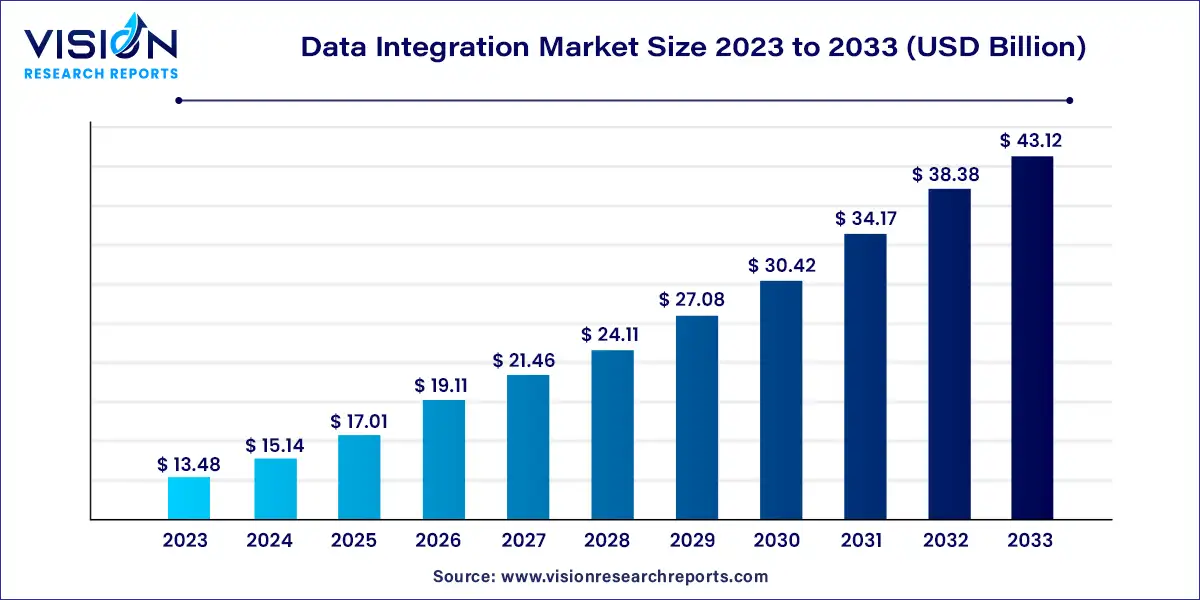

The global data integration market size was estimated at around USD 13.48 billion in 2023 and it is projected to hit around USD 43.12 billion by 2033, growing at a CAGR of 12.33% from 2024 to 2033.

The data integration market is experiencing unprecedented growth driven by the increasing adoption of cloud computing, big data analytics, and digital transformation initiatives across industries. As businesses strive to harness the power of data to gain insights and make informed decisions, the demand for robust data integration solutions continues to escalate. This overview delves into the current landscape of the data integration market, highlighting key trends, challenges, and opportunities shaping its trajectory.

The growth of the data integration market is propelled by several key factors driving its expansion. One significant factor is the escalating adoption of cloud computing technologies, which offer scalability, accessibility, and cost-efficiency to businesses seeking to streamline their data management processes. Additionally, the surge in big data analytics initiatives across industries underscores the importance of robust data integration solutions to extract actionable insights from vast and varied datasets. Furthermore, the increasing emphasis on digital transformation strategies necessitates seamless integration of disparate data sources and systems to drive innovation, agility, and competitive advantage. Moreover, the proliferation of IoT devices, mobile applications, and social media platforms underscores the critical need for real-time data integration capabilities to support dynamic data streams and enable timely decision-making. Overall, these growth factors collectively contribute to the expansion and evolution of the data integration market, creating opportunities for vendors to innovate and meet the evolving needs of businesses in an increasingly data-driven world.

| Report Coverage | Details |

| Revenue Share of North America in 2023 | 40% |

| Revenue Forecast by 2033 | USD 43.12 billion |

| Growth Rate from 2024 to 2033 | CAGR of 12.33% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The tools segment led the market in 2023, accounting for over 71% share of the global revenue. The high share can be attributed to software tools, as they aid in deploying solutions in various industries to extract, transform, and load data in a significant amount of time. Tools provide a central location for processing and storing multiple data sets in one database from different sources. These tools help in mapping, designing, cleansing, transforming, and storing data in the cloud and on-premises. The software tools provide a common platform for the organization and support the functional aspects of work in every field.

For instance, in January 2022, Fivetran Inc., a provider of automated data integration tools, upgraded its data integration tools in the market. They added a software-as-a-service (SaaS) data integration tool to extract, transform, and load data from various sources into data warehouses. The company further automates its integration process through sources, such as Salesforce, Inc., into cloud-based data warehouses like Amazon, Google Cloud, and Microsoft Azure. The service segment is predicted to foresee significant growth in the forecast years. Services offer the skills and knowledge required to combine data from many sources into a single database. Furthermore, it reduces the chances of human error and fraud, enhances efficiency, and quickly processes large volumes of data.

Professional service providers offer consulting, training, and technical support, whereas managed service providers handle infrastructure maintenance and solve complex operations, allowing enterprises to utilize technology fully. For instance, in May 2022, Striim, a business intelligence, and data integration solution developer, stated that Striim Cloud would be made available on Google Cloud, allowing clients to enable business intelligence and decision-making to meet the needs of the digital economy. The Striim Cloud is a fully managed service platform for data integration and streaming that would allow customers to create real-time data pipelines that could stream trillions of events per day and be supported by enterprise-grade operational security.

The on-premises segment held the largest revenue share of over 64% in 2023. The high share can be attributed to on-premises data integration software capabilities to combine data regardless of its structure, type, and volume from numerous on-premises sources that handle integrations using in-house software. The software includes a data replication tool that keeps track of the data consistency across the cloud and local network. The data from various on-premises software systems could be unified with the aid of on-premises data integration solutions. The location for an on-premises data integration system is one of the company's physical offices. For instance, in August 2022, Equalum Ltd., a data integration platform and data ingestion solutions provider, announced a raise of USD 14 million in a series C funding round.

The raise will support the demand for on-premises and hybrid cloud projects that integrate with Amazon Web Services, Inc., Google LLC, and Azure. Further, it would also aim towards scaling its business internationally by growing the delivery of data integration. The cloud segment will witness significant growth in the coming years. The cloud platforms' main goal is to create unified data stores that all applications and users can access transparently and efficiently. Cloud data integration refers to technology and tools connecting various systems, IT environments, repositories, and applications for real-time data exchange. It includes consolidating different data from multiple systems where the endpoint is a cloud source, such as Google Cloud, Oracle Cloud, Azure SQL, and Amazon RDS.

The cloud deployment of data integration software helps transform, consolidate, and clean the data to give the users a view of all essential interactions. Furthermore, integrated cloud services can be accessed by multiple devices through the internet. For instance, in March 2021, Denodo Technologies, a data virtualization platform provider, launched Denodo Standard, a cloud data integration solution. The new offering uses Denodo's cutting-edge data virtualization engine for greater performance and productivity. Customers can now access real-time data services without replicating their data in another repository. Further, the technology allows installers to connect to cloud data warehouses, SaaS applications, and data lakes and integrate the data from these various sources into a uniform view for businesses to access through dashboards, reports, or developers.

The marketing segment led the market in 2023, accounting for over 34% of global revenue. The segment's rise can be attributable to various factors, including studying consumer behavior, comprehending consumer wants and preferences, and personalizing customer interactions. Marketers utilize data integration to segment their target market based on age, gender, and product likes and dislikes. This allows them to make smarter marketing decisions, such as creating campaigns targeted at particular demographics. For instance, in September 2021, Redslim AG, a data integration and data harmonization service provider, partnered with Nielsen Consumer LLC., a U.S.-based big data analytics company.

The partnership aims toward a smarter market and studies consumer behavior, preferences, and wants for FMCG and retail industry consumers. Furthermore, they would position themselves in the market to quickly solve and address the issues and keep up with the rapidly evolving consumer market. The sales segment is presumed to grab a significant share over the forecast period as it helps access essential data from a single location. It enhances data-driven insights to boost productivity and improves customer engagement by quickly analyzing customer data. Thus, it utilizes new information to support marketing and sales initiatives.

The HR segment will witness significant growth in the coming years. HR data integration refers to automatically sharing candidate, employee, or job-related data among various HR applications or centralizing data from many sources into one database. Instead of wasting time manually entering the same information twice into different HR programs, data integration allows HR professionals to concentrate on strategic issues that help a company flourish. For instance, in August 2022, Bullhorn, Inc., a cloud-based customer relation management (CRM) solution and a cloud computing company that helps in recruiting and staffing, surveyed recruitment firms benefiting through data integration.

The survey stated that 56% of the firms had gained more revenue in 2021, and 64% increased recruitment fill rate due to data integration. Besides, the operations segment will acquire a significant market share as it helps streamline distribution and production processes, automates specific functions, and boosts workplace productivity. Furthermore, data integration helps better use data-driven insights to increase productivity and inventory control and enhance awareness of the company's overall operations.

The IT & telecom segment dominated the market in 2023 and accounted for a revenue share of over 21%. With the help of data integration, IT & telecom sectors could quickly bring together data from internal databases, customer records, and third-party systems. This would help evaluate data quality and recommendations for resolving issues that are driving the segment's growth. For instance, in August 2022, Nagarro, an IT service management company and a pioneer in designing digital products, partnered with Zendesk, a cloud-based software provider. Through this initiative, Zendesk's open and adaptable platform would offer a unified view on a single dashboard and easy customer data integration for Nagarro's IT clients.

In addition to personalizing client interactions and automating proactive services at scale, it will increase agent productivity. The banking, financial services, and insurance segment is expected to showcase significant growth over the forecast period. The massive amount of data generated daily by financial institutions is increasing the demand and driving the segment's growth. With data integration, banks can track the customer journey and better understand how interactions with tellers, call center agents, websites, and other branch employees affect customers' decisions to use financial services. Financial services organizations may get a 360-degree perspective of their customer's demands and what keeps them from switching to competitors.

They engage them in fresh ways by combining data from transactional systems, CRM, and digital marketing automation. The retail & manufacturing segment is anticipated to have significant growth in the coming years. The growing need for data integration software enables retailers and manufacturers to take advantage of the data they are already producing and turn it into valuable insights for expanding their businesses. An integrated and unified view of the company's clients, sales, and operations could be advantageous for every retail or manufacturing department. For instance, in January 2022, oxylabs.io, a proxy service provider and a company that creates competitive data-gathering solutions and invests in technology advancements, surveyed retailers that have benefitted from data integration.

The survey stated that 43% of retailers used data integration to estimate market trends, 39% to forecast consumer demand and benchmark against the competitors in the market, and the remaining to raise the quality of customer policy, enhance pricing policies, and develop new products. Furthermore, the healthcare segment is expected to showcase significant growth over the forecast period. Gaining a thorough understanding of a person's health and achieving better patient outcomes gets more and more challenging as the number of healthcare data sources and data kinds rises.

In the healthcare industry, data integration is essential as massive data integration can save costs by identifying fraud and unnecessary misuse, uncovering disease prevention strategies, lowering the number of incorrect diagnoses, introducing more individualized care, and limiting the number of overdiagnoses. For instance, in August 2022, the MINISTRY OF HEALTH OF the REPUBLIC OF INDONESIA launched "SATUSEHAT, "a data integration platform in Jakarta, to continue its digital transformation in the healthcare industry. The platform would offer standardized formats, data exchange protocols, and health data integration. Furthermore, it would help doctors easily study patients' health issues and achieve better outcomes. They would also digitally record the patient's data so patients would not need to bring their physical medical records.

The large enterprise segment dominated the market in 2023 and accounted for a revenue share of over 69%. The growth is attributed to large enterprises' high adoption rate of data integration software to meet new demands, scale their infrastructure, and maintain support for their products and services. In large enterprises, it's challenging part to bring all the data together and gain a competitive advantage, but data integration benefits the enterprises in various ways, such as increasing productivity, greater visibility, reducing the burden of IT, and helping gain more opportunities for enterprises. For instance, in May 2021, Torry Harris Business Solutions, a company with expertise in data integration, data architecture, and cloud platforms, launched an integrated governance framework.

The framework would promote seamless integration, maintain support for their services, and scale infrastructure across large enterprises. The small & medium enterprises segment is anticipated to register the fastest CAGR from 2023 to 2032 due to increased demand for cloud-based software spending. Furthermore, the spending would help in improving efficiency and reducing infrastructure costs. Small & medium enterprises can consolidate data from several sources in an organized way using the data integration process. In addition, it converts the gathered data into insightful and practical knowledge.

For instance, in December 2021, Intellicus, a provider of data integration tools and business intelligence analytics software, and reporting tools, expanded its data integration solutions for small and large enterprises. The COVID-19 outbreak helped serve as a catalyst and aid in advancing digitalization. A significant portion was spent on data integration, business intelligence, reporting, and analytics. The industries with the highest adoption rates of new data integration interfaces in 2021 included banking, supply chain management, retail, manufacturing, and FMCG. Further, by expanding its data integration and business intelligence solution, a process of automation was induced to minimize the use of manual intervention.

North America dominated the market in 2023, accounting for over 40% share of the global revenue. Developed countries like Canada and the U.S. drive the market's growth. With the increased adoption of digital strategies, the region is moving towards upgraded and innovative technologies. Growing technological advancements in the area are essential factors promoting market expansion in North America. The rising number of global data integration businesses will aid the expanding market. For instance, in August 2022, Software AG, a provider of enterprise integration software solutions, acquired Stream Sets, a U.S.-based company that offers a data integration platform to build, deploy, design, and operate smart data pipelines. The acquisition allows Software AG to enter the cloud data integration segment, which would help the company increase its product portfolio offerings.

Moreover, it would help scale their business, offer data integration services to their customers, and expand their presence in the North America region. Asia Pacific is likely to possess lucrative market opportunities in the coming years. The leading players in the APAC data integration market are focusing on growing their product portfolios, rising investments, and strategic partnerships to create both easy and robust functionality. Along with this, several initiatives were implemented, and it is anticipated that the industry will expand as e-commerce trade in the region continues to rise. For instance, in July 2022, Boomi, LP.a data integration platform provider, expanded its offerings for cloud data integration in Japan. The company invested in Japan's market to meet the increasing demand for business automation and data integration solutions which would scale the company's business for customers across the region.

By Component

By Deployment

By Organization Size

By Business Application

By End-user

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Data Integration Market

5.1. COVID-19 Landscape: Data Integration Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Data Integration Market, By Component

8.1. Data Integration Market, by Component, 2024-2033

8.1.1 Tools

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Services

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Data Integration Market, By Deployment

9.1. Data Integration Market, by Deployment, 2024-2033

9.1.1. Cloud

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. On-premises

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Data Integration Market, By Organization Size

10.1. Data Integration Market, by Organization Size, 2024-2033

10.1.1. Large Enterprises

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Small & Medium Enterprises

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Data Integration Market, By Business Application

11.1. Data Integration Market, by Business Application, 2024-2033

11.1.1. Marketing

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Sales

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Operations & Supply Chain

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Finance

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. HR

11.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Data Integration Market, By End-user

12.1. Data Integration Market, by End-user, 2024-2033

12.1.1. IT & Telecom

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. BFSI

12.1.2.1. Market Revenue and Forecast (2021-2033)

12.1.3. Healthcare

12.1.3.1. Market Revenue and Forecast (2021-2033)

12.1.4. Manufacturing

12.1.4.1. Market Revenue and Forecast (2021-2033)

12.1.5. Retail & E-commerce

12.1.5.1. Market Revenue and Forecast (2021-2033)

12.1.6. Government & Defense

12.1.6.1. Market Revenue and Forecast (2021-2033)

12.1.7. Others

12.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 13. Global Data Integration Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Component (2021-2033)

13.1.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.1.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.1.4. Market Revenue and Forecast, by Business Application (2021-2033)

13.1.5. Market Revenue and Forecast, by End-user (2021-2033)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Component (2021-2033)

13.1.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.1.6.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.1.6.4. Market Revenue and Forecast, by Business Application (2021-2033)

13.1.7. Market Revenue and Forecast, by End-user (2021-2033)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Component (2021-2033)

13.1.8.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.1.8.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.1.8.4. Market Revenue and Forecast, by Business Application (2021-2033)

13.1.8.5. Market Revenue and Forecast, by End-user (2021-2033)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Component (2021-2033)

13.2.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.2.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.2.4. Market Revenue and Forecast, by Business Application (2021-2033)

13.2.5. Market Revenue and Forecast, by End-user (2021-2033)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Component (2021-2033)

13.2.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.2.6.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.2.7. Market Revenue and Forecast, by Business Application (2021-2033)

13.2.8. Market Revenue and Forecast, by End-user (2021-2033)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Component (2021-2033)

13.2.9.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.2.9.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.2.10. Market Revenue and Forecast, by Business Application (2021-2033)

13.2.11. Market Revenue and Forecast, by End-user (2021-2033)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Component (2021-2033)

13.2.12.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.2.12.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.2.12.4. Market Revenue and Forecast, by Business Application (2021-2033)

13.2.13. Market Revenue and Forecast, by End-user (2021-2033)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Component (2021-2033)

13.2.14.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.2.14.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.2.14.4. Market Revenue and Forecast, by Business Application (2021-2033)

13.2.15. Market Revenue and Forecast, by End-user (2021-2033)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Component (2021-2033)

13.3.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.3.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.3.4. Market Revenue and Forecast, by Business Application (2021-2033)

13.3.5. Market Revenue and Forecast, by End-user (2021-2033)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Component (2021-2033)

13.3.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.3.6.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.3.6.4. Market Revenue and Forecast, by Business Application (2021-2033)

13.3.7. Market Revenue and Forecast, by End-user (2021-2033)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Component (2021-2033)

13.3.8.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.3.8.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.3.8.4. Market Revenue and Forecast, by Business Application (2021-2033)

13.3.9. Market Revenue and Forecast, by End-user (2021-2033)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Component (2021-2033)

13.3.10.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.3.10.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.3.10.4. Market Revenue and Forecast, by Business Application (2021-2033)

13.3.10.5. Market Revenue and Forecast, by End-user (2021-2033)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Component (2021-2033)

13.3.11.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.3.11.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.3.11.4. Market Revenue and Forecast, by Business Application (2021-2033)

13.3.11.5. Market Revenue and Forecast, by End-user (2021-2033)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Component (2021-2033)

13.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.4.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.4.4. Market Revenue and Forecast, by Business Application (2021-2033)

13.4.5. Market Revenue and Forecast, by End-user (2021-2033)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Component (2021-2033)

13.4.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.4.6.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.4.6.4. Market Revenue and Forecast, by Business Application (2021-2033)

13.4.7. Market Revenue and Forecast, by End-user (2021-2033)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Component (2021-2033)

13.4.8.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.4.8.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.4.8.4. Market Revenue and Forecast, by Business Application (2021-2033)

13.4.9. Market Revenue and Forecast, by End-user (2021-2033)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Component (2021-2033)

13.4.10.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.4.10.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.4.10.4. Market Revenue and Forecast, by Business Application (2021-2033)

13.4.10.5. Market Revenue and Forecast, by End-user (2021-2033)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Component (2021-2033)

13.4.11.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.4.11.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.4.11.4. Market Revenue and Forecast, by Business Application (2021-2033)

13.4.11.5. Market Revenue and Forecast, by End-user (2021-2033)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Component (2021-2033)

13.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.5.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.5.4. Market Revenue and Forecast, by Business Application (2021-2033)

13.5.5. Market Revenue and Forecast, by End-user (2021-2033)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Component (2021-2033)

13.5.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.5.6.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.5.6.4. Market Revenue and Forecast, by Business Application (2021-2033)

13.5.7. Market Revenue and Forecast, by End-user (2021-2033)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Component (2021-2033)

13.5.8.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.5.8.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.5.8.4. Market Revenue and Forecast, by Business Application (2021-2033)

13.5.8.5. Market Revenue and Forecast, by End-user (2021-2033)

Chapter 14. Company Profiles

14.1. Informatica Inc.

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. International Business Machines Corp.

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Microsoft

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. SAP

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Oracle

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Talend

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. SAS Institute Inc.

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. TIBCO Software Inc.

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Denodo Technologies

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. QlikTech International AB

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others