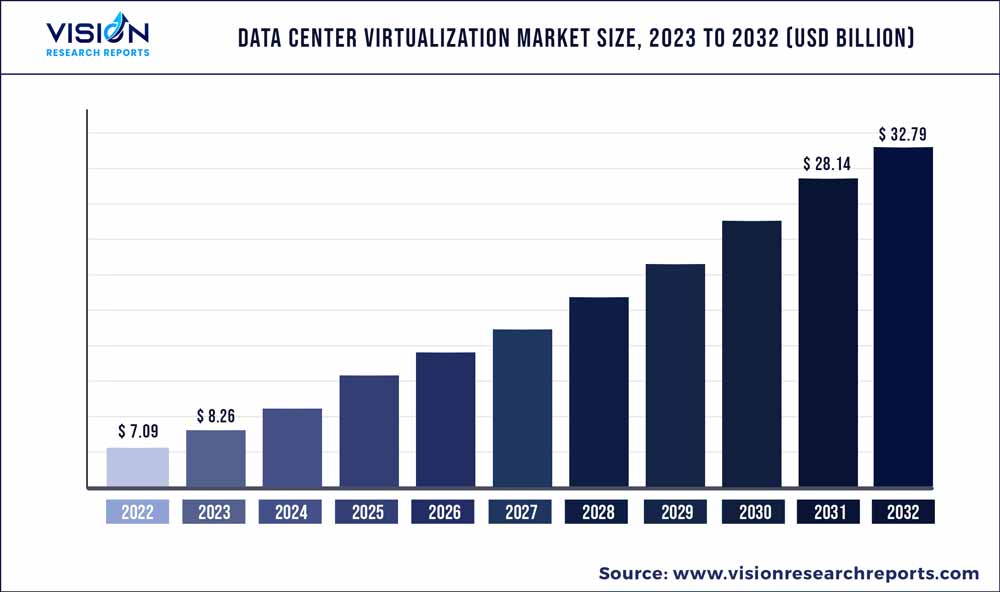

The global data center virtualization market was valued at USD 7.09 billion in 2022 and it is predicted to surpass around USD 32.79 billion by 2032 with a CAGR of 16.55% from 2023 to 2032. The data center virtualization market in the United States was accounted for USD 2.3 billion in 2022.

Key Pointers

Report Scope of the Data Center Virtualization Market

| Report Coverage | Details |

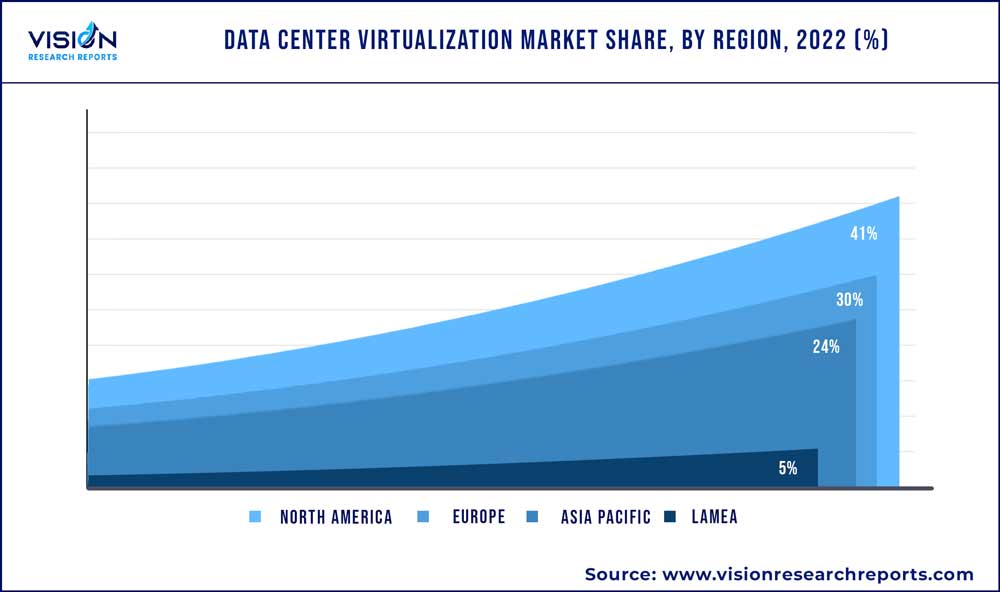

| Revenue Share of North America in 2022 | 41% |

| CAGR of Asia Pacific from 2023 to 2032 | 17.07% |

| Revenue Forecast by 2032 | USD 32.79 billion |

| Growth Rate from 2023 to 2032 | CAGR of 16.55% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | ATTO Technology, Inc.; AT&T; Cisco Systems, Inc.; Dell Inc.; Fujitsu; HCL Technologies Limited; Hewlett Packard Enterprise Development LP; Huawei Technologies Co., Ltd.; IBM; Konverge; Microsoft; Oracle; Rahi; Veritis Group Inc.; VMware, Inc. |

The main factors driving the growth are the rising need to lower the operational cost of organizations and increase business agility and the increased need for unified and centralized management of data centers. Moreover, factors such as the rising demand to cut data center complexities, the rising price of data center technology, the increasing adoption of private cloud, and the rapid growth in data center traffic are expected to contribute to market growth shortly. The presence of companies such as Cisco Systems Inc., VMware, Inc., and Hewlett Packard Enterprise Development LP, and a more comprehensive geographical presence, has also contributed to the data center virtualization across regions.

The market players have been involved in various strategic partnerships to gain better traction, which has been driving the adoption of data center virtualization. For instance, in January 2023, Zetaris (an Australia-based analytical data virtualization platform) announced a technology partnership with Dataiku (a French AI platform) in Australia and New Zealand. Through the partnership, businesses in Australia and New Zealand can leverage Dataiku and Zetaris to dramatically improve the speed and ease with which insights can be gained from disparate data sources.

The COVID-19 pandemic had a favorable impact on the data center virtualization market. Improved corporate awareness concerning the aids of increased pressure to provide more secure and robust IT environments, cloud services, and the establishment of local data centers throughout the regions have all driven the growth of the market. Moreover, data centers maintain data security and program availability as more educational institutions and businesses move online.

The pandemic significantly boosted internet services and digital transformation worldwide, as prominent businesses and industries have started cooperating and working from home. The demand for data centers has grown due to this remote work to keep businesses running during the COVID-19 pandemic. Following the pandemic, a new business environment has developed, encouraging digitization and cloud services as firms modernize their digital infrastructure to support better working practices.

The benefits of server virtualization, which has contributed significantly to the development of data center virtualization are also fueling the market growth. Some significant benefits include cost saving, better efficient resource provisioning, improved productivity, IT consolidation, better management, flexibility and scalability, improved storage capacity management, hosting multiple OSes, and better continuity. Some major companies offering server virtualization include VMware, Inc., Veritis Group Inc, Hewlett Packard Enterprise Development LP, and Cisco Systems, Inc., among others. The presence of such companies, which have a more comprehensive global network, has resulted in the better adoption of server virtualization, thereby driving the industry’s growth.

The companies offering data center virtualization solutions have also been involved in a partnership aimed at offering an enhanced solution, which has attracted customers into the market. For instance, in August 2021, CloudFabrix (India-based operations intelligence analytics provider) partnered with Verge.io. (U.S.-based data center operating system software provider). The partnership will combine the Verge.io virtualization operating system with CloudFabrix AI-based Asset Intelligence & Operations to provide complete data center transformation for enterprise and CSP organizations.

Type Insights

The server segment of the data center virtualization market by type occupied the largest revenue share in 2022. It is projected to continue its dominance over the forecast period. The growth of the server segment can be attributed to the benefits of server virtualization, which include better server reliability and availability, better utilization of physical services and power, lower operational costs, and virtual machine creation. Major companies have been coming up with a server virtualization solution, enabling capabilities, thereby attracting more businesses. For instance, in April 2022, Oracle expanded its Oracle Linux KVM server virtualization solution with Oracle Linux 8 support, which enables enhanced VM auto-start configurations, enabling full customization when cloning VM, and sealed template indication, among others.

The desktop segment is projected to grow at the highest CAGR from 2023 to 2032. The benefits offered by desktop virtualization have been the major factor driving the growth of the segment. Some significant benefits of desktop virtualization include easy rollout, enhanced security, better control over installed software, and reduced downtime. Several companies have been involved in various strategic initiatives, including partnership, acquisition/merger, and collaboration, among others, which have been driving the growth of the desktop segment. For instance, in June 2021, Nerdio announced the integration of Microsoft Windows 365 and Teradici Corporation’s PC over IP technology into Nerdio’s solution named “Nerdio Manager,” enabling users to choose between Windows 365 and Azure Virtual Desktop.

Component Insights

The software segment accounted for the largest revenue share of around 80% in 2022 and is expected to continue its dominance over the forecast period. Risen adoption of virtualization software such as network virtualization, storage virtualization, and server virtualization in data centers is contributing to the growth. The virtualization software, sometimes called Software Defined Data Center (SDCC), enables businesses to take control over the entire IT framework as a singular entity and from a single interface. The benefits of virtualization, such as reduced cost capital, increased speed and flexibility, reduced operating costs, and reduced infrastructure and real estate requirements, have contributed to the software segment's growth.

The service segment is expected to exhibit the highest CAGR of over 15.05% during the forecast period. The service segment is further divided into technical support services, optimization services, advisory & implementation services, and managed services. These services offer organizations an understanding of the transformation roadmap. Moreover, such services offer abilities that facilitate organizations to run the entire data center operation and respective cloud services as a unified entity. The presence of major companies such as Cisco Systems Inc. and HCL Technologies Limited, offering data centers virtualization services such as advisory, and technical support, among others, has also contributed to the growth of the service segment.

Service Insights

The optimization services segment of the data center virtualization market is projected to grow at a CAGR of around 18.36% over the forecast period. The growth can be attributed to the benefits of the optimization services, which include reducing the cost of operations, increasing profitability, enhanced security and compliance, faster provisioning, increased productivity, better data mobility, and scalability, among others. The benefits of optimization services have been a major factor in driving its growth.

The advisory & implementation services segment occupied more than 35% in 2022. The growth of the segment can be attributed to major companies such as IDX; Agilant Solutions, Inc.; VMware, Inc.; and Nikom InfraSolutions Pvt. Ltd. The presence of such companies has offered advisory and implementation services to businesses to utilize better the benefits of implementing data center virtualization by offering insights on cybersecurity assessment, compliance & regulatory assessment, and business continuity assessment, among others. These attributes have contributed to the wider adoption of advisory & implementation services, thereby driving the market’s growth over the forecast period.

Organization Size Insights

The large enterprises segment held the largest market share of over 71% in 2022. Large enterprises are in demand for data center virtualization software and services owing to a high volume of data and millions of customers for which several servers need storage and networking. In the age of increased market competition, large enterprises have been involved in implementing various technologies which could help businesses to gain better traction in the market, owing to the benefits of implementing data center virtualization, which includes simplified management, optimization of resources, and integration with managed services among others. All these factors have contributed to the growth of the large enterprises segment.

The small and medium-sized enterprises segment is expected to register the highest CAGR of over 17.03% during the forecast period. The adoption of data center virtualization has significantly increased among SMEs owing to its benefits, which include cost reduction, better team production, improved disaster recovery, minimal downtime, better provisioning and deployment, and cloud migration. Moreover, effective campaigns in the data center virtualization industry offering solutions specific to SMEs have also been boosting SMEs' adoption of data center virtualization. For instance, VMware, Inc. offers a specific solution to SMEs, including server consolidation, business continuity, desktop management, operations management, and hybrid cloud.

End-use Insights

The IT and telecommunication segment held the largest revenue share of over 59% in 2022 and is projected to sustain its position over the forecast period. Telecom companies utilize data centers to offer various services/ applications such as Mobile Network Monitoring, PDN and Serving Gateways, Gi-LAN, Policy and Charging Rules Function (PCRF), CDN & OTT Caching, Assurance, and Insights. This results in a high number of telecom data centers across the regions; these data centers have been adopting virtualization software services to enhance their capabilities which have been a significant factor in driving the growth of the IT & telecommunication segment.

The healthcare segment is expected to witness a rapid CAGR of approx. 18.06% over the forecast period. The demand for data center virtualization is expanding due to the benefits of data center solutions in the healthcare industry, such as better patient experience, easy and secure data sharing, access to high-quality health records, insights throughout patient journeys, and improved patient and provider satisfaction. The benefits of the data center in the healthcare industry, when combined with data center virtualization, such as increased productivity, faster provisioning, data mobility, profitability, cost management, and better security and compliance, have together contributed to the growth of the healthcare segment.

Moreover, the presence of companies such as Google, which has been at the forefront of offering data center solutions to the healthcare industry, has also been driving the growth of the healthcare segment in the data center virtualization industry. For instance, in July 2021, Google announced Healthcare Data Engine, a solution for life sciences and healthcare organizations which harmonizes multiple sources.

Regional Insights

North American region occupied more than 41% of the revenue share in 2022 and is projected to continue to dominate over the forecast period. The region has been at the forefront of adopting the latest technologies, which has played a significant part in the region's growth. Moreover, the region is also home to some of the major companies, such as Microsoft; VMware, Inc.; and Cisco Systems Inc., which has continued the growth of the adoption of data center simulation software in the region. The U.S. is home to many data centers, which has been a major factor driving the regional growth. According to the United States International Trade Commission, the U.S. is home to 33% of the total number of data centers globally (~8,000) as of January 2021.

Asia Pacific is expected to register more than 17.07% CAGR over the forecast period. The region's growth can be attributed to factors such as the rising number of data centers, improving digital infrastructure, digitalization of businesses, increasing adoption of cloud services, and cost-effective aspects of data center virtualization. Moreover, the presence of top players operating in the data center virtualization industry, such as Huawei Technologies Co., Ltd., and Fujitsu, among others, has also continued driving the growth of the regional market.

Data Center Virtualization Market Segmentations:

By Type

By Component

By Service

By Organization Size

By End-use

BY Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Data Center Virtualization Market

5.1. COVID-19 Landscape: Data Center Virtualization Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Data Center Virtualization Market, By Type

8.1. Data Center Virtualization Market, by Type, 2023-2032

8.1.1. Server

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Storage

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Network

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Desktop

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Application

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Data Center Virtualization Market, By Component

9.1. Data Center Virtualization Market, by Component, 2023-2032

9.1.1. Services

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Software

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Data Center Virtualization Market, By Service

10.1. Data Center Virtualization Market, by Service, 2023-2032

10.1.1. Advisory & Implementation Services

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Optimization Services

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Managed Services

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Technical Support Services

10.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Data Center Virtualization Market, By Organization Size

11.1. Data Center Virtualization Market, by Organization Size, 2023-2032

11.1.1. Small and Medium-Sized Enterprises (SMEs)

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Large Enterprises

11.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Data Center Virtualization Market, By End-use

12.1. Data Center Virtualization Market, by End-use, 2023-2032

12.1.1. BFSI

12.1.1.1. Market Revenue and Forecast (2020-2032)

12.1.2. IT & Telecommunication

12.1.2.1. Market Revenue and Forecast (2020-2032)

12.1.3. Manufacturing & Automotive

12.1.3.1. Market Revenue and Forecast (2020-2032)

12.1.4. Government

12.1.4.1. Market Revenue and Forecast (2020-2032)

12.1.5. Healthcare

12.1.5.1. Market Revenue and Forecast (2020-2032)

12.1.6. Education

12.1.6.1. Market Revenue and Forecast (2020-2032)

12.1.7. Retail & SCM

12.1.7.1. Market Revenue and Forecast (2020-2032)

12.1.8. Media & Entertainment

12.1.8.1. Market Revenue and Forecast (2020-2032)

12.1.9. Others

12.1.9.1. Market Revenue and Forecast (2020-2032)

Chapter 13. Global Data Center Virtualization Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Type (2020-2032)

13.1.2. Market Revenue and Forecast, by Component (2020-2032)

13.1.3. Market Revenue and Forecast, by Service (2020-2032)

13.1.4. Market Revenue and Forecast, by Organization Size (2020-2032)

13.1.5. Market Revenue and Forecast, by End-use (2020-2032)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Type (2020-2032)

13.1.6.2. Market Revenue and Forecast, by Component (2020-2032)

13.1.6.3. Market Revenue and Forecast, by Service (2020-2032)

13.1.6.4. Market Revenue and Forecast, by Organization Size (2020-2032)

13.1.7. Market Revenue and Forecast, by End-use (2020-2032)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Type (2020-2032)

13.1.8.2. Market Revenue and Forecast, by Component (2020-2032)

13.1.8.3. Market Revenue and Forecast, by Service (2020-2032)

13.1.8.4. Market Revenue and Forecast, by Organization Size (2020-2032)

13.1.8.5. Market Revenue and Forecast, by End-use (2020-2032)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Type (2020-2032)

13.2.2. Market Revenue and Forecast, by Component (2020-2032)

13.2.3. Market Revenue and Forecast, by Service (2020-2032)

13.2.4. Market Revenue and Forecast, by Organization Size (2020-2032)

13.2.5. Market Revenue and Forecast, by End-use (2020-2032)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Type (2020-2032)

13.2.6.2. Market Revenue and Forecast, by Component (2020-2032)

13.2.6.3. Market Revenue and Forecast, by Service (2020-2032)

13.2.7. Market Revenue and Forecast, by Organization Size (2020-2032)

13.2.8. Market Revenue and Forecast, by End-use (2020-2032)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Type (2020-2032)

13.2.9.2. Market Revenue and Forecast, by Component (2020-2032)

13.2.9.3. Market Revenue and Forecast, by Service (2020-2032)

13.2.10. Market Revenue and Forecast, by Organization Size (2020-2032)

13.2.11. Market Revenue and Forecast, by End-use (2020-2032)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Type (2020-2032)

13.2.12.2. Market Revenue and Forecast, by Component (2020-2032)

13.2.12.3. Market Revenue and Forecast, by Service (2020-2032)

13.2.12.4. Market Revenue and Forecast, by Organization Size (2020-2032)

13.2.13. Market Revenue and Forecast, by End-use (2020-2032)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Type (2020-2032)

13.2.14.2. Market Revenue and Forecast, by Component (2020-2032)

13.2.14.3. Market Revenue and Forecast, by Service (2020-2032)

13.2.14.4. Market Revenue and Forecast, by Organization Size (2020-2032)

13.2.15. Market Revenue and Forecast, by End-use (2020-2032)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Type (2020-2032)

13.3.2. Market Revenue and Forecast, by Component (2020-2032)

13.3.3. Market Revenue and Forecast, by Service (2020-2032)

13.3.4. Market Revenue and Forecast, by Organization Size (2020-2032)

13.3.5. Market Revenue and Forecast, by End-use (2020-2032)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Type (2020-2032)

13.3.6.2. Market Revenue and Forecast, by Component (2020-2032)

13.3.6.3. Market Revenue and Forecast, by Service (2020-2032)

13.3.6.4. Market Revenue and Forecast, by Organization Size (2020-2032)

13.3.7. Market Revenue and Forecast, by End-use (2020-2032)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Type (2020-2032)

13.3.8.2. Market Revenue and Forecast, by Component (2020-2032)

13.3.8.3. Market Revenue and Forecast, by Service (2020-2032)

13.3.8.4. Market Revenue and Forecast, by Organization Size (2020-2032)

13.3.9. Market Revenue and Forecast, by End-use (2020-2032)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Type (2020-2032)

13.3.10.2. Market Revenue and Forecast, by Component (2020-2032)

13.3.10.3. Market Revenue and Forecast, by Service (2020-2032)

13.3.10.4. Market Revenue and Forecast, by Organization Size (2020-2032)

13.3.10.5. Market Revenue and Forecast, by End-use (2020-2032)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Type (2020-2032)

13.3.11.2. Market Revenue and Forecast, by Component (2020-2032)

13.3.11.3. Market Revenue and Forecast, by Service (2020-2032)

13.3.11.4. Market Revenue and Forecast, by Organization Size (2020-2032)

13.3.11.5. Market Revenue and Forecast, by End-use (2020-2032)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Type (2020-2032)

13.4.2. Market Revenue and Forecast, by Component (2020-2032)

13.4.3. Market Revenue and Forecast, by Service (2020-2032)

13.4.4. Market Revenue and Forecast, by Organization Size (2020-2032)

13.4.5. Market Revenue and Forecast, by End-use (2020-2032)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Type (2020-2032)

13.4.6.2. Market Revenue and Forecast, by Component (2020-2032)

13.4.6.3. Market Revenue and Forecast, by Service (2020-2032)

13.4.6.4. Market Revenue and Forecast, by Organization Size (2020-2032)

13.4.7. Market Revenue and Forecast, by End-use (2020-2032)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Type (2020-2032)

13.4.8.2. Market Revenue and Forecast, by Component (2020-2032)

13.4.8.3. Market Revenue and Forecast, by Service (2020-2032)

13.4.8.4. Market Revenue and Forecast, by Organization Size (2020-2032)

13.4.9. Market Revenue and Forecast, by End-use (2020-2032)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Type (2020-2032)

13.4.10.2. Market Revenue and Forecast, by Component (2020-2032)

13.4.10.3. Market Revenue and Forecast, by Service (2020-2032)

13.4.10.4. Market Revenue and Forecast, by Organization Size (2020-2032)

13.4.10.5. Market Revenue and Forecast, by End-use (2020-2032)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Type (2020-2032)

13.4.11.2. Market Revenue and Forecast, by Component (2020-2032)

13.4.11.3. Market Revenue and Forecast, by Service (2020-2032)

13.4.11.4. Market Revenue and Forecast, by Organization Size (2020-2032)

13.4.11.5. Market Revenue and Forecast, by End-use (2020-2032)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Type (2020-2032)

13.5.2. Market Revenue and Forecast, by Component (2020-2032)

13.5.3. Market Revenue and Forecast, by Service (2020-2032)

13.5.4. Market Revenue and Forecast, by Organization Size (2020-2032)

13.5.5. Market Revenue and Forecast, by End-use (2020-2032)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Type (2020-2032)

13.5.6.2. Market Revenue and Forecast, by Component (2020-2032)

13.5.6.3. Market Revenue and Forecast, by Service (2020-2032)

13.5.6.4. Market Revenue and Forecast, by Organization Size (2020-2032)

13.5.7. Market Revenue and Forecast, by End-use (2020-2032)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Type (2020-2032)

13.5.8.2. Market Revenue and Forecast, by Component (2020-2032)

13.5.8.3. Market Revenue and Forecast, by Service (2020-2032)

13.5.8.4. Market Revenue and Forecast, by Organization Size (2020-2032)

13.5.8.5. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 14. Company Profiles

14.1. ATTO Technology, Inc.

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. AT&T

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Cisco Systems, Inc.

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Dell Inc.

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Fujitsu

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. HCL Technologies Limited

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Hewlett Packard Enterprise Development LP

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. Huawei Technologies Co., Ltd.

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. IBM

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Konverge

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others